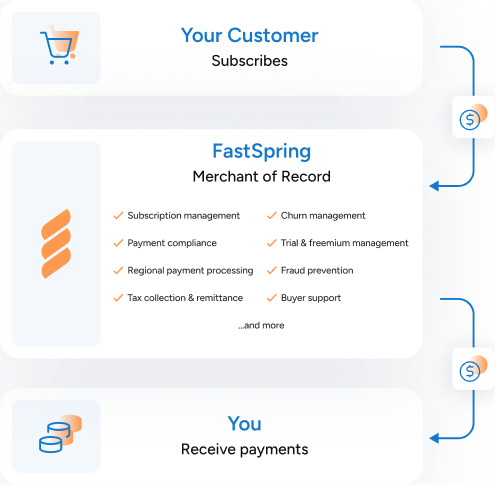

A value-added tax (VAT) is an indirect or transaction tax levied on the sale of goods and services around the world. The purpose of which is to tax the end user on the consumption. It is calculated as a % of the supply. A consumption tax can have many names; VAT, GST (goods & service tax), sales tax, etc. but work similarly. Its the sellers burden to account and assess any tax that is due on the transaction. works very similarly to sales tax. For purchases of SaaS, software, and digital goods, VAT is calculated based on the location of the buyer making a purchase. VAT rates vary within the EU, and each EU country has the authority to determine its own VAT rates. VAT rates can and do change as new laws and regulations are passed.

Over 150 countries have some type of consumption tax. A Seller is responsible for understanding of “selling” into all of these countries.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)