More Payment Options =

More Customers

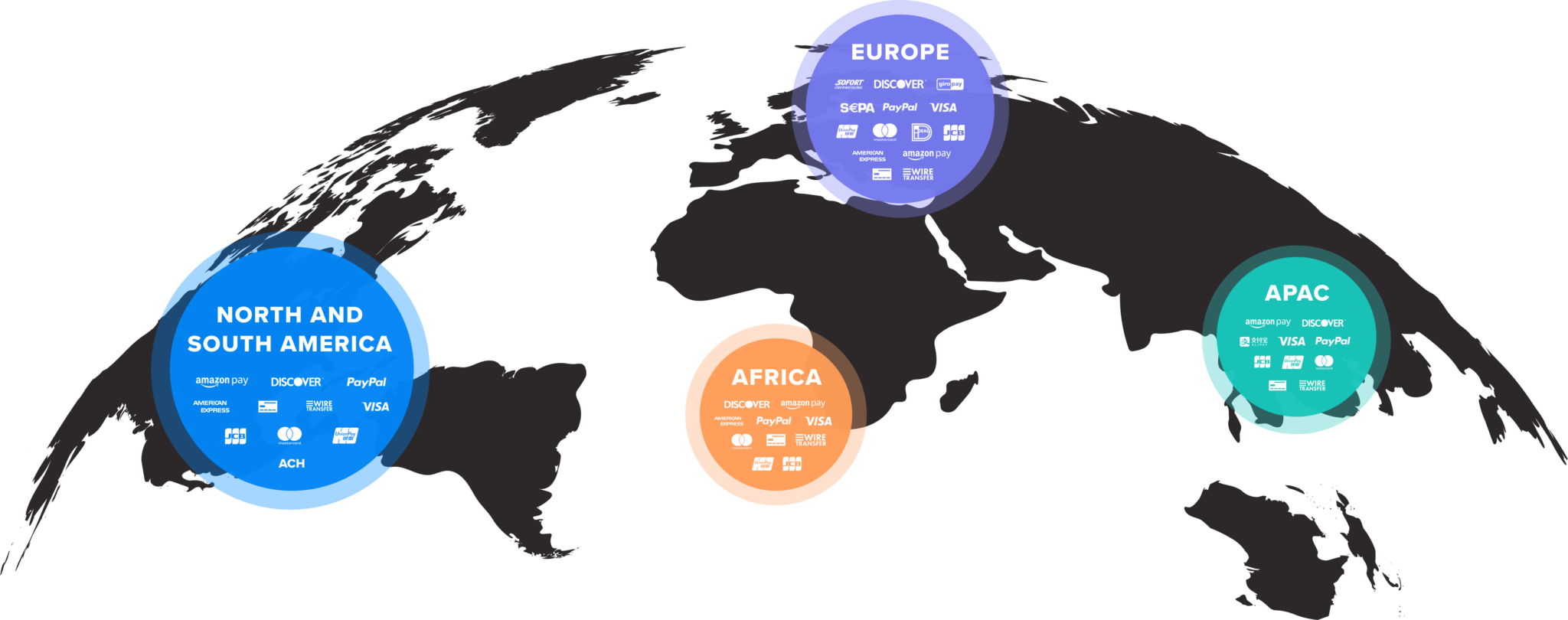

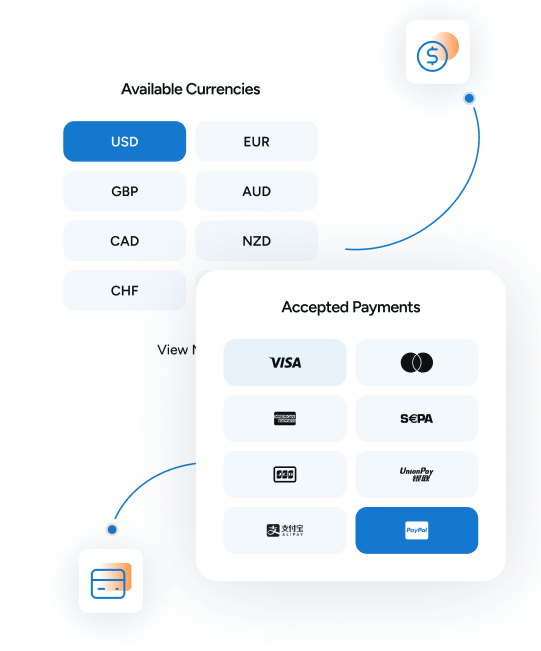

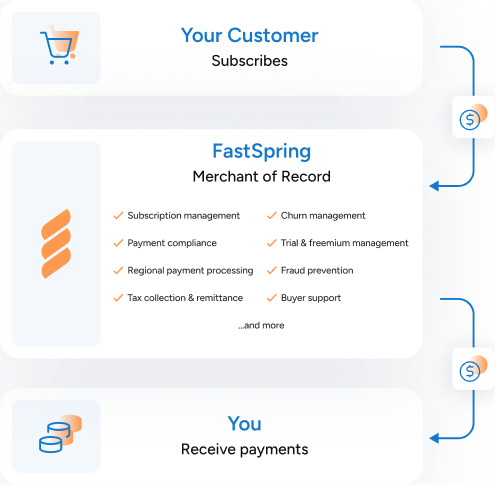

Offering local payment options is one of the easiest ways

to increase revenue for SaaS and software companies. FastSpring sellers can easily accept payments using the most popular methods from countries around the globe! No conversions to calculate.

No worrying about new payment options you may not even know about. Just turn on localized payments. We take care of the rest.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)