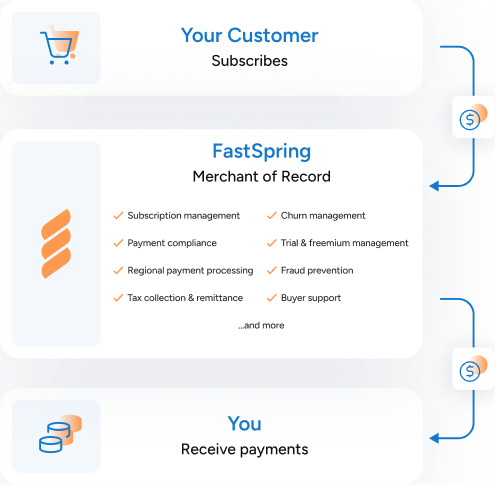

Most SaaS and software companies using Stripe pay for a variety of extra services to do everything FastSpring offers in a single service. When you use Stripe, you can process payments and receive money to your bank account. With a merchant of record (like FastSpring), processing payments and receiving money is only a small part of the service. FastSpring also provides a fully-built checkout tool, subscription management, compliance, fraud monitoring, and we collect and remit all purchase-related taxes ( sales tax, VAT, and GST, etc.) on your behalf.

It’s the agent vs. principle. Stripe is only a transaction facilitator, they assist and connect a buyer and seller directly to complete the transaction. All liability and responsibility remains with the Seller. FastSpring is a principle and steps into the shoes of a seller, selling to the buyer. Thus taking on all liability and responsibility of the “selling party”

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)