SaaS, software, and mobile app companies are always chasing the next logos, stacking pipeline, and are obsessing over booked revenue. But to measure success, you need to understand what’s underneath all of these KPIs.

If you look just underneath the surface, you find annual recurring revenue (ARR) telling you who showed up to make a purchase. Dig a little deeper and you’re going to find net revenue retention (NRR) which tells you who stayed long-term.

By focusing on optimizing your net revenue retention rate in addition to ARR, you can supercharge revenue, reduce customer acquisition costs, and even boost your valuation.

Below, we’ll cover:

- What NRR is and how it differs from ARR.

- Why you should optimize for both.

- How FastSpring can help with both ARR and NRR.

If you’ve been looking at payment services providers but want a more comprehensive merchant of record to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, and digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

What Is NRR?

Net recurring revenue is a measure of how well a company has retained and grown revenue from current customers.

This is different from ARR because ARR is a measure of total recurring revenue (annualized) from current customers without accounting for the growth of current customers the way that NRR does.

A simple NRR calculation is to divide your total recurring revenue by the starting recurring revenue over a specific period.

ARR and NRR: Two Sides of the Same Engine

Most digital product and SaaS companies track annual recurring revenue, which is an annualized figure showing the predictable revenue streams from your subscribers.

Imagine you’re on a road trip — that’s your business journey and it’s made up of two parts: ARR and NRR.

ARR tells you how many users said yes to your product. It’s like inviting people on a road trip and your users are the ones who said ‘yes’.

But you’re not only interested in filling up the seats in the car. NRR tells you if your users keep saying yes after their initial purchase. It’s like how long your passengers ride along and if they start pitching in for gas.

ARR is motion. NRR is momentum.

You can accelerate fast and close deals quickly, but NRR shows if customers are comfortable enough on the ride to pitch in for snacks, take scenic detours, or explore additional routes and services.

NRR reveals if your product continues delivering value when no one’s watching. It measures whether what you’ve built truly holds up out on the open road.

In short, ARR gets you started, but NRR keeps you going. To build lasting growth, companies need both metrics working together. One showing how effectively you’re acquiring customers, and the other how well you’re retaining and expanding on those relationships. Balancing motion and momentum means knowing not just which users said yes, but which users continue to say yes — and why.

Why Both ARR and NRR Are So Important for Growth

While ARR tells you how effectively you get people to join your road trip, NRR is the fine print telling you how your product fits within their world. It’s about upsells, churn, and the overall health of your product.

Growth isn’t just about getting new customers — it’s about proactively working to maintain, nurture, and expand accounts. It’s ensuring that the current customers coming on the trip also settle in, turn up the music, and plan to stay.

So for anyone building or growing a product, embracing both ARR and NRR together is the magic formula for long-term, sustainable growth. NRR doesn’t care about drag racing to win new customers — it cares about keeping existing customers on a steady journey for the long haul.

What Signs to Watch For, and Why ARR + NRR Matters

ARR measures your company’s ability to acquire new customers effectively, while NRR provides deeper insight into how well your products continue to deliver value over time. When you measure ARR and NRR, there are some key things to keep an eye out for:

Is NRR on the Rise?

A rising NRR signals genuine product-market fit and customers are expanding services without being pushed. This momentum is only possible when the foundation set by ARR is strong and the experience post-sale holds up.

Use this signal to double down on what’s working:

- Identify which products, features, customer segments, or behaviors correlate with growth and build around them.

- Reinforce post-sale engagement to help more customers reach value faster. Double down on education, proactive support, product training, and other customer success levers to help your entire user base be successful.

- Create a growth potential playbook based on the successful customer journey and use it to inform lifecycle marketing, upsell triggers, and even product roadmap decisions.

- Turn your high NRR into new sales by capturing and sharing testimonials, case studies, and usage benchmarks to show future users what ongoing value looks like.

