Subscriptions are the lifeblood of any SaaS business model.

On the surface, it’s a perfect model. A customer subscribes to your product, and every month, they pay to keep their access to it. Simple, right?

However, SaaS subscriptions can also cost businesses money if they’re not set up with the customer’s experience in mind. There will come a situation where a customer may put the wrong card information on file, or their card may expire without them realizing, and leave you unable to take their subscription payment.

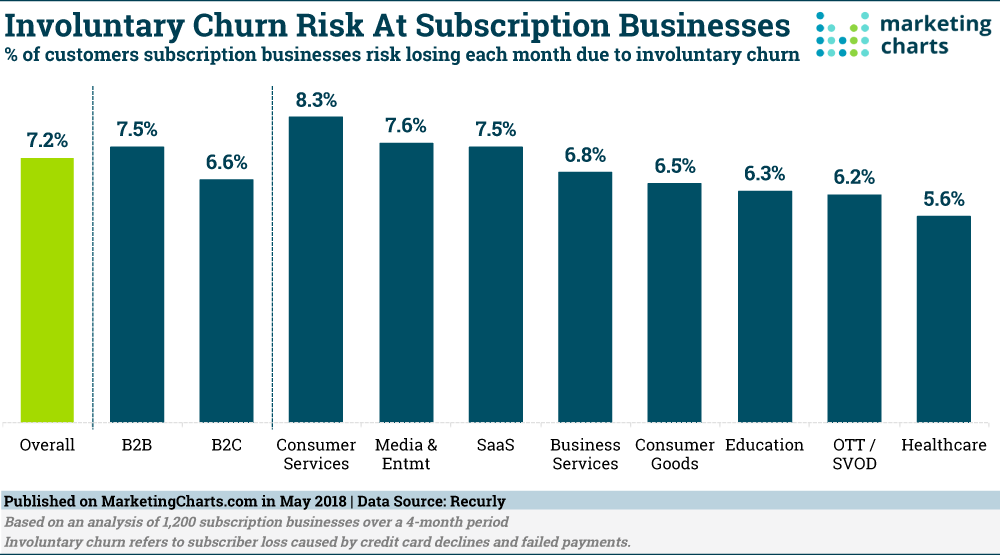

Incorrect payment details can lead to one of the unspoken reasons behind customer losses in the SaaS industry—involuntary churn. This is when a customer churns without them realizing or against their will. Involuntary churn makes up 7.2% of churn in all sectors, and 7.5% of all churn in the SaaS space.

The good news is, there are ways to control this churn and stop it from happening. By putting specific prevention measures in place, you can make it less likely for a customer’s card payment to fail and get recurring subscriptions fulfilled seamlessly.

Let’s take a look at how you can put these processes into play in your own business.

Why failed payments and involuntary customer churn go hand in hand

Maintaining your recovering revenue and cutting involuntary churn go hand in hand.

And one aspect that underpins both of these factors is providing your customers with a stellar user experience. If you have the right processes in place, you can keep your customers happy and keep generating revenue—at the same time.

Before we go too deep into how to keep your revenue flowing, it’s essential to explore what involuntary churn means. Picture a typical payment cycle that you may have set up for your customers:

- They sign up for your product

- Their payment is scheduled for the 28th of that month

- The first charge of their card on file fails

- Your system then sends your customer an email informing them that their charge has failed and that they could lose access to your product if they don’t take action

- The customer doesn’t act, and the next attempt at charging their card for payment also fails

- After the third failed attempt to take payment, your system then deactivates their subscription and either move them back to a freemium version of the product or cancels their account altogether

However, what this cycle doesn’t show are the many reasons that could be causing the failed payment collections.

It’s because of these reasons why planning for involuntary churn is crucial to revenue recovery. Planning can take many forms, such as:

- Setting up a series of “dunning” emails, which create a cycle of payment reminders for your customers to change their card details/payment processing options

- Look at how card details are updated internally. If a customer updates their details, is it carrying across to your payment system correctly?

- Make sure your payment processing is free of gateway issues and stops fraudulent activity.

Here are three steps you can take to recover revenue and limit involuntary churn from your customers.

Three ways you can attempt to recover revenue payments

1. Give your customers a seamless experience for collecting payment

We just entered into 2020 and we are living in an age where customers aren’t hoping you will collect payment automatically; they expect you to.

