We don’t have to look far to find examples of B2B SaaS companies that have found traction using a self-service or product-led motion. Look at Zoom or Slack: businesses designed for enterprise organizations that use B2C-like onboarding flows (such as product-led growth, or PLG) to fuel interest and adoption.

In fact, it’s telling that the number of publicly-traded PLG-led companies nearly quadrupled between 2015 and 2020.

Are you still making assumptions about your B2B go-to-market motion — assumptions that ignore B2C selling methods — that are limiting your growth potential?

According to TrustRadius, 87% of B2B buyers prefer at least some element of self-serve in their journey, if not in every part. Specifically, of the whopping 60% of buyers that are millennials, 29% want an entirely self-serve journey from start to finish, no reps required.

I was recently interviewed by my friend Steve Lurie, who’s the Chief Engagement Officer of B2B Rocks. We talked about one of the biggest trends playing out in the software industry: the convergence of B2B and B2C.

What does that mean exactly? My hypothesis is that our traditional notions of “B2B vs B2C” are holding many companies back from unlocking their true growth potential and that ultimately, this binary designation will cease to exist in the near future.

Below I’ll lay out exactly how this is happening, why it matters, and what you can do to take advantage.

How B2B and B2C Are Converging

1. Products Are Finding New Growth in the Opposite Segment

Historically, when SaaS businesses have gone to market, they’ve done so by finding product-market fit with one of two core audiences: consumers or businesses. And that decision shapes their product and sales processes for the life of their company. Evolving outside this initial go-to-market motion has historically required a dramatic “pivot” — still considered a dirty word in tech communities.

While this still holds true for finding initial product-market and go-to-market fit, more and more we’re seeing examples of businesses evolving much more quickly into both market segments.

Companies like Dropbox, 1Password, and Sketch originally found success with general consumers or freelancers, then expanded into the mid-market and enterprise markets. Why? Essentially, the original value proposition held true in a B2B context.

For Sketch, the growth of the UX design function has fueled the need for design teams to collaborate with the same tool and buy multiple licenses — not just buy individually.

In the case of 1Password, web security and convenience were even more powerful when leveraged in a B2B context. This once exclusively B2C company recently raised $620 million to expand its product, the largest funding round for a Canadian company in history.

On the flip side, one of the reasons Zoom was able to scale as quickly as it did was its ability to expand into the consumer sphere. This was obviously accelerated by increased remote communication needs due to the pandemic, but the fact that they had designed a mostly self-serve, B2C-like experience for B2B buyers made the expansion to consumers much quicker.

Currently, there are fewer examples of B2B SaaS expanding into the consumer space, but I believe this will continue to become more common as software companies think “users first” (e.g., PLG).

2. B2B Buyers Are Bringing B2C Expectations Into Work

Covid has poured gas on an already raging ecommerce phenomenon. Our preferences and expectations for how and where we buy have been completely rewritten. In our personal lives, we’ve grown accustomed to being able to research products on our own and getting questions answered without needing to talk to someone.

And we’re the same people when we go to work.

