This report was published in 2023. Click here for the updated 2024 report.

Q4 sales numbers usually outperform the rest of the year thanks to year-end holidays and their associated shopping cycles — but how much does that trend carry over into software and SaaS sales? And does it improve B2B sales too, or is it more just a B2C advantage?

FastSpring serves as a merchant of record for over 3500 companies that use our platform every day to sell digital products globally. We’ve analyzed aggregate sales data to give you insights into just how important Q4 can be for your software, SaaS, or other digital goods business.

While modern holiday shopping trends may have started with Black Friday deals and spread to Cyber Monday, the entire weekend is now often referred to as Cyber Weekend — and sales throughout the quarter are generally strong as shoppers prepare for its many holidays. Are you optimizing all possible Q4 sales opportunities for your software business?

Below, we’ll cover:

- U.S. sales trends by month and quarter.

- Global sales trends by month and quarter.

- How B2B vs. B2C sales compare.

- Advice for making the most of seasonal sales opportunities around the world.

- How FastSpring can help.

Are you looking for a merchant of record to help you grow your business internationally? FastSpring provides an all-in-one payment platform for SaaS, software, video game, and digital goods businesses, including VAT and sales tax management, payment localization, and consumer support. Set up a demo or check out our platform yourself.

About Our Data

Where the Data Are From

FastSpring supports over 3500 companies to help sell digital goods in over 200 countries and territories globally, but we’ve narrowed down the data we used for this report to keep it applicable to software and SaaS companies.

The data below are also specific to where the sales took place, not where the companies are located.

For the global statistics, we selected eight countries — the United States, Canada, Germany, Great Britain, India, Brazil, Australia, and China — to get a broad view of sales around the world.

When the Data Are From

The data below are pulled from 2018-2022 to give the most up-to-date insights, while showing trends that are relatively consistent across a five-year period and avoiding any outliers skewing the data unnecessarily.

We further use a seasonal index to highlight each month’s or quarter’s sales against the year’s monthly or quarterly average.

US Year-End Trends for SaaS and Software Purchases

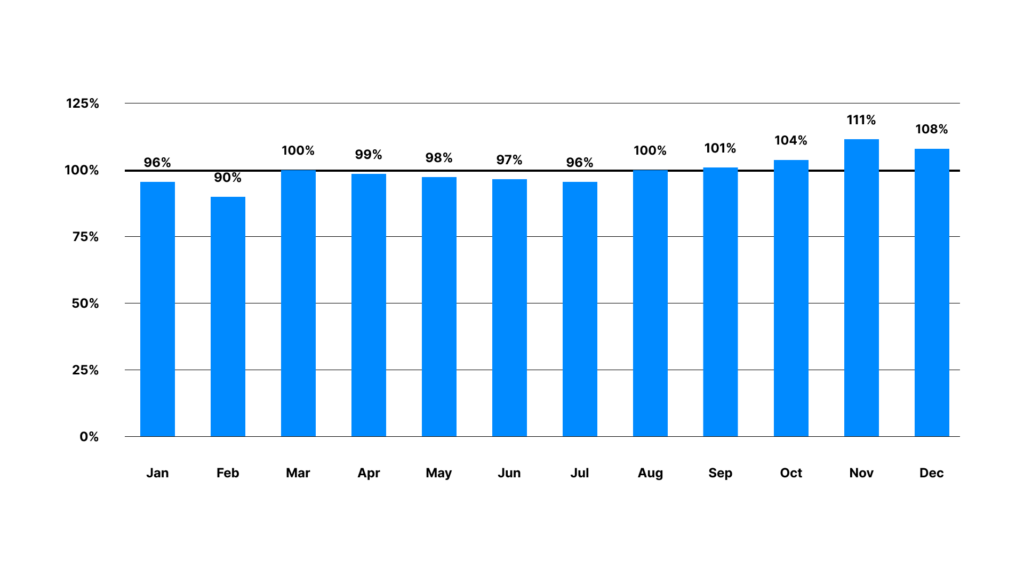

We first looked at U.S. software and SaaS sales data from 2018-2022 to glean insights into monthly and quarterly sales trends across the last five years.