If you’re still sending out invoices and asking customers to pay for their subscriptions manually, not only does this add a layer of friction to the process, but it can cause payment delays. Invoices get lost, and while not on purpose, some customers might forget to pay them and inadvertently put their subscription at risk.

The easiest way to avoid this is to give your customers a seamless, automatic experience when collecting their subscription payments. Your payment page should not just provide the customer with a seamless experience when they’re signing up for their subscription, but make it easy for them whenever they want to update their payment details.

Here are a few ways you can make your customer’s subscription payments a seamless experience:

- Have a dedicated portal/page where customers can update their details: A customer should be able to update their payment details whenever they need, and not just if a payment fails. Make sure this option is available for your customers at all times.

- Security first: Any time a customer inputs their payment details, it should be done so in an encrypted space. Making sure your customer’s card details secure is a crucial part of keeping them around. Who wants to deal with a company that doesn’t have a secure payment system?

- Make it easy—even if they’re on a mobile: Your customers are busy people. Make sure your payment portal/page is responsive no matter what type of device they’re using. If they’re able to update their payment details, whether they’re in the office or commuting, the more likely they are to do it.

- Check that everything is working as it should be: As great as technology is, we all know that sometimes, it fails. Make sure you check up on your payment cycle and update pages to ensure they’re working as they should be. Otherwise, you might find that customers have been trying to update their payment information—they just haven’t been able to.

Using a full-service payment processing platform can take care of all of this for you. For example, FastSpring helps subscription businesses manage their entire subscription lifecycle, from acquisition to activation. Whether your company uses free trials, monthly, annual paid plans, proration, and discount management, FastSpring takes care of all the behind-the-scenes work that goes into recovering revenue.

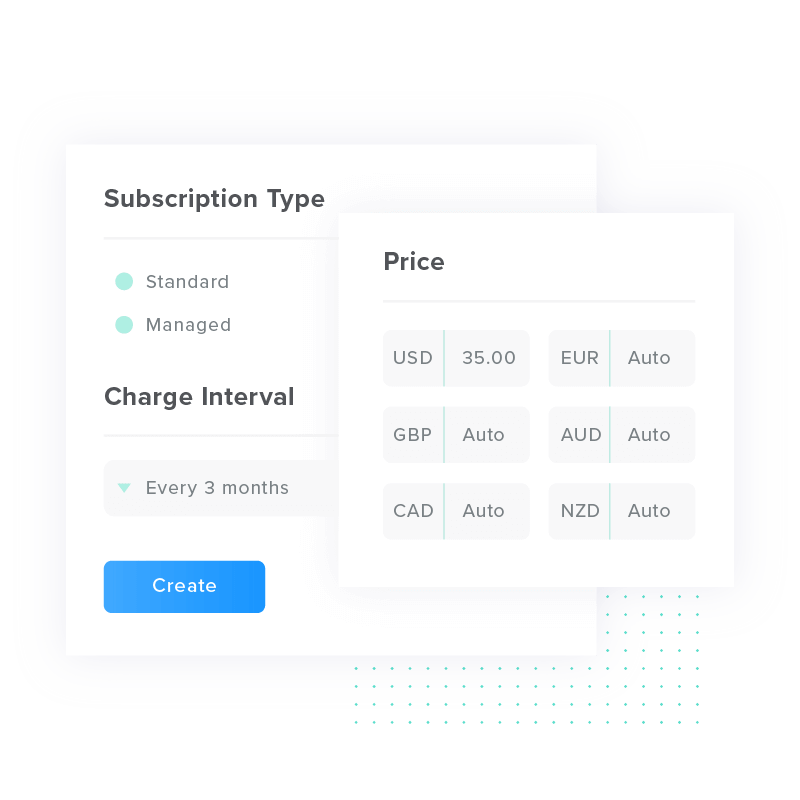

Using FastSpring, you can collect subscription payments on autopilot. FastSpring manages subscriptions using multiple payment gateways and supports all major payment methods, currencies, and languages.

2. Give them breathing room if their first payment fails

Payment failures happen. It’s a natural part of the subscription game.

So when a customer’s card fails, give them some time to figure out why it happened. With technology like card updaters coming onto the scene, card details are now more likely to get updated on file automatically. However, there are some instances where a customer’s card details won’t be kept up to date, and this is where dunning emails come into play.

