2022 Emerging SaaS Customer Markets

The number of countries or regions that are big consumers of tech is growing. In emerging markets around the world, more and more residents are coming online and using smartphones. Alongside new users and better digital infrastructures comes higher spend.

Southeast Asia is becoming a hot new market for major tech companies to add their next regional headquarters, while United States venture firms are turning to South America for their next big investment.

FastSpring has a unique perspective on where people are buying software and signing up for subscriptions. Using a merchant of record model, we help over 3,500 SaaS and software companies sell around the world. And between 2019 and 2021, FastSpring processed tens of millions of transactions in over 200 countries or territories.

In this report, we’ll show you the top countries where we see the most sales year after year. Then we’ll highlight 25 countries and three regions with the highest growth rates of software and subscription sales — places where you can find new opportunities to increase revenue and brand awareness.

We’ll also give you tips on how to break into new markets.

Note: Sign up for our three-week email series on optimizing regional revenue for more insights on localization for SaaS and software.

Countries with the highest revenue in 2021

These twenty countries topped the list of subscriptions and downloadable software sales from our customers in 2021. We looked at the top twenty markets from 2015 until 2021 and saw the same list of countries each year with little change. FastSpring’s own growth will strongly impact the growth rates you see.

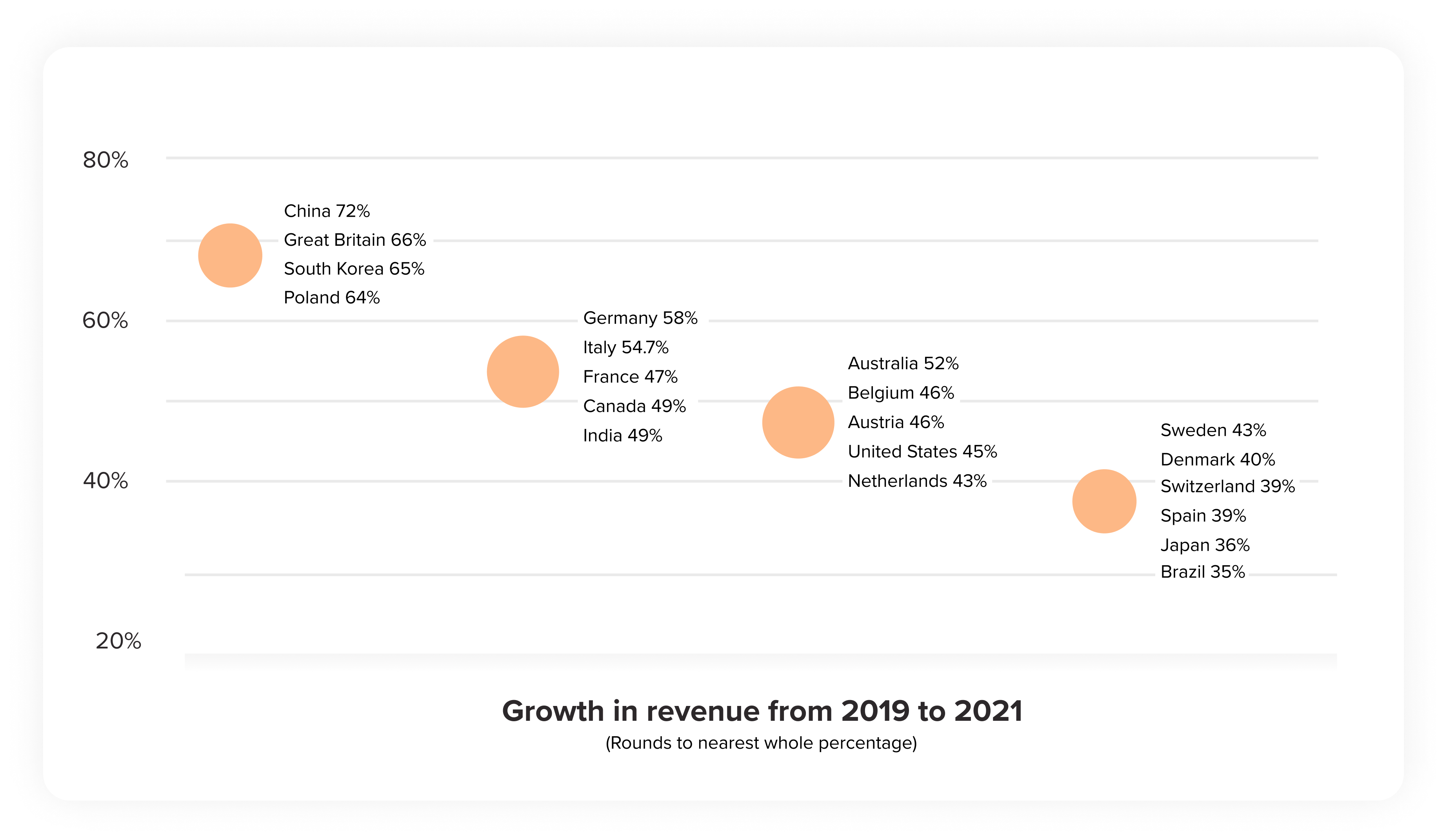

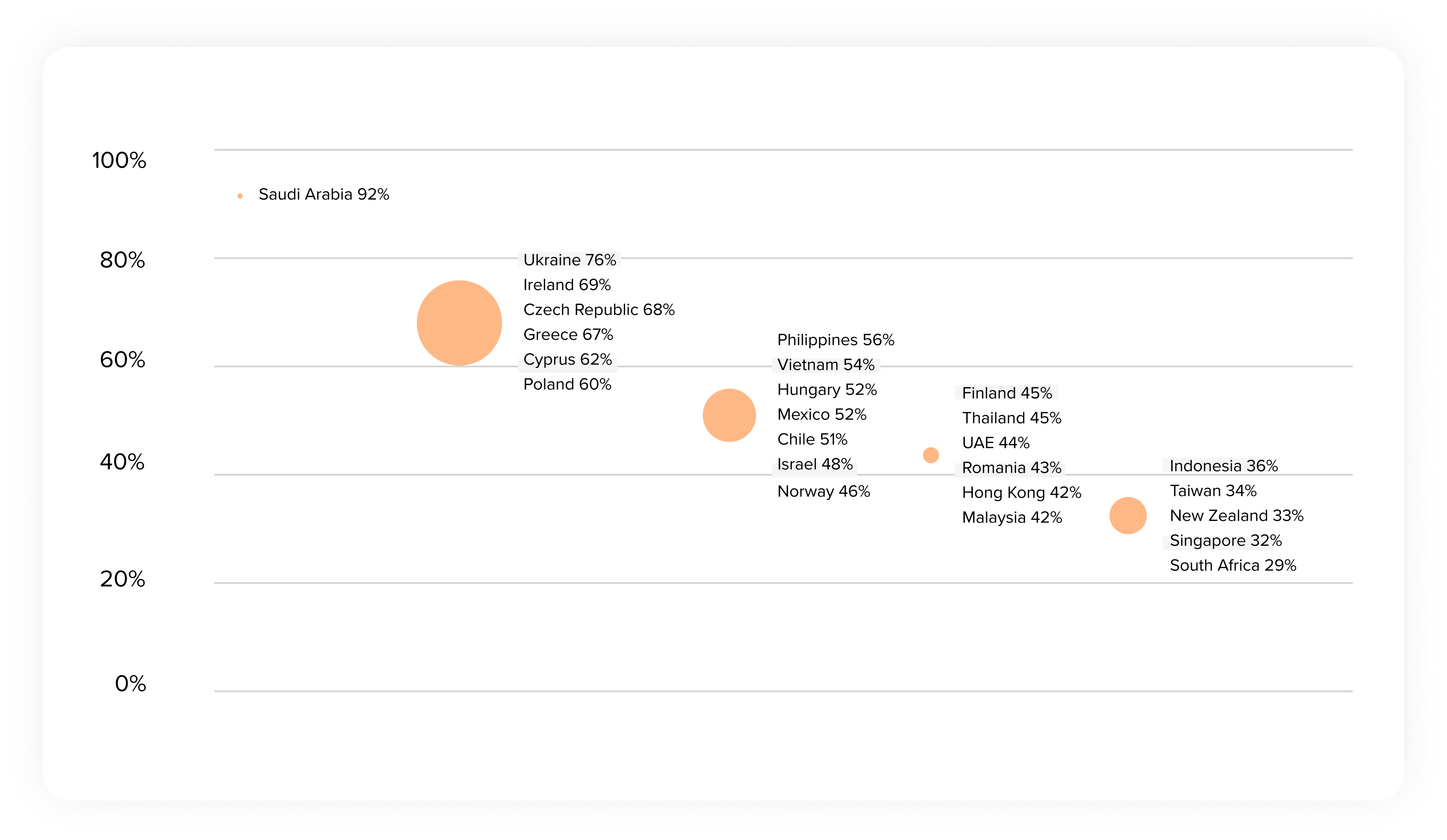

To come up with the top twenty-five emerging markets, we looked at our revenue data from 2019 and 2021 to find the countries with the highest YoY growth rate. We intentionally skipped 2020 because of the unusual economic situation the pandemic created.

We excluded the top twenty countries shown above and any country or territory with a low number of transactions. We then sorted the countries based on revenue growth from 2019 to 2021.

Here are the top 25 countries with the highest growth in revenue.

We dug further into the sales per country to better understand these markets.

