Our platform intelligently routes payments to an acquiring bank in the same location as the issuing bank for transactions, which maintains continuity between currencies and languages, resulting in increased approval rates.

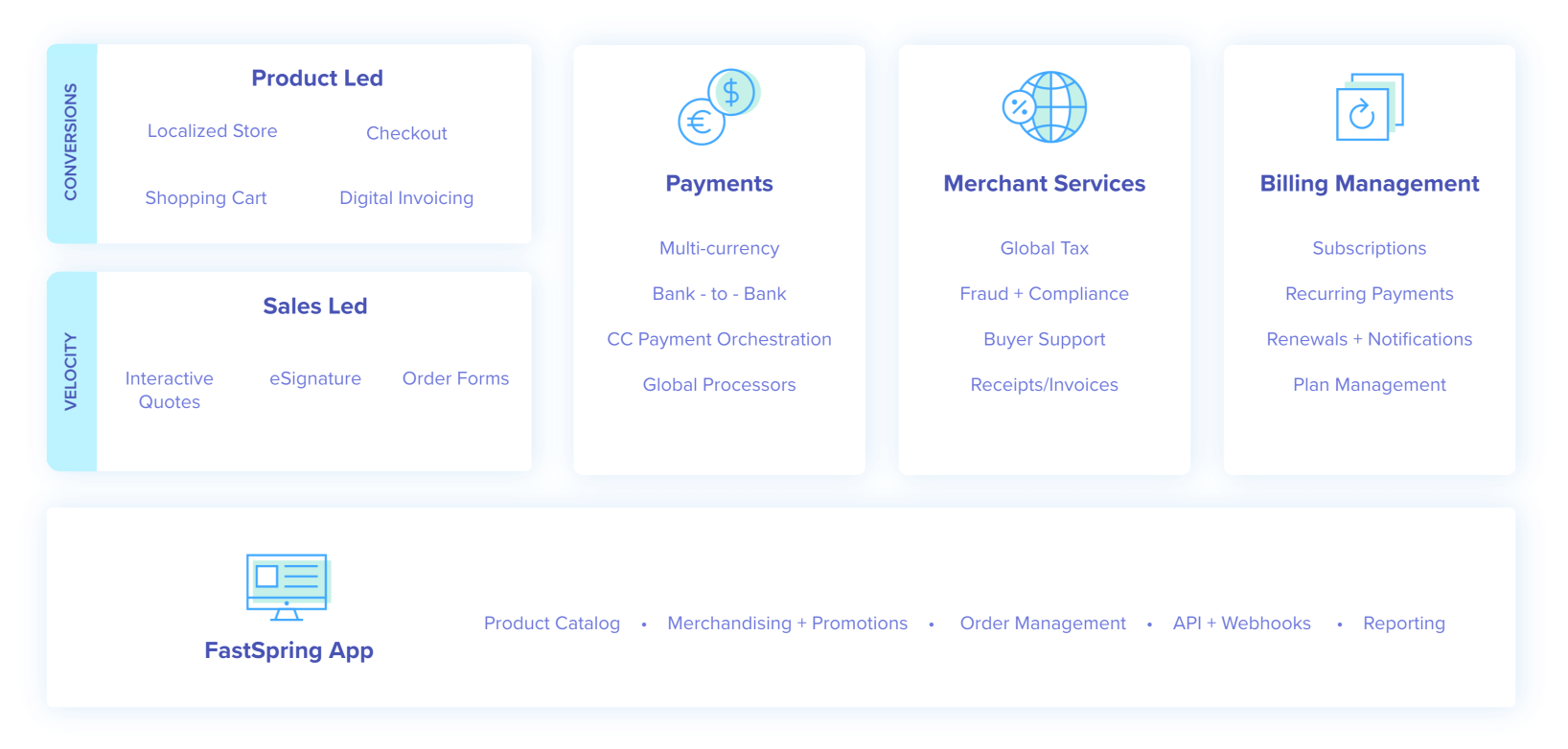

More Than Just a Payment Gateway. We’re Full-Stack.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)