Get the latest from FastSpring’s Support leaders about important tax updates, fraud and chargeback strategies, our new Changelog, and more.

- Explore the Power of Changelog Integration in Our Documentation

- Navigating the Tax Landscape: Key Changes That Demand Your Attention in 2024

- Quarterly B2B Onboarding Update: Your Complete Guide to Seamless Transactions!

- Fraud, Chargebacks, and Mitigation Strategies

Need FastSpring support? Visit our Support page.

FastSpring provides an all-in-one payment platform for SaaS, software, and digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Set up a demo or try it out for yourself.

Explore the Power of Changelog Integration in Our Documentation

In our continuous efforts to enhance user experience and keep you informed about the latest updates to our platform, we are excited to announce a significant change to changelog accessibility. We are now integrating our Changelog directly into our Documentation Site, providing you with a seamless experience to stay up to date with all the latest releases and improvements.

Staying informed about the changes to our platform is crucial for several reasons:

- Improved Performance: Stay ahead of the curve by leveraging the latest features and optimizations for a smoother and more efficient user experience.

- Bug Fixes and Enhancements: Our commitment to providing a seamless experience means regular bug fixes and enhancements. Keeping up with updates ensures you benefit from these improvements.

How to Access the Changelog

To access the Changelog, you have two options:

- Direct Access: Visit https://developer.fastspring.com/changelog to reach the Changelog directly.

Please be aware that we are transitioning away from the current Changelog site at changelog.fastspring.com. While this site will still be accessible alongside the new Changelog for a limited time, we encourage you to start using the updated links provided above. - FastSpring Docs: Click on the “Changelog” link located at the top of the landing page within FastSpring Docs.

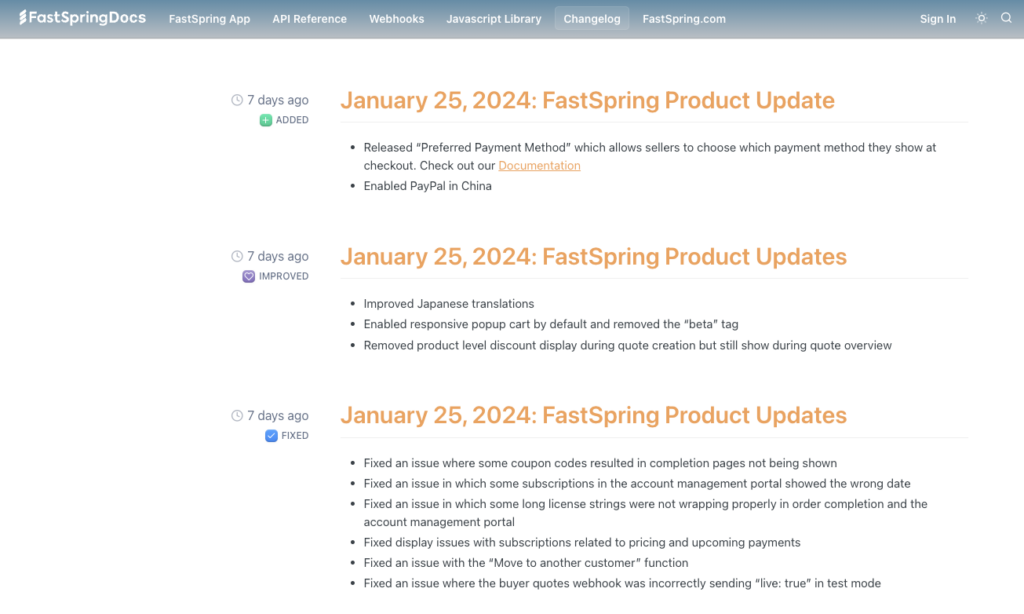

Changelog updates will display with the most recent updates at the top.

Changelog posts from 2015-2020 are available on the archived post located at the bottom of the changelog posts displayed.

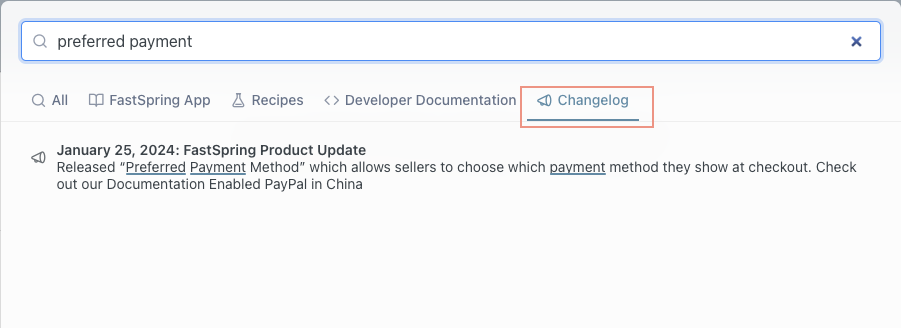

How to Search for Changelog Items

- Click on the Search icon in FastSpring Docs.

