When managing international recurring payments, there are three overarching considerations:

- Staying up to date with local tax laws and transaction regulations

- Making it really easy for customers to make the initial purchase and sign up for recurring payments

- Ensuring each subsequent payment goes through

While this may sound simple, there’s a plethora of factors to consider to achieve those three goals including:

- Currency conversion rates

- Preferred payment types

- Payment processing

- Tax collection and remittance for each country, state, territory, etc.

- Payment failure handling

- Fraud prevention

- Subscription management

- Site translations

- Chargebacks

- Dunning process

- And much more

Most recurring payment providers only help you with a few of these categories and leave the rest for you to figure out. For example, some payment solution providers will help you process payments in foreign currencies but won’t help you pay your taxes in those countries.

In contrast, our solution, FastSpring, acts as the Merchant of Record for SaaS companies which means we handle all of this for you.

In this article, we cover what it means to be a Merchant of Record and how FastSpring:

- Collects and pays sales taxes (including VAT, GST, etc.) for you

- Stays in compliance with local laws and regulations

- Reduces churn with proactive payment retries and customer notifications

- Makes it really easy for customers to buy

- Manages recurring payments for you

- Provides everything for one flat rate

If you’d like to see how FastSpring handles everything from currency conversions to end-of-year taxes for you, sign up for a free account or request a demo today.

What It Means to Have FastSpring as Your Merchant of Record

A Merchant of Record (MoR) is the business entity that sells goods or services to the buyer. The MoR is responsible for every aspect of a transaction including gathering and processing payment details, security, taxes, compliance issues, chargebacks, audits, etc. If something goes wrong or is done incorrectly, the MoR will help resolve the issue on your behalf.

Companies can act as their own MoR and handle all of this internally or they can outsource the entire process to FastSpring and let us take on full liability for each transaction. When FastSpring is acting as your MoR, you control the product/service, checkout experience, and branding — we handle everything else, namely taxes, legal compliance, credit card network approval rates, dunning, and more.

Let FastSpring Handle the Collection and Remittance of Sales Tax and VAT

It used to be true that SaaS and software were exempt from many tax laws throughout the world (or just not a major target for audits). But tax regulations regarding digital sales are changing and being more strongly enforced.

Every country, state, province, territory, etc. that you do business with has its own laws regarding the amount and type of taxes that need to be collected and when it needs to be paid. And that’s a lot to keep up with.

Note: Learn more about how global tax compliance can impact your company’s valuation and more in our deep dive on global software tax compliance.

Typically, global tax management requires using a payment processing platform and a tax compliance software to calculate and collect sales and VAT taxes on each transaction. While some payment platforms will collect taxes for you, you’ll still be responsible for remitting those taxes. If you don’t pay the correct amount of taxes, you may end up owing thousands of dollars in penalties and interest. But figuring out how to pay taxes in each jurisdiction is often very time-consuming and typically requires a team of accountants and tax professionals.

