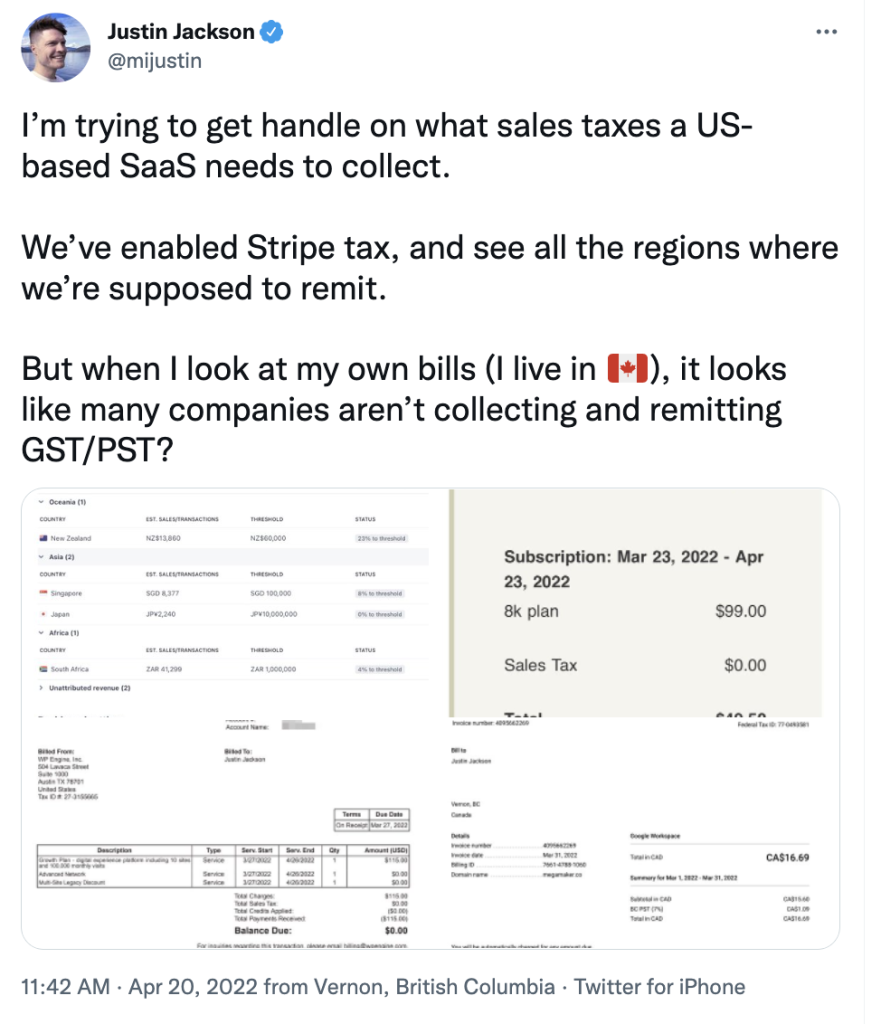

One of the things I’ve learned while working at FastSpring is how common it is for SaaS and software companies to ignore transaction-related taxes (sales taxes, VAT, GST, etc.).

And I get it.

Sales taxes, VAT, and GST are complicated, confusing, and not what software leaders want to spend their time on.

But also, you should know that ignoring transaction-related taxes has risks well beyond paying some back taxes at some time in the future.

During one of my conversations with FastSpring’s Global Tax Director Rachel Harding, the most knowledgeable person I know about this topic, she told me about:

- 40% interest and penalties she’s seen software companies accrue when they’ve ignored state sales tax requirements.

- Multi-million dollar valuation adjustments from historical sales tax noncompliance during acquisition due diligence.

And much more.

So to answer our own question: No, you shouldn’t ignore sales, VAT, and GST taxes.

In this piece, we offer different ways to learn what SaaS companies need to understand about taxes:

- Listen to the podcast episode of my first conversation with Rachel.

- Read highlights about the 5 things SaaS companies need to understand about sales taxes.

- Stream our live webinar about the four ways SaaS companies can manage VAT, GST, and sales taxes.

Listen To The Podcast

5 Things SaaS Companies Need to Understand About Sales Taxes

1. Sales, VAT, and GST Taxes Can Affect SaaS Valuations

When Rachel was working on a mergers and acquisitions tax team for small software companies, she saw million-dollar purchase price adjustments as a result of tax noncompliance.

“If you’re looking to have any kind of ownership change, majority or minority investment, people want to look into your company,” Rachel explained. “They are going to look at all your processes, like do you have a handle on where your products are taxable? Are you watching these rules, collecting and remitting? Are you compliant? Because if not, you’ll want you to fix it before they buy it, or they’ll just dock the purchase price.”

2. If You Do It Right, You Shouldn’t Owe Anything Extra

“If you do it right, technically, it’s net zero to you,” Rachel explained.

Sales tax is a consumption tax — a tax on the consumer, not on your business. It shouldn’t be something you’re paying out of pocket. But it is up to you to collect sales tax on the customer’s behalf — and remit it to the right government agency. It’s a buyer’s liability, but a seller’s obligation.

“It’s when you’re doing it wrong that it becomes an expense and liability on your balance sheet. Feasibly, you’re not going to assess a customer sales tax two years after it was due. So then it’s all out of pocket.”

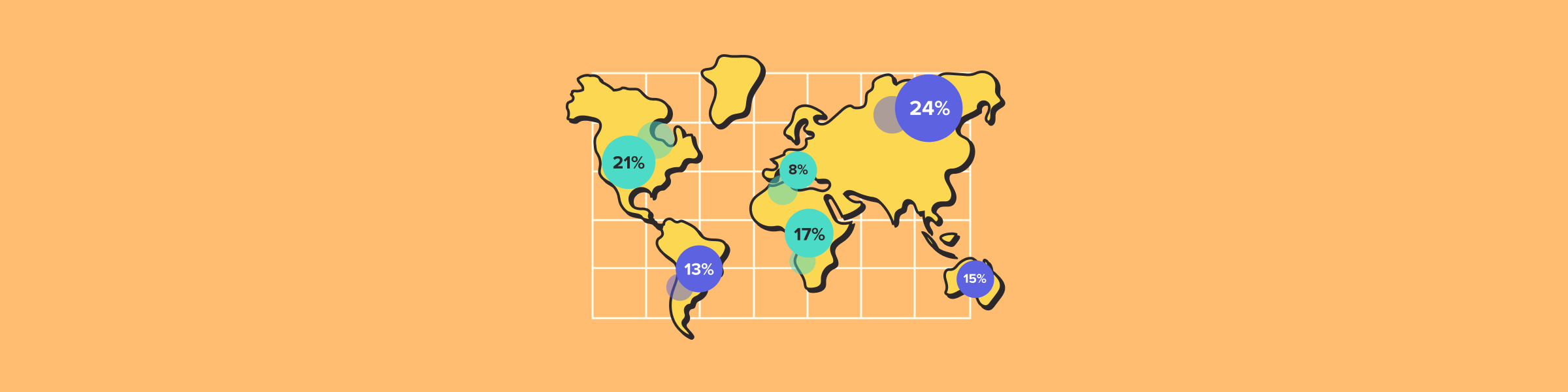

3. Consumption Taxes Are Calculated Based on the Location of the Buyer, Not the Seller

Sales taxes are complicated (especially in places like the U.S.), but in general, the thing to know is that sales tax is collected where the benefit of the item is consumed (aka where your customer is located). It is not calculated based on your location, or the location of your company’s headquarters.

