FastSpring previously presented on SaaS fees pricing and packaging to combat stagflation in 2022, but this article is based on an updated presentation delivered in March 2023 by David Vogelpohl. For more information or to view the prior presentation, check out the additional details at the end of this article.

Pricing your software as a service (SaaS) can be hard enough even during the best of times, but figuring out how to dial in the right pricing to drive more revenue in times of stagflation can be even more challenging.

This article offers tips for optimizing pricing and packaging of your SaaS products in a less-than-stellar economy:

- What is stagflation?

- Using your pricing model to fight stagflation.

- Optimizing your SaaS Pricing Strategy for new MRR vs. net revenue retention.

- Test creative SaaS pricing model combinations to unlock revenue.

- Inflation isn’t flat: Vary your strategy.

- How FastSpring can help.

FastSpring helps SaaS and software companies sell around the world. Our all-in-one payment platform includes a best-in-class localized checkout, subscription management, global tax management, reporting and analytics tools, and more. Sign up for a free account or request a demo to learn more.

What Is Stagflation?

Succinctly put, stagflation is an economic condition affected by three key factors:

- Low growth. 📉

- High inflation. 📈

- High unemployment. 📈

This means there’s more pressure than ever on:

- The wallets of prospects you want to attract. 🧲

- The wallets of existing customers you’d like to see upgrade. ⬆️

That’s why carefully considering your SaaS pricing model becomes crucial if you want to continue growing your business in a tight economy.

