Thinking about transitioning to a subscription-based business model?

You’re not alone. In fact, according to a recent report from Gartner, more than 90 percent of software providers are expected to migrate to a subscription-based business model by 2022.

We know this is a big decision for businesses. That’s why our Director of Pre-Sales and Implementation, Adam Cohen, is here to answer all of your burning questions about subscription management and recurring billing.

Q. Why should I care about subscriptions?

A. There are several reasons why you should consider transitioning your company from one-time purchases to a subscription-based business model. Subscription-based business models make it easy to support innovation and enhancements of your software products. The consistent recurring revenue funds your business while your customers experience a long-term relationship with your product or service that is always up-to-date. The predictable revenue from a loyal customer base is ideal when your business is looking to scale.

Q. What are some things to consider when building a subscription-based business model?

A. Subscription-based revenue models are only as good as the strategy and planning you put into it. One of the most important aspects you have to consider is fulfillment—how will your subscribers access your digital product? Will they get a software key sent to their email? Will they get a direct download link after they complete their purchase? It’s important to make sure your customers get access to your digital product quickly and easily.

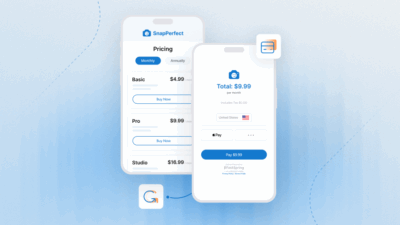

Another thing to consider is how you set up recurring billing for your product. Are you going to charge monthly, quarterly, or yearly? How much are you going to charge on a recurring basis? Will you have tiered pricing to accommodate a variety of users’ needs? You have to find a balance between the pricing of your product and the value your users get from it.

Q. How do I reduce churn?

A. One of the most important indicators of success for subscription-based business models is churn rate. The churn rate is determined by evaluating the number—often calculated as a percentage, of subscribers who have left during a set period of time. Some of the things you can do to help reduce the number of lost customers include:

- Incentivize prepayment

- Automate recurring billing

- Automate subscriber communication

- Send a survey to churners

- Celebrate loyalty

Q. How do I keep track of my subscribers and their payments?

A. Maintaining a regular line of communication with your subscribers and staying on top of their billing and payment methods is critical to ensuring a consistent revenue stream. These important communications are managed by processes known as dunning management. With the right ecommerce solution, you will have all the dunning management features you need to:

Automatically retry payments when the payment method fails.

Send an alert to subscribers when a payment has failed.

Send a proactive notice to subscribers when their payment method is expiring soon.

Alert subscribers when their subscription is up for renewal.

All of these processes can be automated so you save time and resources checking on delinquent accounts in your system. This helps reduce churn and increase the lifetime value of your customers while minimizing disruption to the customer experience.

With FastSpring, you have the ability to customize the frequency and messaging for dunning notifications. FastSpring has a secure, web-based portal through which companies can configure a set of emails that are sent to buyers at specific cycles in the subscription process.

Q. How does FastSpring help software companies sell subscriptions worldwide?

A. FastSpring’s full-service ecommerce platform includes all of the features and solutions software companies need to manage subscriptions and recurring billing throughout the entire life cycle of a subscription, from trials, through renewals, upgrades, prorations, and cancellations.

As a Merchant of Record, FastSpring handles the complete subscription management process, download and license fulfillment needs, global sales taxes, returns, chargebacks, international data privacy issues, PCI compliance, and more. In addition, we have built in the currencies, payment methods and languages that work on a global basis. Our model is a partnership model—our success is based on the success of our customers.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)