In practice, the most meaningful data for sourcing sales is the billing and computer IP address. As the name implies, SaaS is taxed similarly to services and not goods, meaning only 20 of 45 U.S. states with sales tax regimes actually tax SaaS. And since 2018, if you have enough taxable sales in a region that exceeds the specified threshold, then you are deemed to have economic nexus (a big shoutout to South Dakota v. Wayfair for this concept!).

A sales threshold is the amount of sales you have in a specific jurisdiction before you have to file taxes. Each tax region (whether it’s on a state, territory, or country level) has unique ways of defining a threshold.

4. Tax Laws and Regulations Have Changed Dramatically in the Last 10 Years

Sales taxes, VAT, and other transaction-related taxes have changed a lot in the past ten years. Some changes are more important than others and have changed the landscape entirely.

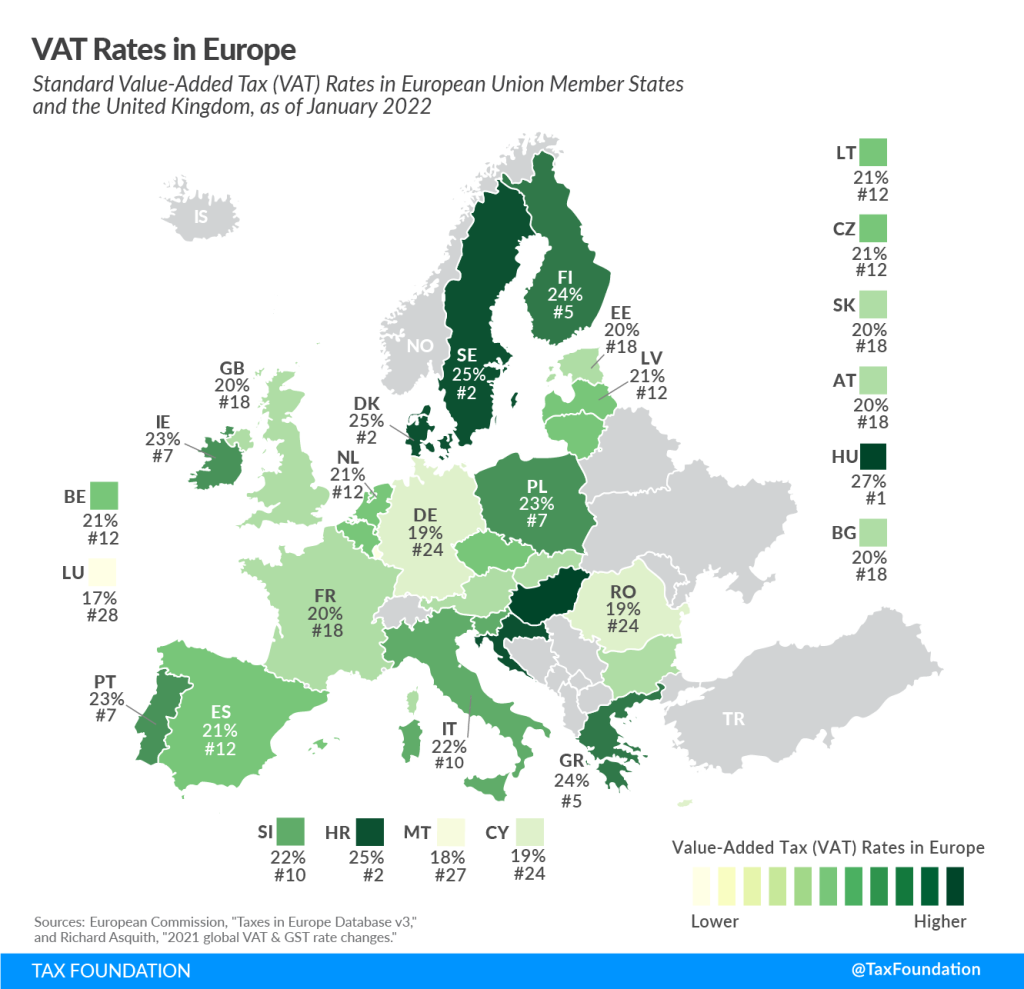

2015: EU Requires VAT Collection From Non-EU Software Companies

On January 1, 2015, the EU began requiring software sellers to collect and remit VAT based on the location of the buyer — not the location of the seller’s company or employees.

VAT rates are set by the country, meaning countries are responsible for keeping up with changes to these rates on a country level.

2018: U.S. Votes That States Can Collect Sales Taxes From Non-Resident Businesses

In 2018, the U.S. Supreme Court ruled that states may charge sales tax on purchases made from out-of-state sellers (including online sellers), even if the seller does not have a physical presence in the taxing state (South Dakota v. Wayfair, Inc.). (A.k.a. the reason we are writing this article since now nonresidents and small businesses need to understand sales tax and its application.)

In the U.S., sales tax regulations differ from state to state. Florida and California do not require collection of sales taxes on SaaS subscriptions. But New York and Pennsylvania do.

Just in 2020, Massachusetts reclassified SaaS fees as “personal tangible property,” meaning SaaS subscriptions are now subject to sales taxes within the state.

In our interviews, Rachel offers other examples of how tax laws are changing for SaaS companies around the world:

“We are seeing, all around the globe, countries creating rules that specifically target non-resident businesses providing digital goods and services. Some will have a threshold of sales, some of them say every dollar is taxable.”

5. Global Consumption Taxes Keep Getting More Complicated

New tax mandates are being passed that directly impact SaaS. Very soon, in countries around the world, SaaS companies running digital platforms may be required to report all sellers using their platform.

Why are tax laws getting more complicated?

Countries know they’re losing tax revenue on digital sales that software companies aren’t disclosing.

As a result, they’re finding new ways to track the flow of money in their state or country and enforce collection.

The 4 Ways SaaS Companies Can Manage Sales Taxes and VAT

So how do SaaS companies figure out all the taxes they need to withhold and remit around the world?

There are four approaches that we see SaaS companies take to fulfill their obligations for transaction-related taxes:

1. Ignore It

As we’ve described in this article, ignoring sales taxes is a very common approach — yet one that can leave your company liable for years of back taxes, fees, and penalties. The days where this approach can work is shrinking. As online commerce continues to grow, so does the drive and ability to regulate it.

2. Do It Themselves

Doing taxes on your own is a good option for larger companies with the resources to manage it effectively with an in-house team.

But it’s not as easy as plugging an automated tax tool into your sales platform.

SaaS companies also need to think about:

- Making sure your data is clean and accessible.

- Understanding what’s taxable and the rates to charge.

- Monitoring tax thresholds to know where you’ll need to remit taxes and file tax returns.

- Remitting the correct amounts and filing returns on time for all tax jurisdictions where you have an obligation. This can be monthly, quarterly, or annually.

