Software companies can easily sell to customers around the world, right? So why not market your product globally?

Anyone who does business across borders can tell you: it’s not that simple.

- Do you need to translate your website?

- Do you accept their country’s form of currency?

- Do you know local privacy and tax regulations?

We recently spoke to a software entrepreneur based in the Caribbean who was facing this issue.

Customers liked his products, and his company was growing rapidly. “But my country has less than a million people,” he told us. “If I really want to grow my business, I need to expand to other markets.”

He knew that selling his software in other countries would create a variety of tax, payment processing, and compliance problems.

“That’s why I need a merchant of record,” he explained.

In this piece, we’ll explain what a merchant of record is — and why using one can make it much easier for software companies to go global.

What Is a Merchant of Record?

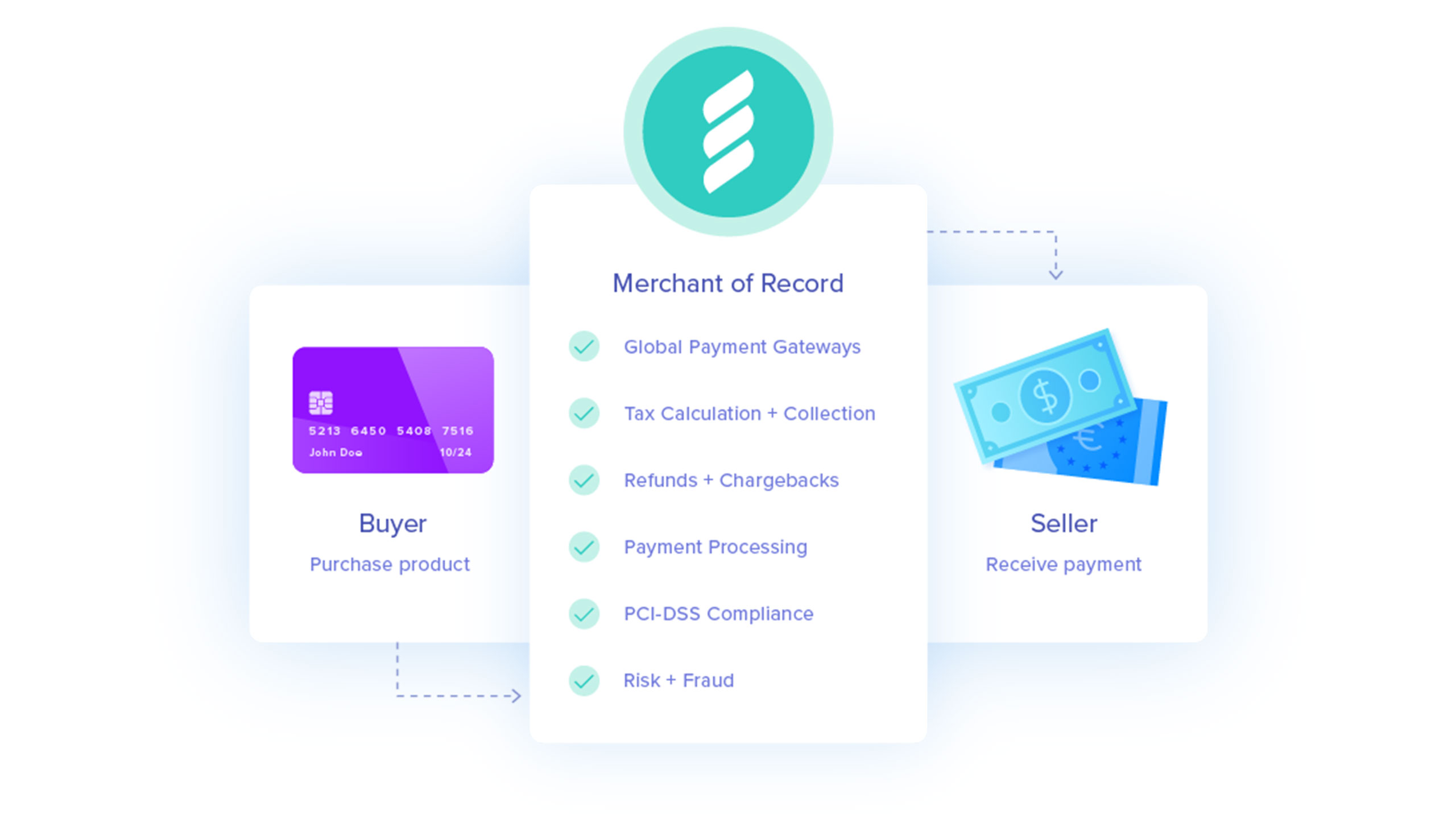

A merchant of record (MoR) is the entity that sells goods or services to a customer. Companies can be their own merchant of record, but you can also outsource this work to entities that sell goods or services on behalf of a business and, by doing so, take on the liability related to the transaction.

A merchant of record helps you stop worrying about the tax and compliance issues involved with accepting payments from around the globe — so you can focus on what you do best: building great products.

Note: FastSpring is the merchant of record for thousands of growth-stage SaaS and software businesses around the globe. Learn more about how FastSpring can help you grow your business globally.

