It should come as no surprise that one of the two certainties of life also follows you into the digital world. We’re talking about everyone’s favorite topic, taxes.

But if you thought the same policies for collecting sales tax in physical brick and mortar stores applied to digital businesses, think again. Online stores enable customers to shop anywhere around the world, regardless of their physical location. This means the tax is often determined by the location of the buyer, seller, or a combination of the two. With cross-border ecommerce expected to reach $627 billion by 2022, tax complexities will only continue to increase as different countries introduce their own regulations.

In the United States alone, sales tax is governed by 45 different sets of state-level laws. And if you’re looking to expand your business into international markets, you have to deal with collecting value-added tax (VAT) too.

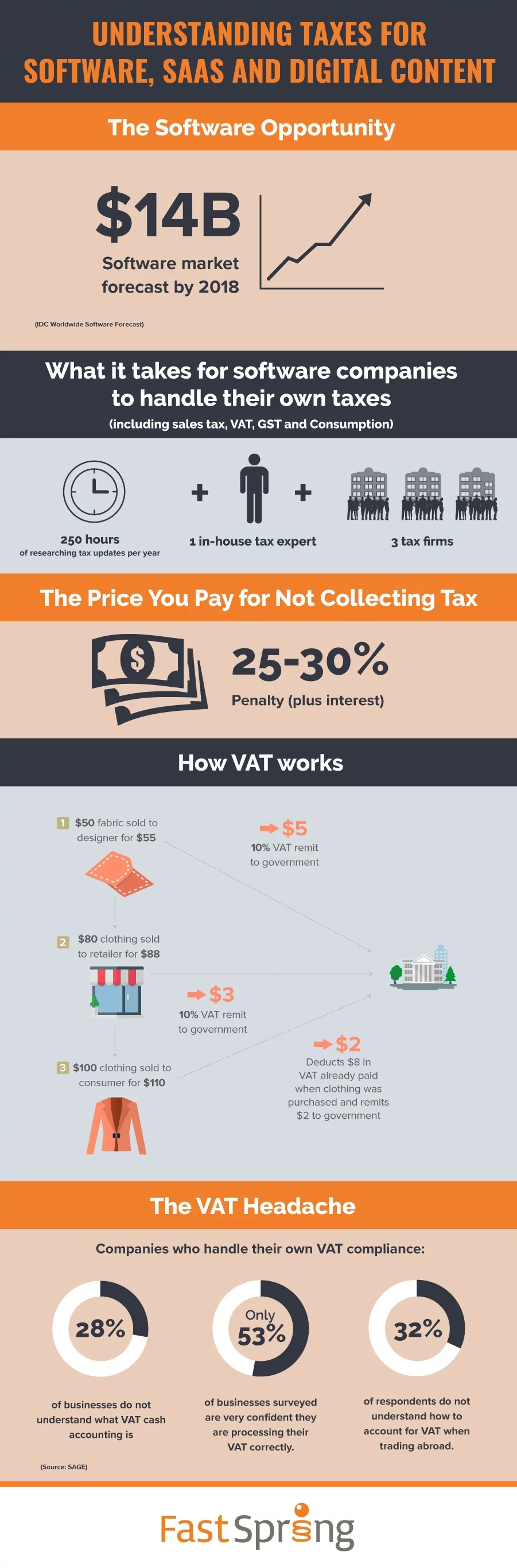

We understand taxes are a huge headache for many businesses, however, you can’t afford to ignore them. So we’re helping you understand the basics when it comes to taxes for digital goods and services. Check out the infographic below to learn about the various taxes for software, SaaS, and digital content.

Location is everything for ecommerce sales tax.

Previously, online retailers benefited because they could voluntarily decide to collect and remit sales tax on the sale of their products.

However, in light of the recent Wayfair State Tax Ruling, ecommerce businesses must now take on the responsibility of sales tax remittance for each state that requires one even if the business does not have a physical presence in the state.

While this ruling applies mainly to the sale of physical goods, online businesses who sell software and other digital products should stay informed of any changes to this regulation since they are most likely be applied to the sale of digital goods in the future.

Understanding Value Added Tax (VAT) for cross-border sales.

The Value-Added Tax (VAT) is a broadly based consumption tax assessed on the value added to goods and services. The VAT applies to all imported goods and services bought and sold for use or consumption in the European Union.

Digital products are broadly defined in the VAT, meaning if you’re selling software or digital products to E.U. citizens, it almost certainly applies to you.

Recognizing the costs of complex taxes.

It is estimated that software companies spend roughly 250 hours per year researching tax updates and must hire at least one in-house tax expert.

For growing software businesses these additional costs directly affect your bottom line. Hours spent researching constantly changing sales tax compliance can be used to improve your software or establishing digital marketing strategies to drive more sales.

Additionally, if your business is planning on paying any uncollected sales tax down the road, you could be liable for additional fees on your late remission. These can include both an interest fee and a penalty fee—usually in the form of a flat rate charge based on the original tax due.

Avoid the hassle of back-office management.

All too often many businesses realize that there’s a lot of work involved to remain compliant on all necessary global and local tax compliance. FastSpring’s all-in-one ecommerce platform handles tax collection, compliance, and payments on your behalf, including U.S. state taxes and European Union’s Value-Added Tax (VAT).

Ready to learn more about the ins and outs of taxes in the U.S. and around the world? Download our ebook, Understanding International Sales Tax and VAT Requirements.