SaaS accounting software can help you automate:

- Recurring invoicing.

- Payment processing.

- Remitting taxes.

- Payment reconciliation.

- Payment reminders.

- Subscription management.

- Reporting.

- Expense tracking.

- Payroll.

- And more …

However, it’s almost impossible to find one accounting software solution that satisfies all your needs as a SaaS company. Even software that advertises SaaS-specific features is rarely a complete solution.

For example, many accounting software offer a way to collect payments, however, it’s typically only for United States payments, not international payments. If you want to collect international payments, you’ll likely need an additional payment solution that specializes in global payment processing.

That’s why most SaaS companies end up layering multiple point solutions on top of generic accounting software to build the solution they need.

In this guide, we compare seven accounting software options by covering what each one can and can’t do. In particular, we start with an in-depth look into the solutions our platform, FastSpring, provides and how we take on transaction and sales tax liability for you.

Table of Contents

FastSpring is an end-to-end payment solution for companies selling digital products and software-as-a-service. We help you gather and remit indirect tax (e.g., sales tax, VAT, GST), balance monthly transactions, send recurring invoices and collect payments, and much more. To see how we can help you quickly expand globally, sign up for a free account or request a demo today.

FastSpring: Sales Tax, Transaction Reconciliation, Payment Processing, and More for Software Companies

FastSpring provides solutions for:

- Gathering and remitting U.S. sales tax and international VAT and GST.

- Global payment processing.

- Sending invoices and payment reminders.

- Reconciling transactions with fulfillment.

- Reporting.

- Much more …

But FastSpring does more than just provide software for a few aspects of accounting — we’re Merchant of Record (MoR) for SaaS companies.

As your MoR, we handle all of these tasks for you. Plus, we take on transaction liability and the responsibility of calculating, gathering, and remitting sales tax, VAT, and GST.

In the following sections, we dig deeper into how FastSpring helps SaaS companies expand globally while simplifying accounting tasks.

Note: You will need additional accounting software for payroll, income tax, internal balance sheets, etc. FastSpring easily integrates with other solutions (e.g., QuickBooks) via extensions, webhooks, and an API.

“One of the key factors [for switching to FastSpring] was the fact that FastSpring was easing our administrative burden regarding global tax and VAT management, and the number of invoices that we needed to register.”

– Ovi Negrean, Co-founder and Chief Executive Officer

Fully Managed Sales Tax, VAT, and GST

SaaS companies didn’t always have to pay sales tax, VAT, and GST, however, that’s no longer the case. More and more countries are passing laws that require non-resident SaaS companies to gather and remit some form of indirect tax. If you don’t, you may face heavy fines and/or be banned from transacting in that jurisdiction.

Most accounting software will help you add sales tax (assuming you’ve configured the options and settings correctly) to invoices and generate reports for remitting sales tax. However, accounting software is typically inadequate for:

- Calculating and collecting VAT or GST. If you want to transact outside of the U.S., you’ll be completely on your own to calculate and remit VAT, GST, and other forms of indirect tax. (As we discuss in this article on SaaS tax software, even most tax software is inadequate for collecting international indirect tax.)

- Adding sales tax to purchases on your website. Some accounting software will offer a payment portal where customers can settle invoices. However, this is entirely separate from any checkout you may have on your website, which means you’ll need different software for collecting indirect tax on your website (which means extra cost and extra work).

Plus, you’re ultimately held responsible for all tax liability. Maintaining tax compliance is often more complicated than simply collecting and remitting the correct amount (and type) of indirect tax at the right times.

For example:

- Countries such as Serbia, the United Kingdom, Taiwan, and others require electronic invoicing (from resident and non-resident companies alike), which can cost companies $2k-$5k per year. Note: E-invoicing mandates are increasing at an alarming rate — the EU is rolling out universal electronic invoicing requirements by 2028.

- Countries such as India, Indonesia, Japan, and others require your account to be “pre-funded” meaning you have to predict the amount of tax you will owe and keep that money in your account until it’s time to remit the funds (often up to three months in advance).

- Countries such as Colombia, Japan, Mexico, Serbia, and others require local representation. This means someone with a physical presence (usually a lawyer or accountant) in that country has to be responsible for your tax liability, which can cost anywhere from $5k to $15k per year.

- Countries such as Taiwan, Indonesia, Nigeria, Vietnam, and others require you to file an income or profits tax return once you start collecting indirect tax, which can add up to $5-$10k per year.

That’s why most SaaS companies end up hiring full-time tax accountants and specialists to handle indirect tax.

FastSpring simplifies the entire process and makes it really easy to add all forms of indirect tax to invoices (and collect it at checkout) by handling it for you.

With over 20 years of experience filing 1,200+ tax returns each year in 100+ jurisdictions, our team ensures the correct amount (and type) of indirect tax is collected (we even handle tax-exempt transactions in the U.S. and B2B reverse charges when applicable).

Then, our team remits those taxes for you and ensures all the necessary procedures are in place to stay compliant. We have long-standing relationships with tax specialists globally to stay current on regulation changes, enforcement updates (sometimes specific industries are targeted), and trends they are seeing with other software companies.

If a country or state approaches you about tax compliance, our team will often provide you with copy-and-paste responses.

Quote Management and Recurring Invoicing

With most accounting software, you can easily manage B2B subscriptions on your website, but not B2C transactions — which is why many companies end up with two different solutions. That means double the cost and double the work.

With FastSpring, you can manage B2B and B2C transactions from one platform.

FastSpring provides several options for setting up different subscription models such as:

- Fixed, per seat, metered, tiered, and bundled billing.

- Prorated billing to accommodate upgrades and downgrades mid-cycle.

- Automatic or manual renewal.

- Upsells, cross-sells, one-time fees, discounts, and gifts.

