Last week, I canceled an annual SaaS subscription (I had three weeks left until renewal).

Interestingly, even though I paid for a year-long subscription, the company didn’t let me keep the last three weeks of access to its premium features.

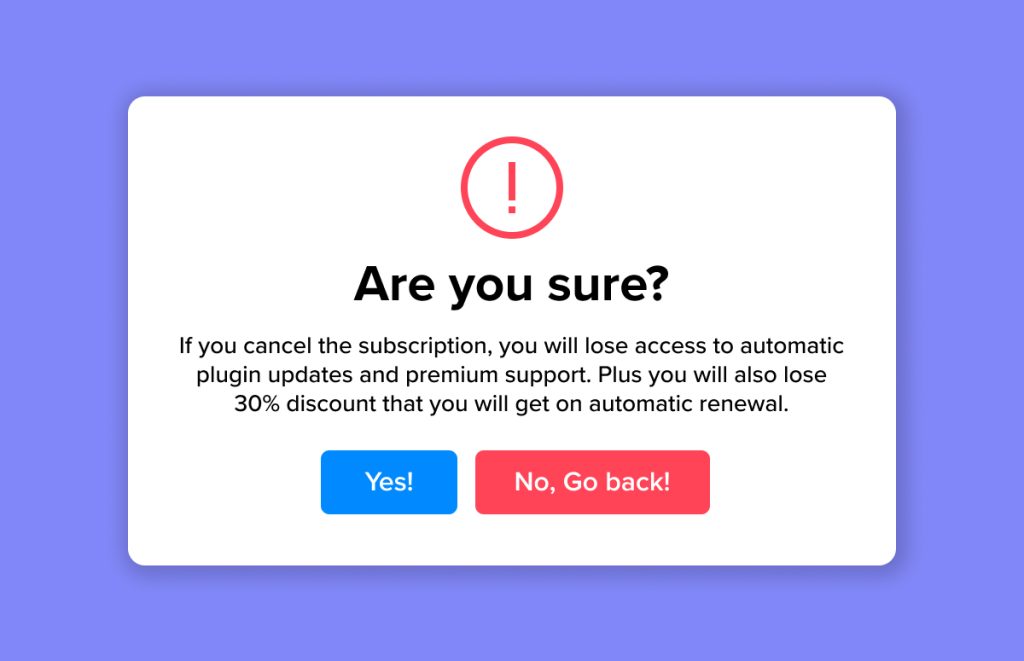

As soon as I started canceling, a popup warned me that I’d immediately lose access to all paid features.

“This action will immediately downgrade your subscription. Are you sure you want to continue?”

I canceled anyway, knowing I didn’t need the tool going forward. In the language of SaaS, I churned. And the experience got me thinking:

- Was immediate removal of paid features the best chance to keep me from churning?

- When did I officially count as “churned”? Did they count me as churned on the day I canceled? On the day my subscription would have renewed? What if I had downgraded, upgraded, or changed my usage?

- What could they have done better to try to prevent me from canceling?

In this article, we take our best shot at answering these and many other questions surrounding churn.

In part one, we cover benchmarks and common churn formulas.

In part two, we’ll cover five churn-prevention strategies that have been successful in other SaaS businesses.

And in part three, we’ll conclude with a set of definitions you can use when talking about churn with others — and some additional resources.

If you prefer, you can use this 👇 table of contents to jump between sections of this article.

Table of Contents

- Part I: SaaS Churn Benchmarks

- Part II: 5 Proven Strategies for Reducing SaaS Churn

- Part III: Churn Definitions and Additional Resources

Note: FastSpring has churn-prevention features built into our platform, such as automatic card retries, custom customer notifications to prevent card issues before they happen, and much. Set up a demo to learn how we can help you reduce churn.

Part I: SaaS Churn Benchmarks

When folks in SaaS talk about churn, we don’t always do a good job of making sure we’re on the same page.

If someone says they have a 5% churn rate, are they talking about monthly, quarterly, or annual churn?

Are they including customers who never made it out of a trial?

Can you compare the churn rate of a SaaS company targeting enterprise customers to one selling to the general public?

When we set churn benchmarks for SaaS companies, there’s so much to consider. And in this section, we break it all apart so that you can run an extensive churn analysis on your own company and have a better idea of how you’re doing.

