Show results from:

fastspring.com

Docs

Product

-

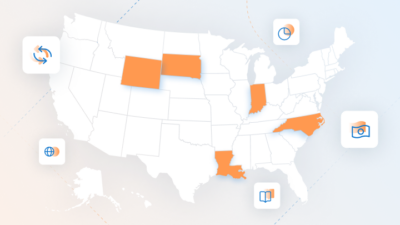

Global Online Payments Easily transact across borders

-

Fraud Prevention Intelligent alerts, fewer chargebacks

-

Subscription Management + Billing Flexible recurring billing tools

-

Affiliate Marketing Find engaged buyers for your product

-

Checkout Localized, Embedded, and Branded

-

Digital Invoicing Pain-free B2B digital sales

-

Tax Compliance We handle all taxes including VAT

-

Interactive Quotes Streamline custom SaaS deals

-

Reporting and Analytics Understand Everything about Subscriptions and Revenue

-

Merchant of Record We handle the complexities of global selling for you

-

Developer Tools Review the most recent resources for building your store experience

Use Cases

- SaaS Accelerate your SaaS revenue

- Video Games Sell games or in-game purchases

- Digital Products Coverage from checkout to fulfillment

- Downloadable Software Save time while increasing conversions

- Mobile Apps Subscription or one-time payments for mobile apps

- eLearning and Courses Easily sell courses on your own site

- B2B Close PLG and sales-assisted prospects faster

- Customer Stories How FastSpring sellers succeed

Developers

- Documentation Learn how to use FastSpring

- Store Builder Library JavaScript tools for commerce

- API Reference Endpoints, methods, and examples

- Code Samples Examples of common patterns

- Webhooks Handle important events

- Changelog See what's new per release

- Integrations Connect your stack to FastSpring

- Status Check in on the platform

Resources

Support

(opens in new tab)

Question a Charge

Loading search...