This article has been updated since it was originally published with the most current information about SEPA Direct Debit transactions as of April 2023. For more information on FastSpring’s latest updates for SEPA Direct Debit support, read our more recent post here.

If you sell software internationally, you know how difficult handling cross-border payments can be. From making sure you display the right currencies for each region to supporting your customers’ preferred payment methods, global commerce can come with its fair share of challenges.

That’s why many buyers in the European Union and surrounding countries prefer paying with SEPA Direct Debit. Not only does it help simplify multi-currency payments, but it also reduces the likelihood of failed payment transactions.

In this article, we’ll break down the basics of SEPA Direct Debit and explain why it’s so important to accept it at checkout if you’re doing business in Europe.

Table of Contents

- What is SEPA Direct Debit?

- How does SEPA Direct Debit work?

- SEPA Advantages & Disadvantages

- FastSpring’s SEPA Experience

Looking for an online payments partner and merchant of record that facilitates SEPA Direct Debit? Sign up for a demo or check out the platform yourself.

Already a FastSpring seller and want to enable SEPA Direct Debit for your business? Submit a support ticket from inside the platform or from our support page.

What Is SEPA Direct Debit?

SEPA Direct Debit is an international wire transfer that allows merchants to collect payments from accounts in the countries and associated territories in the Single European Payments Area (SEPA).

SEPA is similar to ACH Debit (US) and EFT (Canada), except with a few notable differences:

| Currency | All SEPA Direct Debit transactions happen in Euros |

| Chargebacks | Buyers have 13 months to get a refund for unauthorized SEPA payments |

| Bank details | To collect SEPA payments, you need a customer’s IBAN |

| Implementation | Payment timing, how mandates are stored, and the submission process |

The European Payments Council launched SEPA to simplify cross-border transactions in Europe. The goal is to make global payments as easy and cheap as domestic payments by bringing together countries to create a single market for Euro-denominated transactions.

Why Is It So Important to Accept SEPA?