Is There an Ideal Churn Rate for SaaS?

I often hear that a 5% to 7% churn rate is ideal for SaaS companies. But is this purely anecdotal? How common is it for SaaS companies to meet this benchmark?

In other words, 5% to 7% might be the ideal, but what’s the average?

To investigate, Ryan Law, former CMO and cofounder of Cobloom, performed an analysis of six recent churn reports or studies and found that there is no consensus on the average churn rate for SaaS companies. Half of the reports he studied showed an average annual churn rate of 10%. The other three showed a larger and wider range: from 32% to 61% annual churn.

Why such a wide range? Ryan theorizes that there’s not enough data out there to get a more accurate picture of SaaS churn because it’s not something most companies want to be very transparent about.

But he sees other common aspects that impact churn: a company’s size, and its industry.

Churn Can Vary by Industry

Industries can have very different churn benchmarks.

“Look through your own tech stack, and you’ll likely see some products you view as essential, and others deemed ‘nice-to-have,’” Ryan writes. “It’s likely that a finance or sales tools will be less susceptible to churn than a marketing tool, simply because it’s perceived to be more directly responsible for revenue.”

He adds that niche tools with fewer competitors will also see lower churn.

Company Size Impacts Common Churn Rates

Ryan points out that many of the largest SaaS companies target enterprise customers that use longer contract lengths, so their churn rate will be lower. So the flip side is that SaaS companies targeting individuals or small businesses with a larger customer base and shorter contract lengths will naturally have higher churn rates.

While Ryan compares the common churn rates of large and small SaaS companies, what he’s really saying is that your churn rate will vary based on the size of your customer and your average contract value. The smaller the ACV, the easier it is to churn.

What Is Acceptable Churn?

Hotjar founder David Darmanin understands that a churn rate doesn’t mean much on its own. “Ultimately, churn and the amount of churn you have matters as much as the size of your market and the speed at which you’re bringing on new customers,” he explained on an episode of the ChurnFM podcast.

If your market is small, then churn matters significantly more. But if your target market is relatively large, and you use a low-friction sales approach, then you can withstand a higher churn rate without it dramatically impacting your business.

This realization led David to break down churn into two categories: acceptable and worrying. Some churn is acceptable, perhaps even necessary — especially if you’re using a more B2C-style sales approach.

“Worrying churn is where you’ve identified an ideal customer, and they’re coming on board, then they stop using [your product], or they stop paying for it,” David said.

In other words, churn really starts to matter if you’re losing a large percentage of your ideal customers.

It can even be a good thing to lose users that don’t fit your ideal customer profile (ICP). They’re not the users you want to spend time supporting or seeking feedback from.

But there’s another distinction that matters to David: How do users feel about the product when they leave?

“Ultimately, I think what has a much bigger impact on this kind of flywheel you’re creating (in our case, at Hotjar) is that if people are exiting or pausing with a bitter feeling, that actually has a much bigger impact than the fact that they stopped paying you. Because word-of-mouth for us is actually much bigger fuel than the revenue that we’re collecting or churning or dropping or whatever.”

This is where collecting feedback from churning customers comes in (a topic we’ll dive into farther below).

What’s the Best Churn Rate Formula to Use?

To measure churn, the easiest churn rate calculation is the number of churns during a given period divided by the number of customers at the beginning of a period.

For instance, if you’re calculating monthly churn, and you start with 1000 customers and lose 27 of them, your churn rate for that month would be 2.7%.

But this formula misses out on a lot of important details.

For instance, it doesn’t take into account the number of new users you gained during that period and how many of them churned, versus the number of existing customers that churned.

It’s also not weighted for growth. If you lose the same amount of users each month, but you continue to gain more customers than you lose, your churn rate will decrease, but there’s been no change in customer behavior.

If you use this simple equation to measure monthly churn, you might even notice that your churn rate can vary depending on how many days are in a month!

For these reasons, the basic churn rate formula does not give you an accurate account of how you’re growing or who you’re losing. It’s just too simple.

When deciding how you’re going to calculate churn, Outlier AI recommends two things:

- The churn formula you choose should be in line with your top business priorities. Decide what details are most important to you to track and refine the formula accordingly.