After calculating a monthly average, we compared each month to that average to get a percentage. For example, if February shows a percentage of 90%, that means it is 10% lower in sales compared to the monthly average. If November shows a percentage of 111%, that means its sales are 11% higher than the monthly average.

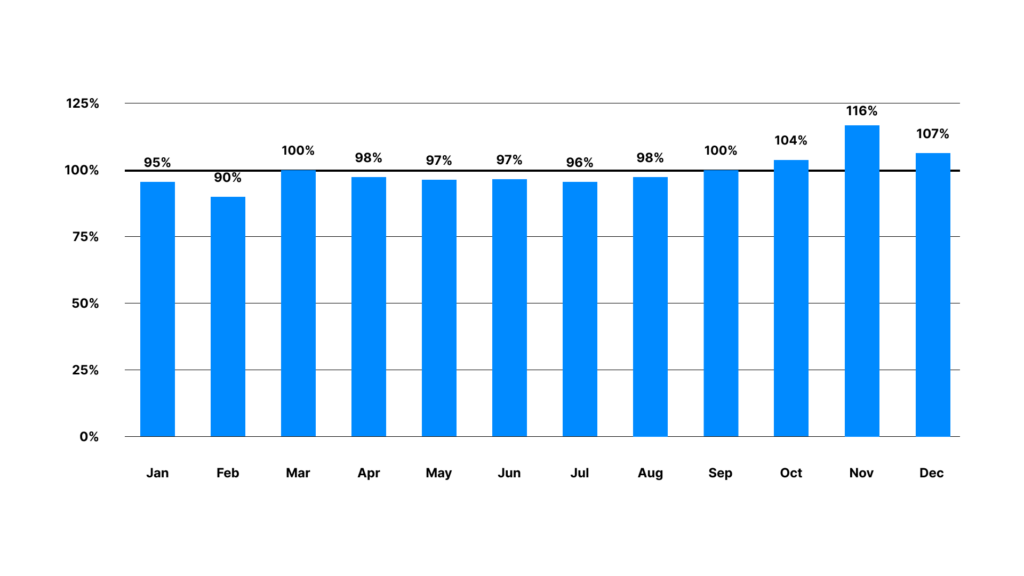

5YR Average US SaaS and Software Sales by Month

While sales do peak in November at 11% higher than the monthly average, sales for all three months in Q4 are the highest throughout the year, with October at 4% higher and December at 8% higher.

