When you’re trying to decide how to scale your business and how to calculate profits, there are tons of metrics out there you can use.

In fact, it’s easy for businesses to get overwhelmed by metrics and not know which ones to prioritize. One of the most critical areas to get a grasp of, however, is how much a customer is worth to your business.

This metric? It’s called Lifetime Value (LTV), and it’ll tell you how much a customer will spend during their time with your business. Depending on what calculation you use, LTV can paint an honest picture of whether your customers are spending and staying long enough to cover acquisition costs and hopefully—make you a profit.

In this article, you’ll learn all about LTV, why it’s important, how other companies have used it to scale, and finally—how to calculate your company’s LTV.

What Is LTV, and Why Is It Important?

Lifetime Value (LTV) is a metric that shows the average revenue generated by a customer before they churn.

By calculating your customer’s LTV, you can get a better idea of how much each new customer will add to your overall revenue and how much you can justify spending on customer acquisition. Because of that, it’s one of the most useful metrics a business can use to make future decisions about where to focus your sales and marketing efforts to bring more customers in.

LTV is also closely tied to your Customer Acquisition Cost (CAC)—the metric that calculates how much it costs your company to turn a lead or a prospect into a paying customer. That’s because if your CAC is higher than your LTV, it’s impossible to make a profit. If your LTV is lower than your CAC, you’re actually losing money with every new customer your company brings on board.

The top three reasons you need to have a firm grip on your LTV are because it:

- Helps Prioritize Winning Marketing and Sales Strategies

No company has unlimited funds, so you must spend your money wisely. Measuring your LTV of customers depending on their acquisition channel makes it easier for you to distribute funds to sales and marketing efforts that will bring in customers that will stick around for longer - Tracks Your LTV/CAC Ratio

If you don’t know how much it’s costing you to acquire customers, or if those customers are worth the cost, you risk losing money. Tracking your LTV/CAC ratio allows you to spend the right amount on customer acquisition while still making a profit - Focuses on Loyal Customers

As LTV shines the light on where your most valuable customers are coming from, it allows your customer success team to focus on segments of your customer base that have the highest average LTV.

What’s a Healthy LTV/CAC Ratio?

Knowing how much it costs to bring a customer on board—and how much they’re worth—is key.

For Entrepreneurs Analyst David Skok says companies should aim for an LTV/CAC ratio that’s higher than 3. First, Skok says you should calculate your CAC by taking your sales and marketing costs (including salaries) over a certain period, and then dividing them by the number of customers you’ve acquired in that time.

Next, calculate your LTV.

“To compute the LTV, you would look at the Gross Margin that you would expect to make from that customer over the lifetime of your relationship. Gross Margin should take into consideration any support, installation, and servicing costs,” Skok says.

“It doesn’t take a genius to understand that business model failure comes when CAC (the cost to acquire customers) exceeds LTV (the ability to monetize those customers.)”

If your ratio is out of whack—crunch your numbers and see if your CAC is too high, or if your customers aren’t sticking around long enough to pay it off.