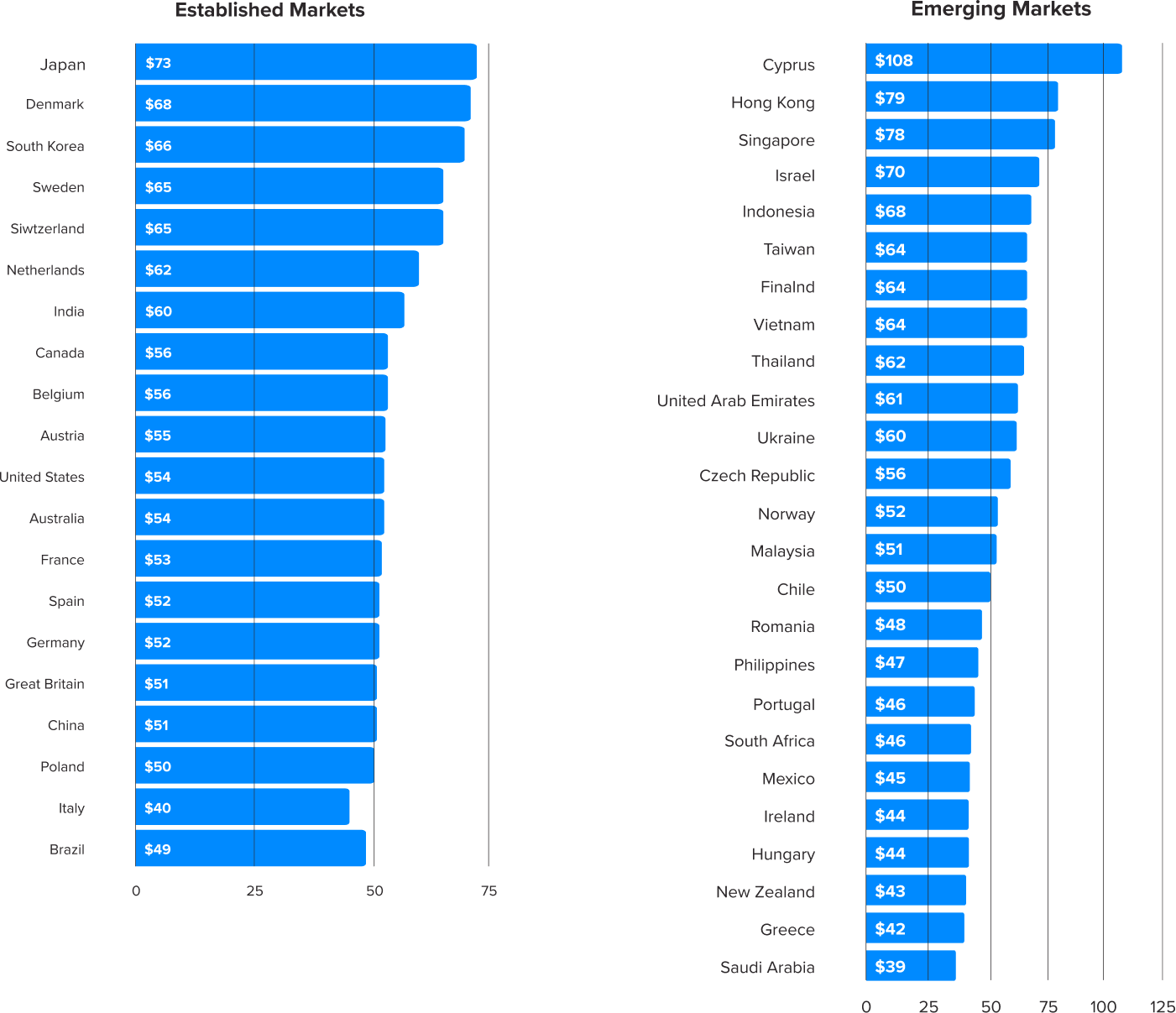

We suspect that the more sales you see per country or territory, the more alike they become in terms of average order value. Since emerging economies have fewer sales, we see a wider range of average order values. However, these numbers can give you an idea of what people are willing to pay.

For instance, we see many countries in Southeast Asia and East Asia have a higher average order value than other regions. If you’re running localized pricing tests, this could be a region to try out a higher price.

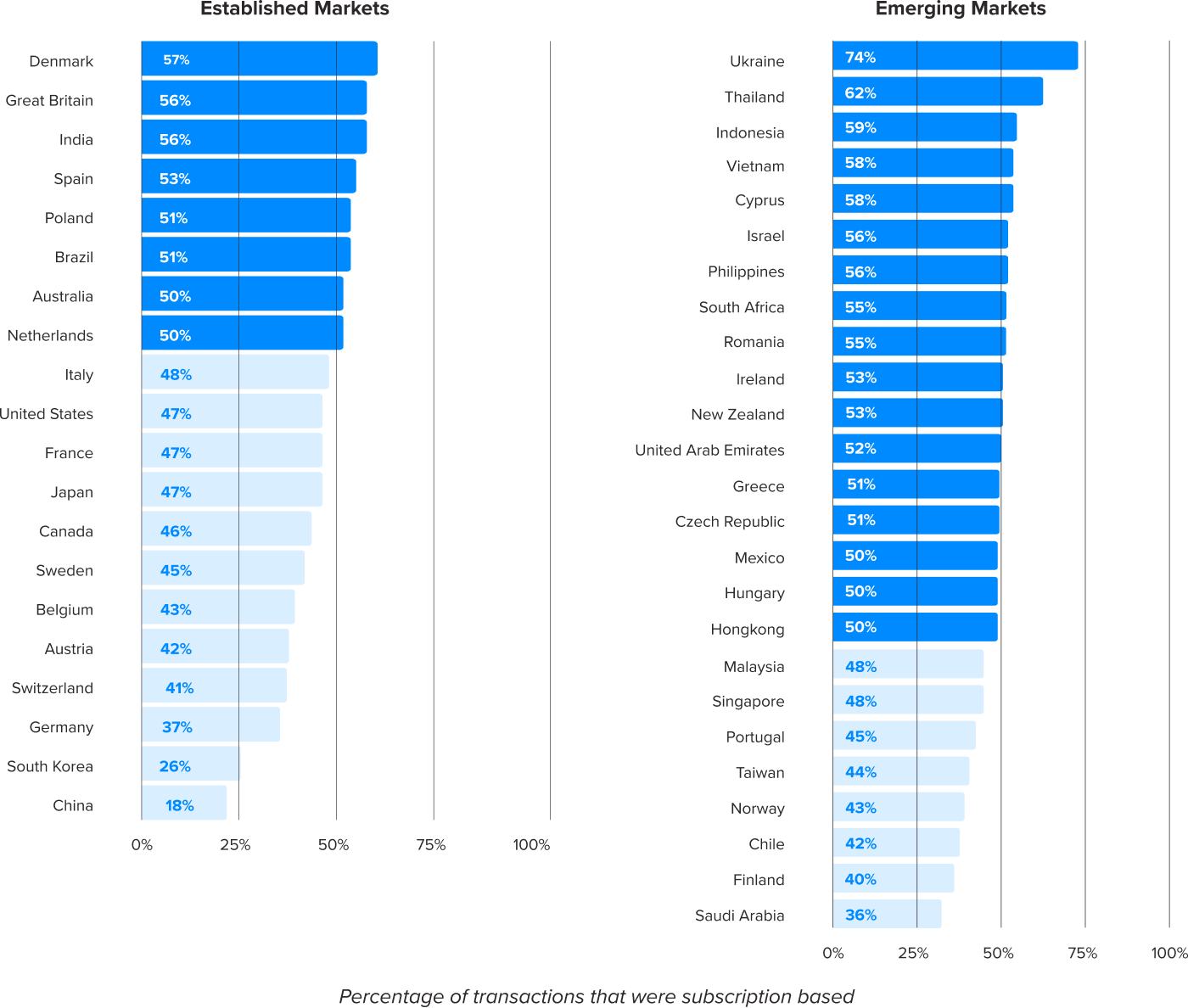

If you’re selling subscriptions, do you lean into countries with higher growth rates (such as China) or countries with a higher willingness to commit to a subscription plan?

Keep in mind that our data is impacted by where our customers are promoting their products, so it’s possible that our subscription-based customers just happen to favor certain regions or countries over others. But other factors that can influence this data include how long a product category has been around and how long it has been common in a particular country, as well as cultural purchasing preferences.