Keep in mind: rapid ARR growth can mask churn. Monitor your leading indicators like support tickets, feature usage, NPS, and be ready to intervene early. Growth hides churn… until it doesn’t.

Is NRR Declining?

A declining NRR isn’t just a retention rate problem. It’s a signal that your growth engine is leaking. You might be adding ARR through new customers, but without retention and expansion, that growth won’t compound.

If you’re having growth troubles, address it early with a structured approach:

- Dive into your data to look for patterns. Break down customer churn by segment, product usage, and support history. Look for spikes in cancellations, stalled renewals, or downgrades.

- Speak with churned and at-risk customers to understand what changed and use feedback to improve. Use this feedback to validate your hypothesis from your data or as an indicator to do more research.

- Look to improve your customer retention levers like onboarding, self-serve resources, and engaging inactive users. Customer growth can be largely impacted by feeling supported throughout the entire lifecycle, not just at product delivery.

- Consider changing your product positioning or packaging. Sometimes you’ve got the right product, but user expectations aren’t being met. If you’re seeing feedback that users aren’t getting the value they expected, it might be a sign that you need to change up messaging in sales, pricing, and onboarding.

In today’s SaaS business landscape, where customer acquisition costs (CAC) are climbing, budgets are tightening, and buyers are increasingly selective, ARR alone won’t fuel growth. When ARR and NRR work together, you not only acquire customers — you keep them, grow them, and build a business that runs on compounding growth.

How FastSpring Helps Grow ARR + NRR

FastSpring is built to power overall SaaS growth, and that includes features to help optimize for both ARR and NRR.

How FastSpring Helps With ARR

- Reducing checkout friction, making it easier for new customers to buy.

- Preventing endless free trials and trial abuse.

Make It Easier for New Customers to Try and Buy

On the ARR front, FastSpring makes it easier to get new customers on board. With customizable trial options, you can build a free trial that works for both your business and your customer base.

You can collect payment details upfront (during checkout) and automatically bill after trial completion, or opt for a cardless free trial. Cardless free trials remove friction from the trial checkout process and minimize perceived risk on the customer’s end, often yielding higher trial signups.

Imagine this: A customer who’s shopped with you before comes back to your store. They saved their payment information the first time around, so with FastSpring’s 1ClickPay feature, they can now pay with just one click — no need to reenter card details. Just one click, and their purchase is on its way.

This reduces checkout friction and makes it supremely easy to buy, on the customer’s end, and it means higher conversation rates and more revenue growth for your business.

Prevent Endless Free Trials

FastSpring customers have the option to enable Trial Hopping Prevention, which prevents trial users from accessing multiple cardless free trials with the same email address. Users who attempt to start a new free trial with one already in progress (or recently expired) are blocked and encouraged to add a payment method and choose a paid upgrade.

This helps to mitigate trial abuse, boost free-to-paid conversions, and cut down on new customer acquisition costs.

How FastSpring Helps With NRR

- Closely monitor subscriptions.

- Make the most of every customer interaction.

Closely Monitor Subscriptions

Understanding your customers is the number one key to higher NRR, and that means you need to be able to proactively monitor a lot more than just revenue and churn. FastSpring offers an in-depth Subscription Overview and Revenue Recognition dashboard that can help here.

Think of it like your business’ subscription reporting command center. The dashboard covers the most important subscription and SaaS metrics:

- Monthly Recurring Revenue (MRR).

- Active customers.

- Active subscriptions.

- Cancellations.

- MRR churn rate.

- Active trials.

- Lifetime value (LTV).