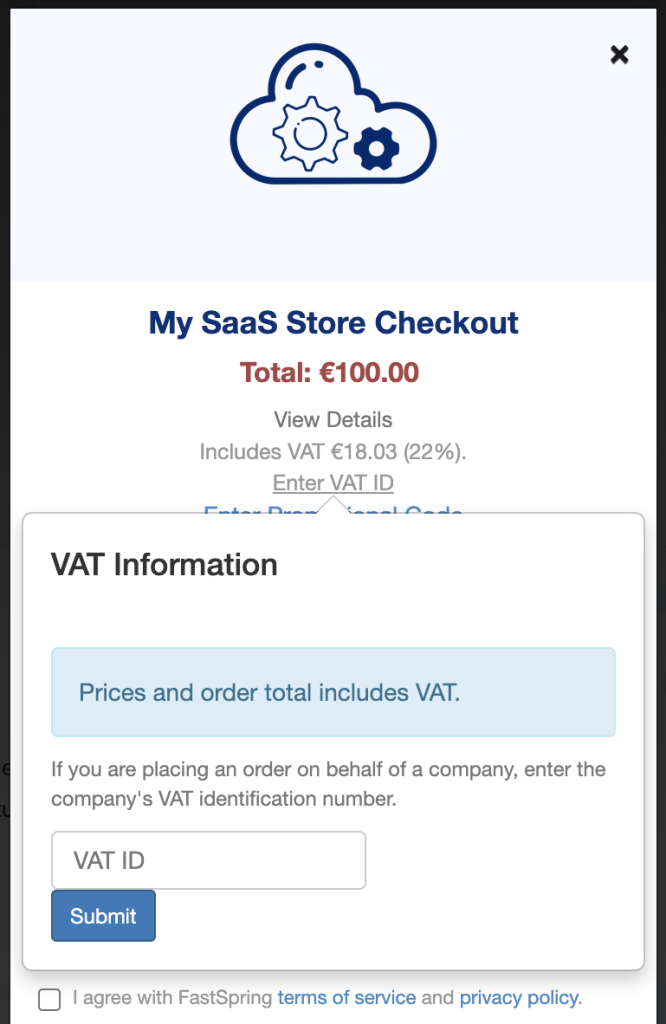

When FastSpring is your MoR, we collect and remit consumption tax (including GST, VAT, SST, etc.) for every transaction and file all necessary tax returns for you.

FastSpring automatically calculates and adds the required taxes to the customer-facing price at checkout. We also support tax-exempt transactions and other special cases.

Effortlessly Stay in Compliance with Local Laws and Regulations

Just like taxes, each country, state, territory, etc. also has its own laws and regulations for how recurring transactions take place. For example, the Reserve Bank of India limits automatic recurring payments to ₹15,000 INR. If a payment is over that amount, the customer has to manually approve the transaction with additional factor authentication (AFA) such as a one-time password (OTP). To comply with this RBI regulation, you also have to file an e-mandate that outlines the type of AFA you will use.

This is just one of many examples of the types of regulations you have to consider when transacting globally.

Staying up to date with the local regulations of each jurisdiction can be time-consuming and costly. If you don’t have the correct procedures in place, you won’t be able to collect payments. Some payment platforms will help you stay on top of local laws and regulations by notifying you if they learn about new laws or regulations. However, your organization is ultimately held liable for knowing about and following all laws and regulations.

But for FastSpring customers, this is not a concern because as your MoR, we assume full liability for adhering to local transaction laws and regulations. Our team of legal experts stay up to date on all relevant legalities and make sure all the necessary procedures are in place for collecting payments.

FastSpring is fully compliant with the EU General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Additionally, we renew our level one certification (which is the highest level possible) with the Payment Card Industry Data Security Standard (PCI DSS) every year.

Reduce Involuntary Churn with Automatic Payment Retries and Customer Notifications