- Don’t make the formula too complex. “The more complex it becomes, the more likely someone will make a mistake calculating it at some point, and you’ll have a misleading metric.”

Business analysts have published their own churn formulas. Steven Noble’s post about how Shopify measures churn is a must-read. And a Baremetrics post looks at churn of different types of customers, such as users downgrading or annual plan subscribers leaving.

One more thing: When people talk about churn, they’re typically referring to the number of customers lost. But there are other types of churn you can measure, such as revenue and transactional churn. Check out Outlier AI’s post for more on these.

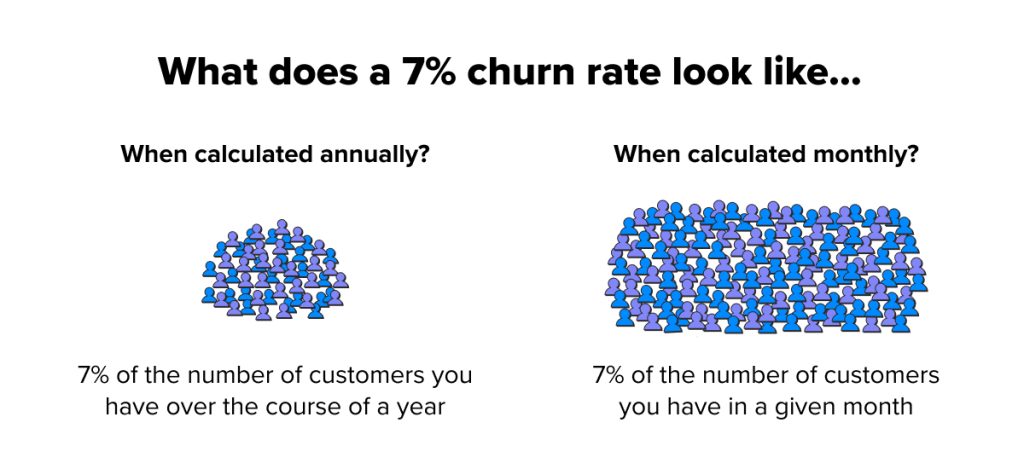

Monthly vs. Annual Churn: Which Should You Track?

There’s a big difference between monthly and annual churn. If you lose 7% of your customers to churn over a year, that’s a way different number than losing 7% of your customers every month.

While it’s not a bad idea to be measuring both, your monthly churn rate should be much, much lower than your annual churn rate.

What Is Negative Churn?

When attempting to get the big picture about churn, you shouldn’t just take into account how many customers you’re losing. The full picture includes the behaviors of your returning customers, as well.

And that’s where negative churn comes into play.

I’ve heard people ask whether negative churn is a myth. It’s not actually, but it might not be what you think.

Negative churn occurs when the revenue gained from upsells and cross-sells outweighs lost revenue from churned customers over a period of time.

When you’ve reached this point, you could continue losing customers with no new customer acquisition and still increase your revenue (at least for a while).

According to VC Tomasz Tunguz, reaching negative churn should be a goal.

“Combined with annual prepay contracts, negative churn is a very powerful growth mechanism,” Tomasz writes. “When thinking through your pricing model and your customer success strategy, it’s worth trying to engineer negative churn into your startup.”

Next Level Churn Rate Analysis: Who and Why

On a high level, a churn analysis is simply analyzing the rate at which you are losing customers.

But don’t stop there. Your churn rate just tells you the what, not the why or the who. To really understand and do something about churn, you’ll need to know why people are churning and which users you’re losing.

SaaS growth expert Fred Linfjärd recommends using a mix of quantitative and qualitative data analysis to understand who is churning and why, as well as how to take action.

Quantitative Data Gathering: Website and Product Data

Sample questions to try and answer:

- Which user groups are more likely to churn?

- Are there patterns in their product usage?

- What support documentation did they view before churning?

Qualitative Data Gathering: Surveys and Exit Interviews

Questions to try and answer:

- Why did they leave?

- What would make them reconsider?

Hopefully this gives you a better understanding of how churn is impacting your business. Next, let’s look at how to develop a churn-reduction action plan.