- Keeping up to date about changing tax laws and regulations.

- Responding to notices and inquiries from tax authorities. Are they phishing, or is it actionable?

This can be burdensome for a finance department without technical expertise and cause resentment and turnover.

3. Hire an Accounting Firm

When you outsource your taxes, there are fewer internal resources needed, but it’s going to cost more. And rather than a customized approach, hiring an accounting firm usually means they’ll take a conservative approach with maximum compliance — even if you would prefer something more customized.

There’s a perspective that really only an in-house tax expert can provide — one that requires understanding the business, its strategies, tax laws, and how they all intersect.

4. Use a Merchant of Record (MoR) and Outsource the Liability

A merchant of record is a powerful sales approach that can lessen the strain on company resources and finances.

At FastSpring, we act as the merchant of record for all transactions on your site, making us responsible for collecting and remitting taxes on your behalf. Whether you’re trying to manage reduced tax rates, customized taxation, tax-exempt transactions, B2C or B2B — everything is handled for you.

A merchant of record is also at your side if any tax audits or inquiries come up. If an audit happens, we intervene and take the lead — so you can stay focused on building and growing your SaaS business.

What’s the Best Solution for Your Company?

Maybe this is all overwhelming, but the worst thing you can do is nothing.

As Rachel put it, “I can never promise that you will or won’t get audited. What I can promise is that small actions now can set you up for a much brighter future.”

To figure out what’s best for your company, she recommends assessing your resources and your options.

“It’s really knowing the business, your footprint, global tax laws (duh), and what risks you are willing to take on.”

As a merchant of record, FastSpring collects and remits taxes on your behalf, so you never have to worry about it. Learn more about our tax services.

You can also sign up for a FastSpring account or request a demo to learn more about FastSpring.

Stream Our Live Webinar on the Four Ways to Manage Sales Tax

Transcript for this webinar is at the bottom of the page.

Watch our Two Interviews on YouTube

Transcript of the Webinar

Nathan Collier

Thanks, everyone for coming today. We are going to be presenting today about the four ways that SaaS companies manage sales taxes and VAT. Our future guests is on screen here. Rachel Introduce yourself.

Rachel Harding

Yes, hello, everybody. My name is Rachel Harding. I’m the global tax Director here at fast spring coming up on my two years here. I have about I think it’s more close to 12 years of corporate tax experience. I’ve worked in public accounting industry have done m&a roles cryptocurrency and then more recently fast springs. Dealing with the size and software world. And tax is kind of one of my passions, I love dealing with tax and kind of making it breaking it down making it simple to understand and digest. It’s just kind of an I’m here and excited to talk about tax today.

Nathan Collier

Thanks, Rachel. I’m Nathan Collier. I’m the director of content at FastSpring. I lead the content and community here. Before that, I’ve run a couple of content marketing agencies at this point, and I’ve worked with a whole bunch of sass companies. Markham is here as well demand gen manager Matt, introduce yourself as well.

Rachel Harding

Everyone excited to be with you. I’m one of the newer members here at fast spring but have 10 plus years experience in the SaaS world this this point ranging from experiences in companies held by private equity all the way out to new startups. So excited to moderate I’ll be keeping an eye on chat within zoom, and especially within the community as well. So as questions come in, I’ll look to respond to them and pose them to both Nathan and Rachel, as they see, seem pertinent.

Nathan Collier

We will be taking questions. So you can find this in the Slack community global SaaS leaders, Matt, if you would just grab the link to the registration page for the community itself in case somebody might be watching this and wants to join, you can drop that in the chat. We will take the questions from there first. And then we will also take questions from Q&A here in zoom. Just to note, like we can’t give individual tax advice, Rachel can answer questions about taxes in general about about sort of trends in the market and all kinds of all kinds of interesting things. But we can’t give individual tax advice. So with that, let’s get into it. So Rachel, let’s talk about six things that people need to understand when thinking about SaaS sales taxes. And when we say SaaS sales taxes we’re talking about, we’re talking about what let’s establish that first.

Rachel Harding

Yeah, so usually, like, I’ll refer to sales tax, but what I mean is it’s only called sales tax in the US. Mostly, it’s called that in international jurisdictions, but it can be called GST. Japan calls it consumption tax, Cst. The point is, is that these are all kind of high level, they’re attacks on a transaction on an exchange of goods, indirect tax. So when I refer to sales tax, I’ll be talking all-encompassing everywhere. That specific indirect tax. Cool. So kind of one thing that also just that we want to take away, or walk through the four ways how you can manage it, but if anything, if you take away anything from this, we’ll we’ll go through the six bullet points. And that’s kind of the the point if you take away anything, it’ll be these items.

Nathan Collier

Let’s start with this. Yes, sales tax isn’t bad or a tax on the consumer. But sellers. It’s the sales obligation to collect, manage and remit those taxes.

Rachel Harding

Yeah, so I tend to say like if you do sales tax, right, it’s it’s not out of your pocket. It’s really a burden on the consumers. Those are the ones who should be paying the tax. However, it is the sellers obligation, though, to collect, assess remit. It’s not your tax, it’s only your tax if you do it wrong. But it shouldn’t be coming out of the consumers pocket when they purchase something.

Nathan Collier

Sales taxes are too far, sales taxes are based on the location of the buyer where the product is consumed and not the seller. So this is one that I think is, as we’ve talked about this, this is one sometimes misunderstood. So talk about this.

Rachel Harding

Sure. So tax kind of the tax jurisdictions what they want to tax something that’s like in their country if it’s consumed in their country, what that equates to operationally is the location of where of the purchaser where the end user is, when you kind of look at that at a granular level that usually equates to a billing address and IP address. That’s the jurisdiction that where has rights to tax that transaction? So you would look to that jurisdiction for the tax rate, the filing and remittance,

Nathan Collier

Right. And so the history of the history of this when we talked about it was that if I go down to the local store, and I buy an item there, I’ll pay tax there, but that in tax laws were they were designed around that interaction, not for online sales, right? And so the changes are For the last 20 years have been tax laws catching up with how people now buy things. Is that fair?

Rachel Harding

Yes. So kind of before, I’ll say before 2018, it was actually we were giving like countries were giving advantages to non residents selling into countries, they were not trying to but the advantage was coming from basically, if a local person went to the store and bought a tangible good or even a digital good in their country, the retailer, local retailer would assess that. However, if they were purchasing it online from a foreign vendor, who didn’t have that requirement, they didn’t have to pay that. And sometimes, you know, that can be 20%, up to 20. It can be up to like 27%, which can definitely change the price of a product. So all of these rules kind of came in to equal the playing field between businesses, and where they’re located.

Nathan Collier

Right. And I remember this because I used to be able to buy stuff online tax free, right? And over the over the last few years, most businesses are now starting to assess sales tax sales tax on those on those transactions. Yep. Number three, tax laws and regulations are ever evolving, but notable changes in 2018 and 2021. So talk about talking about that. And then these two specifically.

