According to an OpenView survey, by 2023, 56% of SaaS companies will be using or expecting to test usage-based pricing, which they define as “a pricing model that enables customers to pay for a product according to how much they use it.”

Usage-based pricing (UBP) — or consumption pricing — is based on the amount of usage of a specific metric, such as gigabytes of storage used or the number of API calls made — over a period of time.

This way of pricing SaaS products is super popular right now, but that doesn’t mean it’s the best fit for most companies.

Here’s my take on it in a nutshell:

→ UBP is trending as a solution to an old problem: pricing needs to accurately reflect value — for both sides. UBP can better align value so buyers and sellers perceive the deal to be fair.

→ BUT that doesn’t mean it’s right for everyone — and in fact you might already be deploying a version of UBP.

→ Seat-based pricing (SBP) is a usage-based metric. The question for you to consider is: is the number of users (or seats) the most highly correlated metric with value?

→ Don’t get sucked into using UBP as a solution looking for a problem. As you think about pricing, focus on one thing: is pricing perceived to be fair.

In this piece, I’ll break down my thoughts on usage-based pricing and how to decide if it’s worth investigating for your company.

Why Is UBP Trending?

SaaS pricing is tough to optimize. One primary reason is there are very few limitations. With high gross margins and few technical constraints, products can really go wild with their pricing and packaging in ways that we don’t see in other industries.

SaaS is also a very young industry, and we’re still in the early stages of ideation around pricing, packaging, and even sales models. The best companies are innovating rapidly, not just on their product but in the ways they monetize. In many ways, we are at the beginning of the beginning, and usage-based pricing gives people a more accessible way of approaching pricing.

This is all very exciting, but it also means that, with fewer limitations and well-tested best practices, we can easily get caught up in the “next big thing.”

So why is UBP “the next big thing”?

Like many trends, usage-based pricing is a catchy name with recent success stories that play on an existing concept — pricing fairly. Consumers, whether they are businesses or individuals, want to feel like they are paying a fair price. In the world of SaaS, customers are making that decision every time they renew or when they allow another monthly charge. But fairness cuts both ways. SaaS providers should also be compensated fairly for the value they deliver, and in most cases that value increases as the product continually improves and the customers’ usage increases. Designing a pricing model that optimizes for fairness — in both directions — is a fundamental tenant of SaaS pricing. To do that effectively, the metric upon which your pricing is based needs to be as close to the customers’ perceived value as possible.

When done right, UBP accelerates you toward this answer. It’s important to recognize, however, that alignment with value is not the only consideration when coming up with an ideal pricing metric that is linked to value. There are two considerations that you have to optimize:

- Linked pricing metric as closely to value as possible (the fairness principle)

- Make your pricing as simple and easy to forecast as possible

The degree to which you weigh one versus the other depends on a variety of factors including your market, what your competitors are doing, average price point, product type, and the preference of your buyers. It typically takes time to find the right balance for your product and your market, and there are no shortcuts. Continuous testing is the only proven path to success.

Most of the time, when you read or hear something about UBP, it’s positioned as an alternative to seat-based pricing, which has been the dominant sales model for B2B SaaS companies.

(But even with more companies trying out other metrics and pricing models, seat-based pricing is still the most common B2B model.)