Hubspot Focused On LTV to Scale Its SaaS Company

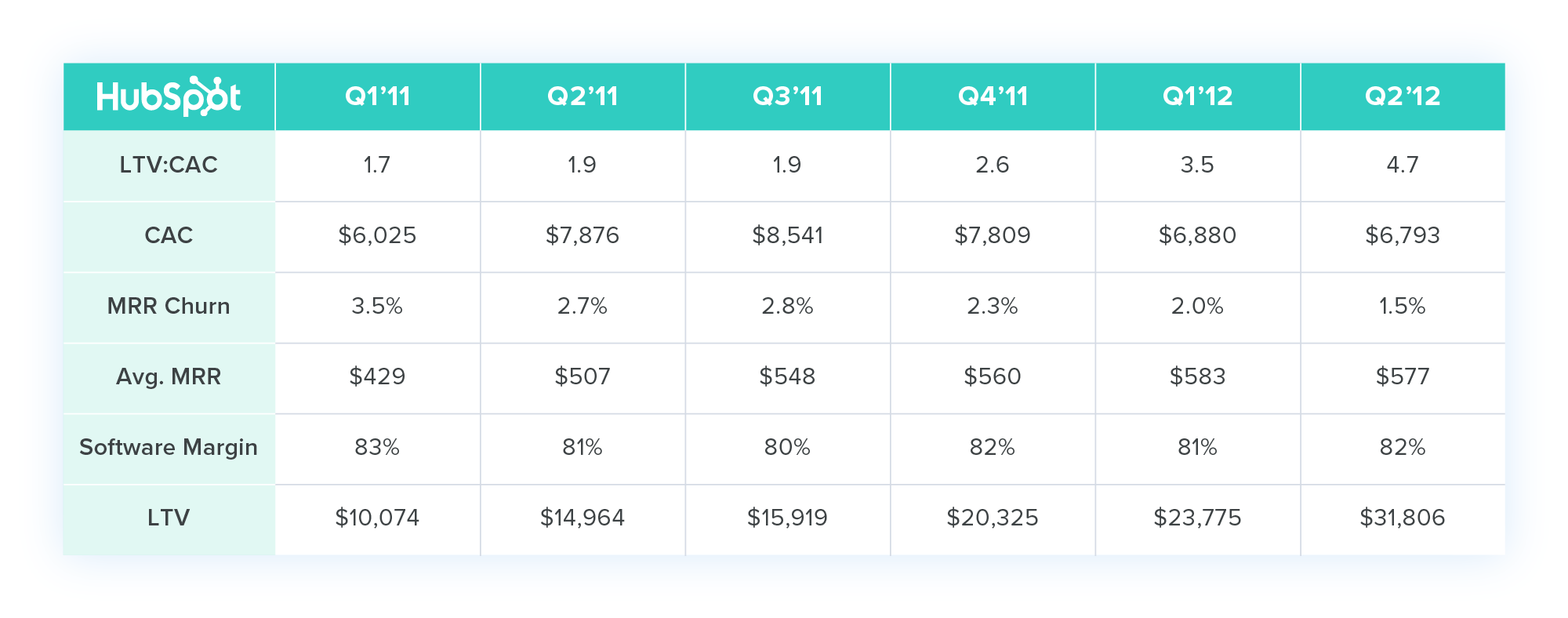

Almost a decade ago, SaaS company HubSpot focused on improving its LTV:CAC ratio in hopes of expanding.

In doing so, they uncovered a model that not only kept them profitable but helped them scale to employ 3000+ people and over $600 million in annual revenue. HubSpot’s head of corporate development, Brad Coffey, told Forbes that the company used a formula that broke down its LTV:CAC ratio so it could make more precise business decisions on what “levers” to pull. Coffey compared their formula to a machine.

“Put a dollar in at the top and the LTV:CAC ratio will tell you roughly how many dollars come out at the bottom,” he said.

If your money isn’t multiplying, “you’re going to want to spend some time tuning that machine.”

Here’s what their formula looked like:

Notice any big changes?

In between Q1 of 2011 and Q2, HubSpot dropped their monthly churn rate by nearly 1%. By the time Q2 of 2012 hit, it had dropped by 2%. Huge. In doing so, their LTV tripled. Coffey says the improvements were thanks to changes they made in each of their customer segments.

“In the SMB market, for instance, we had the right sales process in place – but had an opportunity to improve LTV by improving the product to lower churn and increasing our average price in the segment,” he says.

“In the VSB (Very Small Business) segment, by contrast, there wasn’t as much upside left on the LTV (VSB customers have less money and naturally higher churn) so we focused on lowering CAC by removing friction from our sales process and moving more of our sales to the channel.”

By breaking down their costs and focusing on customers with a higher LTV, HubSpot was able to cut their churn rate and boost their revenue.