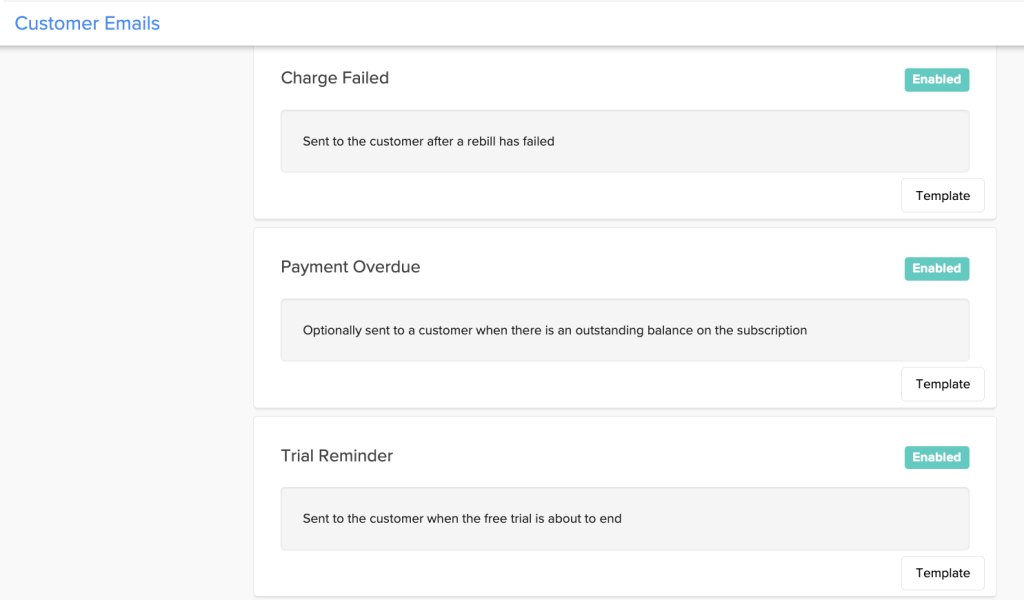

Since involuntary churn is one of the main ways subscription-based companies lose customers, many companies have a system for automatically retrying failed payments or notifying customers of failed payments. This is a good place to start, but the next step is to notify customers of soon-to-be-expired payment types before the payment and to follow up multiple times after a failed payment. However, it can take a lot of employee hours and effort to maintain these systems.

That’s why FastSpring handles all payment failures and customer notifications for our customers.

FastSpring sends out email reminders to cardholders when their card is about to expire so they can update the details before the card payment goes through. FastSpring also automatically retries failed payments. If the payment continues to fail, FastSpring will immediately notify the customer. You can also choose to have us send out reminder emails two, five, seven, fourteen, and twenty-one days after their payment method fails. In our experience, these alerts and reminders can significantly decrease the level of involuntary churn.

During this time, your customer’s service won’t be disrupted. By continuing the service, the customer will be less likely to let the subscription lapse and more likely to take the time to update their information.

You can also choose to pause rather than cancel their service if they fail to update the payment information. This makes it easier for your customer to restart their subscription without the hassle of onboarding again.

By using FastSpring, one of our customers was able to reduce churn by 50%. Learn more about how he did it.

Make It Really Easy for Customers to Buy with Preferred Payment Methods, Localized Transactions, Translations, and More

Friction at the purchase step can cause companies to capture less customers than they otherwise would have. For international customers, there can be many causes of payment-related friction. For example:

- You don’t offer their preferred payment method

- The text at checkout isn’t in a language they understand

- The price isn’t listed in their local currency

- The transaction gets declined or takes too long to complete

FastSpring helps you overcome these challenges by:

- Accepting many different payment methods (and managing those payment options so that transactions are quickly authorized)

- Translating your checkout page(s) to many different languages

- Converting prices to local currencies

We cover this in more detail in the following sections.

Preferred Payment Methods

Different forms of payment are popular in different countries. If you don’t offer forms of payment that certain buyers are used to, you’ll convert less of them to customers. That’s why it’s important to ensure your payment solution can support all the forms of payment that your target customers are most familiar with. However, many international payment solutions will be very limited in the types of payments they support.

For example, some payment service providers will only support debit transactions. If your target customers are used to paying with credit cards or e-wallets (e.g., PayPal), this will be a problem.

Additionally, if you want to accept international payments, you also have to consider the variety of credit cards used in different countries. For example, while MasterCard and Visa credit cards are commonly used in the United States, UnionPay is more common in China.

However, adding and managing popular payment methods is more complicated than adding their logo to your checkout screen. Each card issuer has different tolerance levels for fraud and chargebacks and different rules for how a transaction takes place. If you aren’t in compliance with these requirements, the card network may stop authorizing payments altogether.

FastSpring is compliant with major credit card networks around the world, which means you can easily accept payments in nearly any country and we manage chargebacks and fraud for you.

FastSpring also supports popular debit and e-wallet payment methods including:

- ACH

- SEPA

- BACS Direct Debit Scheme

- PayPal

- Amazon Pay

- And many more…

Finally, card networks are more likely to authorize locally processed payments where the buyer’s bank and the seller are both in the same jurisdiction (for example, a buyer in Germany buying from a business also in Germany). FastSpring works with multiple acquiring banks across the globe and is always working to add more. Since we sell on your behalf as a MoR, more of your company’s transactions will be processed locally which means more payments will be approved.