Rachel Harding

Yeah, so I mentioned those two dates. 2018 was a significant change in the laws in the US. And then more than 2021, change was in Europe. In 2018, there was a case that made all the way to the Supreme Court, it was South Dakota V Wayfair. And essentially, the outcome was, you no longer needed a physical presence in a state to have to collect sales tax, you’re just by selling into a state, you’re likely going to have a requirement to collect file and remit. The states will have thresholds, meaning most states in the US use $100,000. So if you have $100,000 of sales into a certain state, you likely will trigger a filing requirement at that point. Regardless, if you you don’t need, you know, people, office equipment, it’s just merely based on sales. That change happened in 2018, which kind of put us sales tax on the map as an issue. And then more recently, in 2021, Europe went through and they reduced their thresholds, they reduced the thresholds basically to zero. So, whereas the US has $100,000 threshold, Europe just says, nope, every single dollar is taxable, regardless of what your businesses, there’s not, they don’t give you kind of that initial sales free. So that kind of changes the game, because every dollar has become subject to sale stocks are back in Europe, whereas before there were higher thresholds around around $100,000. So those two change is kind of have really changed the game, and how we think about sales tax, but how companies should be worried about it.

Nathan Collier

Sorry, for jumping ahead. I was my my microphone was skipping out on me. So I was clicking trying to fix that. And it advanced the slide. You told me when we were talking earlier that like you remember where you were when the Wayfair ruling came out like it was that monumental?

Rachel Harding

I mean, for for a tax nerd like me, yeah, anybody in the tax industry, it’s one of those kind of moments in history where you remember exactly where you were, what you were doing, like I was in a product meeting with tax people in product and we everybody kind of saw that notice come through, and basically stopped the meeting. And we’re talking about this because it was huge, before, you only had to collect sales tax if you had a physical presence. So like, if you’re Amazon, you’re basically in every state, you have to collect in every state. But before that, if you weren’t in the state, like Amazon is based Seattle, like it didn’t have to collect if it didn’t have an office or remote employees. This has also kind of changed when everybody went remote. It became it becomes more important with the pandemic because ever all employees went remote. Having an employee in a state will trigger sales tax collections. So it’s something to be aware of as a company like where your own employees are.

Nathan Collier

Number four on the list is global sales taxes are getting more complicated, not less, I think, just to continue that theme from the last point right

Rachel Harding

Yeah, it’s something that like we’re seeing about six to 10 countries a year are coming out with new tax regulations specifically guided geared towards taxing foreign businesses that are selling intangible goods, meaning software says digital goods. So it’s important, like the landscape is changing pretty rapidly. So it’s important to kind of just keep your eye out for all of these changes.

Nathan Collier

Talking about this one, because this is one that when you sell this, when you sell this, to me, originally, I couldn’t like I just had never thought about this, because because of the liability here. So ignoring taxes can be costly and even lower your company’s valuation if it’s not done properly.

Rachel Harding

Yeah, so for companies that you know, are looking to get, if you’re trying to go public, even to get investment to get your series funding all of these things, you’re going to they’re going to look at your tax practices and whether or not you’ve looked into like sales tax and understanding it. When I did, I did two years in m&a. And it was right it was 2018 2019, when nobody was even thinking about sales tax, and routinely, during diligence, we would find issues that, you know, million dollar purchase price adjustments, where they have to account for this liabilities that they would reduce the value of your company, which is huge.

Nathan Collier

I’ll come back to that one. It takes experience to identify actionable phishing emails, from informational info or for scams, and even just we’ll talk about this in a second, just just the jurisdictions themselves kind of how they’ve been doing things a lot. So you get this all the time in your inbox, right?

Rachel Harding

Oh, yeah, I actually, we have a separate tax inbox that I mean, we get hundreds of emails, like I won’t say hundreds a day, but like hundreds weekly, that come in from all the different jurisdictions and they can be anywhere from like actionable items where they need you to do something. I’ll call it fishing, but it’s basically they’re just throwing you a bone to see if you respond and provide more information, and maybe they can find a liability. And then there are scams, because I will go out and say at least the states, you know, their, IT security is not as great as some of the private companies. So you they’ll send one time, there was a email that came out that see seed every single taxpayer, and it was like, like, they just, they’re not known for, you know, being super tech savvy. So understanding like, the differences between all the different communications goes a long way, in kind of what the time that it takes to be compliant.

Nathan Collier

Right. So we’ll talk about sort of who responds to that. And here in a second, but just for example, you were talking about phishing me, like pH me like the scam version of phishing, but you’re also talking about like phishing, meaning like jurisdictions just like, sort of testing you to see how you respond to see how they then will respond to you. Those two things there. So this is an example of something that you forwarded to our kind of our team as we were talking about this. And even the question like, Is this legit? Like, the first question is, is it legit? And then the second question is, like, do you do you need to respond to this? Because if I understand if I remember correctly, we had already done what we needed to do in Singapore, right?

Rachel Harding

Yep. So yeah, this email was a perfect example of like, if you, if you didn’t really, like understand kind of tax, and you were just getting this email, it would be it would, it would make you jump and you would, you know, get into action and want to respond to it. This was sent out and basically, they took didn’t take into consideration like the people that already are registered and compliant, but sent us a notice being like, you need to be collecting taxes. It’s like, okay, well, we, we already do. And you see a lot of these so kind of knowing, like, where you collect kind of like where you have a requirement helps and figuring out like, what is this even like, do I need to respond? Etc.

Nathan Collier

Alright, so then so these are the kinds of emails that a business owner would get, just all the time, just just like we do. Yep. Let’s jump into the four options to manage its costs. So that’s the landscape. How do you manage this? There’s, there’s kind of four ways that that, like you, you kind of have this like, way this, I guess, framework of doing it. And really, before I before I move into this, like, Matt, is there any Are there any good questions that we should stop and ask have Rachel answer?

Matt Marcum

Yeah, I’m happy to do that I was about to panic a little bit, because I promised Daniel, I would get his question out to Rachel. So Daniels got an interesting one to consider. And he says, as I find that he often sees cases where the buyer, usually a large company chooses to buy through a software reseller. In the software, resellers location is often different from the buyers location, different states or different countries, what location ultimately matters? And then who is responsible for collecting sells slash VAT in most cases?

Rachel Harding

Yeah, no, that’s a good question. So if I’m understanding your question that you’re asking like, it’s the business that’s buying from a reseller, and then that big business is then turning around and selling on to the consumer, the end user? I’ll I think that’s what you’re trying to say. So what happens kind of, and when I tackle questions, like the US does it one way, of course, right? Like we always do it some different, and then internationally, that is done like a certain way. But most sales in between either b2b, or exempt entities. Those are not subject to sales tax, because that business is not the end user, they’re usually passing it on, or selling it to the end user. In that kind of chain, you would look when the business sells it, then to the end user, the consumer. That’s when you would charge sales tax, and it would be in the location that the consumer is that. So the initial transaction from the when you purchase from the reseller doesn’t matter. It’s that it’s that transaction where it goes to the end user is where it matters. Hopefully that answered your question.

Nathan Collier

If I’m, if there’s a follow up, let us know.