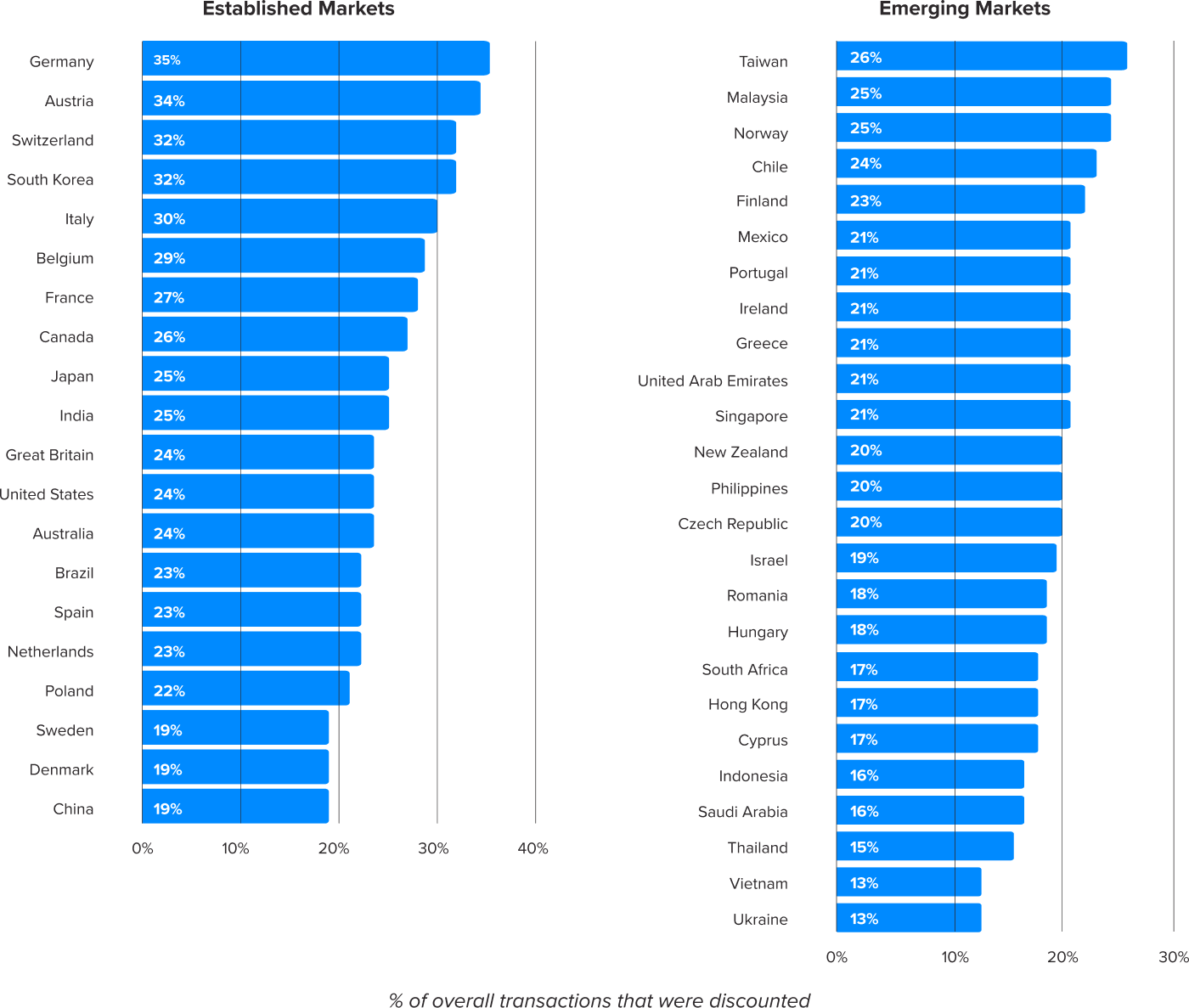

An average of 26% of transactions were discounted for established markets, versus just 20% for emerging markets. This could be because established markets are more used to competitive pricing.

Of the established markets, we see that Sweden, Denmark, and China are the most willing to pay full price, whereas Germany and Austria are the most likely to take advantage of promotions.

When breaking into smaller or emerging markets, there may be less need to use discounts or other promotional pricing since you’ll have less competition.

There are growth opportunities around the world for SaaS and software companies, so how do you successfully cross new borders?

We’ll send you nine emails over the course of three weeks about optimizing sales in different regional markets, including:

