It’s almost time again for Cyber Weekend, and November sales spikes aren’t just for holiday gifts and physical goods — SaaS and software companies also benefit from this annual increase in sales.

Once a single Black Friday shopping day, deals expanded to encompass the following Cyber Monday, with the entire weekend now referred to as Cyber Weekend. And between the Cyber Weekend halo effect, major global holidays, and end-of-year budget spends, sales in November and Q4 are stronger than other times of the year.

That creates a lot of opportunity for your SaaS or software business to optimize sales opportunities during this profitable weekend, month, and quarter.

Because FastSpring is a merchant of record for over 3500 companies that use our platform daily, we can analyze aggregate sales data for benchmarking insights into Q4 for your SaaS or software business.

We’ve updated this annual report with:

- Up-to-date U.S. trends in year-end SaaS and software sales data.

- Up-to-date global trends in year-end SaaS and software sales data.

- How FastSpring can help you take advantage of those Q4 sales lifts.

FastSpring is a merchant of record that can help you easily grow your business internationally. We provide an all-in-one payment platform for SaaS, software, video game, and other digital product businesses, including VAT and sales tax management, payment localization, and award-winning consumer support. Set up a demo or try it out for yourself.

Our Data Sources and Analysis Methodology

Where: Like last year’s Cyber Weekend data report, even though we help over 3500 companies to sell digital goods in over 200 countries and territories, we’ve pulled sales data from eight countries around the world to help us narrow it down a little. Those countries are the U.S., Canada, Germany, Great Britain, India, Brazil, Australia, and China.

Note that the data below are specific to where the sales took place, not where the companies are located.

Besides the global data, we also highlight the trends just for the U.S., since it is a large, single market that SaaS and software companies often target.

When: Using aggregated data from the most current five calendar years helps us show insightful trends while avoiding any major outliers skewing the data unnecessarily. The data below come from 2019-2023, and we use a seasonal index to highlight each month’s or quarter’s sales against the year’s monthly or quarterly average (more on that below).

What: While FastSpring supports the sales of many different digital products including SaaS, software, digital downloads, video games, and mobile games, we’ve limited this data only to SaaS and software sales to keep it applicable to a specific industry and avoid being so broad that it isn’t helpful.

The figures shown were also all calculated in U.S. dollars for simplicity’s sake.

How: First, we calculated a monthly or quarterly average for each year. For example, four quarterly totals of $100, $200, $300, and $200 would average to a quarterly average for that year of $200. So $200 would be our baseline of 100%

Then we compared each month or quarter’s actuals to that year’s average to get a percentage. For example, if Q1 shows a percentage of 90%, that means it is 10% lower in sales compared to the quarterly average. If Q2 shows a percentage of 111%, that means its sales are 11% higher than the quarterly average.

That data was then combined to get the five-year averages and help smooth out any stark outliers.