- Click on the Changelog filter.

- Enter your search text, and search results for Changelog will be displayed.

You can now easily search for specific release items or browse through the entire changelog to explore recent updates.

Subscribing to Changelog Updates via RSS Feed

Never miss a beat with our platform updates by using the RSS feed for our Changelog. Here’s how you can set it up:

- Follow FastSpring’s changelog RSS feed by just adding .rss to the end of the changelog URL: https://developer.fastspring.com/changelog.rss

- Once you have your URL, you can use any RSS feed widget/tool to input the URL and generate HTML to embed it.

With these changes, we aim to make it easier for you to stay informed, engaged, and empowered with the latest updates to our platform. Explore the Changelog on FastSpring Docs and subscribe to the RSS feed for a seamless and proactive update experience!

Navigating the Tax Landscape: Key Changes That Demand Your Attention in 2024

As we embark on a new year, it’s crucial to stay informed about the latest updates regarding taxation and global VAT rates. Here are some important highlights for the quarter:

Year-End Tax Forms for 2023 Activity

We have been busy preparing and mailing all required tax documents prior to the January 31, 2024 deadline for all sellers meeting the required criteria.

If you are a US seller with proceeds exceeding $20,000 and engaging in 200 or more transactions during the year, you should have received IRS Form 1099-K, Payment Card and Third Party Network Transactions.

Foreign sellers earning US source income subject to withholding will receive IRS form 1042-S, Foreign Person’s US Source Income Subject to Withholding. However, it’s worth noting that this is a rare occurrence.

Please keep an eye on your mailbox for these important documents if applicable to you.

Delayed Implementation of the $600 Threshold

The IRS has postponed the implementation of the reduced $600 threshold until 2024. If your 2023 activity did not surpass $20,000 and 200+ transactions, you will not receive Form 1099-K.

To ensure accurate year-end reporting, please confirm your tax status or update your mailing address information by completing the W8/W9 electronic questionnaire here.

Understanding Gross Proceeds

It’s essential to distinguish between gross proceeds and profits. Remember, you pay taxes on your profits, not your gross proceeds. Gross proceeds are used to compute your profit, factoring in returns, allowances, operating expenses, and more. For additional guidance, refer to our FastSpring help documents on information reporting.

Global VAT Rate Changes — Effective January 1, 2024

Stay informed about recent changes in global VAT rates:

- Singapore GST rate increased to 9%.

- Switzerland VAT rate increased to 8.1%.

- Estonia VAT rate increased to 22%.

- Luxembourg’s temporary 1% VAT rate reduction, which expired at the end of last year, is back up to 17%.

We understand that these changes may impact your business, and staying informed is crucial for smooth operations. If you have any questions or need assistance, our support team is here to help.

Wishing you a prosperous year ahead!

Beth Thorpe

Senior Platform Support Specialist

Quarterly B2B Onboarding Update: Your Complete Guide to Seamless Transactions!

As we kick off the new quarter, we are thrilled to present our updated B2B Onboarding Fact Sheet — a comprehensive guide crafted to streamline ecommerce transactions for your B2B buyers.

Whether you’re a seasoned seller or new to our platform, our updated B2B Onboarding Fact Sheet is the go-to resource to help your buyer through the vendor setup and ecommerce transaction process. The included information can be imported into buyer-specific document formats or to customer onboarding portals as you help them complete any unique purchasing requirements to ensure a smooth and efficient vendor setup process.

Download the fact sheet here or point your buyers to our Customer Support Portal to the Checkout and Purchasing > Set up FastSpring as a Supplier menu, where they can access it directly.

Thank you for choosing FastSpring as your trusted business partner. We look forward to continuing to serve you and your buyers with excellence.

Beth Thorpe

Senior Platform Support Specialist

Fraud, Chargebacks, and Mitigation Strategies

As Benjamin Franklin wisely noted, “In life, there are two constants – death and taxes.”

In the realm of e-commerce, a third constant arises: fraud.

Fraud encompasses deceitful actions to illicitly acquire goods, services, or financial advantages.