Using Your SaaS Pricing Model to Fight Stagflation

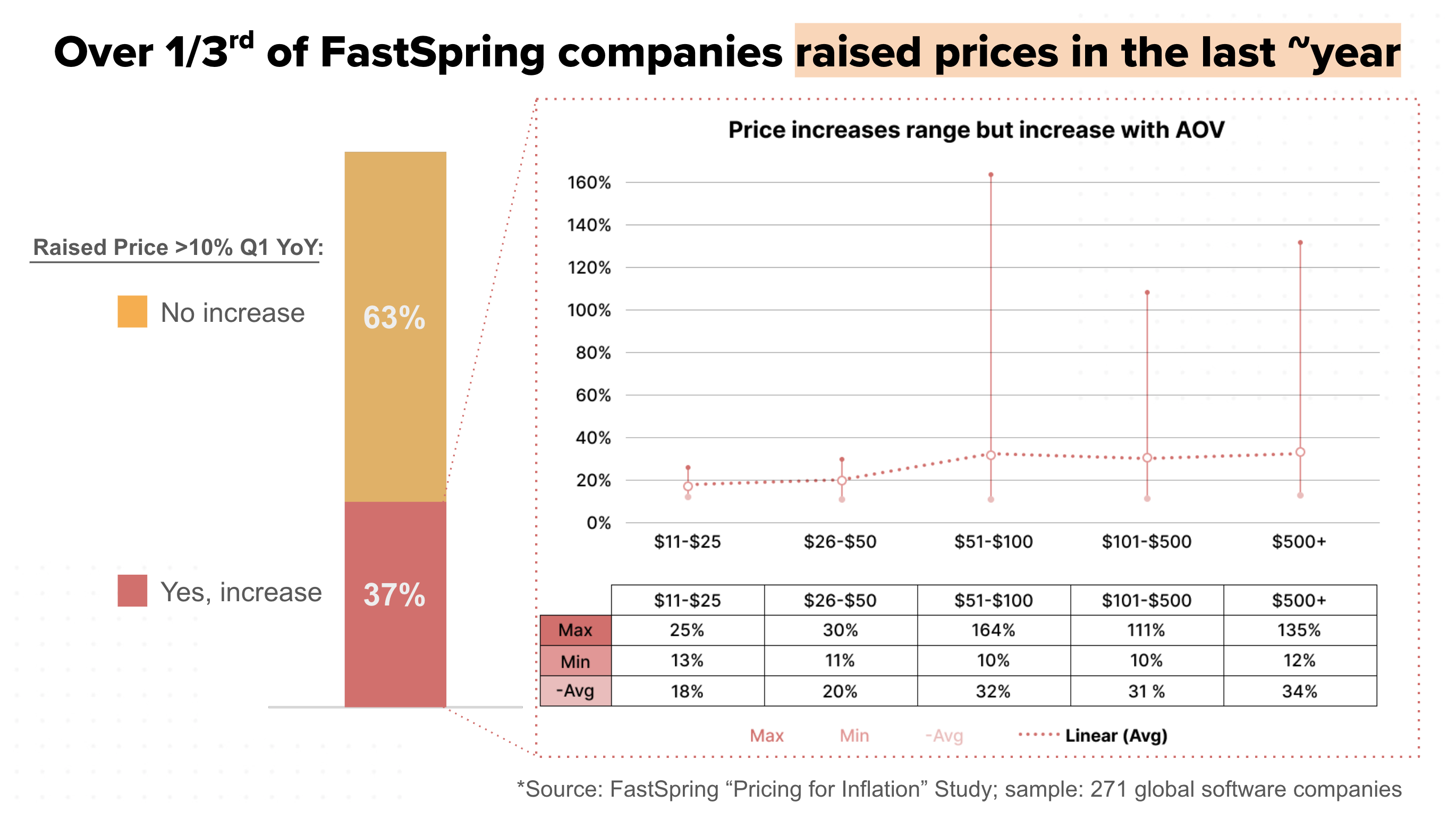

The easiest answer is to raise your prices, and you wouldn’t be alone if you did so.

Over a third of FastSpring’s SaaS, software, and digital goods customers raised prices in the last year.

Interestingly, SaaS companies tend to raise prices higher than the rate of inflation.

Pulling this lever — no surprise — generally works to increase revenue, even though it can be a tricky move to make when many customers have less money to spend in a stagflation economy.

But reconsidering pricing and packaging is also one of the most under-optimized levers in SaaS.

Why Raise Prices? Why Not Try Something Else?

There are plenty of other levers you could pull to try to increase revenue when the market is tight, besides increasing your pricing.

Increasing acquisition, increasing conversion rates, and reducing churn are all possible options.

However, all of those options take a lot of work in the form of cross-functional time and energy to implement them.

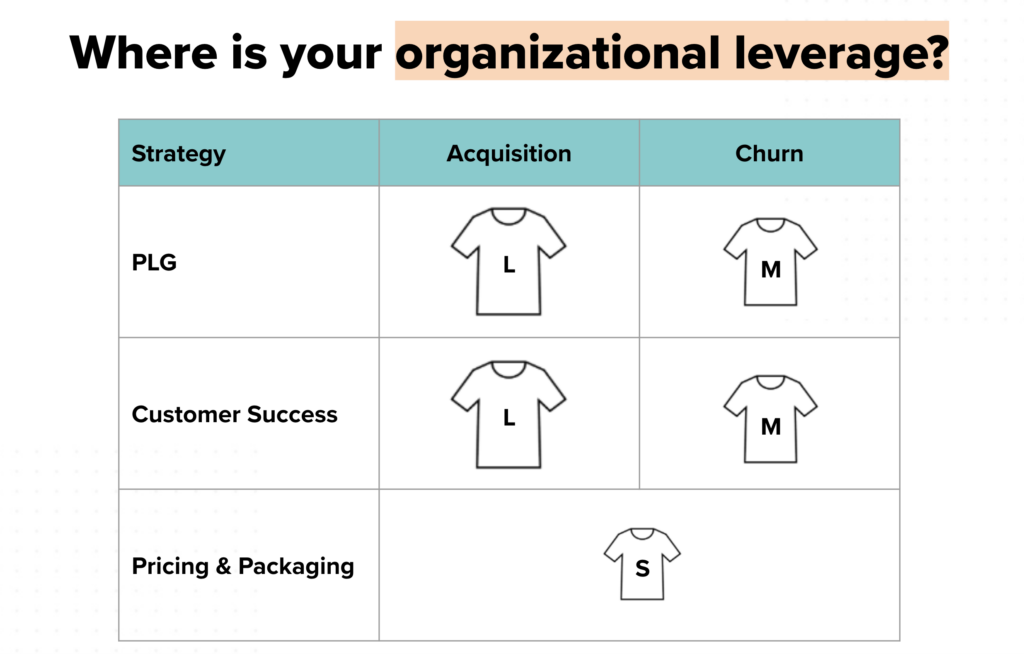

If you consider the effort and resources that need to be invested in increasing acquisition or decreasing churn through strategies such as product-led growth (PLG) or bolstered customer success efforts, it can become a slow and potentially overwhelming process, illustrated here by medium and large t-shirts:

Each of those medium and large t-shirts represent the amount of effort, resources, etc. it takes to implement PLG and customer success efforts in a way that will increase customer acquisition and decrease churn.

But product pricing changes take very little effort and can be done very quickly, as signified by the small t-shirt above.

As Patrick McKenzie points out, it can be as simple as replacing a smaller number with a bigger number:

All things considered, changing your pricing may be the easiest, simplest change you can make when your business needs to increase revenue quickly.

