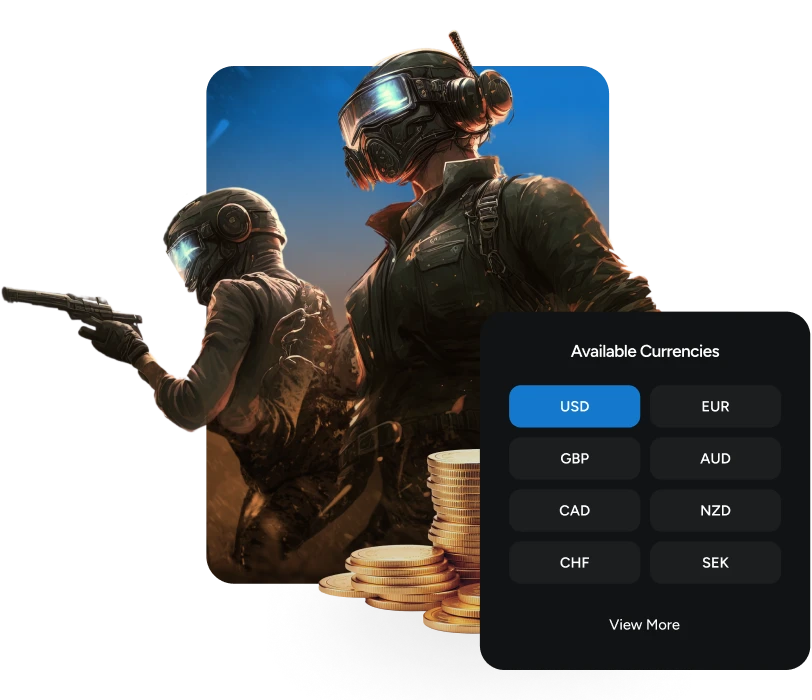

Unlike traditional payment partners, FastSpring uses a managed fraud prevention model. For you, that means we take on a lot of the work for risk management and fraud prevention — so you don’t need to worry about self-managing chargeback rates, approvals in different countries, and more. FastSpring’s managed fraud prevention model includes:

- Device-Level Protections: Velocity checks, CAPTCHA, and 3D Secure authentication prevent fraudulent transactions.

- Platform-Level Risk Adjustments: Custom data attributes like session language mismatches and player history refine fraud decisioning.

- Processor-Level Fraud Alerts: Direct integrations with global payment providers detect and respond to fraud in real-time.