US Year-End Trends for SaaS and Software Purchases

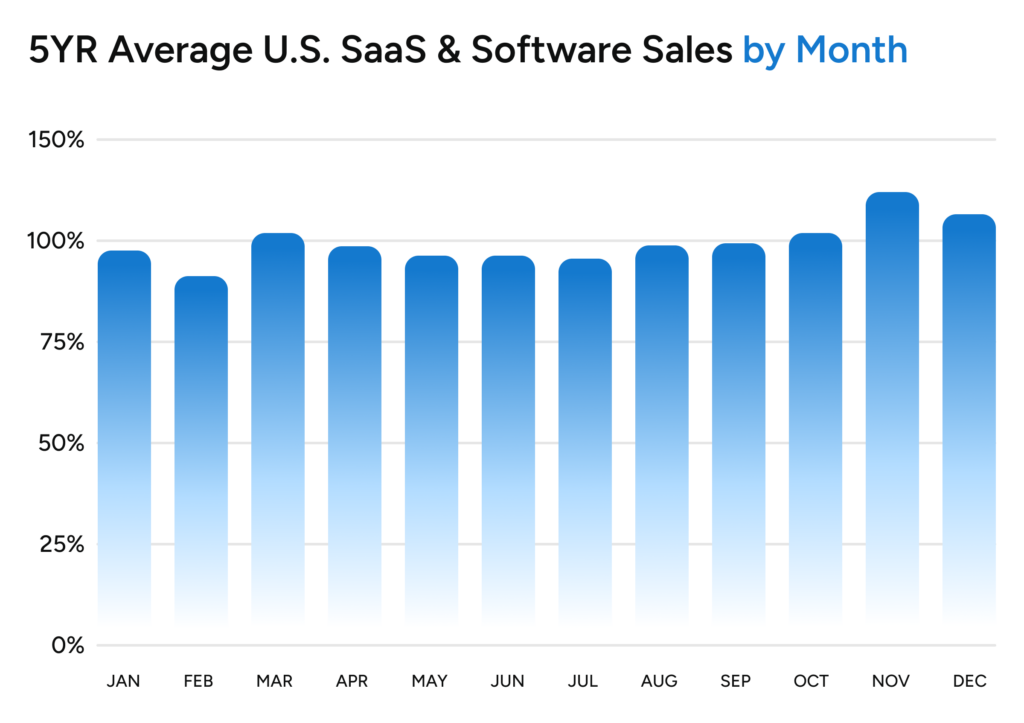

Here are the monthly and quarterly averages for U.S. software and SaaS by month and quarter.

5YR Average US SaaS and Software Sales by Month

Months that stand out as particularly higher than the monthly average include March and October (tied for third place) at 2% higher, December at 7% higher, and November highest at 12% over the monthly average.

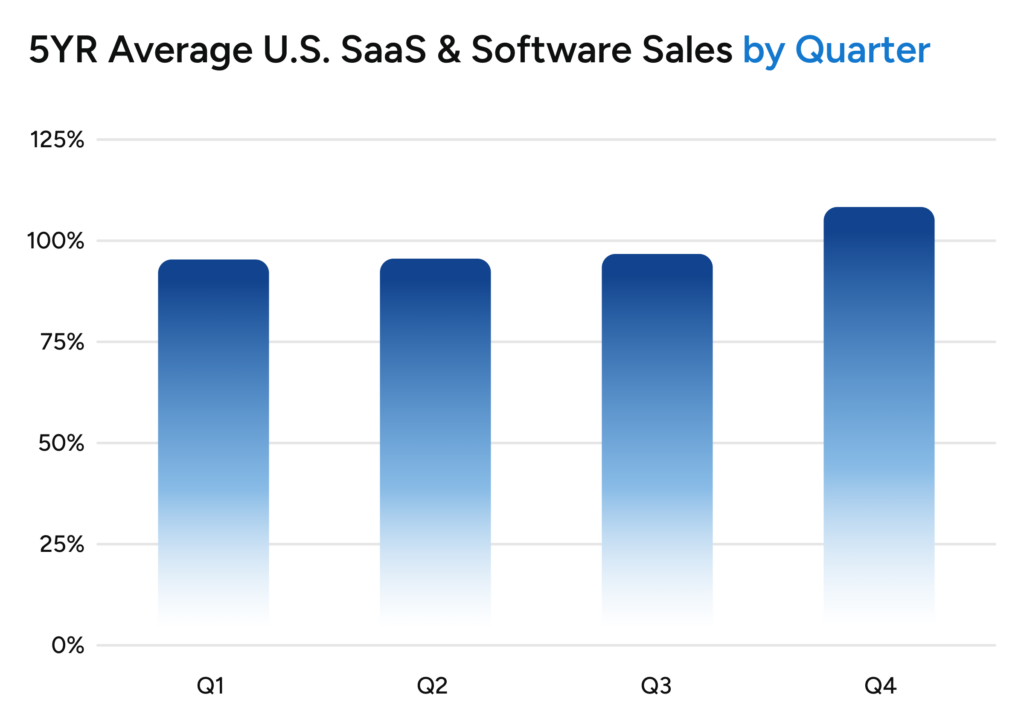

5YR Average US SaaS and Software Sales by Quarter

After seeing the monthly averages above, the quarterly averages offer no big surprises — Q4 comes in at 7% higher than the quarterly average.