Automatic Currency Conversions and Language Translations

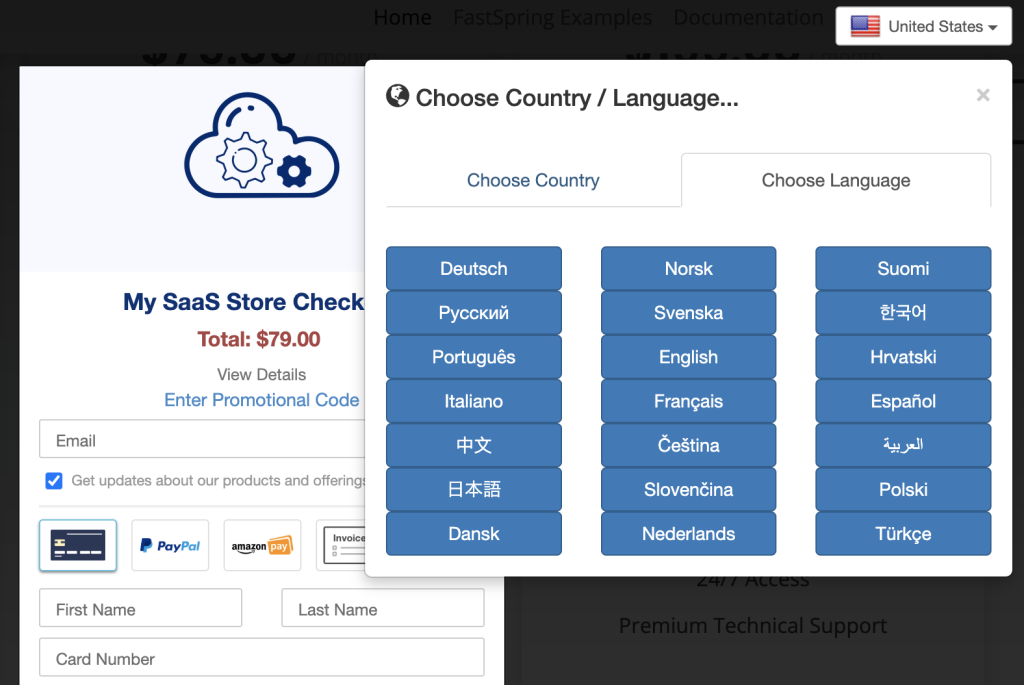

Customers are more likely to trust a checkout experience offered in their native language and currency. So, if you haven’t translated your checkout text or converted your prices to the local currency, you’ll likely lose potential customers.

With FastSpring, you can translate your shopping cart into different languages and automatically convert the customer-facing price to local currencies.

For shopping cart translations, you can:

- Let each buyer select their preferred language from a dropdown menu.

- Lock the language and FastSpring will automatically select the appropriate language based on the buyer’s location.

You will also have two options for currency conversions:

- Let FastSpring automatically convert prices to the local currency. FastSpring uses OANDA for exchange rates and we update prices four times per day. (Contact our sales team for information on markup rates.)

- Set your own price for each currency. Our team can help you determine what the fixed price should be.

If you choose to let FastSpring convert product prices for you, we match the general format of the price. For example, if your base price is $19.99 and the conversion to Euros is €20.29, FastSpring would change it to €20.99.