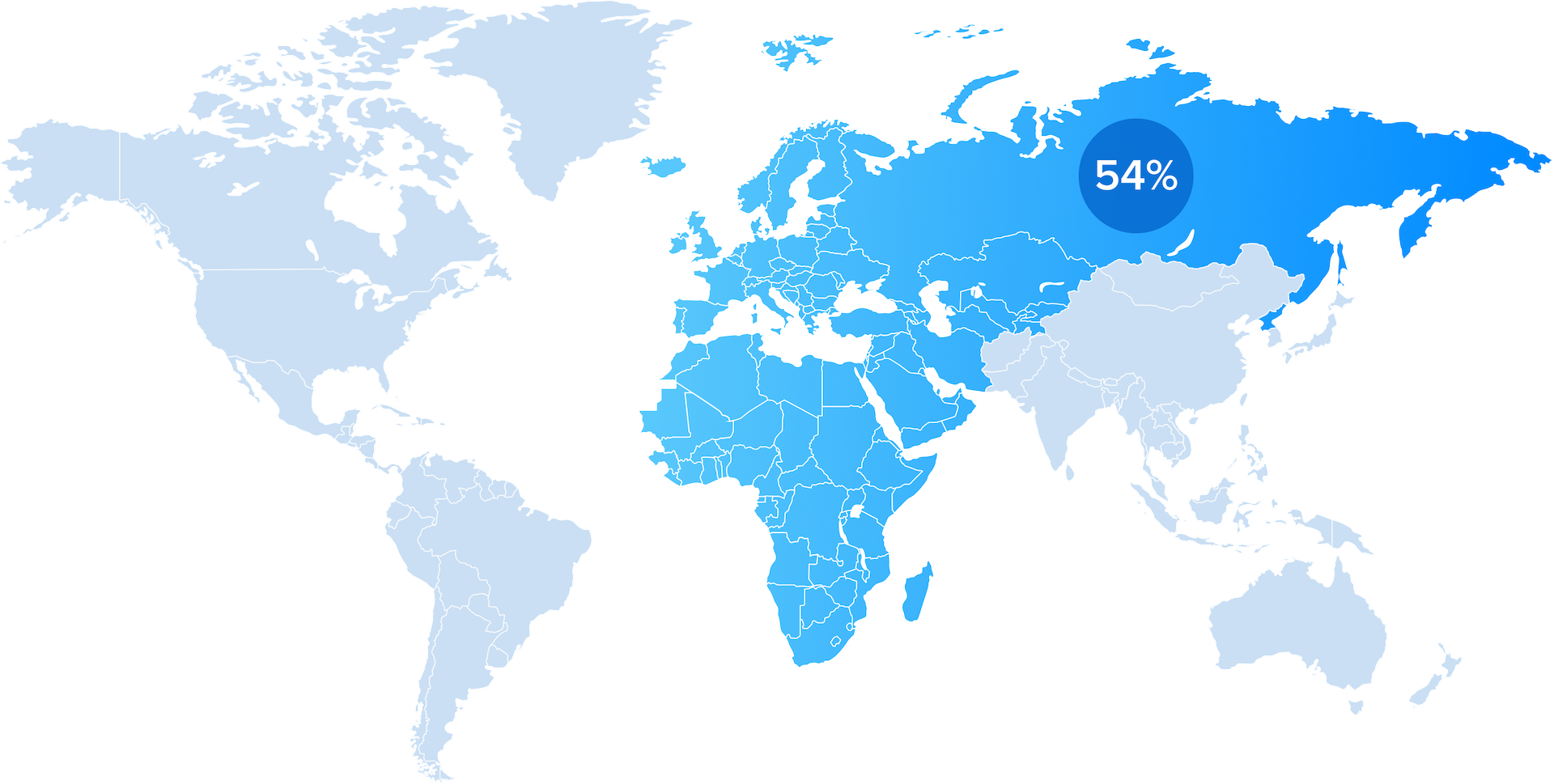

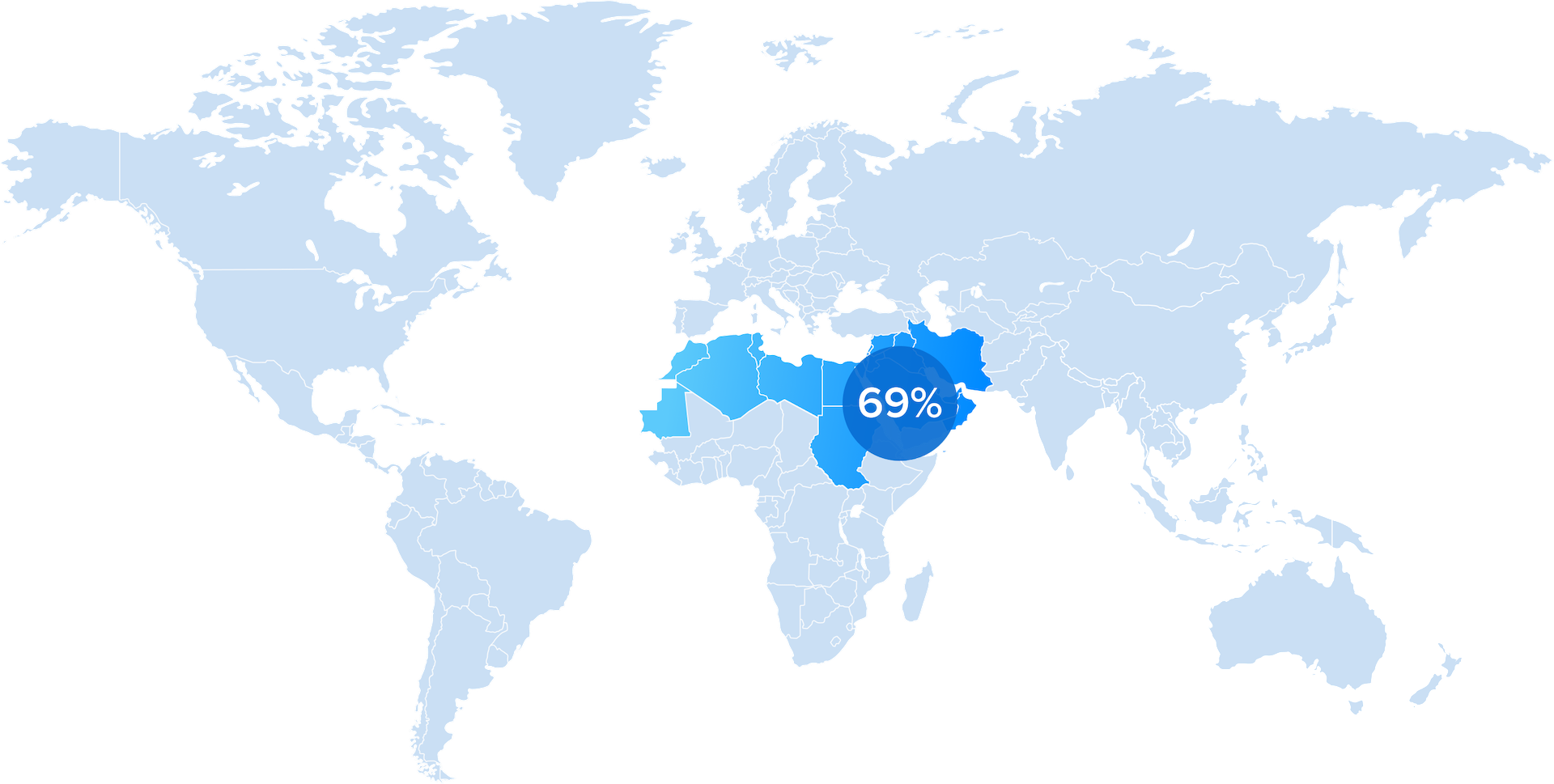

Of the three regions we’re highlighting in this report, the Middle East and Northern Africa (MENA) had the highest growth rate at 69%. It’s also 15 percent higher than the broader EMEA region. Saudi Arabia topped our list of emerging customer markets this year, with a 92% growth in revenue from 2019 to 2021. The United Arab Emirates also made the list with a 44% growth rate.

According to GfK, a consumer and market intelligence group, the MENA region has the strongest consumer technical goods market growth in the world. Consumers are conscious of tech trends. For instance, over half of MENA consumers surveyed were interested in learning more about the metaverse.

These consumer trends are likely related to the fact that the region boasts one of the youngest and fastest–growing populations in the world.