As a merchant of record (MoR), FastSpring handles payment processing while carrying the responsibility of ensuring legitimate transactions. FastSpring has implemented the following efforts to effectively detect and mitigate fraudulent activities:

- Rigorous fraud prevention measures, including collaboration with advanced third-party systems.

- Continual monitoring.

- Regular updates and verification of buyer identities.

- Maintenance of secure payment processing systems.

Chargebacks

In the world of online transactions, a chargeback refers to the reversal of a credit or debit card charge initiated by the cardholder’s bank. This reversal is commonly triggered when a cardholder alleges that a transaction resulted from fraud or abuse. The consequences of chargebacks can be detrimental both in the short and long term.

FastSpring’s dedicated Risk team diligently monitors chargebacks and takes a proactive approach by conducting thorough assessments before deciding to fight the chargeback. This careful consideration is part of our commitment to supporting our customers in managing and mitigating the impact of chargebacks effectively.

FastSpring Tools

The Chargeback Overview Dashboard is available on FastSpring’s Contextual platform for a quick snapshot of your chargeback metrics, including current chargeback rate, chargebacks by payment method, and much more!

Chargeback Mitigation Strategies

Outlined below are eight steps that we suggest implementing to assist you in minimizing potential chargebacks and establishing lasting customer security.

1. Implement Clear Policies and Communication Channels

To reduce chargebacks, you must establish clear refund policies, prominently featured on your websites and in customer communications. Providing end users with a refund option mitigates chargeback likelihood. Additionally, ensure accessibility to your Customer Support by clearly displaying contact details, offering multiple communication channels (email, phone, live chat), and promptly responding to inquiries.

2. Proactive Customer Communication

Regular communication with customers, including order updates and automated notifications at various purchase stages, minimizes misunderstandings. If possible, look into utilizing email or SMS alerts for order and delivery confirmations, fostering transparency and excellent customer satisfaction.

3. Provide Excellent Customer Support

Equip your Customer Support team with the knowledge and tools necessary to address customer concerns promptly and professionally. Training is key to resolving issues efficiently and maintaining a positive customer experience.

4. Document and Track Customer Interactions

Maintain a detailed record of customer interactions through a CRM system (or similar tool). This will help track communications and provide valuable insights into recurring issues.

5. Investigate and Respond to Chargebacks

Upon receiving a chargeback notification, you should promptly investigate the case, collecting relevant evidence such as order details, communication history, and proof of delivery. Should this happen to you, please reach out to risk[at]fastspring.com.

6. Collaboration is Key

Establish a relationship with the FastSpring Customer Support team, making sure you stay informed by utilizing our documentation and subscribing to our changelog. Seek guidance on effective chargeback navigation, and stay informed about any updates that may impact your chargeback management strategy.

7. Analyze Chargeback Trends

Regularly review your Chargeback Overview Dashboard in the FastSpring platform to identify trends. Share insights with relevant stakeholders, and collaborate with the FastSpring Support team to set up webhooks for timely alerts.

8. Continuously Improve

Conduct periodic assessments of your chargeback management process, seeking feedback from your customer team and from customers themselves. Identify areas for improvement and implement strategies to enhance the overall customer journey, ultimately reducing chargebacks and fostering a positive relationship with your customers. For subscription management, you can find out more information from Visa and Mastercard on payment reminders.

Follow the above eight steps to protect your business from fraud and chargebacks while building strong customer relationships. Implement clear policies, communicate proactively, offer excellent customer support, and continuously assess and improve. FastSpring is committed to supporting your journey for sustainable growth and top-notch customer satisfaction in the ever-evolving ecommerce landscape.

Fraud, Chargebacks, and Mitigation FAQ

Q: How is my chargeback rate calculated?

A: Your chargeback rate is the number of chargeback transactions during the given period divided by the total number of transactions during the same period.

Mastercard calculates their chargebacks slightly differently — total number of first chargebacks this month / previous month’s total number of sales transactions.

Q: How many chargebacks are considered too many?

A: Your chargeback rate should not exceed 0.90%, which you can see on your Chargeback Overview Dashboard in the FastSpring platform. FastSpring has an early warning threshold of 0.65% to ensure your chargeback rate is under control as soon as possible if it does begin to rise.

Q: Can my end users get banned for submitting too many chargebacks?

A: Simple answer: Yes, they can. Chargeback data is automatically fed into the FastSpring fraud engine, and this serves as a key signal for all sellers across the FastSpring platform.

Gareth Earney

Customer Success Manager

FastSpring provides an all-in-one payment platform for SaaS, software, and digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Set up a demo or try it out for yourself.