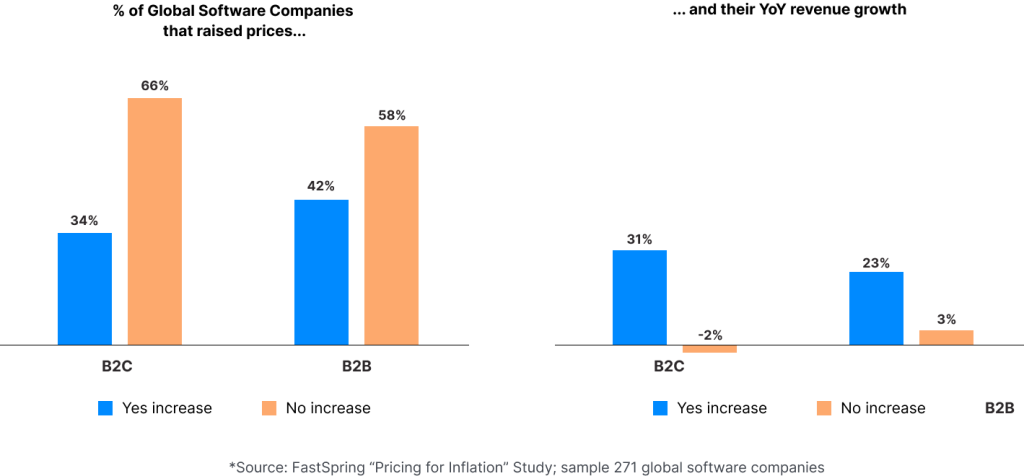

To see what happened when companies raised their prices, we pulled a random sample of 271 global SaaS and software sellers using FastSpring to process transactions over the past year. We then looked at what happened to growth and revenue for companies that raised prices — and those that didn’t.

We found that 37% of software sellers raised their prices over 10% between Q1 of 2021 and Q1 of 2022. And those that did increased their revenue by 20% to 33% more than companies that kept their prices the same.

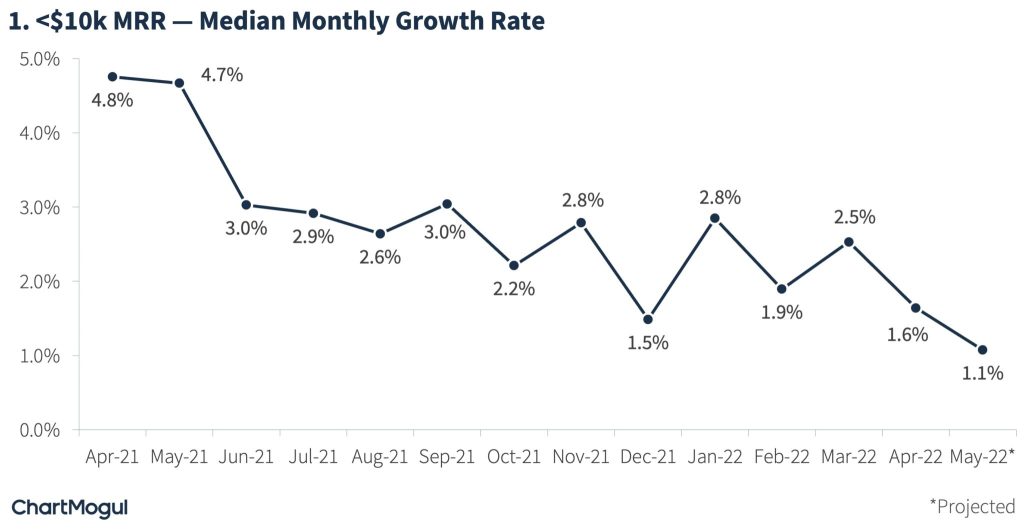

1. Companies that raised prices grew 15% more than companies that didn’t raise prices.

When we looked at overall growth, we found that companies that raised prices in the last year on average saw 15% higher growth than companies that left prices unchanged.

Whatever churn a company experienced as a result of a price increase was consistently offset by the increased revenue generated by the increase.

2. The average price increase was 20%.

On average, companies seemed to choose 20% as the amount they increased their prices.

We saw the biggest increase in price for transactions over $500, with an average of a 34% increase.

Companies with less expensive products increased prices the least.