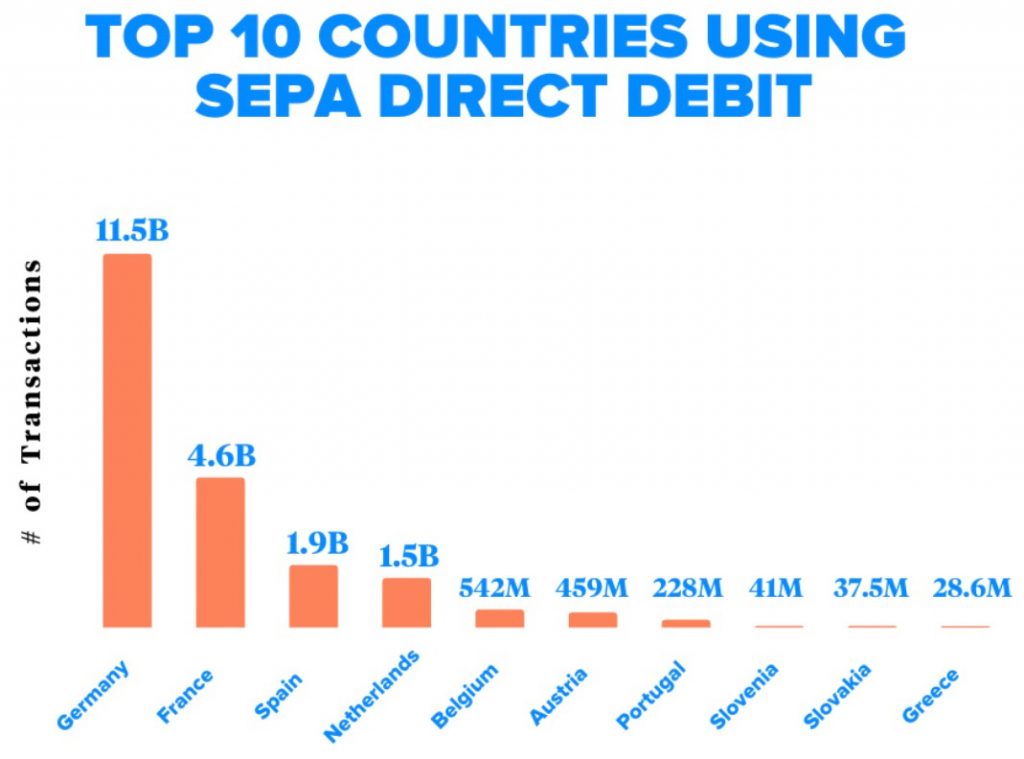

Today, more than 529 million citizens use SEPA to make over 146 billion electronic payments per year in the 36 member countries. This accounts for over 30% of online checkout in Europe, making it an important payment method to support if you’re selling into the European market.

European-Economic Area (EEA) SEPA Countries

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Norway

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

Non-EEA SEPA Countries and Territories

- Andorra

- Monaco

- San Marino

- Switzerland

- United Kingdom

- Vatican City State

- Saint-Pierre-et-Miquelon

- Guernsey

- Jersey

- Isle of Man

Additionally, any European with a bank account can pay with SEPA. By supporting this single payment option at checkout, you can reach over 500 million potential buyers across 36 countries.

The above list includes all countries in the SEPA region. For a list of countries FastSpring supports, please see our documentation.

To see more updates about how FastSpring supports SEPA transactions, view our more recent SEPA announcement here.

How Does SEPA Direct Debit Work?

SEPA transfers work similarly to domestic transfers, with a few minor differences happening behind the scenes. Here’s how they work from the merchant’s perspective:

- Mandate

- Pre-notification

- Payment request

- Post-submission

Step 1: Mandate

Before you can collect payment by SEPA Direct Debit, your customer must complete a mandate authorizing you to take payments. A mandate is the billing agreement given by a buyer to allow a seller to collect future payments from them from their Euro-denominated bank account.

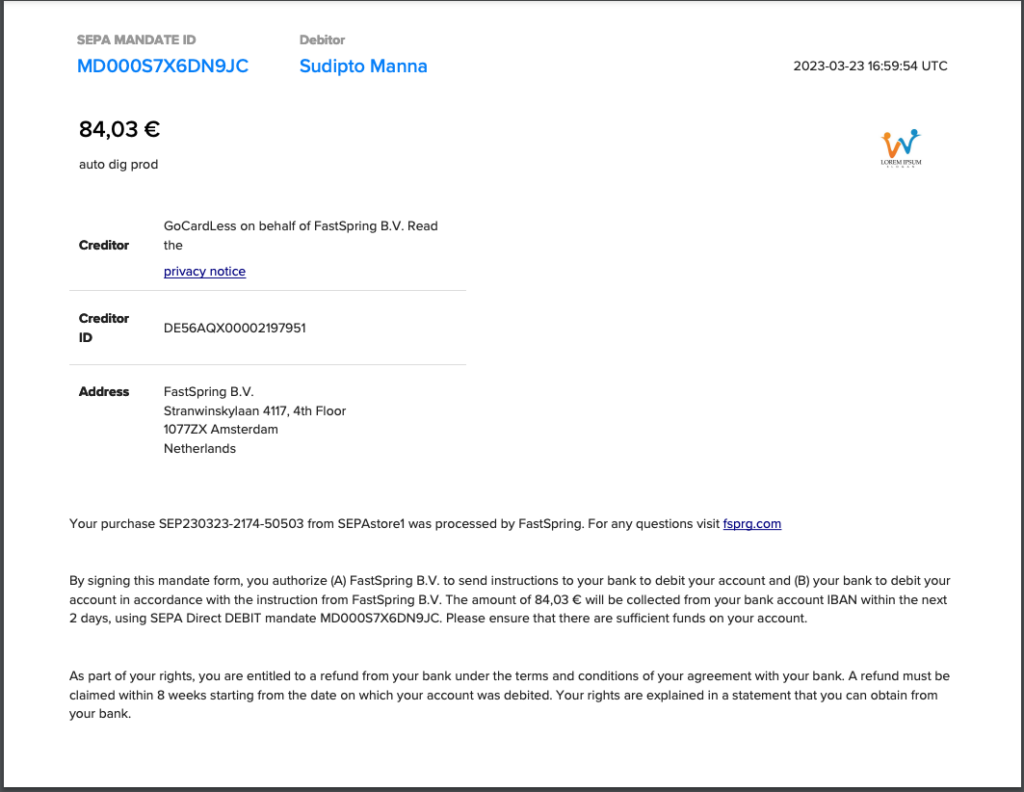

Mandates must include certain mandatory information.