How to Calculate Your Customer’s LTV

Now you know what LTV is and how important it is to your revenue margins, let’s get down to some calculations.

The traditional method of calculating LTV is actually pretty simple:

Average value of a sale × Number of repeat transactions ×

Average retention time in months or years = LTV

Here’s an example. A customer spends $50 every month at their favorite online clothing store for 5 years. The customer’s LTV would be: $50 X 12 months X 5 years = $3000.

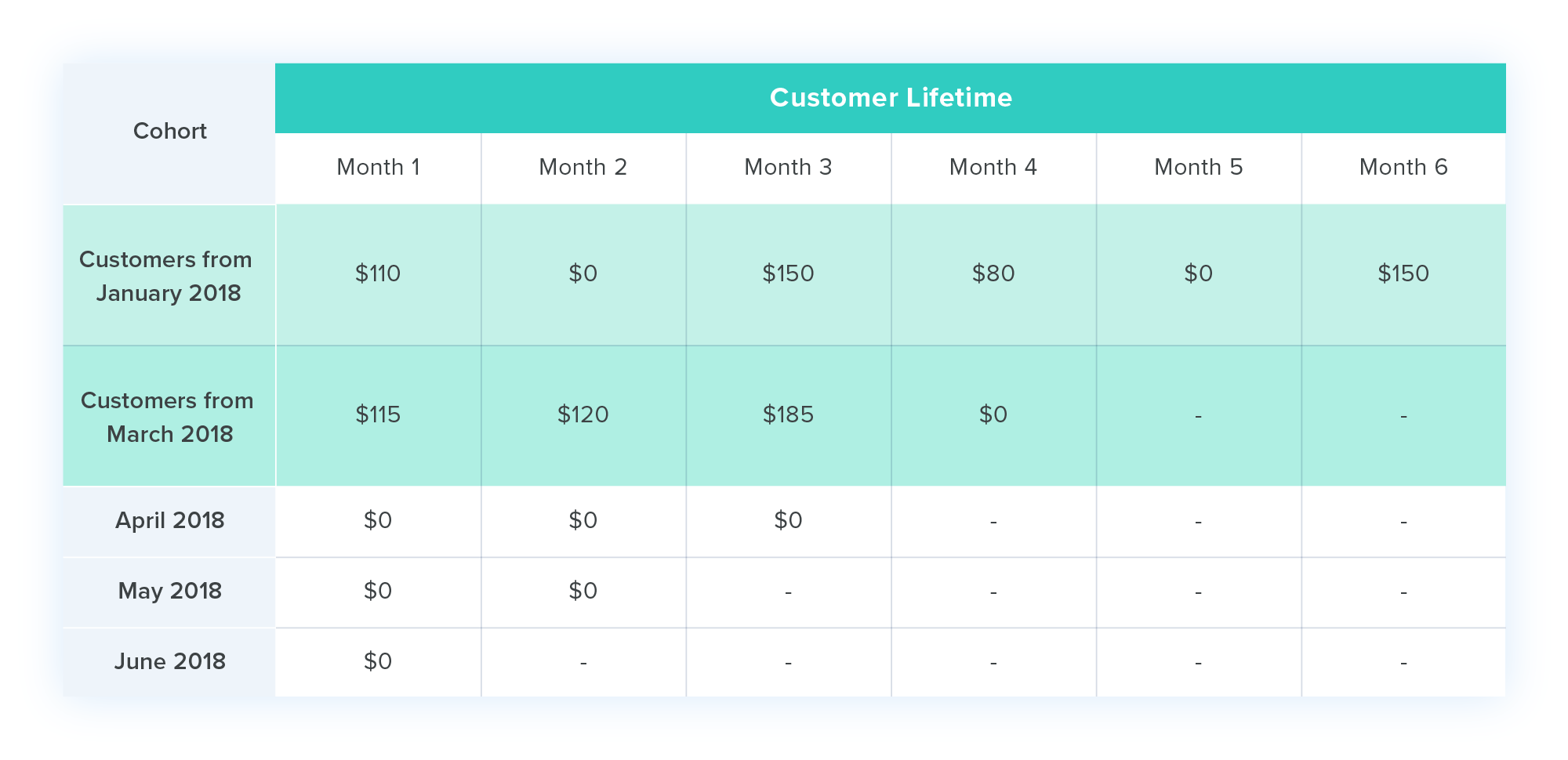

OWOX’s Maryna Sharapa says you can go a step further and split customers into “cohorts”; groups of customers who made their first purchases around the same time who share similar characteristics. Sharapa says analyzing cohorts allows companies to calculate the average revenue per cohort, not per user, like this:

“In addition to calculating CLV, cohort analysis can help you find the number of loyal clients, improve lifetime value by finding the points where purchasing drops off, and accurately assess ad campaign performance,” Sharapa says.

These methods are fine for short-term forecasting, but for subscription-based companies, the calculation gets a little more complicated. A customer that’s on a lower-tier product will be worth less over their lifetime than a customer on a more expensive package, so it’s essential to segment your customers.