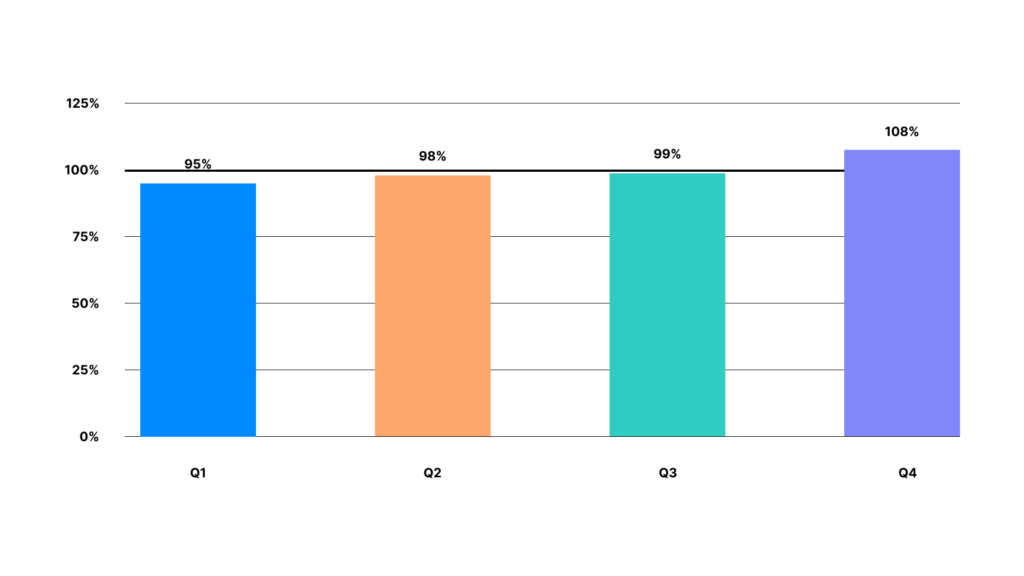

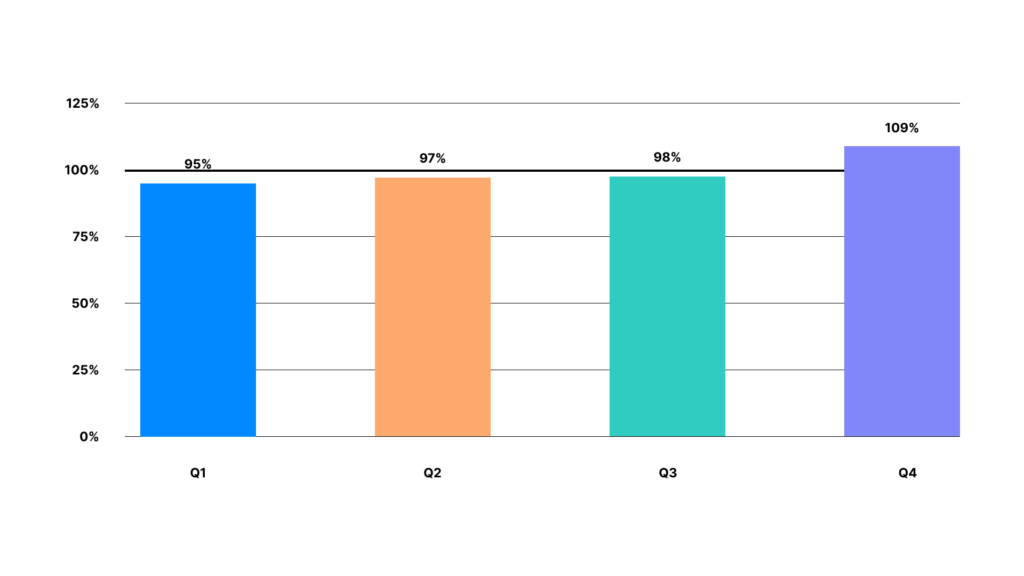

5YR Average US SaaS and Software Sales by Quarter

When looking at the quarterly average, Q4 sales are higher by 8% — high enough that each of the other three quarters fall below the average.

Global Year-End Trends for SaaS and Software Purchases

Moving beyond the U.S., we combined data with the same parameters from the U.S., Canada, Germany, Great Britain, India, Brazil, Australia, and China. This gives us a clearer picture of how late-year software sales might fluctuate across the globe.

In fact, the bump gets bigger.

5YR Average Global SaaS and Software Sales by Month

Global sales jumped to a yearly high of 16% more in November compared to the monthly average. As in the U.S. data above, October and December round out the highest quarter of the year with respective 4% and 7% increases.

5YR Average Global SaaS and Software Sales by Quarter

When viewed from a quarterly perspective, Q4 is 9% higher than the quarterly average, once again so high as to push the other three quarters below the average.

While global Q4 quarterly sales were only 1% higher than sales in the U.S. for the same quarter, November as a standalone month showed a jump of 16% compared to the U.S.’s 11% jump in the same month — suggesting that November specifically is a huge sales opportunity around the world.