1. Software Companies Often Struggle With Foundational Billing Tasks

Even before they consider selling in another country, many software companies struggle with the foundational tasks related to billing, such as:

- Ensuring compliance with PCI-DSS standards for cardholder information.

- Decreasing payment failure rates.

- Managing and maintaining relationships with merchant banks and payment processors.

- Negotiating payment processor fees.

- Handling payment disputes, refunds, and chargebacks.

- Calculating, filing, and remitting software sales tax.

Some of this work may be done for you by your accountant or payment processor, but they’re probably not doing everything: like helping you decrease customer churn or issuing refunds.

Most likely (unless you’re already working with a MoR) you’re doing some of this work internally or not at all.

When you sell products to buyers in another country, things get even more complicated.

2. VAT and Sales Tax Are Usually Based on the Buyer’s Location for Digital Goods

When selling software or digital goods, VAT and sales tax is almost always calculated based on the location of your customer, not the location where you do business.

(This is different from professional services, which are often taxed based on where the service is performed rather than the location of the buyer.)

For example, let’s say you sell software (or a digital product) and you choose a simple payment processor (like Stripe or PayPal).

In that situation, if you have enough customers in Canada to meet the Canadian threshold for tax filing, then you must track, file, and remit taxes in Canada — regardless of your location or the headquarters of your company.

With a merchant of record, unless you’re located in Canada, you’ll outsource the sales tax, VAT, and many of the compliance responsibilities to your MoR — who will track, file, and remit taxes on your behalf in Canada and in all the various countries where your customers live — instead of you doing that on your own.

If you multiply the Canada example by the number of countries where your customers live, you can see why so many software companies choose a MoR over simple payment processing when they expand globally.

With a merchant of record, you can grow your business much faster and with much less stress and cost from accountants and tax professionals.

3. The Rules Change All the Time

The specific requirements of doing business across borders vary from country to country, how much business you’re doing there, the structure of your business, and a variety of other factors. But common steps include:

- Learning the preferred payment methods of a given region.

- Handling currency conversions when taking payments.

- Understanding foreign tax requirements, including whether your offerings are subject to a value-added tax (VAT).

- Detecting and handling fraud, which can be more prevalent on international payments.

That’s work you do per country, which means if you have a lot of customers in ten different countries, that’s ten sets of local taxes to figure out — a timely and costly process.

And this is why it’s so helpful to use a merchant of record service when you’re ready to go global.

4. A Merchant of Record Simplifies Your Financial Operations

You didn’t start a software company to spend your days figuring out complex tax rules in countries all over the world. You started it because you had a great idea for a product, and you knew how to build it.

A merchant of record lets you get back to what you do best: developing your product.

The MoR buys the software from you, then resells it to your customer. Instead of working directly with customers and financial service providers, you communicate with just one entity — your MoR.

Your customers will still visit your website to buy software or update subscriptions, but when they’re ready to check out, they buy the software from the MoR.

They’ll receive a receipt from the MoR, and the MoR will be the name listed on their bank or credit card statement. This is how the MoR becomes the liable party for the sale.

MoRs maintain robust ecommerce platforms to manage payment and tax processes. At FastSpring, we also provide other services like digital invoices and interactive quotes that are a part of our customer’s financial system.

5. A Merchant of Record Is Cost-Effective

If you’re paying a lawyer or accountant to figure out the taxes and business regulations of each country where your customers live, those costs add up fast. Not to mention localizing your payment platform, such as making sure your site accepts the preferred payment method of each country.

A MoR (like FastSpring) already has an understanding of local taxes, multiple payment gateways, and more. This makes it the most cost-efficient way to collect payments and remit taxes from a global customer base.

6. With a Merchant of Record, You Can Go Global Immediately

Localizing currency and your checkout experience is a project that often takes years for companies who build those capabilities on their own.

Since a MoR already has everything set up and ready to go, as soon as you become a customer of a global MoR, the currency, preferred payment methods, and the checkout experience will be customized for your customers right from the start.

7. A Merchant of Record Helps You Stay Compliant

Each country has its own sales and privacy regulations, and they’re always changing. This means you’ll need to keep a lawyer on retainer that’s familiar with the ever-changing global tax regulations if you’re handling compliance internally.

Once again, a MoR will do this work for you, avoiding costly fines and lawyer fees.

How Is a Merchant of Record Different from a Payment Service Provider?

A payment service provider (PSP), such as PayPal or iDeal, is a platform that acts as an alternative payment method from cash, debit, or credit cards. And you’re probably already working with one or two PSPs — whichever are most popular in your country or the country of your customers.

A PSP only handles the processing of payments, not anything else that goes into an order process, such as sales and VAT taxes, or payment disputes.

A merchant of record, on the other hand, handles all of it.

Some PSPs like Stripe accept multiple currencies — which is a big step towards being able to support customers from multiple countries or regions. But various PSPs are popular in different places. For instance, in Sweden, Swish is far more popular than PayPal or Stripe for mobile payments.

And while PSPs are equipped to accept payments in different countries, they are not responsible for helping you calculate a country’s tax requirements.

Note: FastSpring is the No. 1 full-stack merchant of record service for growth-stage SaaS and software businesses. Learn more about how we can help you grow your business globally.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)