Optimizing Your SaaS Pricing Strategy for New MRR vs. Net Revenue Retention: The Growth Mustache

As you consider implementing different pricing, an additional factor to keep in mind is whether you want to optimize for new MRR, or for net revenue retention — or both.

Enter the “growth mustache.”

The growth mustache is a sideways bracket that a former CFO of mine always referred to. (I added the “mustache” descriptor, because, well, it looks like a mustache to me.)

Growth is driven by new monthly recurring revenue (MRR), or new customers coming in, and by net revenue retention (NRR), or how much of your existing customers’ MRR or ARR you are retaining or growing.

And if your NRR is over 100%, that’s a multiplier to your profits, but it’s also a multiplier to your valuation.

Generally, there’s operational leverage with different pricing and packaging, but you also know you’re in an environment where customers may have less money coming in and more money going out. How you change your pricing could affect your ability to gain new customers, retain and grow existing customers, or both, so keep this in mind as you start making changes.

Test Creative SaaS Pricing Model Combinations to Unlock Revenue

Once you’ve decided that changing pricing options is the route to go, there are still a lot of ways you can experiment. Pay-as-you-go plans, per-feature pricing, freemium pricing models, flat-rate pricing versus usage-based pricing, per user plans — which is right for your SaaS business?

Here are a few options to consider, for starters:

- SKUs:

- Platform tiered plans

- Product(s) tiered plans

- Persona tiered plans

- Single add-ons

- Bundles of add-ons

- Entitlements:

- Features

- Usage

- Support

- Pricing:

- Price

- Recurrence

- Geography

- Payment method

- Discounts

- Free trials

Look within those options for ways you can increase your operational leverage.

For some, that means coming up with a buyer persona-based pricing plan that has a slightly higher average revenue per user (ARPU).

For others, that means including a new add-on that allows them to raise the price more.

For others yet, it may mean switching from a flat-rate pricing model or user-based pricing to a more dynamic feature-based or usage-based pricing structure.

Track the Effects of Any Changes to Your SaaS Pricing Strategy

Carefully monitor the effects of any changes to your SaaS pricing model using reporting and analytics tools. This is to ensure you know whether the changes are helping or harming your SaaS business revenue, your number of users, and other key metrics. It’s important to know exactly which metrics are important on their own or in combination.

For example, if the customer base shrinks a little when there’s an increase in price point, but the remaining active users are paying a higher price and generating more revenue overall, some businesses might be thrilled with that change.

But know which changes are important to your business model. A well-established SaaS business may have very different priorities than a startup has.

Success Is Spelled With 3 S’s

Often when we think of pricing and packaging, we couple our ability to make more revenue with our ability to create something new.

Take for example the innovation S curve: We make something; it grows in adoption; it plateaus. And it’s easy to get caught in the thinking that the only way to get a new revenue stream is to create a new product entirely.

We can decouple that thinking and start thinking that new revenue S curves can be created by changing the packaging, plans, add-ons, and more, just by giving users new ways to purchase from you and use your platform.

If we further take into consideration a usage metric based on a value metric that has overages, those new plans and add-ons themselves can increase ARPU over time.

SaaS Pricing and Packaging Add-Ons

Add-ons offer an easier path to increasing average revenue per user for both existing and new customers on a budget, because they can pick and choose what to purchase from you — rather than paying, say, flat-rate pricing for a larger package that includes a set of features they don’t want or need.

For example, are there existing entitlements you can sell as add-ons without creating any additional engineering work? Can one of those functions be sliced out to create a new SKU without making an entirely new product?

Add-ons come in many varieties, so you can have many different add-ons or create multiple bundles of them.

They come with risk — because they can depress your upgrade MRR if fewer people are upgrading to a larger package — but add-ons can be a powerful driver of NRR.

To mitigate that risk, carefully measure your upgrade and downgrade rates as you begin making changes to your packages and add-on offerings.

Additionally, you can also wait to pitch add-ons until after users have signed up for your core product. Once they’re using your product and like it — and once any additional purchases they make would qualify as upsells, which helps your net revenue retention numbers — pitch them add-ons that would further enhance their experience of using the product.

This allows customers to enter your SaaS product at a lower price point, and then it can help you build your MRR and ARPU through those upsells.

And a lower initial price point can also help you gain an advantage when going after market share, too — especially if you can undercut competitors’ pricing a little.

Creating a New Pricing Tier to Drive Average Revenue Per User (ARPU)

Is it possible that the ARPU-boosting tier you need is one that exists between your existing plans?

For example, if you have a tiered pricing model with $25, $150, and $300 options, maybe the right pricing tier to drive more revenue is somewhere in between, around $75.