Global Year-End Trends for SaaS and Software Purchases

Global trends see even stronger rises in seasonal sales of SaaS and software.

Here’s how late-year numbers fluctuated across the globe when including data from the U.S., Canada, Germany, Great Britain, India, Brazil, Australia, and China.

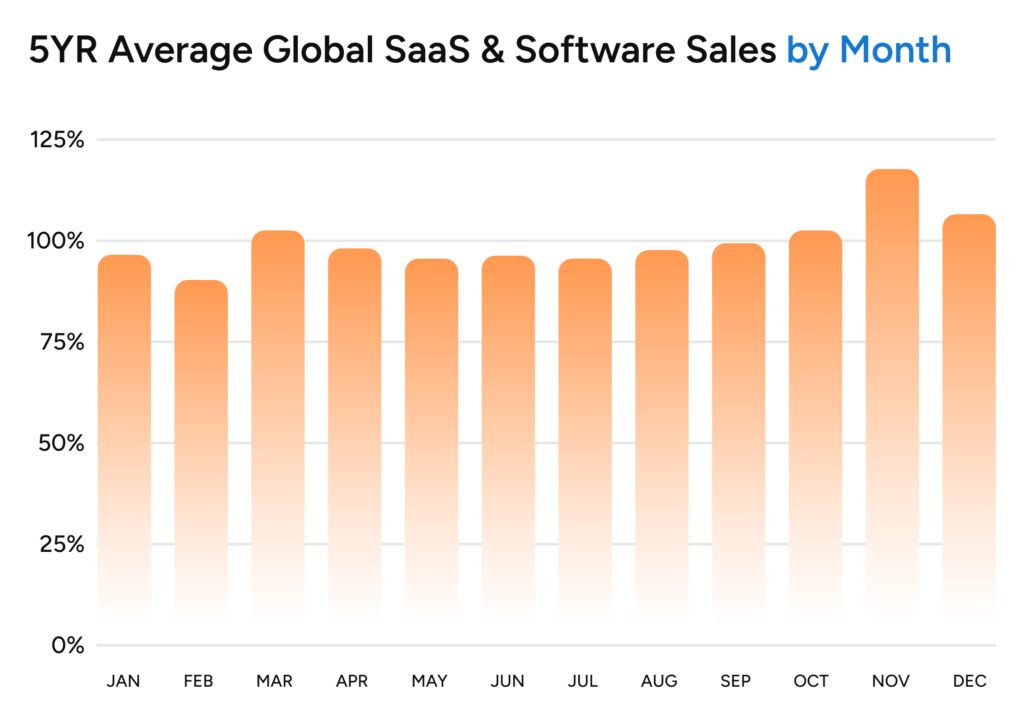

5YR Average Global SaaS and Software Sales by Month

Compared to U.S. numbers, global October sales at 3% above the monthly average and December sales at 6% above the monthly average are fairly expected.

However, November saw a much larger bump in global SaaS and software sales against the monthly average, coming in 18% higher.

Black Friday (and subsequently, Cyber Week) was originally anchored to the U.S. Thanksgiving holiday and may still seem very U.S.-focused. The SaaS and software sales data, however, show that the November sales surge is even stronger outside the U.S. for the other seven countries included in this study, with that 18% rise over the monthly average growing to 29% when the U.S. is removed. (More on individual countries below.)