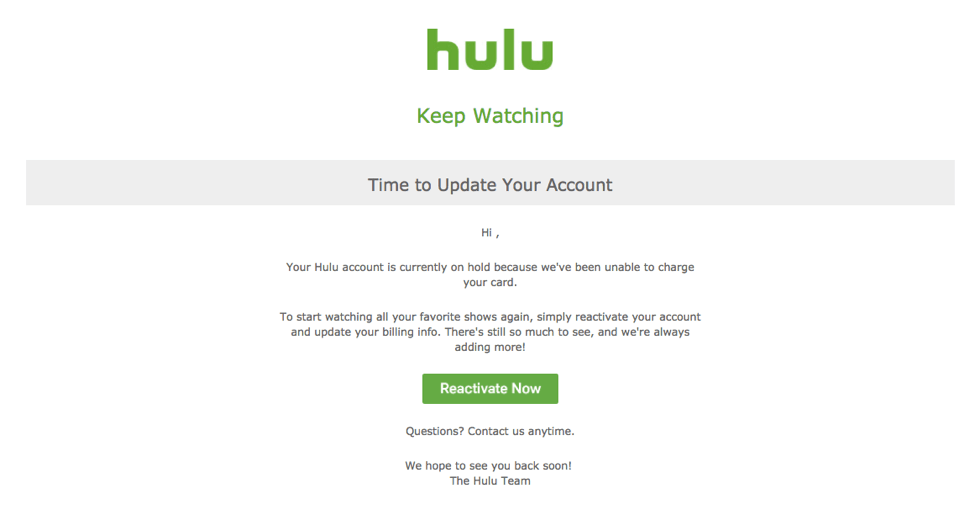

Now, a dunning email shouldn’t harass your customer about a missed payment. Instead, it should be used to check in with the customer to make sure everything is ok, and give them the option to update their payment details, like this dunning email from Hulu:

When setting up a dunning email cycle to recover revenue, you should always:

- Remind your customers why your product is worth it: Don’t demand payment right off the bat. Instead, frame the email in a way that reminds your customers why they signed up for your product in the first place. In the Hulu example above, the dunning email reminds the customer that they can keep watching their favorite shows if they renew their subscription.

- Keep it short and sweet: Don’t send a dunning email that’s as long as a novel. Keep it to a couple of paragraphs, and make sure each one has a purpose. One might be to remind the customer of your product’s value and then be followed up by a short explanation about the failed payment. Don’t make the email all about the failed payment, but make it clear that if the customer doesn’t take action, it will impact their subscription.

- Provide a clear CTA: Just like Hulu did in the email above. Instead of adding in a “pay now” button, they’ve reminded the customer that it is easy to “reactivate” their account. Include a straightforward CTA, so your customer knows exactly what they need to do to keep their subscription alive.

Finally, make the card updating process as seamless as possible. The CTA should link directly to a card payment update page that is responsive to whatever device the customer is reading the dunning email on. Remember—the easier it is for your customers to update their card information, the more likely they are to do it.

3. Give your customers a chance—always

Always give your customers the benefit of the doubt about why their payment bounced, and work with them to offer up alternatives to their subscription package.

For example, when their payment fails, don’t automatically cancel their account and remove them from your customer database. Instead, reach out to them and ask them what you can do to help.

You might offer to:

- Keep their subscription active, but on a lower tier that they can afford

- Move them to a freemium version of your product for the time being

- Pause their account

When it comes to SaaS, especially if you’re selling a pricey product, you mustn’t cut your customers loose as soon as their first payment bounces. Perhaps they have hit a rough financial patch, and they can’t afford to renew their subscription just now. If that’s the case, offer to move them to a free-tier of your product, or temporarily pause their subscription until they are ready.

Of course, treating your customers well when they are having payment difficulties keeps them happy. They want to know that you understand the peaks and troughs that go along with running a business. But pausing their account, instead of canceling it, saves you having to put them through the onboarding process again once they reactivate their subscription.

It’s a win-win for you—and your customers.

Recovering failed payments is key to cutting involuntary churn

Subscription payments are the backbone of any SaaS business—as long as a customer’s card details stay updated.

In case they fail, you need to put in the right system in place to not only recover your revenue but to keep your customers as well. It’s vital that, if a customer’s payment fails, your first communication with them isn’t just to recover revenue. Your focus should be to check in with your customers, ask them if they have any issues or concerns, and try to move forward together.

Your customers are the lifeblood of your company, and recovering revenue doesn’t mean that you’re going to lose them. On the flip side, if you do it right, it can be a positive outcome—for your customers and your business.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)