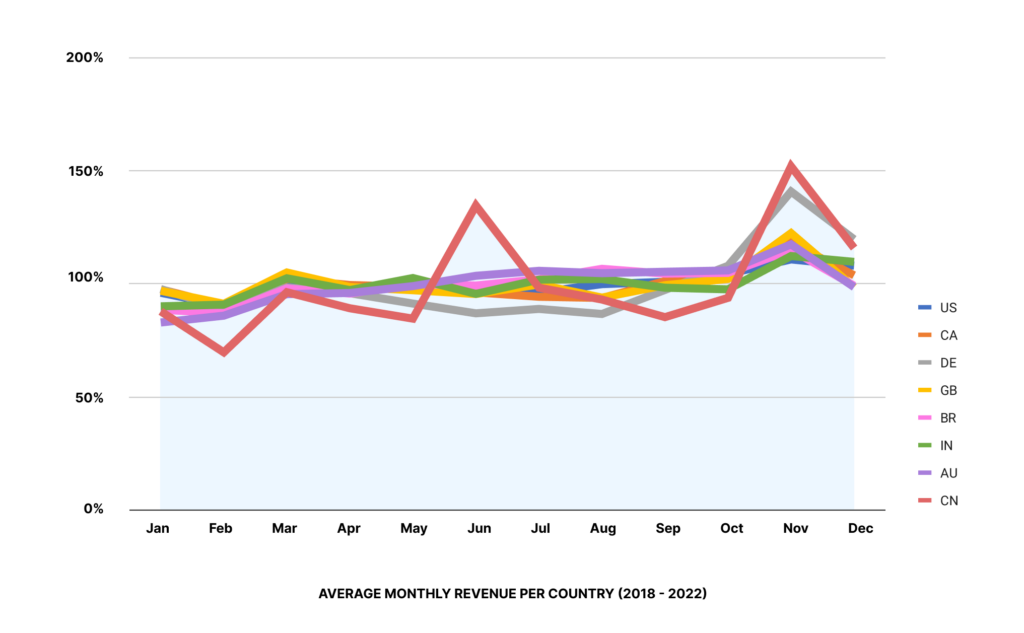

5YR Average SaaS and Software Sales by Month per Country

For more detail on how each month breaks out by country, we parsed the data for the 8 countries we included in our global review. Here’s what monthly software sales fluctuations look like with five years of data for the United States (US), Canada (CA), Germany (DE), Great Britain (GB), India (IN), Brazil (BR), Australia (AU), and China (CN).

Particularly large lifts in countries like China and Germany in November suggest a huge opportunity for SaaS and software companies to profit in Q4, especially if you’re targeting those countries as part of a global expansion strategy.

Additionally, while U.S. data suggest a smaller lift of only 11% in November, keep in mind that North America accounts for a very large share of global software and SaaS sales, with one study reporting 43% of 2022 global software revenue attributed to North America, and another reporting a share of up to 57.5% of the 2020 global SaaS market attributed to NA. Therefore, an 11% lift in November in the U.S. could mean a lot more revenue if it’s a slice of a much larger pie.

B2C vs. B2B

Many companies that use FastSpring to sell software globally serve both B2C and B2B markets, but whether your SaaS business focuses on both or just one, it can be helpful to monitor how Q4 sales trends differ between the two markets. The resulting information can help you decide how much to focus marketing and sales efforts within those segments, especially if one segment offers a bigger opportunity.

While in prior reports, we focused on a small segment of specific companies over three years for B2C vs. B2B comparisons, this year, we expanded the data set. The following information comes from the same eight countries we mentioned above and spans the same five years, 2018-2022. We filtered that data for B2B-only and B2C-only data, and we excluded data from companies that explicitly serve both.