Part II: Five Proven Strategies for Reducing SaaS Churn

Ideally, your churn prevention strategy is led by the qualitative and quantitative research you’ve been conducting — because once you know who is churning and why, it becomes much easier to prioritize which strategies will have the biggest impact. But it’s always helpful to know what other companies have done that has worked well.

1. Update Your Dunning Management System

It’s common for 20 to 40% of customer churn to be involuntary: the result of expired cards, technical issues authorizing transactions, etc. Fred Linfjärd explains why making sure you have an advanced dunning system should be your first priority when battling churn.

2. Prove Value as Soon as Possible

Preventing churn starts at the beginning of the customer journey, and an especially critical time is during the onboarding process.

You’re undoubtedly aware of how important it is to make it easy for SaaS customers to get started. If there’s too much friction from the get-go, they’re not going to keep using it.

But there’s also more and more talk about the importance of providing “quick wins.” As Lincoln Murphy explains, “Customers who realize value quickly are the ones that stick around the longest.”

There are plenty of ways to orchestrate quick wins within the product itself. But it’s also something you can do more directly through emails.

Back when Christoph Engelhardt worked for Moz, he was able to decrease its monthly churn rate of new users by 40% by sending an email that showed the value Moz was providing to its customers within the first thirty days. He explains the process he used in an in-depth post.

3. Look for Red Flag Metrics

Search the product behavior of churned customers to uncover patterns. These behaviors can be red flags alerting you that a customer is in danger of churning.

Groove, a shared inbox for businesses, reduced churn by 71% through this data analysis. Groove’s team compared the product usage between new users that churned before thirty days and those who stayed. They discovered that users who churned had much shorter first sessions and less frequent log-ins than users who remained on after the first thirty days.

4. Customize Your Cancellation Offers

A common churn reduction strategy is to automatically send an offer to users who decide to cancel their subscription, whether it’s a discount, the ability to pause the subscription, or something else.

Wavve, a social media tool for podcasters, was able to recapture over 30% of users who pressed the cancel button by adding an offer at the end of a short cancellation survey.

This strategy worked so well because attaching the offer to the cancellation survey allowed Wavve’s team to personalize the offer based on why a user was canceling.

5. Automate What Works, Including Collecting Feedback

Once you’ve reduced churn, how do you keep it at a consistently low rate?

You keep collecting feedback in an automated way.

The personalized offer attached to a cancellation survey that Wavve employed was also a huge part of Fred Linfärd’s strategy when he reduced churn by 50% at a photo editing software company.

The cancellation survey allows you to keep collecting valuable feedback to stay on top of why customers are churning. “You can automate or systemize your qualitative feedback collection and, in this case, find out why they leave you. So typically, an exit survey would be sent to someone who cancels, either via an email or maybe even when they hit the cancel button. If you can automate that collection, that’s going to continuously get you feedback, so you don’t have to think about doing it,” Fred explained in our interview.

As your product and customers change, so will the reasons they churn. Continuing to evaluate feedback is an important part of maintaining a low churn rate.

And by automating the feedback collection process, it frees up your time to work on other projects.

Want more strategies to reduce churn? Fred offers some great tips on how to reduce churn and increase your average customer lifetime value through specific strategies that upsell customers to annual contracts. Check out the interview here.

Part III: Churn Definitions and Additional Resources

What Is Churn?

Customer churn, also known as customer attrition, is the loss of users to a product or service. It’s the opposite of customer retention.

What is a SaaS Churn Rate?

A SaaS churn rate is the measurement of the number of SaaS customers who cancel their subscription during a given period.

What Is the Average SaaS Churn Rate?

There is no consistent average churn rate for SaaS. Per multiple studies, the average churn rate can vary from 10% to 60% depending on the size of a company and its market.

Churn and Retention KPIs to Track

Besides monthly or annual customer churn rate, other SaaS metrics that can give you a fuller picture of customer churn and retention include:

- Dollar-based net retention rate (NDR)

- Customer lifetime value (CLV)

- Monthly recurring revenue churn (MRR churn) and annual recurring revenue churn (ARR churn)

How FastSpring Can Help

Reduce involuntary churn using our built-in revenue recovery tools, such as automatic payment retires, customer reminder emails, and a self-service portal.

Learn more about our subscription management platform.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)