Tax Information Reporting Form 1099-K

What you need to know

- US sellers with more than $20,000 in proceeds and more than 200 transactions within the year will receive IRS form 1099-K, Payment Card and Third Party Network Transactions, reporting total gross proceeds by month for the previous calendar year. Foreign sellers earning US source income subject to withholding will receive IRS form 1042-S, Foreign Person’s US Source Income Subject to Withholding. (This is rare.)

- The IRS has delayed the implementation of the reduced $600 threshold until 2023. If your 2022 activity did not exceed $20,000 and 200+ transactions, you will not receive a form 1099-K.

- Please be aware that the year end tax form will show FS Intermediate Holdings, Inc. as the reporter, this is the parent entity of FastSpring.

- If you haven’t already confirmed your tax status by completing the W8/W9 electronic questionnaire, please do so here. This information is used to report on form 1099-K.

- Gross proceeds are different from profits. You pay tax on your profits, not your gross proceeds. You use gross proceeds to compute your profit, which also includes amounts for returns and allowances, operating expenses, etc.

- While we are unable to give direct tax advice to our sellers, we want to help make dealing with taxes as easy as possible and are here for you.

Frequently Asked Questions

What is a 1099-K?

- Form 1099-K is a document that taxpayers receive to report income from payment card and third party network transactions. It includes the gross amount of all payment transactions within a calendar year. It includes adjustments for discounts and taxes but NOT for refunds/returns and fees. We’ll send you a 1099-K if you meet the selling threshold of $20,000 in proceeds and more than 200 transactions in the calendar year.

Why do I need a 1099-K?

- Merchants of Record, and other online marketplaces like FastSpring must report certain transactions once they are over a stated amount. For payment processing activities, IRS regulations require FastSpring to issue 1099-K’s for qualifying US sellers. When calculating your taxable income for your income tax return, you should consider the amounts shown on your 1099-K.

What are the IRS requirements for Form 1099-K?

- The IRS is expanding its reach of reporting requirements to include online marketplaces. 2022 is the first year FastSpring is issuing form 1099-K. Starting January 1, 2023 the reporting threshold will drop to $600. A copy of form 1099-K will be mailed to the seller, the IRS, and FastSpring keeps a copy on file for 7 years.

What about state level reporting requirements for Form 1099-K?

- A handful of states use a lower reporting threshold than the IRS including; AR, DC, IL, MD, MA, MS, NJ, VT, VA. State only forms will be issued to qualifying sellers.

What does Form 1099-K include?

- Form 1099-K includes your total proceeds from all selling transactions within the year, if greater than $20,000 and 200 transactions or more. Total proceeds are broken out by month and adjusted for the following:

- Discounts

- Taxes

- Amounts are not adjusted for any returns and refunds or selling fees paid to FastSpring.

- Other identifying form information includes;

- Filers name, address, and TIN [FS Intermediate Holdings, Inc., Santa Barbara CA 82-4153417]

- Payee’s name, address, and TIN

- Total number of payment transactions

- Please note the reported amount is different from your FastSpring payout.

How to confirm 1099-K Gross amount from box 1a vs storefront Reports?

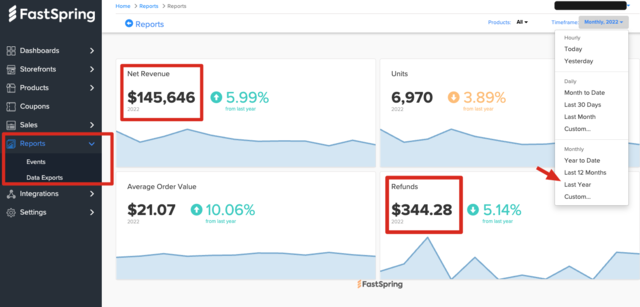

- Navigate to the Reports section and change the period to “Last Year.”

- “Net Revenue” + “Refunds” should tie to the 1099-K box 1a.

- If multiple storefronts, then repeat the process for each storefront and combine the amounts.

- Example:

How is Form 1099-K different from other 1099’s?

- The type of form depends on the characteristics of the money being received. The purpose of a 1099-K is to disclose the amount of money a payment processor or online platform is transacting with on your behalf.

Will I have to pay taxes if I receive a 1099-K?

- Not necessarily. Just because you receive a 1099-K doesn’t mean you’ll owe taxes on the amount reported. The 1099-K shows your gross proceeds, which is different from profits. You pay tax on your profits, not your gross proceeds. You use gross proceeds to compute your profit, which also includes amounts for returns and allowances, operating expenses, etc.

What if I have multiple storefronts?

- Storefront activity will be aggregated under a sellers account ID and reported on a single form 1099-K. If a seller has multiple account ID’s but under the same organization, amounts will also be aggregated.

What if I have a split payee or receive payments as a split payee?

- The income a split payee receives is included in the 1099-K of the parent seller. A split payee will not receive a tax form.

I didn’t receive a 1099-K form for 2021, why am I receiving one for 2022?

- The reporting rules for online marketplaces changed January 1, 2022. FastSpring did not issue forms 1099-K prior to 2022.

Accessing and Using your 1099-K

How do I receive my Form 1099-K?

- For qualifying sellers, forms will be mailed out to your address on file. You can request an electronic copy by reaching out to [email protected].

What if my personal information or address on the form is not correct?

- Identifying information is pulled directly from your storefront. To make any tax form updates, please update your Tax Information within your storefront.

- On the dashboard page select Account Summary.

- Under the Tax Information section select Manage Tax Information.

- Select update and complete the online questionnaire to update your tax information.

- Once updated, reach out to [email protected] to request form reissuance.

Will I receive a form if I’m not a US citizen or resident?

- 1099-K reporting requirements will not apply if you are a non-US citizen and non-US resident selling on FastSpring. We require a completed form W-8 in the online questionnaire in order to properly claim non-US status.

What should I do with Form 1099-K?

- The amounts reported on your 1099-K should be reported on your 2022 tax return.

- Sole Proprietorships would generally report this income on Form 1040 Schedule C

- Corporations or partnerships would generally report this on the entity return: Form 1120/1120S/1065.

- The form does not need to be submitted with your return. The copy provided is for your internal records.

I lost my original form 1099-K, where can I find a copy?

- You can request an electronic copy by reaching out to [email protected].

Why is the form from FS Intermediate Holdings, Inc. and not FastSpring?

- Legally, under IRS entity rules the FastSpring operating entity (Bright Market, LLC) is disregarded for federal tax purposes. Bright Market LLC’s parent company FS Intermediate Holdings, Inc. is the reporter and filing entity of FastSpring operations.

FastSpring does not provide legal, tax, or accounting advice. This material is being provided for informational purposes only and is not intended as, and should not be relied upon for, legal, tax, accounting, or other professional advice. Please consult your own legal, tax, and accounting advisors for advice specific to your situation.

Updated 4 months ago