Tech infrastructure in the region is growing as well. Enterprise IT spend is expected to top $229 billion in 2022. According to IDC, SaaS will make up over 40% of enterprise cloud software purchases in the region.

Scaling out, the region’s GDP is expected to grow 5.2% in 2022, but is also expected to be highly impacted by inflation.

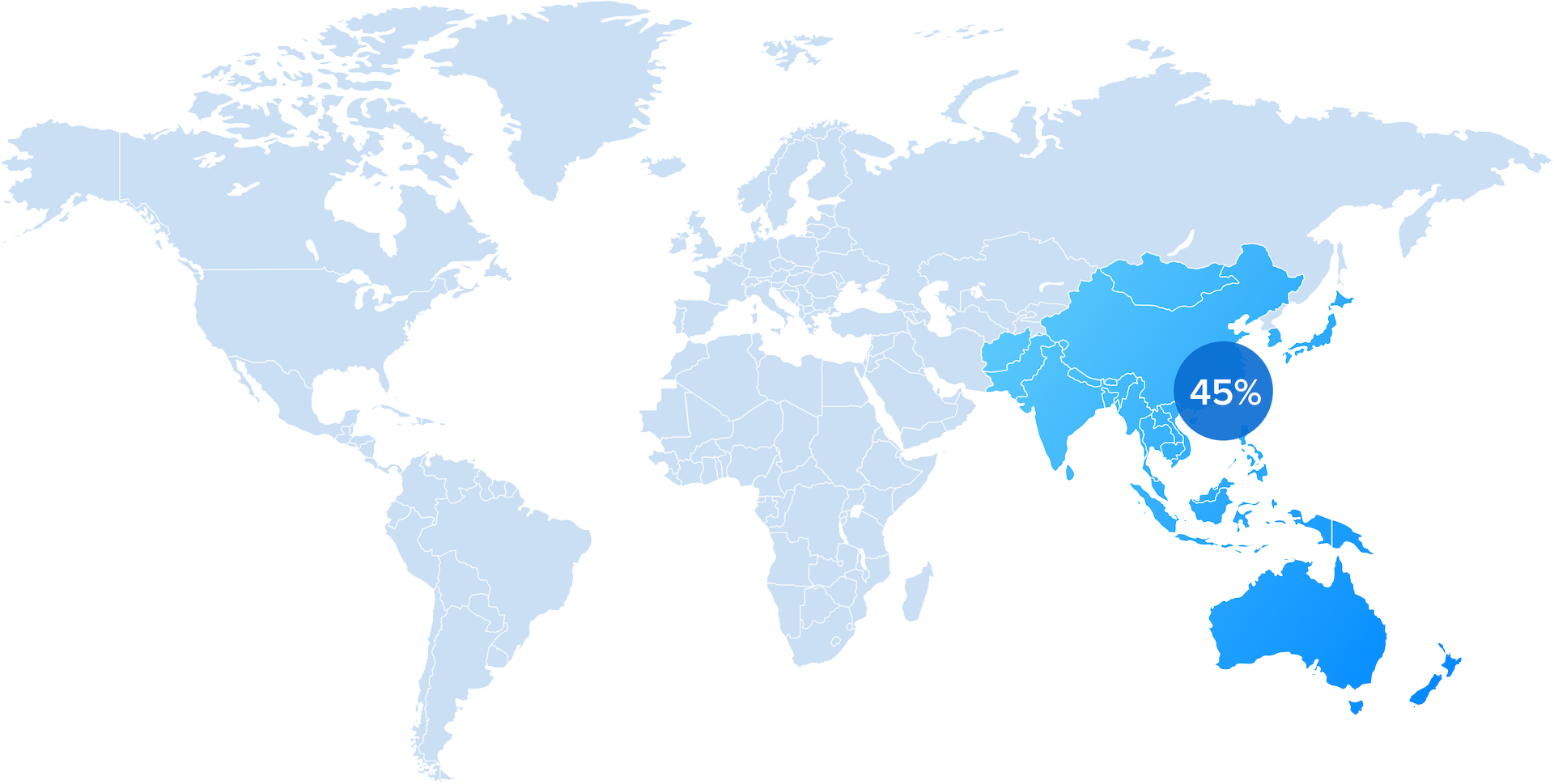

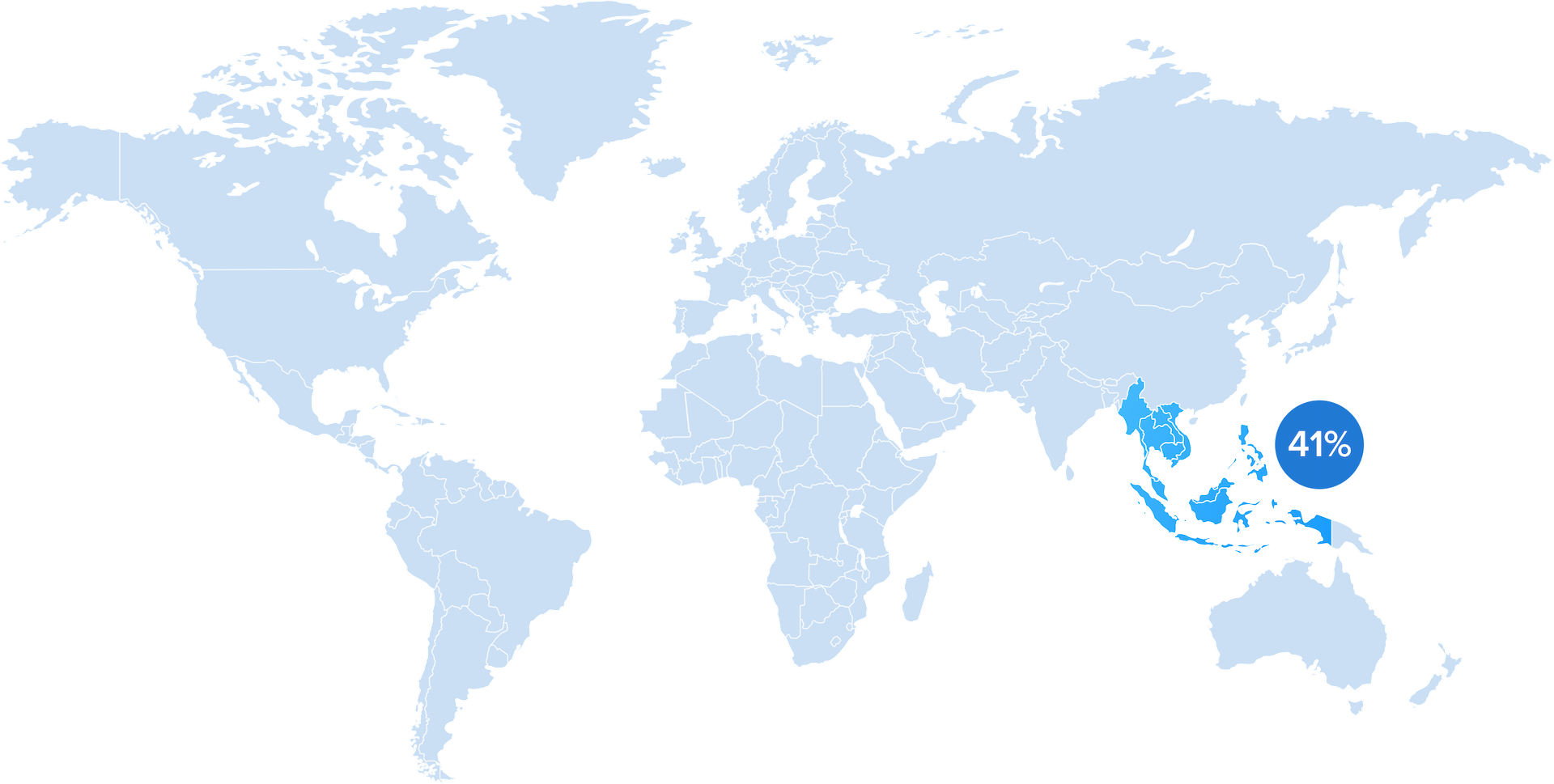

Of the eleven countries that comprise Southeast Asia, six made our emerging customer markets list: Thailand, Vietnam, Indonesia, Singapore, Malaysia, and the Philippines.

The region’s 41% revenue growth is just under the broader APAC growth rate of 45%.

According to a joint report by Google, Temasek and Bain & Co, the increased tech consumption in Southeast Asia is spurred by a growing middle class. In 2020, 40 million people came online and continued to increase their digital spending.

There’s a growing B2B market as well, as more big tech companies and firms open regional headquarters in the area, especially in Singapore. Meanwhile, Indonesia is home to several startup unicorns, including Gojek, Bukalapak, and Tokopedia. The entire region is a growing startup hub where startups are expected to see a combined valuation of $1 trillion by 2025.

Overall, GDP growth is forecasted at 4.9% in 2022 and 5.2% in 2023 — slowed by the war in Ukraine and ongoing problems related to the pandemic.

Like we saw in the Middle East, widespread tech adoption is increasing consumer tech spend across the region and aiding in the rise of a booming tech industry.