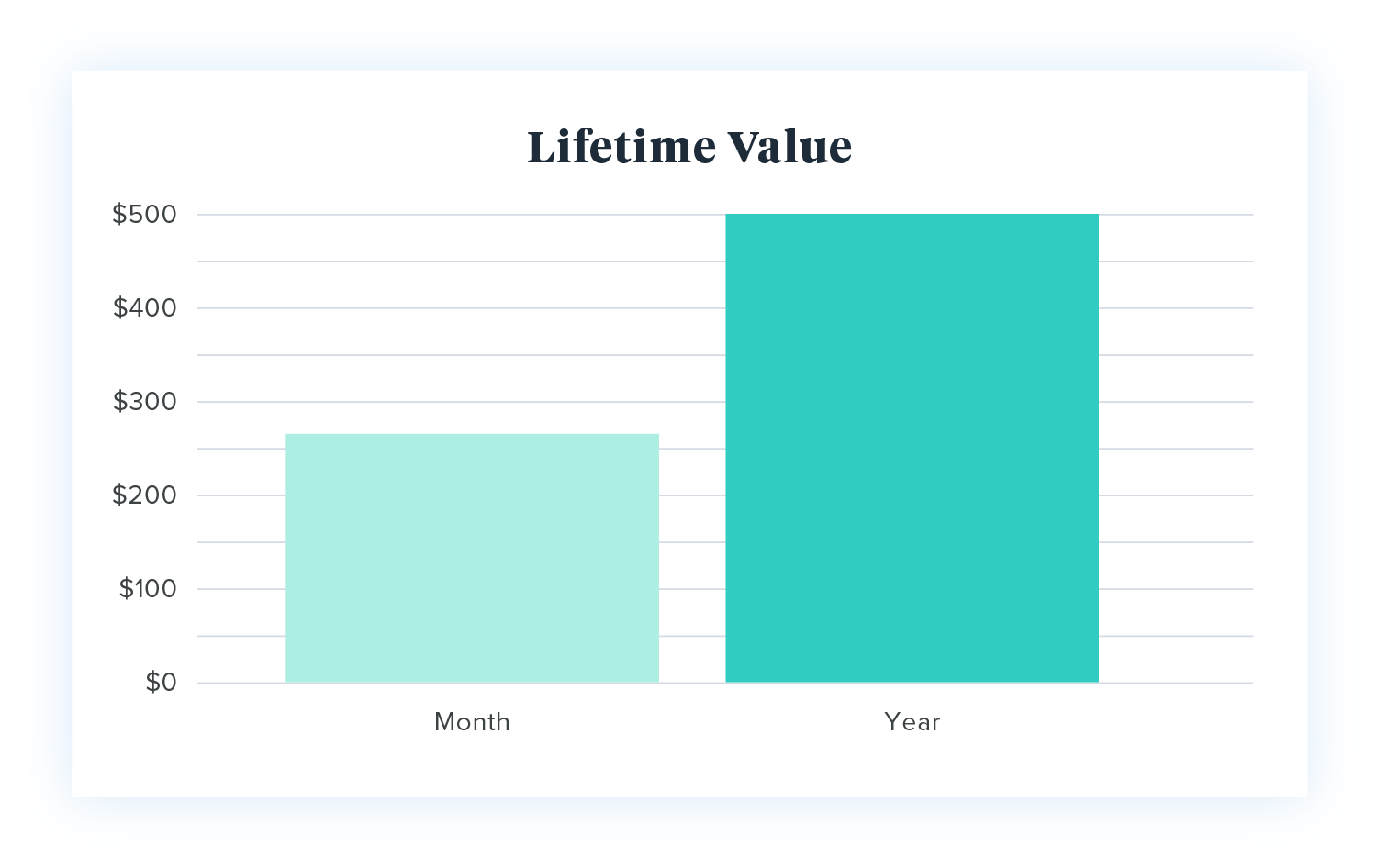

Buffer calculates their LTV by dividing their Annual Revenue Per User (ARPU) by churn rate, but they also split their customers into two segments: monthly and annual subscribers. Julian Winternheimer, a data scientist with Buffer, says they first calculate the churn rates for each segment:

- 7% for monthly customers/average lifetime of 14 months

- 2.4% for annual customers/average lifetime of 40 months

Next, they calculate the average contribution of each customer and multiply it by their lifetimes. For monthly customers paying an average of $20.56/month for Buffer, their LTV is $267. Annual customers average a monthly revenue of $12.68, but as they stick around for longer, they’re worth $507 to the company.

The difference in LTV between Buffer’s Annual and Monthly customers

The calculations mean Buffer’s customers who sign up to annual subscriptions are worth roughly 90% in revenue than those on a month-to-month subscription.

“The cherry on top is the fact that more of that value is realized up-front as a yearly payment,” Winternheimer says.

“Given the fact that there is no added cost to supporting an annual customer, this is a good deal.”