Required Items on a Mandate:

- Payment amount

- SEPA Mandate ID

- SEPA Mandate Date

- Merchant company name

- Merchant’s Creditor Identifier

- Merchant’s full address

- Creditor Information

- Type of payment

- International Bank Account Number (IBAN)

- Bank Identifier Code (BIC)

- Signed Date

- Signature

Here’s an example of FastSpring’s SEPA Mandate:

Step 2: Pre-Notification

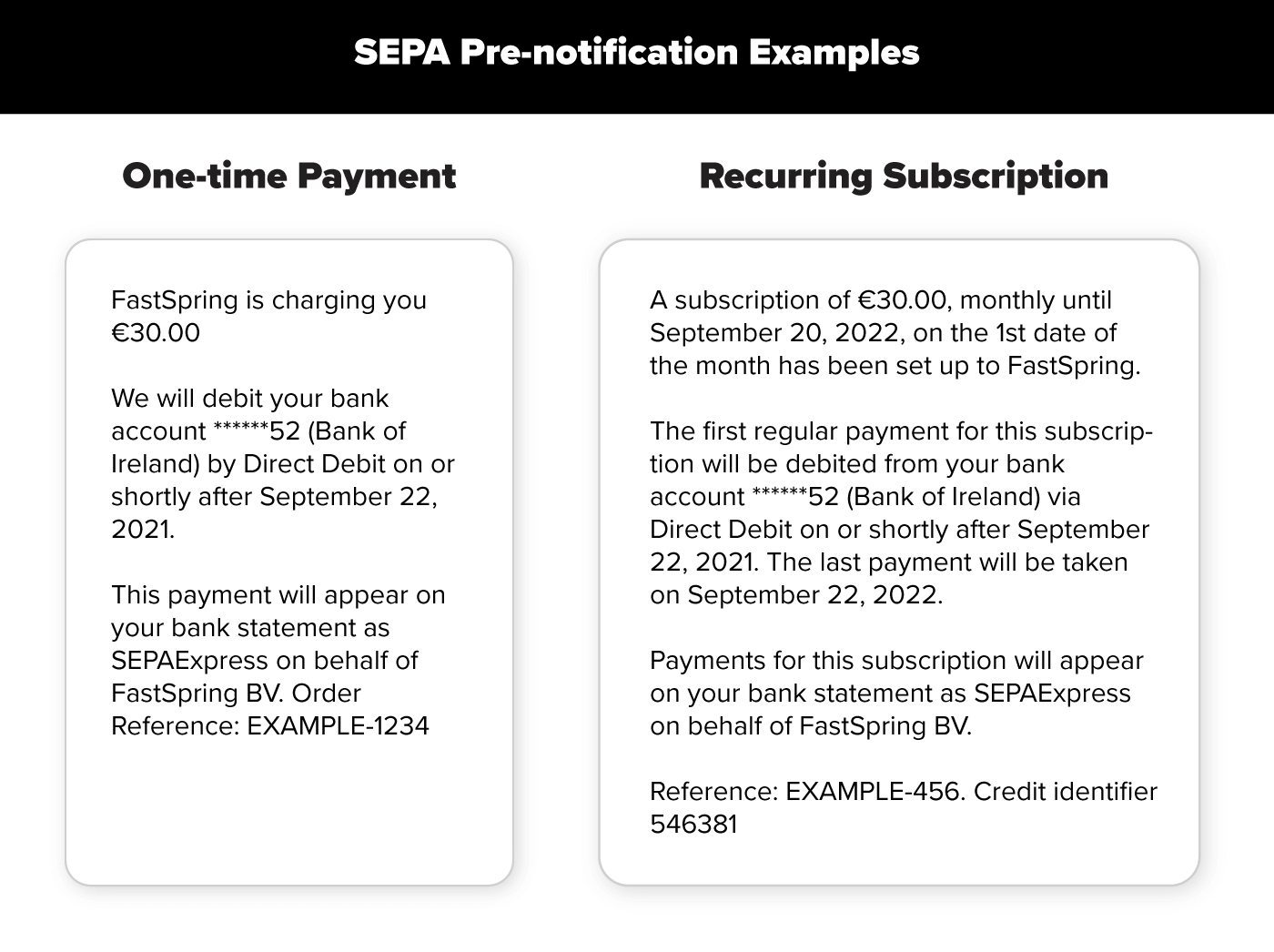

According to SEPA rules, you must send your customers a pre-notification to inform them when they can expect a single payment or regular subscription to leave their bank account. These notifications can be sent by email, text message, phone, invoice, or in a letter.

Fully compliant pre-notifications require the following:

- Appropriate notice period (typically 14 calendar days)

- Amount, due date, mandate reference, and creditor ID

- Merchant’s contact information

Step 3: Payment Request

After the pre-notification is delivered, you can initiate payment by submitting the mandate-related data to the merchant’s bank. FastSpring does this step automatically for its sellers. The bank then forwards the request to the clearing and settlement mechanism, which will then forward this to the customer’s bank for settlement.

Step 4: Post-Submission

After you submit a payment, it will take 2-3 business days to know if a SEPA payment has succeeded or failed. That’s why we recommend waiting at least 48 hours to fulfill an order.

SEPA Advantages and Disadvantages

Advantages

SEPA Direct Debit has 3 important advantages for companies that collect recurring payments:

- Control: Enables merchants to ensure that customers pay their bills on time every month.

- Retention rates: Eliminates failed payments due to card expiry or cancellation. It also increases customer loyalty by offering a convenient set-and-forget payment method.

- Reduced admin: Reduces the admin time involved in collecting payments.

SEPA Direct Debit is also great for B2B invoicing:

- Improved cash flow: Payments happen accurately and on time in an efficient manner.

- Collecting variable amounts: Using a single upfront agreement, merchants can claim a new amount instead of giving a bank new instructions each time a change is needed.