Matt Marcum

Well, there was one other question too, if you don’t mind me jumping in, Chaz has a question. And you mentioned that you’ve seen a lot of successful SaaS businesses, based on his conversations that are actively not in compliance with consumption tax laws outside of their jurisdictions. They might have a physical Nexus and so presuming an IPO or acquisition as another concern, or hope, what are the consequences of this level of non compliance? So this is assuming there isn’t an IPL or imminent? Sure, acquisitions?

Nathan Collier

This is a preview of an answer coming coming soon. So give it give a quick answer. And then the jazz will we’ll get into this one here in a couple of slides, too. And this is

Rachel Harding

Kind of. I mean, this is the million dollar question. Ultimately, you will see this, you will see companies that are nothing seems to be going wrong. But and they aren’t being compliant with taxes, I can never promise that people who are doing it wrong are going to get penalized. What I can speak to is the changes that we see in the environment. And by changes, I mean, I routinely use a network of advisers and keep up to speed kind of on what’s happening where meaning what jurisdictions are, are going after what recently, we knew that the US was really hammering on information reporting. We know that Thailand started going after has started to pick up on their audits. We know we know Mexico is kind of like first to market in terms of automating everything. So they already require a kind of their local companies to turn things to submit every piece of the transaction electronically. So knowing that, right, like I’m very quick to respond and making sure FastSpring operations are all set, because those things are always changing. That’s something that you know, if you’re just a small SaaS business, that you can be successful. But if you don’t have that tax resource that’s tapped into this, you’re not going to know that. So really, the answer is that it’s always going to be a risk. It just matters. Like how big of a risk are you willing to take on? If you’re starting to if you have sales into countries that are in the millions? I would say you should definitely have an advisor look, at least look at it to tell you the can quantify because you need to have all the facts of the business and on the operations to understand where the risk is. If you’re still like under $100,000 In into each country, each state I I’ll tell you that. That’s a reasonable line. That’s when you need just are looking into things. If you’re in the millions, it adds up quickly. Because if you’re talking about 20% on a million dollars, it can add up very quickly. So it’s your it’s just kind of I know personally, I don’t like to sit with that feeling of having a loose end. And the minute you get that notice, it’s it’s kind of like all over, I will tell you, we are in an audit with Texas, and it’s been going on for a year, Texas initially thought they came in and they thought they were going to it was going to be $500,000 they were gonna get out of us. We have, like back and forth like so many times, it’s under $50,000 the liability?

Nathan Collier

Rachel, as we’ve talked about, it’s not that, like we did, like saw that we were out of compliance. It’s just that jurisdictions pick companies to audit like this.

Rachel Harding

And they just want to see all of your practices. This one in particular, like, they were trying to assert that our marketplace was so much bigger than what it was. So slowly, just had to go through and communicate that to them.

Nathan Collier

And that’s the risk, right? Is this the three things like is the I’m sorry to jump in? But like, oh, yeah, it’s the it’s actually the liability. This is I think, what we’ve talked about in the past the liability, meaning the money, right, like, if you don’t collect taxes now, that like, if you collect taxes properly, now, you’re, it’s the liability, you’re adding that to your sale. But if you didn’t collect it, like now, you’re still liable for it in reverse, so then it becomes your liability. And then we’ll talk about statute of limitations here in a minute, because that’s an important one meaning like, there’s a there’s a look back window for companies that are not compliant. And then the other thing is just the almost every SaaS company, like even if you’re not looking at an IPO or an acquisition, like do you want that as an option? That’s, that’s a question you have to deal with as somebody, even if you’re not planning to do that, like maybe someday in the future, you will want to and then the third one is just what Rachel you were just talking about, which is, how many how much time have you spent dealing with that audit? Like many, many, many hours, right? So you, you as the business owner ended up being the one who who deals with those taxing sorry, so time, liability, and then potential IPO are the three. So let’s jump into to these slides. And we’ll come back to this because I’m sure that that’s one that’s complex, and will need additional clarification. But hopefully, I think as we get through this one, will, will start to answer some of those questions in even more detail. Here’s the four. So once the DIY approach to yourself, one is to outsource, three is of merchant record model. Four is to ignore them entirely, which is what we were just talking about, which is there’s an awful lot of companies that are not in compliance. And they’re just hoping to avoid any consequences from that. So let’s talk through these real quick, Rachel and the implications of each so yeah, first, let’s talk about the dual your yourself approach advantages, advantages, disadvantages, and then who’s who’s this best for him?

Rachel Harding

Yeah, so the advantages is like you kind of have the control of how much risk you want to take on the disadvantages you you kind of need to have a tax resource are knowledgeable person to understand like what they’re looking at. If you do it yourself, you know that like you’re going to be on the front lines in terms of responsible for knowing what amount to collect what products are taxable. There are some countries that don’t tax stats, like there are states that don’t taxes like knowing which is which so because customers know when they’re routinely buying says you’ll hear from them, if you’re charging the the wrong rate, or if you’re doing it wrong, you’ll need to know that then you’ll also be responsible for making sure like it’s either a monthly quarterly annual filing, I know fast, bring the file over and fall over 1000 returns each year. It’s it’s no small feat, when you’re trying to file you have to remit payment, like there’s discrepancies. It takes a lot of time. So it will take away resources from your other businesses. But this is a good option for somebody who really is only doing business in one jurisdiction, so they kind of know their footprint. And they can easily figure out what the tax requirements are in that jurisdiction.

Nathan Collier

Right. And then the other the other example that is like a really big company like Amazon that has the resources to build out a whole.

Rachel Harding

Right, because I mean, yeah, it’s kind of like that as you come to a point where you’re that big that you want it then bring it in house. But you need to you have a whole team to do it. Right.

Nathan Collier

What happens if you outsource? advantages, disadvantages and who’s the best for?

Rachel Harding

Yeah, outsourcing is a great option. As you start to grow out of one jurisdiction because you’re not a specialist and tax jurisdictions everywhere. The advantages here is that they, they will completely kind of handle everything from you know, beginning to end, the dis, and there have the technical expertise, what I see, one of the disadvantages being is that, as a third party adviser, they have to kind of tell you a more conservative approach, which may or may not be in line with your business strategy, like you might not have all those funds, and that time and the roadmap to implement all these things. And they, they they cost, they definitely can cost you’ll spend a lot of time kind of going back and forth. Because they need every piece of information in order to analyze and tell kind of recommend what you do. Also, they’ll never, they’ll never give you kind of a full answer. It’ll always be, we recommend this. So at the end of the day, you’ll have to be the one to make the call whether or not you implement something somewhere, which if you don’t know, from an internal perspective, what that like what that really means it can be kind of a hard position to be in. This is probably for companies, you know, that are outside one jurisdiction and are starting, you know, to dabble overseas have, like, their products can be complex, like they have bundled products, something that needs a second look from a tax advisor.

Nathan Collier

Yeah, I think what we talked about was like when they’re expanding beyond one market into like, a couple of others, right? Potentially, that could be the kind of thing that could be helpful.

Nathan Collier

Merchant of record, this is us. Yes, clearly, we have, let’s just say it, like wherever I should record, we like this model. But talk about like, specifically, just like, what are the advantages of using a merchant banker model disadvantages? And then like, who’s it best for?