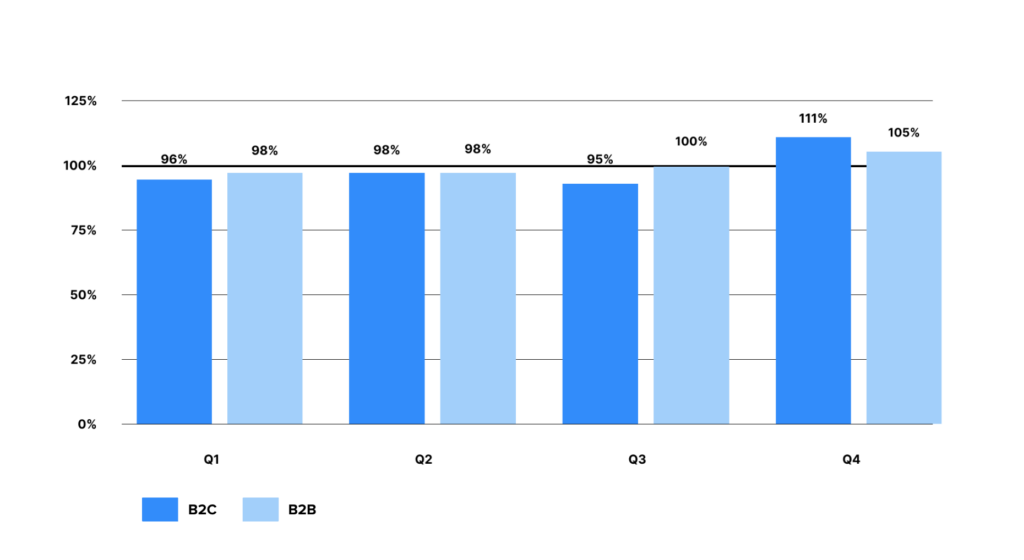

The resulting data show the same general trends throughout the year, with Q4 being the strongest quarter for both segments.

B2C sales saw an average bump of 11% above the quarterly average, which is perhaps unsurprising in a season known for promoting consumerism — “consumer” is in the name.

But don’t sleep on B2B sales in Q4. While B2B revenue appears to be slightly more stable throughout the year than B2C revenue, a 5% lift in Q4 is significant within a sometimes spend-happy segment that still takes advantage of end-of-year deals, regardless of whether a buyer is buying for themselves or their company. Corporate credit cards are of course still wielded by many people — people who are shopping for software, and who may still want a good deal, especially if rigid departmental budgets are a factor in their purchase decisions.

Additionally, some B2B shoppers may be looking to use up budgetary money before the end of the year to ensure their budget is not reduced next year, or they may be pushing their teams or departments set up with the right tools before the new year starts. Business-specific instances like these could contribute to increased B2B sales in Q4 despite the many holiday work disruptions.

To see some of the following strategies in action and take advantage of great SaaS and software deals yourself, check out our 2023 Cyber Weekend deals roundup!

Cyber Weekend Strategies for SaaS and Software Companies

Wondering about the best ways to take advantage of that Q4 bump? Regardless of whether you’re targeting B2B or B2C shoppers, here are some tactical strategies for boosting software and SaaS sales before the end of the year.

Give Partners Custom Coupon Codes

Providing custom coupon codes to your affiliates and partners can work better than a generic one shared everywhere. Your partners will be more likely to promote codes that promote their own brand, and the promotion will work better for their audience if it mentions their brand.

Plus you’ll be able to better track how that sales promotion performed compared to other coupon codes.

Use the FastSpring portal to enter custom coupon codes for your partners, or use the FastSpring API to pull codes from your own partner platform and populate in FastSpring.

Don’t Have Partners to Give Custom Coupons To? Find Some!

If you’re not yet taking advantage of promotional partnerships, the holiday season can spur on new connections. Look for other SaaS and software companies that offer a product that compliments yours. (For example, if you make a database tool, look for companies that make front end tools.)

Besides custom coupon codes, offer to exchange Cyber Weekend promotions to each other’s audiences in the form of newsletter messages, website banners, social media mentions, or other preferred methods that will help both companies increase end-of-year sales.

Email Your Own Prospects

Even if you choose not to pursue partnership promotions — or if that’s a larger project you’d need more time to plan for — emailing your existing prospect list is a relatively quick and easy tactic to execute.

Prospects can’t take advantage of sales they don’t know about, so don’t rely only on a website banner to grab the attention of potential buyers on a visit to your website. Bring them to your site with proactive email messages about upcoming, current, and extended deals to grab their attention where they are.

Email Your Current Customers

Just like prospects, customers can’t be upsold if they don’t know about holiday promotions, either.

Here are just a few of the profitable opportunities you could target within your existing user base:

- Upsell add-ons. Analyze user data for customers that use your product the most often or the most broadly, since they might be most likely to want even more features and usability.

- Upsell bigger subscriptions with more features. Just like with downloads, if you can pinpoint your product’s power users, you can target those most likely to want more of your product.

- Convert freemium customers to paid subscriptions with an irresistible sale. If freemium is a big part of your business model, a strong holiday sale might be the lever to finally convert users who love the features they have access to, but who know they could really use a lot more of them.