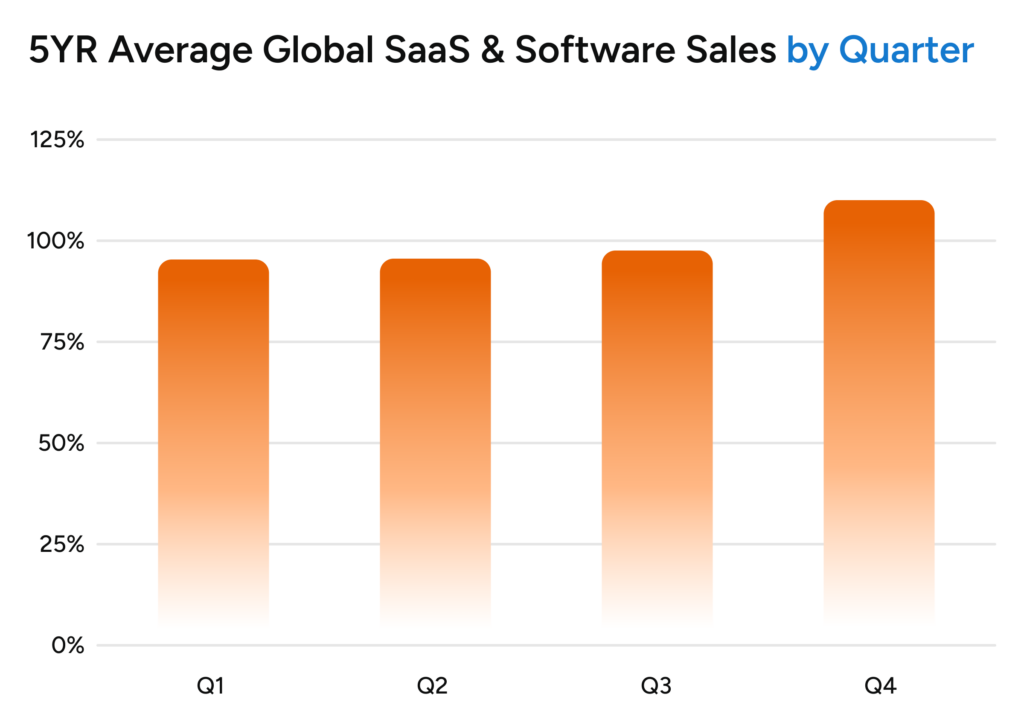

5YR Average Global SaaS and Software Sales by Quarter

Global SaaS and software sales in Q4 were 9% higher than the quarterly average.

So while November global sales were particularly high for that month, the Q4 average doesn’t show as high of a peak, indicating that November is a particularly key month for SaaS and software companies to capitalize on.