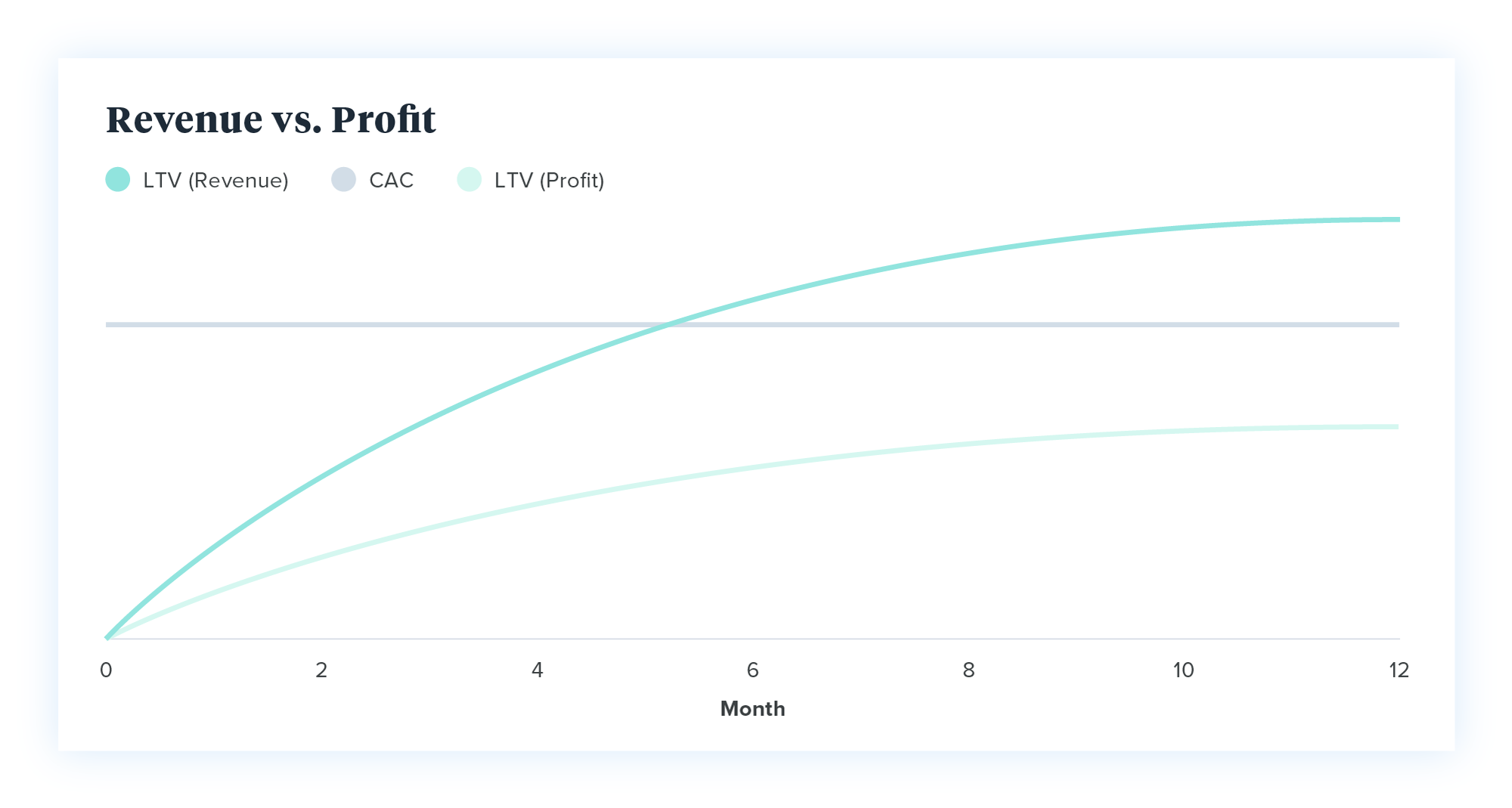

Remember: Use Profit—Not Revenue—in Your Calculations

One of the easiest mistakes you can make when calculating LTV is using profit figures—not revenue.

If you use revenue figures, not only will you overvalue your customers, but it can also throw off your LTV/CAC ratio and make it seem like your spending is sustainable when it isn’t.

Here’s how much of a difference it makes.

You’ve onboarded a new customer to a subscription product worth $50/month. It costs your company $100 to acquire that customer. They stick around for 3 months before churning. On the surface, you’ve made a profit: $150 in revenue – $100 in CAC still leaves you $50 up.

Wrong.

If your profit margin on your product is 50% after costs like staff, tech, and maintenance, you’ve actually only made $75 off of the customer before they churned. As it cost you $100 to acquire them, you’ve lost $25 on the customer.

Remember that CAC only takes into account costs associated with bringing that customer onboard, like marketing and advertising costs. Any costs after that need to be taken into account when you’re calculating your LTV rates.

LTV should always be based on profit—not revenue.

Calculating Your LTV Is The Secret To Making Smarter Business Decisions

Metrics matter, especially when they can help you make crucial decisions like where to put your marketing dollars, and what customers are bringing in the most revenue.

The problem for businesses is, they don’t know what metrics they should be focusing on when there are so many out there. It’s important to remember that calculating and tracking your customer’s LTV can actually help your business move the needle. Not only can they pinpoint how much your customers are worth, but it can also help you predict churn rates and forecast long-term profit forecasts.

Calculating LTV isn’t rocket science, but it depends on what types of products you are selling. Traditional LTV calculations are a good start, and if your business is moving to a subscription-based model, you can get more accurate data by segmenting your customers into cohorts.

The bottom line is once you’ve perfected your LTV calculation, it can help you make smarter business decisions and most importantly—boost your bottom line.