- Upsell from individual subscriptions to team subscriptions, or from team to enterprise subscriptions. It may not be easy to find out which power users are also evangelists for your product at their own companies, but if you have contextual user information (such as that which can be gleaned by your own internal salesforce), Q4 could be a great time to target companies where you have some user penetration but the opportunity to get a lot more.

- Cross-sell into entirely new products. If your business model includes various standalone products, there’s a big opportunity to target the user base of one product with offers to purchase the other, and vice versa. The more products you have, the more segmentation you can do, and the more opportunities you have.

- Switch users from monthly to yearly subscriptions. The English adage “A bird in the hand is worth two in the bush” often applies in business, as revenue available to your company now may be preferable to slightly more revenue doled out slowly throughout the next year. Take advantage of buyers being in a shopping mindset in Q4: Tempt them with a great offer to save money in the long run by switching their monthly subscription to a yearly one.

Leverage Social Media

Social media platforms can be a great place to celebrate events, so sharing holiday-themed posts from your business can be a natural fit.

Many social media platforms have advertising services that can target users by geographies or interests. Consider taking advantage of the ability to show regional holiday ads in applicable regions, or the ability to show ads to users who may have mentioned their interest in the holiday on the platform.

Conversely, organic social media posts — which can often be seen by any users who follow you regardless of geography — can also be a good way to spread sales without limiting views to a small segment. Just keep in mind that if your followers or audience are very diverse, your holiday-specific organic posts should be too.

Offer More Aggressive Discounts in Target Geos

If you experience greater profitability in a particular region or just want to break into a new market, promoting more aggressive discounts in specific regions can help you further take advantage of Cyber Weekend sales increases.

To implement this, use GeoIP-based elements on your marketing site to promote region-specific discount codes.

Then use FastSpring’s Store Builder Library to automatically apply those codes in the checkout to help increase your conversion rates.

Localize Holiday Promotions

While Cyber Weekend has become popular around the world, there are still local holidays that may be more profitable in each region or country you’re targeting. Holidays like Boxing Day can rival more U.S.-centric specials (such as Black Friday and Cyber Monday) in countries such as the UK, Australia, and Canada, or Singles’ Day in China and southeast Asia.

Customize your holiday season campaigns by geography so you don’t miss out on big opportunities in key regions.

How FastSpring Can Help

Need a real partner to help you take advantage of Q4 sales lifts and expand your SaaS or software business globally? Here are just a few of the great FastSpring features that can help your business go farther faster.

Global Payments: Localized Languages, Currencies, and Payment Methods

FastSpring knows that simply making your product available in more countries isn’t enough — it needs to be easy for your customers to make the decision to purchase.

That’s why FastSpring’s global payments features provide a localized checkout experience that can automatically convert pricing to your customer’s local currency and language, then enable customers to purchase with dozens of the most popular payment method options.

Global Tax Management: Let Us Worry About Taxes

While your customers expect the purchase process to be easy for them on the front end of the sale, we think it should be easy for you on the back end of the sale, too — especially when it comes to global tax management.

FastSpring is a merchant of record, which means that not only do we help facilitate payments, but we actually become the entity selling the product — so we become the entity worrying about card brand rules, regulatory rules in many geographies, risk, and even taxes.

Our tax experts stay current on global tax regulations, and we calculate, collect, and remit taxes so you don’t have to. See what one of our experts has to say about taxes here.

Consumer Support Management: Send Them to Us!

One of the other key responsibilities FastSpring helps cover is consumer support management. Your customers can start with us to help them solve issues with checkout and purchasing, taxes, billing and subscriptions, downloads, and more.

If our consumer support topics don’t solve the issue for them, they can contact us directly by submitting a support request, and our team of support agents will reach out to further assist them.

Are you looking for a merchant of record to help you grow your business internationally? FastSpring provides an all-in-one payment platform for SaaS, software, video game, and digital goods businesses, including VAT and sales tax management, payment localization, and consumer support. Set up a demo or check out our platform yourself.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)