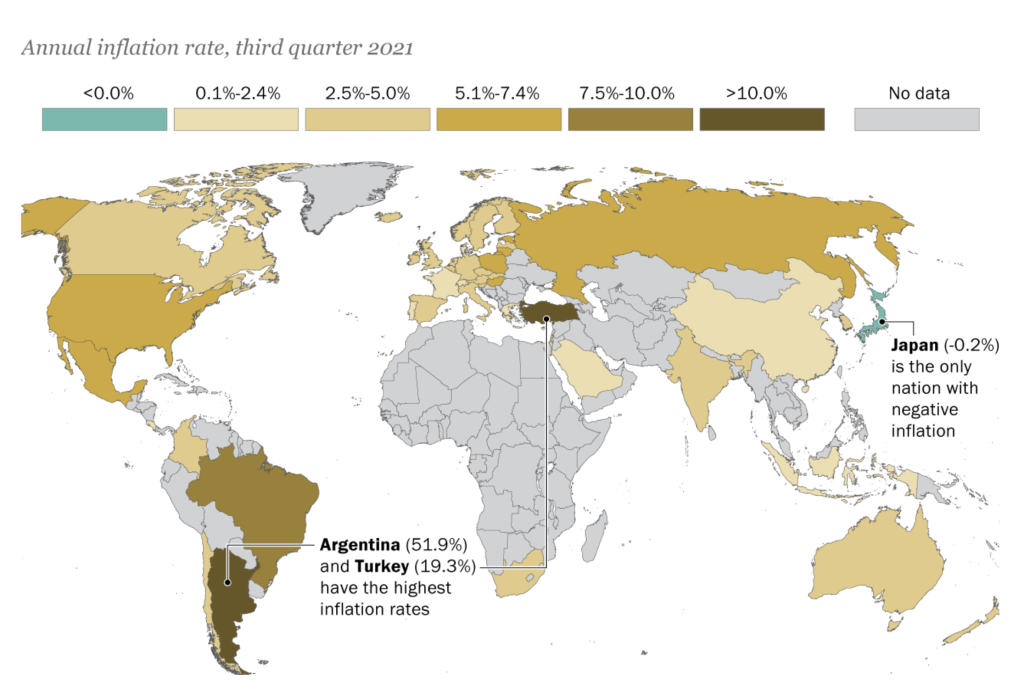

3. It didn’t matter where a company was headquartered.

There was no statistical difference in growth or revenue based on the location of the companies in our study.

SaaS companies (and FastSpring’s user base in general) often have customers from all over the world, so this finding is consistent with our expectations.

In SaaS, it matters less where your company is headquartered. What matters is where your customers are located. And if your customers are all over the world, it pays to understand what’s happening globally.

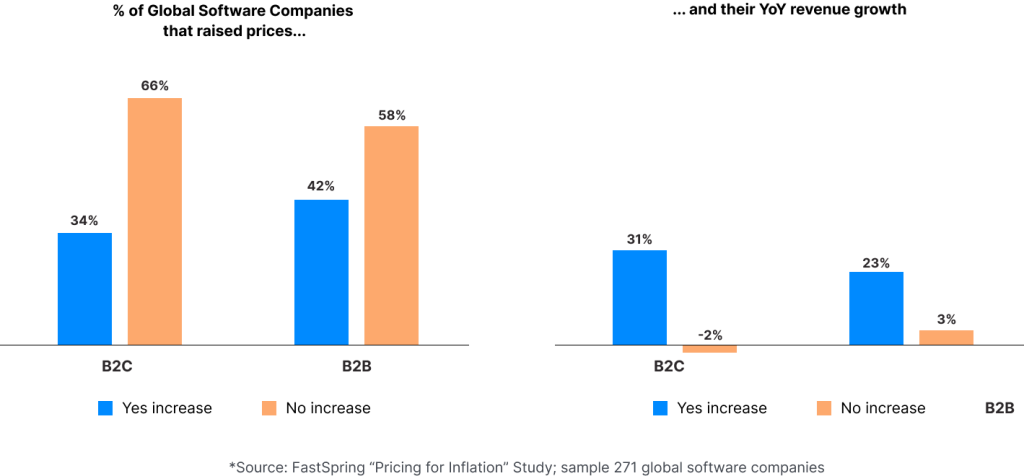

4. B2B companies were more likely to raise prices — but the impact was larger in B2C.

Our B2B sellers were more likely than B2C sellers to raise their prices to offset inflation. In fact, 42% of B2B sellers raised prices in the last year — compared to 34% of B2C sellers.

Our B2B sellers were more likely than B2C sellers to raise their prices to offset inflation. In fact, 42% of B2B sellers raised prices in the last year — compared to 34% of B2C sellers.

Interestingly, B2C sellers that raised prices actually saw higher growth than our B2B sellers, even though B2C sellers were less likely to have raised their rates.

Companies with predominantly B2C sales that raised prices saw a 31% increase in their year-over-year revenue growth, while B2B sellers saw a 23% increase.

While intuition might suggest that B2C buyers would be more sensitive to price changes than B2B buyers, our data suggests the opposite, which may imply that B2C companies are more likely to under-price their products relative to their perceived value to buyers.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)

Our B2B sellers were more likely than B2C sellers to raise their prices to offset inflation. In fact, 42% of B2B sellers raised prices in the last year — compared to 34% of B2C sellers.

Our B2B sellers were more likely than B2C sellers to raise their prices to offset inflation. In fact, 42% of B2B sellers raised prices in the last year — compared to 34% of B2C sellers.