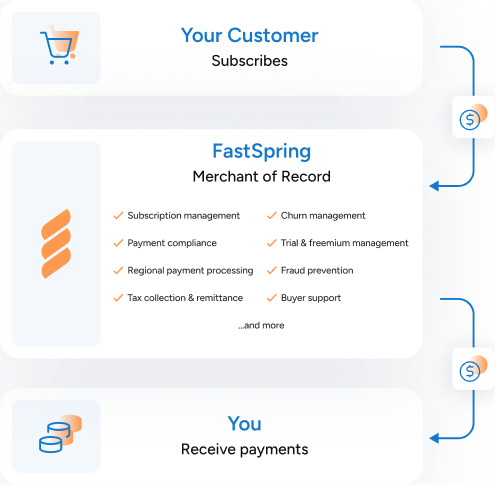

Fraud Prevention

FastSpring partners with Sift, a global leader in risk analysis and fraud prevention, to conduct risk analysis through machine learning and AI. This enables FastSpring to improve fraud detection, lower false positives, improve approval rates, and stop bad actors seeking to defraud companies using our platform. FastSpring can also block transactions from countries and jurisdictions where companies are currently not allowed to do business.