As mentioned above, if you choose to try this, track your results carefully! You may find a lot of $25 users will upgrade to the $75 plan to take advantage of a slightly bigger set of features, because while they never would have jumped from $25 to $150, a $75 option on your pricing page looks much more reasonable to them. But if you find lots of $150 users are also downgrading a tier to save money, it may not be worth it to maintain the new $75 plan.

Segmenting SaaS Plans to Clarify the Value of Your Product and Increase ARPU

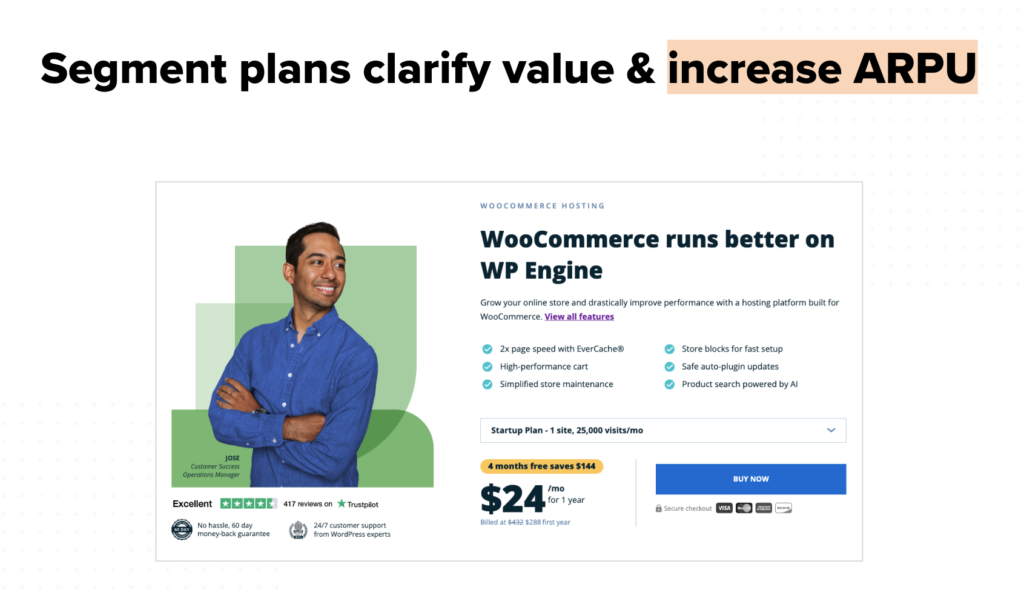

Another possibility is to segment your packaging based on very specific customer needs.

For example, WP Engine is a managed WordPress platform that manages all kinds of sites, but they saw an opportunity to target WooCommerce users specifically, so they created a package that targeted just that audience.

This allowed them to highlight customers’ needs within this one segment to capture their attention and get more signups. Over time, WP Engine was able to add more product value for those users, which increased WP Engine’s revenue.

Payment Frequency Increases Leverage

An annualized pricing option gives buyers the benefit of a discount by paying for a year up front, but it also gives you the benefit of reducing your churn rate while improving a customer’s overall lifetime value, or LTV.

To further leverage this strategy, you can provide more aggressive annual pricing discounts for new subscribers or for those subscribers willing to switch from monthly fees to annual fees.

Intro period pricing can also make adoption easier for users.

Tip: If you’re offering an Enterprise plan and the price point starts looking a little more expensive when paid for annually, try to keep that price below $5000. Many procurement departments have a policy of requiring team members to get approval for any purchases larger than that, so if you can keep prices below that threshold, it’s easier for users to easily make that purchase via credit card without jumping through internal hoops at their own companies. This can vary and isn’t a rule, but it’s a good guideline to try out.