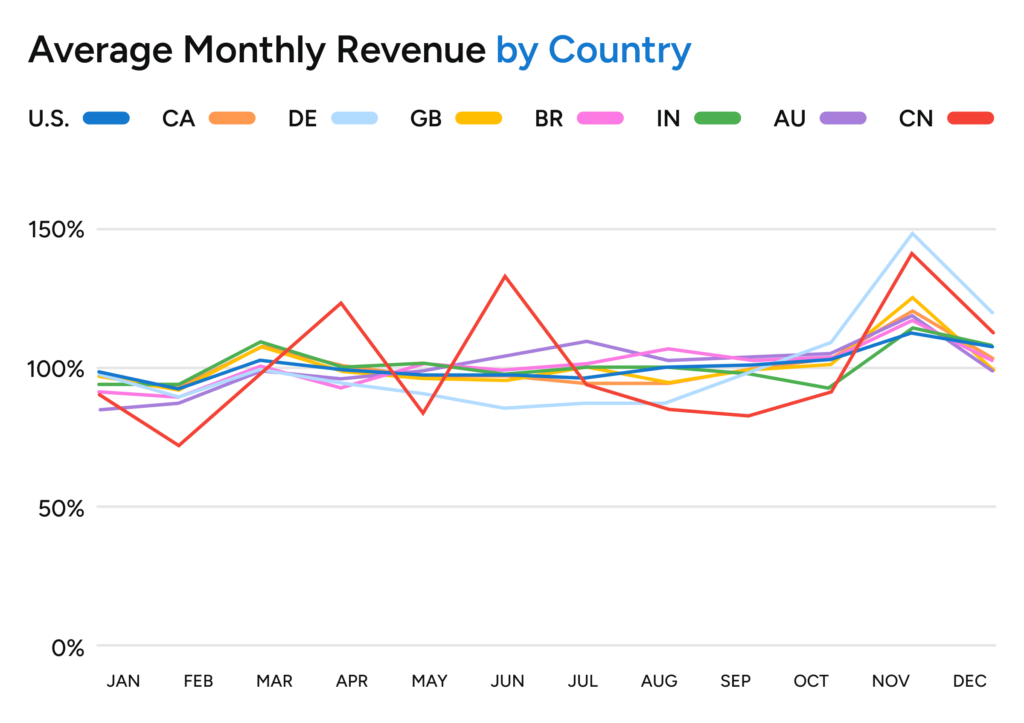

5YR Average SaaS and Software Sales by Month per Country

To further show why sales show a much higher peak in November globally than just in the U.S., we’ve broken out the monthly averages across the eight countries we included for our global tallies.

Here’s what monthly software sales fluctuations look like with five years of data for the United States (US), Canada (CA), Germany (DE), Great Britain (GB), India (IN), Brazil (BR), Australia (AU), and China (CN).

Spikes in China in April and June are likely due to the 418 (April 18) and 618 (June 18) shopping holidays, but as you can see, all countries in our list see a large spike in November — the highest month for all eight countries measured.

Germany and China especially see high spikes in November, indicating that they may be particularly good geos to target for promotions that month as China observes Singles Day on November 11 and Germany observes Black Friday and Cyber Week.

This reinforces that November and Q4 are SaaS and software sales opportunity windows you can’t afford to miss out on. Take advantage of the selling season with:

- Custom coupon codes for partners to promote.

- Email promotions.

- Upsell or bundle offers.

- Social media campaigns.

- Localized promotions for targeted regions.

- Any other offers that might appeal to your target customers in your target regions.

How FastSpring Can Help

Companies already using FastSpring (such as Stardock and TestDome) recognize FastSpring as a true partner to their SaaS and software businesses.

Here are just a few of the reasons FastSpring makes it easy to sell globally in the right places, in the right ways, and at the right times — such as over Black Friday, Cyber Monday, and beyond.

FastSpring Makes Global Payments for You and Your Customers

It isn’t enough to just make your product available for sale in more countries — customers need to be able to purchase with a localized checkout experience that makes them feel comfortable buying. That includes automatic conversions to local languages and currencies as well as offering dozens of the most popular payment methods, which vary by region.

Learn more about FastSpring’s global payments.

FastSpring Handles Global Taxes, From Calculating to Collecting to Remitting

Because FastSpring is a merchant of record, we don’t just facilitate payments — we actually become the entity selling the product. That means we also become the entity worrying about card brand rules, regulatory rules in many geographies, risk and fraud, and even taxes.

Our team of tax experts stays up to date on global tax regulations so FastSpring can calculate, collect, and remit taxes without you needing to worry about it.

Learn more about FastSpring’s global tax management.

FastSpring Supports You and Your Customers

FastSpring doesn’t just offer award-winning support to companies that use us as their merchant of record — we also handle consumer support for your customers.

Consumers can submit an online request to get personalized assistance, or they can reference our helpful support topics such as Checkout and Purchasing, Licenses and Downloads, and more.

Need assistance with your FastSpring store? You can submit a request from within the FastSpring app, or visit our support page.

Read more about our Stevie® award, our Globee® award, or submit a seller or consumer support request.

Get Started With FastSpring

FastSpring is the leading full-stack merchant of record service for growth-stage SaaS and software businesses. Our platform serves as an all-in-one payment platform that handles everything from payment and checkout localization, to sales and VAT tax management, to customer support for end consumers, and so much more.

Learn more about how FastSpring can help you grow your business globally: Set up a demo or try it out for yourself.