This article contains information about FastSpring’s current SEPA Direct Debit support. If you want to know more about SEPA and how it works, read our post on that topic here.

When you’re selling software internationally, it’s vital to give your buyers payment methods that are both familiar and convenient to them. This eliminates friction in the purchasing experience, leading to increased customer acquisition and revenue.

FastSpring helps sellers do this globally with a wide range of payment methods. One such payment method — one of the most widely used in the European Union — is SEPA Direct Debit. Not only does this help to simplify payments across borders in the EU, but it also helps reduce the likelihood of failed payment transactions.

With FastSpring’s new SEPA Direct Debit features, sellers are now able to not only collect payments within the SEPA region, but they also have access to chargeback management and can provide refunds through the FastSpring application.

Looking to try out SEPA Direct Debit with the premier merchant of record in the market? Sign up for a demo or check out the platform yourself.

Already a FastSpring seller and want to enable SEPA Direct Debit for your business? Submit a support ticket from inside the platform or from our support portal, or check out our documentation here.

What Is SEPA Direct Debit and How Does It Work?

SEPA (Single Euro Payments Area) is a system of transactions implemented in the EU and a few surrounding countries that allows consumers and businesses to make cashless euro payments via credit transfer and/or direct debit to anywhere within the SEPA region.

Anyone within the SEPA region can make direct debit payments in Euros — no matter the currency their local bank account is in. This simplifies and decreases costs related to cross-border transactions.

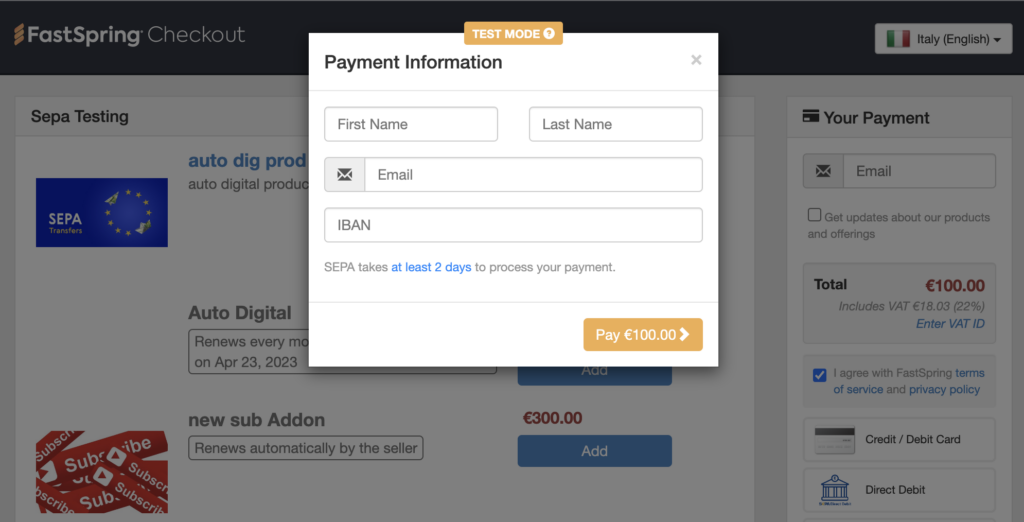

With a SEPA Direct Debit transaction, purchasers are sending money in a bank-to-bank transaction — similar to ACH (Automated Clearing House) in North America. Usually, this clears within two to five business days and allows for easy, unobtrusive payments for both businesses and individuals.

Why Should I Use SEPA Direct Debit?

As SEPA services more than 529 million citizens, any business interested in expanding their global presence would be remiss not to offer SEPA transactions to their potential customers.

To use SEPA Direct Debit with FastSpring, sellers simply need to put in a request within our support portal, and within two business days, it can be live on their storefront.

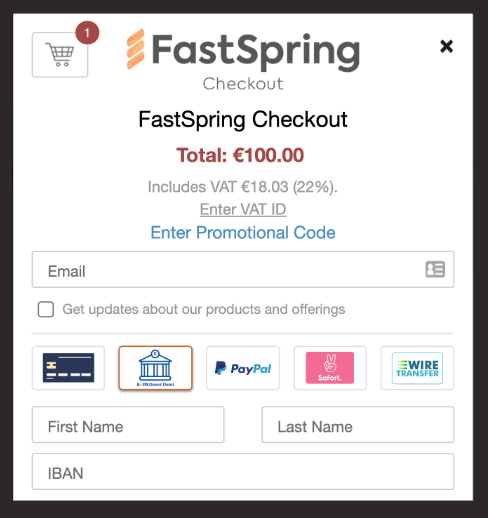

From there, collecting payments from customers is the same as other transactions. For the customers, SEPA Direct Debit will be displayed if they are in any of the covered regions as listed in our documentation. They select the payment method, enter their information, and they’re good to complete their transaction.

Not only is it easy to set up SEPA Direct Debit from the seller portal, but it offers several benefits to sellers who want to expand their business into the global market:

- Broader reach to more than 550 million potential customers in the EU.

- Increased conversion rate by making purchases easier for European customers, since less than half of European customers do not use credit cards.

- Decreased payment failure rates as a result of the bank-to-bank connection with SEPA Direct Debit.

- Increased retention by eliminating failed payments due to credit card expiry or cancellation.

As with all our payment methods, we’re constantly looking for other avenues for improvement with SEPA Direct Debit, including additional support for countries within the SEPA region. Have questions or want to see for yourself? Sign up for a demo or check us out yourself.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)