Rachel Harding

Yeah, I think the like, let, if you want to just flip to the next slide, I think this really clearly shows. Yeah, kind of, it kind of wraps up a lot of things, at least from a tax perspective, what the benefit is, we were laughing the other day that it’s kind of like we’re like a shield. We’re like your invisible shield. When it comes to any anything tax related. Old, because we’re the ones the responsibility is on us. It’s our name, and our you know, tax IDs that are going out to these, like, we’re in 5556, jurisdictions, all 45 states 13 provinces, they come to us, they don’t come to you. There’s a lot of times actually, if you are a customer sellers reach out to us and say, Hey, I got this notice, what do what does it mean? And me and my team will give you exact details on how to handle it, like, oh, you need to, like, I’ll type out sentences and be like, This is what you respond to them. Like, oh, we use a reseller like FastSpring, they file under a bubble, blah, blah, blah, like you have those resources at your fingertips. That’s part of the cost you’re paying for.

Nathan Collier

We should say like, just to say it, like when you use a merchant record, the the customer meaning the consumer buys from the merchant of record, and then we buy from the business. So we’re acting as a reseller of your products. And so because of that the transaction where the consumption happens, I’m, if I’m saying that right? Correct me if I’m not Rachel is between the consumer and, and The Merchant of record, not between the consumer and the software business. So because of that, the merchant of record becomes the entity that then becomes responsible for like collecting and remitting and filing all these kinds of things. And then we just turn around and we, we pay, because we pay the pay the software company, like the based on the purchases. So that’s that’s how that happens. Very, very similar to like a retail model as a way to think about it just like a retail kind of business. And I think this gets to what some of what’s happening some what I see I can only barely sort of seniors go by and in the comments. So we’ll probably come back to this one then when the questions come. But on the on the other side, when you use, like just a payment processor like Stripe, that stripe is processing that payment, but the transaction is happening between the consumer and directly between the SaaS business and so there’s not that resell, that’s not that resell sort of model, that emergency request. And so because of that, when that’s what you’re saying like when when someone using FastSpring gets an email from one of those taxing authorities, then like we could say they can read Ponce actually we use FastSpring. Yep. for that. And so this is their merchant ID.

Rachel Harding

Like when I, when I describe it to like tax people or lawyers, I always say we’re a reseller, or we’re a marketplace facilitator. That’s kind of the terminology that you get. But it means that you’re the you’re the seller, and it’s the seller that has the responsibility to the end user who’s ever who’s ever consuming it.

Nathan Collier

Meaning the merchant of record is the seller. Yeah, yeah.

Rachel Harding

So in this example, the Mor, right? Your store to the MoR. Basically, what happens is, we buy it directly from you. And then we turn around and we sell it to your customers. What that means is that we then become the selling party, and it’s the selling party that is responsible for all the legal tax payment things. It’s you’re not responsible for it when you sell it to us, because we’re a US-based company, and we fall under the exempt reseller exclusion,

Nathan Collier

you’re talking about earlier, where it’s a business transaction.

Rachel Harding

So it depends on like I yeah, I’ve been seeing the comments. And it’s referring to like, international, it depends. There are countries like Mexico, Russia, South Africa, they don’t allow b2b to be exempt, meaning they don’t have that similar exclusion on the b2b sale. So that has to be charged and assessed on that transaction. They don’t treat businesses differently, that a lot of countries are implementing these rules, more and more, whereas it used to only be one or two. There’s now like over 1015 countries that are doing it this way, which totally changes how the concept of how our resellers thought of when you’re taxing the business. So there’s

Nathan Collier

not a clean answer to some of those things. And that’s the point, right? These things are these things are changing in there, then they’re very, very complex. Yeah, like,

Rachel Harding

you have to know exactly which countries which jurisdictions. For me to give, like a accurate answer, there’s the general is they are exempt. But by no means there are always exceptions.

Nathan Collier

Right? Let’s, let’s make sure we cover this. So the advantages of a merchant of record are?

Rachel Harding

Yeah, so we got we kind of talked about all this. But you know, we’re the ones that are creating like, we have a matrix of, I think it’s 52,000 different combinations of tax rates in countries, based on the products that you sell. We made like this is kind of the raw data, we know the rates whose taxable if your products are taxable, all that would be on on the seller, if it wasn’t handled through FastSpring. We do all the filing payment remittance, and then we are the kind of intermediary if there is any issue if there you know, there’s an audit that come to us, if you get notices, which most when you get to a certain size, you will start seeing notice this,

Nathan Collier

we should be we should be clear about that when we say that we’d been like an audit about sales tax and various kinds of sales taxes. Like it’s not that you can’t get audited, it’s just on for these specific types of transactions, like the audit would come to a merchant of record, because the merchant of record is the one collecting the taxes.

Rachel Harding

Yeah, but I mean, the states are getting they get wind of like where you’re doing business. And what the states like the don’t have income taxes tend to be the most aggressive like Texas, Washington, they’d know just by by looking at payment records, and what they’re what customers are reporting, they have an understanding of what businesses even if you’re using a merchant of record, what businesses are doing business in their state. So having that kind of intermediary is a resource you can use. We deal with all the customer questions that they have, like, if you’re not charging the, if you’re charging the wrong rate or not charging all you hear from the customers, like customers are sometimes pretty savvy in terms of like, they know what they’re buying. So if you’re doing something wrong, like you’ll hear from it, so it’s just more resources allocated to trying to take care of an issue, something that we handle entirely

Nathan Collier

right now there there is a perception that a merchant of record is very is costly relative to something like Stripe, so we should should just say that and so but but who is merch have ever really best for

Rachel Harding

I mean, merchant of record is best for anybody who doesn’t want to deal with tax um, I tend I’m a tax person, I love tax. But I would say that’s not the norm. Most people don’t want to know they don’t want to understand the complexities of it. But they do want to be compliant. The best way to do that is to outsource it to a merchant of record.

Nathan Collier

Talked about this, let’s let’s do talk really quickly. Stripe does have a service called taxes, where they do have like a calculation engine that will add on, like taxes, and collect them through the system. But what’s the difference between that system and what a merchant of record does?

Rachel Harding

Yeah, so you will still be responsible for like, filing and pain, and then all the, when they come when taxing authorities have questions, you have to articulate what was done. I don’t know if you can even point to say, well, Stripe did it. Because ultimately, you’re the one that actually completed the transaction as the seller. So it’s all it’s all going to be kind of on you. And when you’re dealing with tax authorities, they love they love it, when they’re engaging with somebody that doesn’t know what they’re talking about. They like me that I’m like, Oh, I know exactly like what you’re aiming for. Because it makes their job much harder. When people don’t know, they’re like, sure I’ll pay.

Nathan Collier

When we say responsible for taxes, we don’t just mean the money, we mean like the the administration of it, and then filing of all the returns in all the places where you meet all the different thresholds. So not just the financial piece of it, there’s also the administrative piece of it, which can be significant. So.

Rachel Harding

And there’s also the visibility that happens when your name and your tax ID start getting out there. That’s when you start to see this influx of hundreds of emails that are coming to you. It’s because our name and our idea out there, every country has our information. Right? When you start doing that, you will start to see that tax just becomes a bigger and bigger beasts to tackle.