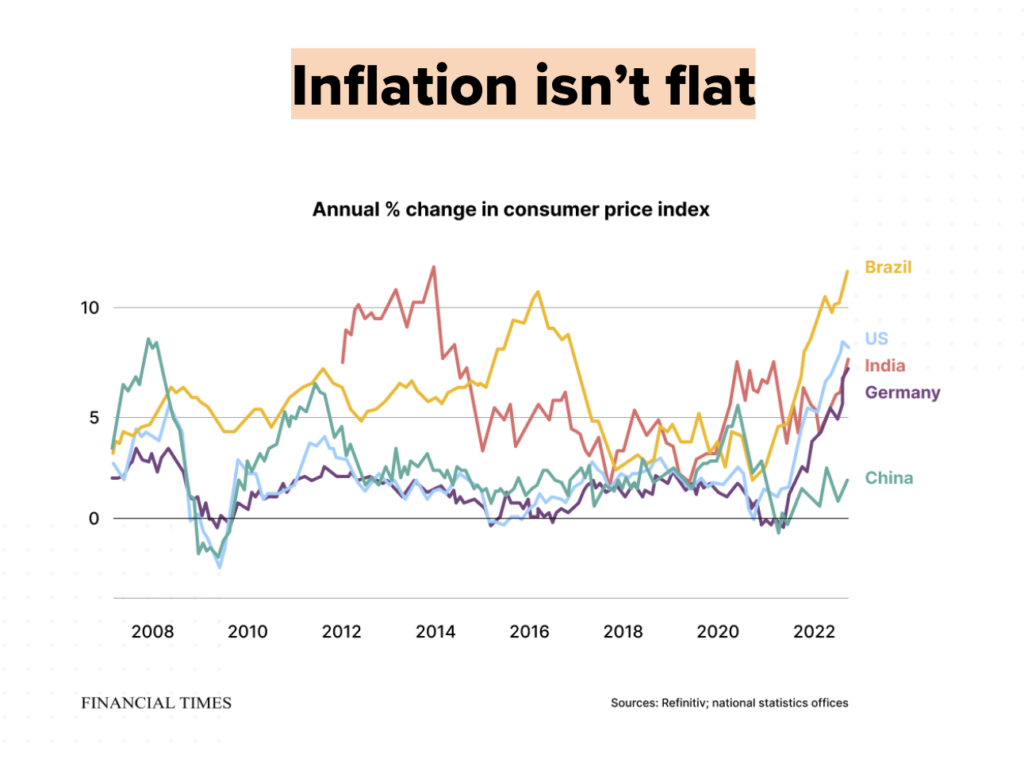

Inflation Isn’t Flat: Vary Your Strategy

As you consider changing your SaaS company’s pricing strategy, potential customers’ willingness to pay isn’t the only thing to keep in mind. Inflation can vary a lot in a relatively short amount of time, and that variation can be further varied in every country or region.

Financial headwinds as they relate to various geographies can mean that localization becomes more important if you offer your saas product internationally.

Remove Unnecessary Purchasing Friction With Localization

Localization typically involves multiple aspects, including but not limited to:

- Accepting the preferred payments of the regions you’re selling into.

- Localizing the pricing.

- Localizing the currency.

Each of those comes with its own additional benefit not just for buyers, but for your profit margin as well.

If you’re not accepting the preferred payment method of the countries or regions you’re selling into, you could be leaving 5-10% on the table. For example, SaaS companies focusing on penetrating Europe should consider accepting SEPA direct debit payments as a payment method, since it’s a very common payment method there.

Localizing pricing converts at 2x for B2C SaaS companies. Just make sure you have a good justification for different pricing in different countries or regions, in case a potential customer manages to see more than one price.

Local currencies are easier to get approved and for the target market to understand. When new customers see your SaaS fees displayed in a currency they’re used to, it makes it that much easier for them to buy, removing the purchase friction of conversion math before making a decision.

How FastSpring Can Help

FastSpring helps SaaS and software companies sell around the world. Our all-in-one payment platform includes a best-in-class localized checkout, subscription management, global tax management, reporting and analytics tools, and more.

Learn how using a merchant of record can help you scale your digital goods, software, or SaaS business faster and remove many of the headaches of breaking into new markets and transacting across borders.

Sign up for a free account or request a demo to learn more.

The information in the above article was recently presented by David Vogelpohl in a webinar hosted by Cumul.io. Watch the original presentation on their YouTube channel.

Want more info on SaaS product pricing and packaging in a stagflation economy? Check out our previous presentation (and podcast episode) with account executive Tony Markov and former FastSpring CPO Kurt Smith, Pricing Strategies to Combat Stagflation.

More articles about SaaS fees and pricing you may be interested in:

- Is usage-based pricing right for your SaaS?: What UBP is and why it may matter to your SaaS business.

- Pricing your SaaS by audience by using FastSpring: More on usage-based pricing, segment-based pricing, and user-based pricing for SaaS companies.

- Seven best SaaS pricing page examples (plus 5 SaaS pricing strategy questions to consider): Data from thousands of SaaS companies suggests the pricing page is the second most important page on your site; here are some excellent examples.

- Subscription vs. pay per use for your SaaS product: The difference between a single-purchase model and a subscription model, and when to change your SaaS pricing model accordingly.

- SaaS billing best practices: 10+ subscription strategies for SaaS and software companies: Learn how seven SaaS companies grew their businesses, and get eight more ideas for how to find the right pricing for your own SaaS product.