- Reduced admin time: Payments can be automated on a scheduled basis.

Other things SEPA is good for:

- Markets with low card use: In Germany and the Netherlands, credit card penetration is lower than 50%. SEPA Direct Debit is the preferred way to pay in these countries.

- Customers with ongoing merchant relationships: Using SEPA Direct Debit to collect payments from accounts, or ongoing customers, works well for the same reasons as invoices. It also provides two additional key benefits to your customers:

- Simple payment method for customers: Automates the collection process and enables customers to simplify the way they pay.

- Offer flexible payment option: Allows ongoing customers the option of spreading costs and paying on account.

Disadvantages

SEPA is not a good option for:

- Transactions that need immediate clearing: SEPA Direct Debit payments are not instant, even under the faster B2B scheme.

- Transactions that are likely to be charged back: The SEPA Core Direct Debit no-questions-asked refund policy makes chargebacks (equivalent to returns in the ACH scheme) easy in the initial eight weeks following the payment.

Read our documentation to learn how SEPA Direct Debit works with FastSpring.

FastSpring’s SEPA Experience

If you’re interested in offering SEPA Direct Debit to your European customers, you can streamline the payment process by signing up with FastSpring.

Our platform automatically presents the mandate at checkout and handles all of the steps to process your buyer’s order, so you don’t need to do anything except enable SEPA as a payment option in your account settings.

Here’s what that looks like from your buyer’s perspective:

- The buyer selects SEPA Direct Debit and enters their bank name, bank code, or IBAN to log in to their bank account.

- The buyer agrees to the SEPA Direct Debit Mandate terms and verifies their bank information to submit the order.

- After submitting the order, the buyer is redirected to an order confirmation page, confirming that the payment is complete.

- Payments typically take at least 48 hours to process.

And we’re constantly optimizing our system to add payment support for more countries and provide a smoother SEPA payment experience. Let us take on your global payment needs — sign up for free today!