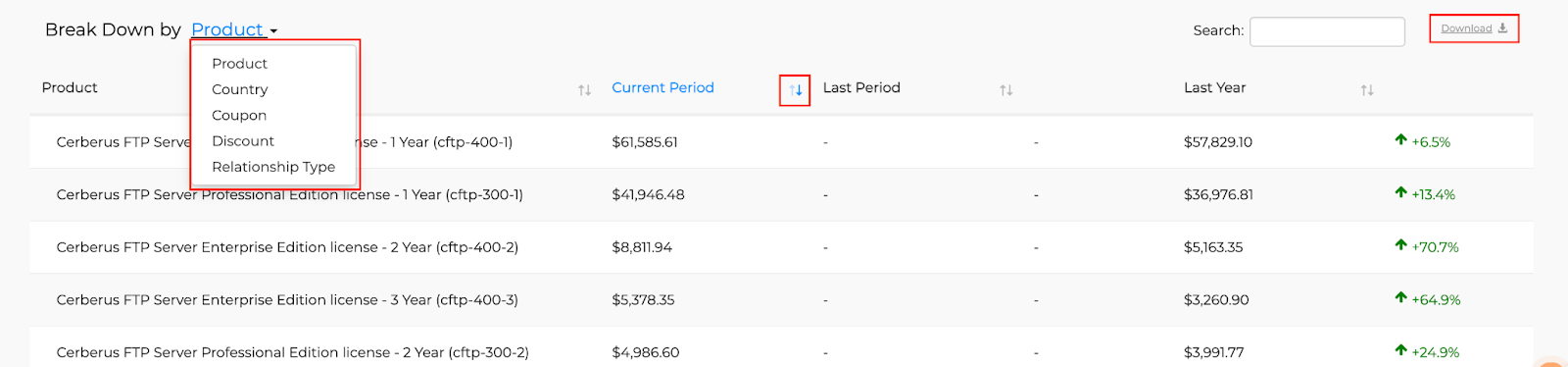

Plus, you can dig even deeper by filtering your MRR data by date, product, country, coupon or discount, relationship type, and more.

Keep drilling down to dive into:

- Contraction: MRR lost to cancellations and downgrades.

- Existing: MRR from existing customers who haven’t changed their subscriptions.

- Activation: MRR contribution from new customers.

- Expansions: MRR contribution from upgrades by existing customers.

Another great tool for boosting NRR is our Subscription Account Transfer API. It allows you to empower your customers to manage transfer of subscription ownership securely and easily. Whether you’re moving subscriptions due to a change in role, merging duplicate profiles, or because of employee turnover, the Subscription Account Transfer API allows you to automate subscription transfers at scale.

Make the Most of Every Customer Interaction

Picture this: You have a new customer, and they’ve bought something from you — is that the end of the road? Boosting NRR is about what comes next. It’s about guiding customers after that first purchase — say, suggesting products that go well with what they’ve already bought, or nudging them toward a premium subscription. In other words, it’s about upselling and cross-selling — not just to increase your total revenue (though it will do that), but to help make the customer’s experience richer, build loyalty, and retain customers for the long term.

FastSpring’s Product Offers API Suite can help you make the most of every customer interaction with targeted and personalized upsells, cross-sells, and even downsells. Combined with our reporting dashboards, you can see overall key metrics for your subscription products, and then use the Product Offers API suite to target users with value-based upsells.

Specifically, with the API, you can create and edit product offerings — and showcase these offers right in your customers’ account management portal. The API helps to match the right product to the right customer. It’s a win-win: You see improved ROI and additional revenue, and your customers see an enhanced, more personalized experience and an easier way to manage subscriptions.

Supercharge Your Company Growth With FastSpring

Proactively building to improve both ARR and NRR is about much more than crafting features or pulling in new users. It’s a journey of constant evolution, iterating, and seeking to truly understand what your users need — and how that changes over time — and then bringing them something that genuinely adds value to their lives.

When developing products and navigating the market’s twists and turns, remember that growth and nurturing go hand in hand. That’s where you find a product that doesn’t just exist but lives, breathes, and resonates for years to come.

If you’ve been looking at payment services providers but want a more comprehensive merchant of record to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, and digital products businesses, including VAT and sales tax management, payment localization, and consumer support.

Interested? Set up a demo or try it out for yourself.