Nathan Collier

Let’s address this because this is addressing the question from earlier. So what happens if you just ignore taxes? Can you do that? Can you get away with it?

Rachel Harding

I mean, as you know, the leader of your company, you can do kind of whatever you want, I can’t promise Yes or No, you’ll have an audit, I can tell you that I have seen purchase price adjustments, I have seen people with like, hundreds of 1000s of dollars of time spent on an on it, that you have to totally pivot from your business to take care of the issue. Without ever tackling anything you never enter you start this thing called statute of limitations, statue of limitations. Basically, the taxing jurisdictions have a finite amount of time that they can come after you if you’ve filed, it usually is three to five years. If you’ve never filed, you don’t have this protection, which means there is no reason why if you get audited for 2021, and they have a full jurisdiction to open and go back until you started your business, let’s say 2010 really having the statute of limitations is it’s a great kind of cover, because of your being compliant. And filing. They only have three years to come audit that period. Well, after that three year period, it’s closed. And

Nathan Collier

you said three years? It depends a little on jurisdiction, right? Sometimes, sometimes three to four,

Rachel Harding

like international tend to be five, federal government is three, but that doesn’t have sales tax. Most states are for

Nathan Collier

so and so. So if I’m if I’m if I’m just not filing taxes, and I’ve had my business since 2010, right, yeah. And I get an audit today. They can go all the way back to 2010. Yeah, and I can’t go back and collect sales tax from 12 years of transactions. I can’t go to my customers and like ask them to pay.

Rachel Harding

Well, I mean, technically sucks. But like,

Nathan Collier

I mean, think about the business just yeah, just not gonna do that. Right? IT companies pay out of pocket, right? So that’s what happens, right? Is that you from a business perspective, you can’t just go back and ask customers to now collect tax. But if I’m collecting taxes, and at least like filing and I’m attempting to stay compliant, right, then they can go back whatever their statute of limitation is. So it may be only back to 2017, 2018 depending on that jurisdiction. So that’s one piece of it the answer the question for earlier and then you worked in m&a and mergers and acquisitions, right? Like before you came to FastSpring. So what happened when a company was was in the process of being acquired by an equity fund or by you know, a bigger company? What happened when they He, like started doing evaluations and about and valuations. And they found out that there was like a lack of tax compliance.

Rachel Harding

Typically what happens is like, there’s two things like you get tasked with cleaning it up. So you need the resource, like, you have to clean it up. So you have to take people from if you have no tax people, other departments to really go through file, vas, you know, file, 10 years of whatever, and then it’ll also be considered part of your value. So if they estimate it to be, you know, $3 million, you have a $20 million company, well, they’re only going to pay you 17. Because you and you have to clean up the liability. So it’s like, it’s a double edged sword, you have to foot all those costs, but you’re also not going to get the value. And I’ve seen it a lot inside companies over the past few years.

Nathan Collier

And then there’s actually one that’s what tax liability is also one of the things that lowers the overall acquisition price, right? So how much can that be? If I’m looking at a 25 $9 million acquisition? What, what’s that? What’s the impact?

Rachel Harding

Yeah, so what I mentioned, like just a standard business that like, let’s say, you know, their US business, they are in 20, states they sell, if you that liability can quickly get up to two $3 million larger if you are making, you know, if you’re under about 20, out, let’s say 10 20 million, you could have a two to $3 million liability.

Nathan Collier

So if someone comes to you, if someone comes to me and wants to buy, even if I wasn’t looking for an acquisition, if they want to buy my company for 10 million, 10 million, it might be eight, after look at this, or if it’s 25 million, it might be 20. Because of this, I never

Rachel Harding

want to underestimate the impact of nobody wants to buy a company that has a big looming tax issue. We’ve seen disinterest in companies because they’re like, Ah, you have this big, big tax issues need to clean up. It’s not worth it. Because they know, excuse me, they know the complexities that go along with it. You always hear it’s tax is always that thing that can make or break deals. And it’s something that you want to stay ahead of.

Nathan Collier

Let’s see. That’s That’s all of it. There’s lots of good questions I see in the chat. Matt has a few that sort of are popping into my on my on my chat here my the screen. So let’s get to these quickly, because these are some sort of some common ones. What happens when SaaS companies don’t properly comply with extra regulations? I think we just been talking about this, but speak to that one for just a second.

Rachel Harding

Yeah, I mean, there are some companies that will get away clean, and you know, there’ll be non-compliant, and there’s no issue, there are companies that will not be able to have that same luck. And it’s really just the luck of the draw. I think as, as the government’s are going more and more digital. And this whole concept of E Invoicing is very much in our two to three year roadmap. Nobody’s going to be able to get away with it. It’s it’s a little bit like the wild west right now. But it’s, it’s coming.

Nathan Collier

So when you say e invoicing, then just a minute on that, because what you’re talking about is the taxing authorities in some locations are now going to require, like, they’ll be able to see all of your transactions for every, for every purchase, and that’s gonna be part of your filing requirement.

Rachel Harding

Yeah, so like places like Mexico, they already require it for the local for Mexico based companies. They have to submit an electronic file, like they’re all different, but it’s basically they have to submit the data of all the, the transaction and all the pieces of it. So basically, they can very quickly see oh, are you even like, it’ll take a day to figure out if you’re collecting tax, but then it starts to getting to the nitty gritty like, Are you like the right rate? What is your product? If you have to submit a harmonized product code and you don’t like your you’ll automatically be kicked out? E-invoicing? Which is I mean, the US is starting a pilot program on this next year. It is it’s going to ensure compliance basically.

Nathan Collier

What countries have changed the rules around that and sales tax for software sales in recent years.

Rachel Harding

Oh my goodness. So many. Right, just the ones like off the top of my head is Mexico, Indonesia in 2020, Malaysia, Chile. Last year, we have Canada, Thailand, Puerto Rico, and these are just ones that like we were on our radar because we had a footprint there and had to start complying with it in 2022 There’s Ukraine, Israel, Armenia, Pakistan. All of these countries are passing laws specifically geared towards non-resident businesses that are selling digital goods, which says is considered to be,

Nathan Collier

Right. So each one of those if you have customers in any of those locations like that’s, that’s the stuff you have to keep up with. If you’re not using a merchant record to go back to our, to our other conversation, how are tax liabilities different from b2b and b2c purchases in different areas of the world? This one, this one comes in a lot as we talk to people about this one.

Rachel Harding

Yeah, so what I mentioned before is b2b tends to be exempt. But it depends on where the other party is located. If those rules allow it to be exempt. What I mean by that is like South Africa, if FastSpring is selling into South Africa, a b2b sale is not exempt. It so it depends on the location of the other country where they’re selling into. The hard and fast rule is typically b2b is exempt. b2c is always taxable. But there are a lot of exclusions and they’re, they’re becoming more and more exclusions kind of as people pass rules. Because they’re, they’re starting to tax businesses. They’re saying, No, we’re not going to let you just, we’re just going to tax it.

Nathan Collier

Right. Matt, What are the questions we have? I see, I see some of them going by. So let’s see if we can address some of these.

