As more and more consumers use their mobile devices (smartphones and tablets) to shop, it has become increasingly important for savvy companies to invest in mobile payment systems.

That said, there are still ways that well-meaning businesses can go astray when they adopt a mobile payment system. Here are some of the top mistakes commonly found among payment solutions.

Mistake #1: Weak Security

Unfortunately, all mobile payment solutions aren’t created equal. As cyber attacks continue to increase, ensuring that your customers are able to securely make payments for goods or services is vital. Failure to utilize a completely secure solution can result in data breaches, which could send customers running straight into the arms of your nearest competitor.

A mobile payment system with security certificates in place—in addition to a fully dedicated fraud protection team— is key. Your customers will rest easy knowing that their sensitive information is safe and you will feel more confident with a team supporting you should something go awry.

Mistake #2: Limited Payment Methods

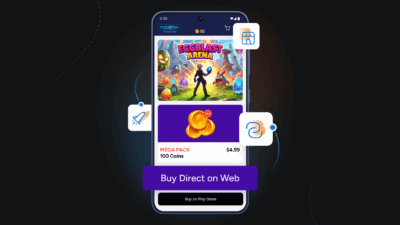

It happens all the time: a prospect is ready to pull the trigger on a purchase, but when they get to the checkout page, they find that their preferred method of payment isn’t available. They click away from the cart and search for a purveyor who will allow them to purchase a similar item using the payment method they prefer.

Rather than limiting the way that customers pay, pick a mobile payment system that will offer a variety of options. Giving customers the choice they want when it’s time to pay for their purchase will help keep them in the funnel until their conversion is completed. In addition to the standard credit cards, a fully equipped mobile payment system will offer methods such as money orders, checks, wire or bank transfer, PayPal, and more.

Mistake #3: Limited Currencies

Failure to acknowledge that customers might not use the currency from your business’s home country is shortsighted at best, and could significantly reduce your business’s global reach. If you hope to scale your company to cater to consumers around the world, it’s important that you have a mobile payment system that won’t charge additional fees for currency conversion.

If your payment platform doesn’t account for the potential for worldwide expansion, it’s limiting your ability to scale your business. Instead, use a platform that will support your growth, offering multi-currency and localization that will make international shoppers feel comfortable making a purchase.

Utilize a Full-Stack Ecommerce Solution

Working with a full-stack ecommerce platform that offers a flexible, full-service mobile payment system will ensure that your customers are capable of making a secure purchase in the currency and with the payment method they prefer. It’s more convenient for the customer as well as the corporation and will streamline the purchasing process from start to finish.

Interesting in seeing what FastSpring has to offer? Click here to request your free demo today.