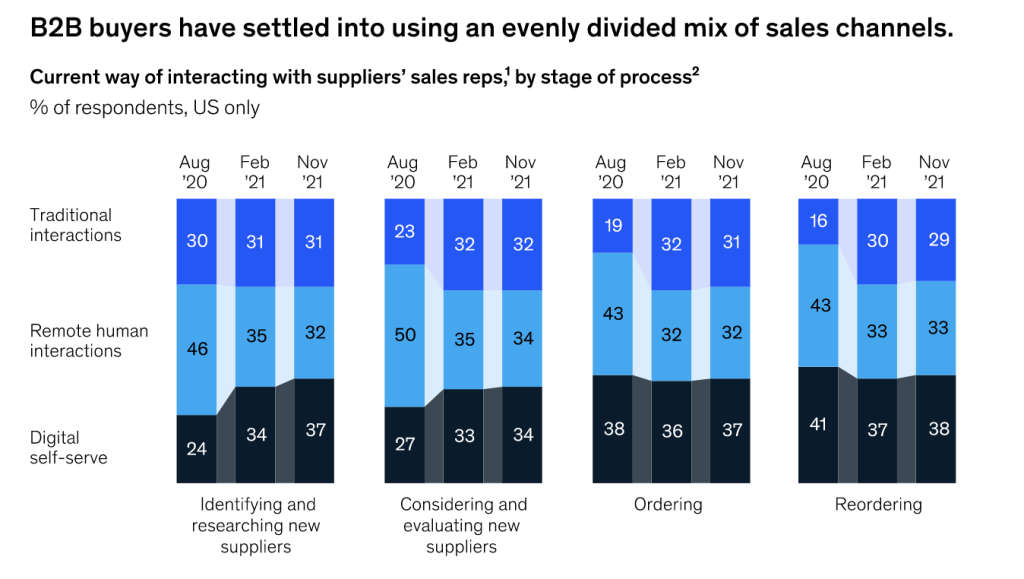

Meanwhile, a 2021 McKinsey study revealed that over two-thirds of B2B buyers prefer remote or digital self-serve channels over a traditional in-person sale.

We want to buy digitally, and we want self-service options, even for larger purchases.

How to Take Advantage of These Changes

1. Make It Easier for Customers to Buy

Per a PYMNTS and American Express report, 67% of B2B buyers “switched to purchasing from vendors that offer a ‘more consumer-like’ experience.”

So how do you win? By removing as many friction points as possible that make it difficult for a prospective customer to buy or an existing customer to increase their MRR using your product.

For example:

- Are you making your quoting and invoicing experience as efficient and flexible as possible?

- Are you making it easy for B2B prospects to understand all your pricing options?

- Do you have an easy way for customers to self-serve plan changes like adding a seat?

- Are you making it easy for all your customers to pay you (such as localized currency and payment methods)?

Ultimately, a “consumer-like” experience is one of control. Zuora found that there are an average of four changes to a subscription plan every year, including upgrades, downgrades, add-ons, etc. These changes need to be easy to make within your product.

In other words, self-service options should extend throughout the customer lifecycle.

Adopting B2C UX expectations and practices can enable B2B SaaS companies to create a seamless buying and subscription management experience that increases the lifetime value of that customer and their satisfaction with your product.

2. Question Your Target Markets

What assumptions are you holding about why you’re only selling to one particular market and not others? Companies need to make sure they’re not relying on false or outdated assumptions about why they’re pursuing one market and not others.

New markets might include businesses or consumers, new industries, or new countries.

And there are many new solutions making it easier to iterate on your product and sales motions and scale into new markets.

Are you in a place to take advantage of them?

3. Prepare to Be Iterative

The most successful SaaS businesses over the next 3-5 years will be the ones that are the most iterative.

This iterative nature is built into startup culture. We know how to “start lean,” but all too often, companies lose this flexibility as they scale.

You need to be able to iterate on your market-fit and your go-to-market strategies to take advantage of new opportunities such as customer types and personas — because they are constantly evolving.

Intellectually, we know we need this flexibility. But in practice, it becomes much more difficult — at least on your own.

There are a lot of ways to solve for this. One approach is to build on top of a single commerce platform that ties all the core elements that require iteration together. At FastSpring, we do this by linking pricing, payments, subscription management, and tax into one seamless platform.

For many, this can make iteration easier and much faster to execute. Too many growing software companies get slowed down by things that aren’t their core competencies because they get hit with complexities they never saw coming as they go after new markets. You can end up spending a whole quarter becoming an expert on sales tax nexus or retooling your billing flow just because you wanted to add a new payment method.

The smartest companies plan for these surprises and instrument their business to react quickly without derailing their product development efforts. That one always hurts.

One Last Thing: B2B vs. B2C Is a False Choice

I started this piece with a question: Is B2B revenue actually better than B2C revenue?

The truth is B2B vs. B2C isn’t the right way to think about it.

There used to be very stark differences between how we sold B2B vs. B2C software, but today we see the ideal buyer experiences converging.

Software of all kinds is purchased by people — and that’s true whether you’re selling to B2B or B2C.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)