Looking to leverage FastSpring’s Digital Invoicing for your SaaS or gaming business? Sign up for a demo or check out our free trial.

When you’re dealing with global sales, taxes are a necessary part of everything you do. For many SaaS companies, being able to accurately apply tax exemptions across the globe is a vital step for accuracy in quotes as well as reporting when tax time comes around.

We’re excited to announce new updates to how we handle tax exemptions in Digital Invoicing. Further, we’ve made improvements to how we handle tax exemptions in Japan to be in compliance with new regulations starting October 1, 2023.

Digital Invoicing Now Supports Tax Exemption When Creating Quotes

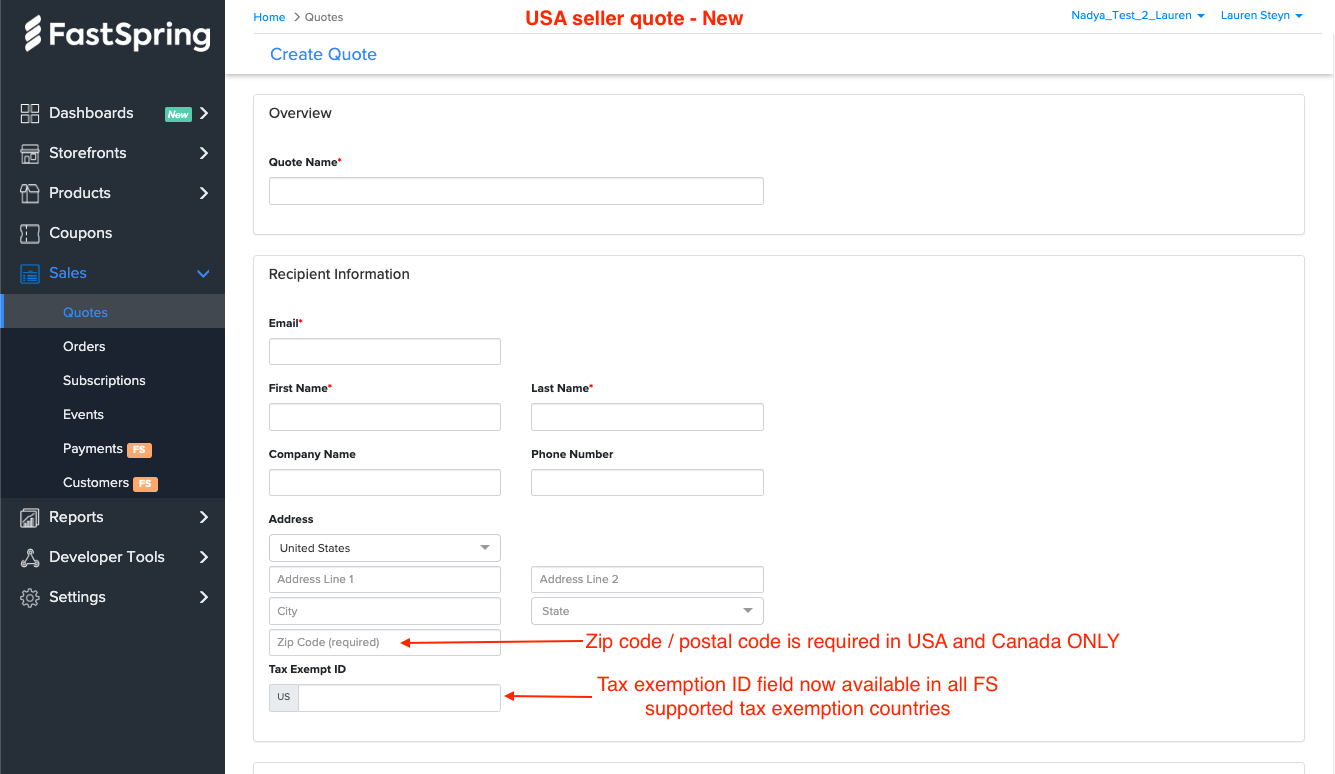

The first of these updates is how tax exemptions are added to Digital Invoicing’s Quotes within the FastSpring platform. Now users are able to add a tax exemption ID to quotes created within the FastSpring App and from the Quotes API. This change applies to all supported countries where FastSpring collects taxes.

Not only does this simplify workflows for FastSpring users who previously had to retroactively add the tax exemption on the invoice, but it also adds additional clarity to pricing for prospects receiving a quote—which will contribute to increased customer acquisition.

Example of the new changes to FastSpring’s Digital Invoicing Quotes in-app.

This change also includes the requirement for zip or postal codes for both the USA and Canada. Now we can more accurately validate the tax exemption numbers at the time of quote creation. These changes apply to both user generated quotes as well as quotes generated by end-customers of FastSpring users.

Note: To enable tax exemption for orders in the USA, please reach out to our team at support@fastspring.com.

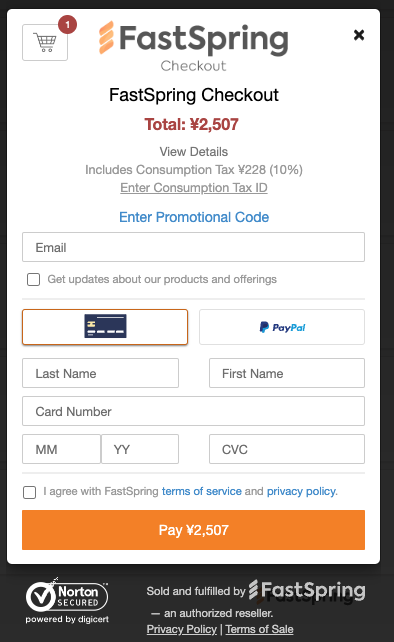

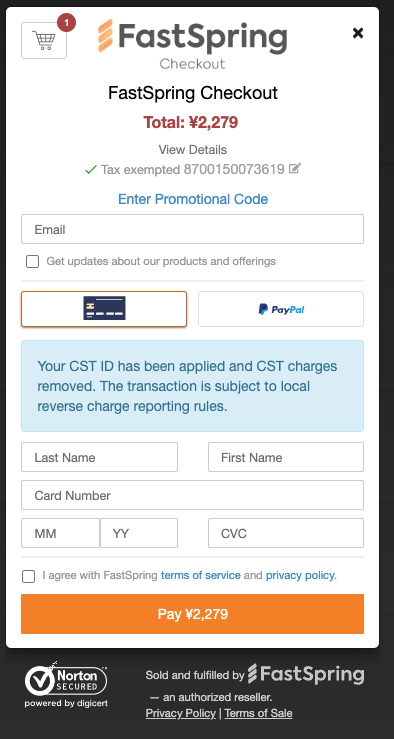

Expanded Support for Tax Exemption in Orders From Japan

Tax Exemption

In addition to the changes we’ve made to Quotes, we’ve also expanded support for tax exemption to orders in Japan. Now users looking to expand their B2B offerings in this region will have access to new tax exempt features. B2B users that input a valid JCT tax ID can receive a 0% rate and report the tax directly under reverse charge accounting.

Qualified Invoice System (QIS)

Japan’s new invoicing system rolls out October 1, 2023!

What does this mean? After October 1, buyers purchasing from non-registered QIS issuers will no longer be able to claim input JCT credits on any consumption tax paid. Credits can only be generated on purchases from official registered issuers like FastSpring. FastSpring registered as a qualified issuer before the Oct 1 date.

Find out more about Japan QIS here.

Interested in learning more about any of these features or have questions about your tax liabilities for games or software sales in Japan? Sign up for a free trial or schedule a demo today.