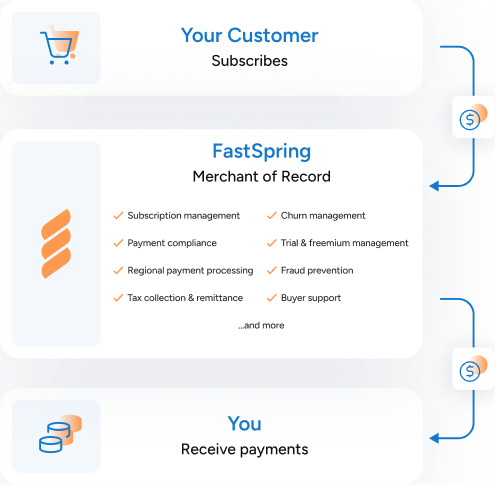

We’ll Collect and Remit Taxes

on Your Behalf

FastSpring acts as the merchant of record for your transactions, which means we’re responsible for handling the sales tax. You control the checkout experience and branding directly on your website. We process the payment, collect appropriate taxes, then remit those taxes so you stay compliant.