Matt Marcum

Let’s, let’s get after it. And there’s a number of them in here. So we’ll try to get to all of them. I want to do spread some of these around now. So one question from Diana Sandoval. And this is about a little bit of confusion in here about buying from resellers. But what if you buy from resellers in other countries, and you sell to US companies, but the product is used by their remote employees in the countries where they purchased from the reseller. So you’re you’re buying a lot going on and that one?

Rachel Harding

Yeah, if you’re buying from a reseller, then typically that transaction would be exempt. However, if you’re selling into the US, the US does not really follow this b2b b2c concept, which is the reason why it’s so complex. They do allow exclusions for entities like exempt you, if you’re an exempt entity, then you’re not taxed. But those are you have to be either a reseller which FastSpring is, you know, a university, a nonprofit, a 501, C three, those are the only times that a purchase is not taxable. If you’re just a standard business, purchasing software, it’s taxable. So, whereas you’re gonna see a lot more much more transactions are taxable when you’re selling into the US because of the rules. So if you’re selling to a company, who their employees are using it, it’s taxable, like you should be collecting sales tax on it. And then it depends on so you want to tax where the where it’s being consumed. But you will find if you try and implement that, operationally, you’re going to be limited to either the billing address the shipping address, the IP address, what most countries and states say is that you need two pieces of corroborating evidence to actually determine where somebody’s located. Some states say you only need one, you have to kind of go through that analysis to be sure that you’re actually sourcing it properly based on the local rules, which is no easy feat. Let me tell you, I’ve refined how we’ve done it. It’s it takes it’s it’s tedious and it takes time. But you you only have the data available to you. But those transactions are would be taxable subject to sales tax. And I would definitely watch out for the states that are don’t have an income tax, because all of their revenue is based on sales tax. And there’s five states that don’t have a revenue or don’t have an income tax. And each SEVEN, SEVEN don’t have an income tax five don’t have sales taxes.

Nathan Collier

Each one of those even depending on the product, each one of them treats certain types of products differently. And so there’s there’s even complexity within that. What else, Matt?

Matt Marcum

Yep, good question from Christian Worf. So, can I sell SaaS through FastSpring to customers in all countries or our countries excluded? What happens if a customer from a country or from an excluded country tries to buy a license?

Rachel Harding

Yeah, so I will say yes, except for the countries that are blacklisted that like you know, are on the international sanctions.

Nathan Collier

It’s, yeah, it’s an international sanctions list that’s meaning is like that is managed. It’s not our choice. It’s just that there’s like, there’s certain sanctions and things that we have to comply with.

Rachel Harding

So what it’s, it’s a smaller list, but the transaction won’t complete if they try. If we source them to that country, if we can tell their IP address is coming from that country, it won’t allow that track transaction to complete.

Nathan Collier

What else? Matt?

Matt Marcum

Let’s start circling back because there were some clarifications coming in from previous questions, too. So Chaz had a follow-up asking, has there ever been a case where a tax authority has successfully penetrated the reseller relationship to produce a liability for a FastSpring merchant to our relationship?

Rachel Harding

Hell no! They I mean, they’re actually Canada … Canada tried. But no go under all, where we’re operating. Each rule, the reseller, we fall under the exempt category, and the liability sticks with us. Now, I will say that the fees what I may see, what we may see in the future is that the fees that we’re earning right on the sale between us and our sellers, basically just the fees on like, our seller, the Commission’s we earn, that may become subject to sales tax, but it’s only like, you know, three to 5% of the transaction. So it’s a very minor. I think that’s what will we will start to see they’re starting to actually go after marketplaces like that. But the product No, like it’s it’s fully investing liability.

Matt Marcum

And I want to circle back to the first question we actually had from Danielle, because he had a clarification on that one, too. So Rachel, if you recall, he was asking about cases where a buyer usually a large company chooses to buy through a software reseller. And that software resellers location is different from the buyers location, he clarified that the business is the buyer and the end user. They’re not reselling at that point. So the question goes back to which location matters at that point, is it and who’s responsible for collecting sales tax slash VAT in those cases?

Rachel Harding

Yeah, so the it would be the big business that would that transaction, you would look to the big businesses location, on where to establish tax, and it would actually be the resellers? Liability, because they’re selling to the end user. So when you it’s sometimes it’s confusing when you’re a reseller, because there’s two different transactions, right? You’re buying and then you’re purchasing as a reseller, only the buy is excluded from tax, the purchase, has to follow normal tax rules in the US, right? That business, it’s going to be taxable. In international jurisdictions, you may be able to leverage the b2b 0% reverse charge. But not all countries allow that. Hopefully that makes sense. So it wouldn’t be the resellers obligation on the transact on the sale to the big business and you look to the big businesses jurist tax jurisdiction to establish the rate.

Matt Marcum

Great. And then another question coming in from from Christian Wolf. Let’s see here. As the founder of a SaaS startup that has international customers from multiple countries. Why should I use FastSpring instead of Paddle? What makes the FastSpring service more valuable than Paddle’s?

Nathan Collier

I’ll take this one. Is Paddle is also a merchant of record. And we will gladly speak to you about how how we’re different than Paddle we we need to take a good look at what you’re doing and what your services are and what your business operations are to give a much better answer to that. So just anywhere on FastSpring.com If you click the button in the top, be happy to chat with you about that more to see if if we’re a good fit for your specific situation.

Rachel Harding

Yeah, I can’t say just high level we offer about five times the amount of currencies when you’re looking to purchase panels. I think it’s very limited to like three or five but we offer Almost 20, I want to say so allows purchasers to buy in different currencies and we our global footprint is bigger Plus, you get me on the back end as your your tax resource, which is part of the value add.

Nathan Collier

That’s a good one. Thanks for the question, by the way.

Matt Marcum

And that looks about like it unless I’ve skipped over from the chat. But I’ve been trying to stay on top of these at this point. So I don’t see anything else coming in.

Rachel Harding

I do see the follow up to Daniel, talking about the FastSpring permissions. So in California, no, it would be subject as if it would be yes, to answer your question. Yes, the sale it would be sales tax would have to be charged because we’re based in California. However, it depends on what California would classify it. And right now, payment processing is usually exempt. So if we qualify for payment processing, there would be no issue. If, as the rules start to change, we’re qualified as like, you know, a data processor, something more than just like a payment processor, subject sales tax could be subject assessed. But if that was the case, right, we wouldn’t be able to facilitate it, you know, we would fully help you on that.

Nathan Collier

Again, that’s a transaction, that’s a purchase a tax on the consumption and the purchase. So ….

Rachel Harding

And this to be clear, this is not happening right now, this is what I foresee in the landscape. This along with E-Invoicing is coming

Nathan Collier

And to go back to what we would say sort of from the beginning, which is like this is exactly the kind of stuff that a merchant of record does, right, as we keep on top of this kind of stuff. So that so that the liability of that kind of stuff stays on the merchant record. All right. We will be active in the Slack community if you’re watching the recording of this. So inside of global slash leaders, Rachel is in there. And we are all in there. And we invite you to, to join go and join the community if you’re not if you’re watching this and if you’re not in there yet. We’ll see you over in Slack community other than that, thanks, everyone for coming today. Thanks, everybody.

Matt Marcum

Thanks, everyone.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)