The landscape of sales tax regulations is constantly evolving, and 2024 has ushered in significant changes that could impact your business. Recent legislative adjustments have seen several states altering their criteria for establishing a sales tax nexus, which could affect the ways in which many online businesses manage their tax obligations.

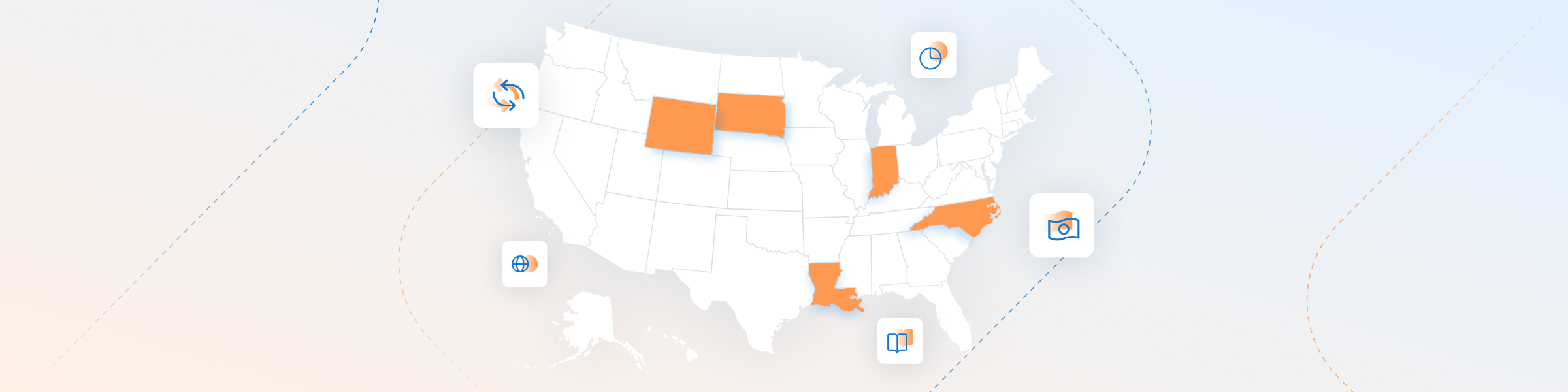

Historically, most states have used a combination of sales thresholds and transaction counts to determine whether out-of-state businesses should collect and remit sales tax. However, starting this year, Wyoming, South Dakota, North Carolina, Louisiana, and Indiana have eliminated the transaction count aspect of this requirement. Now, the presence of a sales tax nexus is determined solely by the sales threshold.

Implications for Businesses

This change simplifies the nexus criteria but also means that more businesses might meet the criteria for nexus sooner than they expected to, based solely on their revenue. It’s crucial for companies — especially those dealing in digital goods like downloadable software, SaaS products, or streaming games — to be aware of these updates, as they may need to adjust their sales tax collection and remittance strategies accordingly.

Keeping Track With FastSpring

Navigating these changes can be complex, particularly for smaller businesses without dedicated tax departments. This is where FastSpring can help.

As a merchant of record, FastSpring automatically handles the complexities of sales tax collection and compliance for you. This allows you to focus on your business and less on the nuances of state tax laws.

Stay updated, stay compliant, and let FastSpring take care of your ecommerce needs so you can grow your business with peace of mind.

Set up a demo or try it out for yourself.