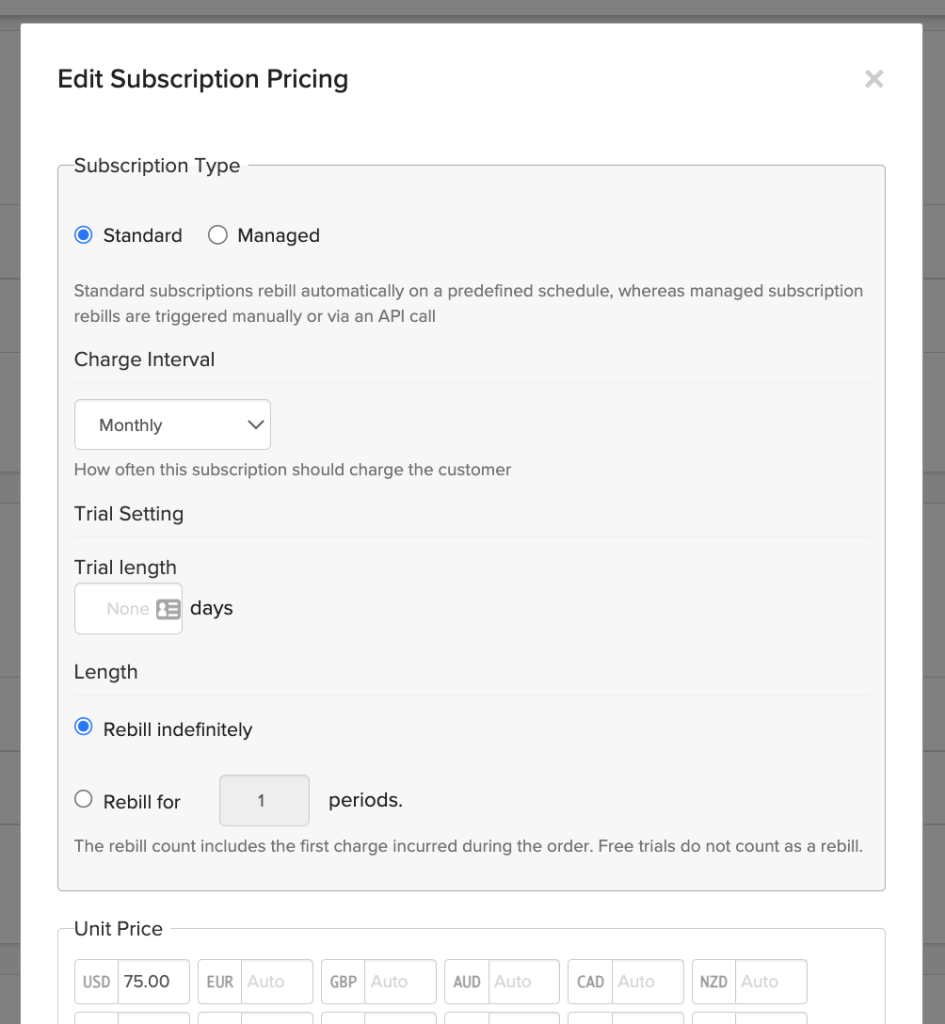

Customize Your Subscriptions and Let FastSpring Manage the Rest

FastSpring provides all the tools you need to create and manage different types of recurring online payments. Here are a few examples of the types of recurring payments you can manage with FastSpring:

- Free trial periods with or without gathering payment information upfront

- Prorated subscription payments

- Variable billing intervals

- Paused subscriptions

- Upgrade renewals

- Prepaid recurring billing

- Subscription bundled with a one-time purchase at sign up

- And more…

It’s easy to set up nearly any subscription scenario with just a few clicks. You can set up most subscription types without any code, but you can also create more complex subscription logic via our API and webhooks library.

All-in-One Pricing (No Hidden Fees)

Many payment system providers will charge a base price for each transaction and then charge extra for each additional feature (e.g., access to international card networks, specialized subscription logic, etc.). This type of pricing makes it difficult to know what you’ll be paying. It can also make it difficult to scale globally as your business grows because the cost will continue to increase as you need more features.

FastSpring doesn’t charge extra for each feature. Instead, our team will work out a simple, flat-rate price that gives you access to every aspect of FastSpring. Your price is based on the volume of transactions you move through FastSpring, and you’ll only be charged when transactions take place.

FastSpring is more than just subscription management or payment processing — we’re your Merchant of Record. To see how we can help you quickly expand globally, sign up for a free account or request a demo today.