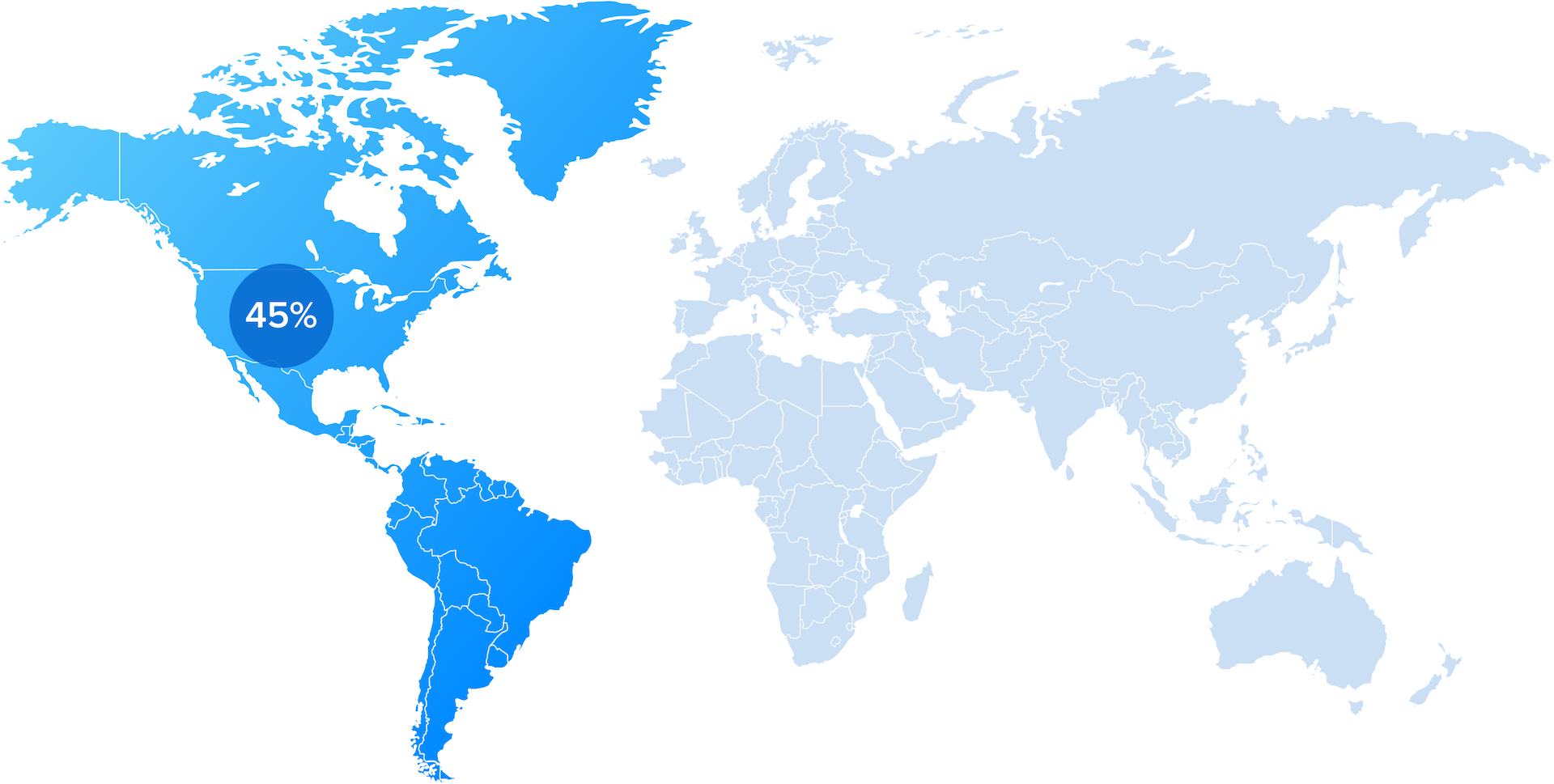

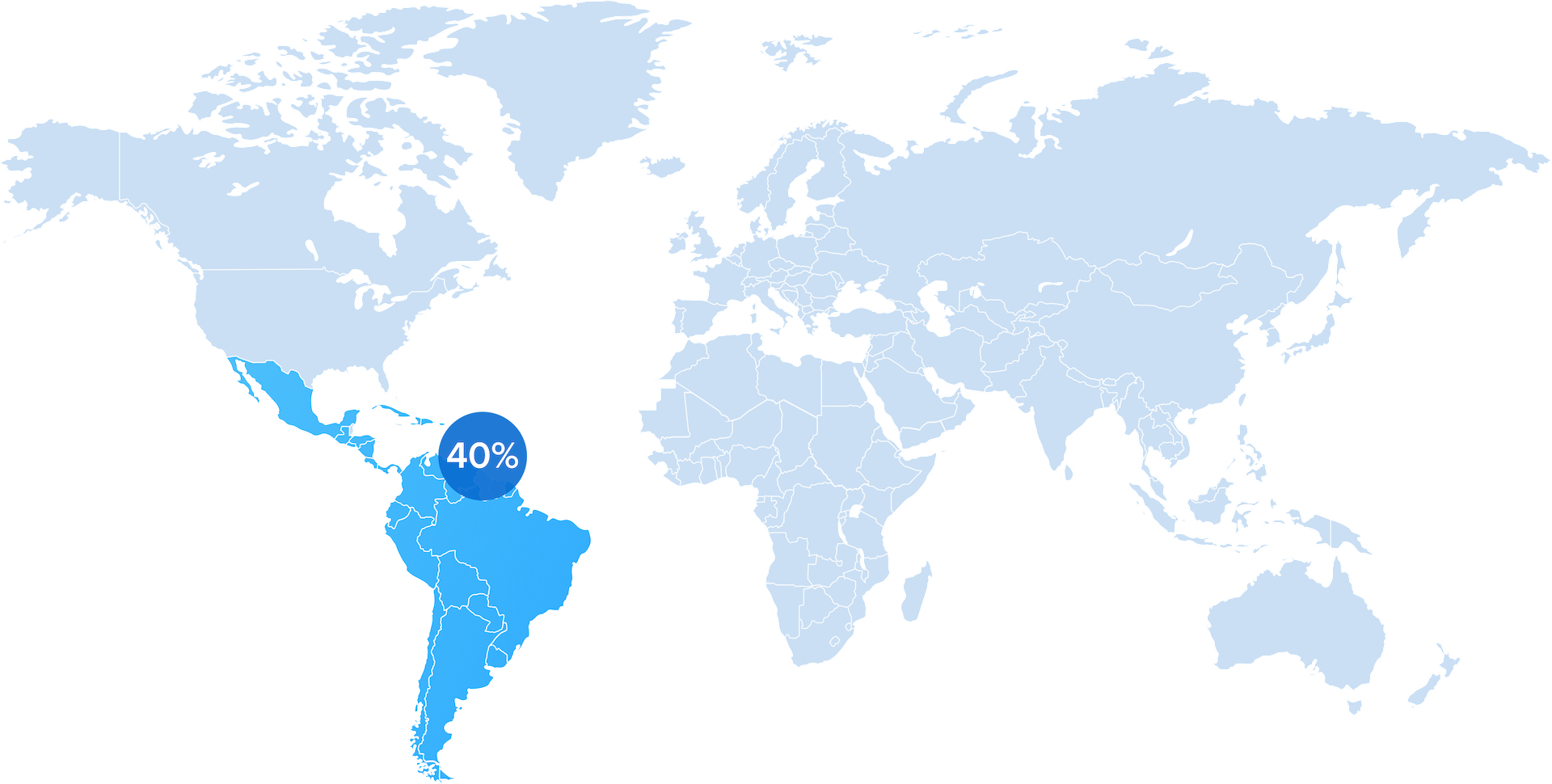

More U.S. venture capitalists are looking to Latin America for solid investments, and we see a larger number of LATAM-based companies joining the U.S. stock market. There’s a striking number of new LATAM unicorns — Contexto counted 45 in February of 2022. Many of these unicorns are online marketplaces that target Latin American consumers.

With the rise in tech companies headquartered in LATAM, we also see B2B tech spend growing. According to a survey by Spiceworks Ziff Davis, 70% of LATAM-based companies plan to increase IT budgets in 2022.

Consumers often prefer to pay in their local currency or using payment methods that are popular in their region. We’ve found that our own customers who localize their checkout have seen as much as 2x the conversion rate of those who don’t.

FastSpring automatically changes the language, currencies, and payment methods of the checkout experience based on where a customer is located.

FastSpring offers multiple purchase experiences, from a self-serve ecommerce checkout to digital invoices you can send your business customers.

At FastSpring, we act as the merchant of record for all transactions on your site, making us responsible for collecting and remitting taxes on your behalf. Whether you’re trying to manage reduced tax rates, customized taxation, tax-exempt transactions, B2C or B2B — everything is handled for you.

We also keep you compliant with global online payment, ecommerce, and privacy standards, including GDPR, CCPA, PSD2, PCI-DSS, and local regulations.

Leave the technical challenges of selling around the world to us. We’ll handle all the hard stuff, such as localizing checkout, billing and ecommerce compliance, and tax management — and let you focus on building and growing your SaaS business. Try out FastSpring for free or sign up for a demo to learn more.