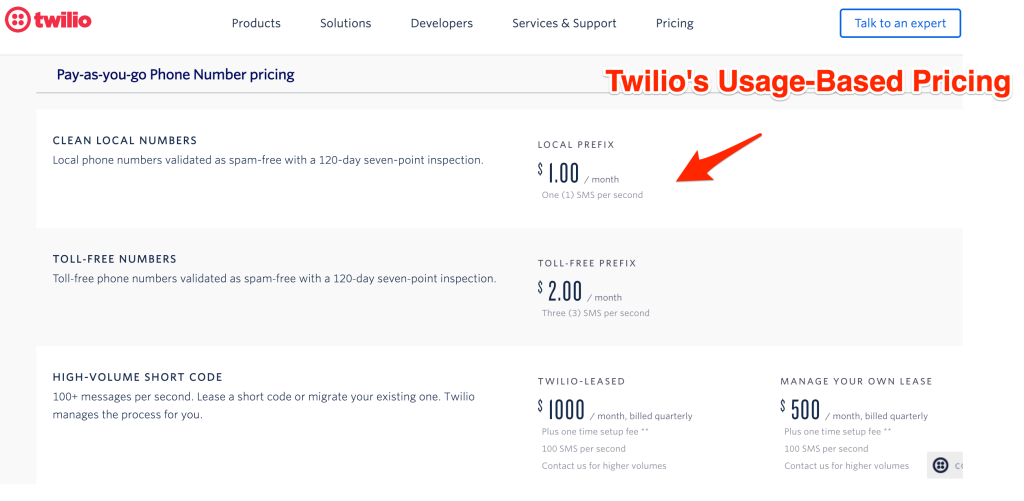

But one of the biggest reasons that UBP is trending is because there have been some major success stories around recent IPOs of companies using this model, such as Snowflake, Twilio, and Agora.

These success stories are intriguing but shouldn’t be blindly copied. Instead, think about the underlying factors making UBP work for certain businesses by asking three questions to abstract the learnings away so you can best apply them to your own situation:

- How is their pricing metric correlated with customers’ perception of value?

- How is the complexity (or simplicity) of their model impacting their sales and renewal process? Does it slow it down or speed it up? Does it make it easier or harder?

- How is their pricing model positioned relative to their competitors? Is it unique or similar? What are the pros and cons?

What Do Many UBP Success Stories Have In Common?

It’s easy to look at companies that have successfully gone public with huge valuations and want to pattern match to find things you can apply to your own business.

But there are a couple of things that most of these companies have in common that make usage-based pricing particularly effective for them. And before assuming that UBP will be right for your business, you’ll want to see if your company also has these traits.

1. The Model Lends Itself To A Measurable Usage Metric

Successful UBP companies all have a primary pricing metric, for example:

- Snowflake: Compute and storage usage

- Twilio: Amount of phone numbers used, call lengths or messages sent

- Agora: Call or live stream lengths or messages sent

These metrics can be easily tracked and estimated by their customers. This is an often overlooked reality – if your prospect can’t easily forecast how much they will pay, you are making their ability to buy from you much more difficult. This is particularly true for enterprise software where spend needs to be budgeted.

2. The Success Stories Tend To Have Long-Term Time Horizons

Another important commonality of successful UBP models: the goals are far-sighted. Choosing this track allows companies to do things in the early or even growth stages of the company that were oriented around long-term value maximization.

For example, more novel B2B products often use UBP to price very low in the first year or two with a customer, so they can prove the value and gain buy-in. Then over time, as that company grows, so does the average revenue per user (ARPU) and profit margin.

While usage-based pricing IPO success stories are very compelling, they undersell the initial deal years when they probably left money on the table due to a more traditional pricing model. Ultimately, that value is catching up in recent years, and that’s why we see just astronomical net dollar retention numbers.

But businesses have very different time horizons that they operate under. Make sure you know what’s right for you and your business first. If you’re funding other projects with cash flow, then you may not have the opportunity to shift to a longer term time horizon.

Is UBP Worth Investigating For Your Company?

If you’re considering UBP, it means that you’re re-evaluating the value metrics that you’re using to price your products.

And instead of limiting yourself to metrics that normally fall into the UBP camp, I’d urge you to simply consider what your ideal value metric or metrics might be – start there.

It might be seats, it might be gigabytes, or minutes. Or it might be that a more tiered approach with bundled features would work best.

Assessing the primary and subsidiary value metrics you use for pricing and packaging is one of the most important growth levers you can pull — so if you’re questioning your pricing model, you’re on the right track. But pause if you find yourself considering UBP just because of the success or hype in the market.

Live Interview With Kurt Smith on Pricing Strategies to Combat Stagflation

Join us for a live interview with FastSpring’s Chief Product Officer Kurt Smith about pricing strategies to consider in volatile markets. RSVP and learn more.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)