- And much more …

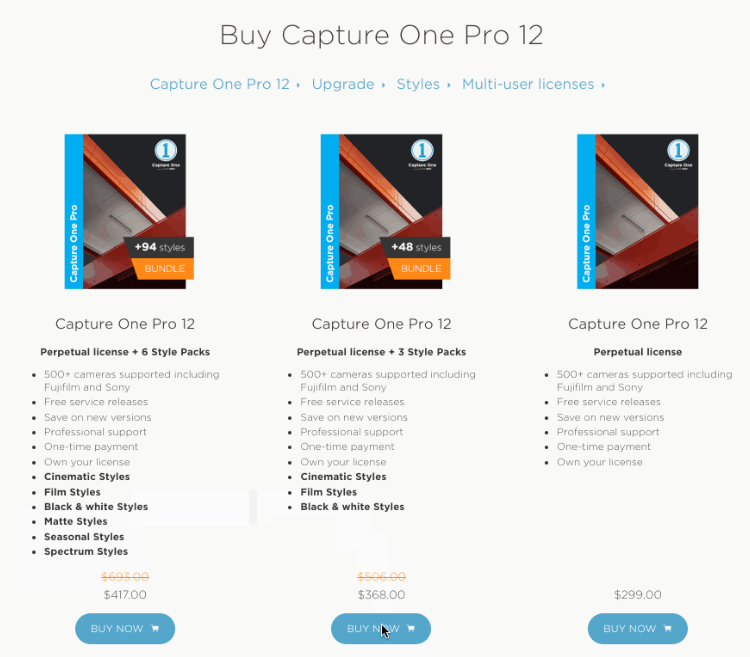

Then, you can make these products available on your website:

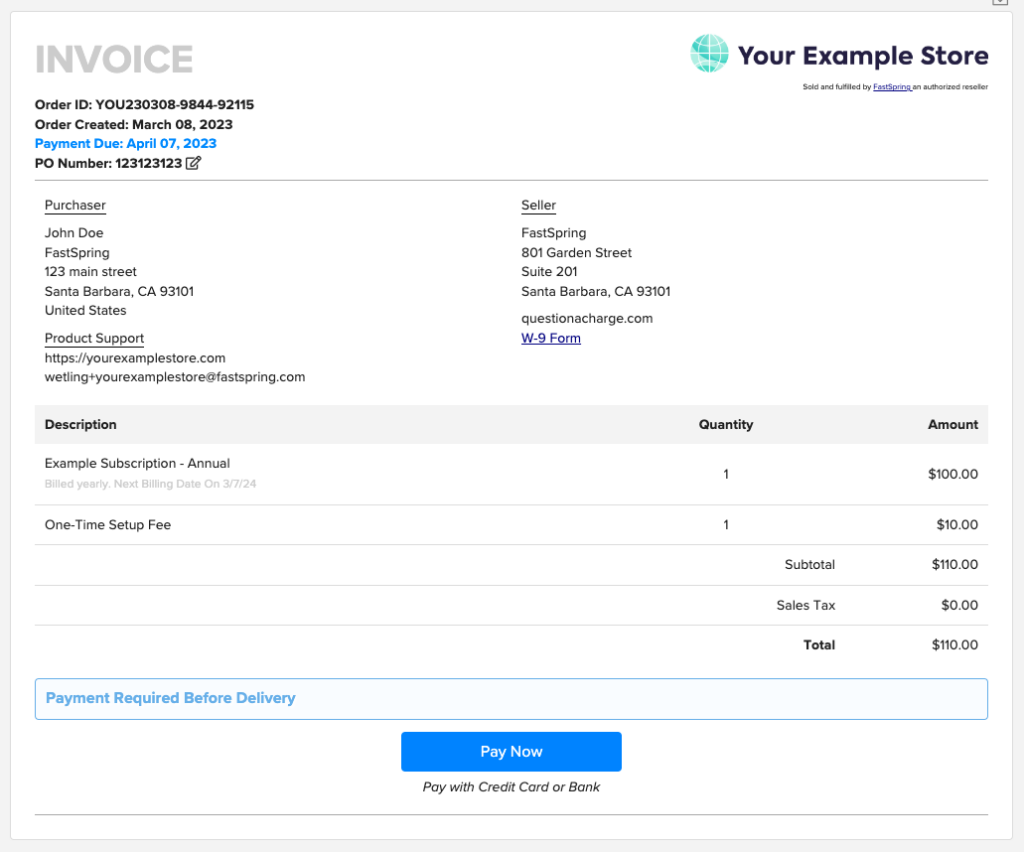

Alternatively, you can add the products to quotes and invoices using FastSpring’s Digital Invoicing tool. With Digital Invoicing, your team can create and manage quotes and invoices (e.g., add discounts and tags, set the expiration date, leave notes for the customer, track the purchase process).

You can also offer a self-serve portal where customers can generate their own quotes or invoices based on items in their cart.

International Payment Processing

Most accounting software will offer simple payment processing for transactions in the U.S., however, most only support a few payment types (e.g., Mastercard, Visa, ACH) and hardly any of them provide payment processing for international payment methods or currencies. To accept international payments, you’d need to integrate with and manage additional payment processors.

FastSpring makes it really easy to accept tons of preferred payment methods around the world (via checkout or invoice) by:

- Managing multiple payment gateways for you. Each payment gateway has specific countries, payment methods, and currencies that they support. For example, a payment processor may support Amazon Pay in the United States but they won’t process payments from Brazil. With FastSpring, you’ll automatically have access to multiple payment gateways that specialize in international transactions (and transactions in the United States).

- Providing currency conversions at checkout and on invoices. You can set the price for each product in each currency or let FastSpring make the conversions for you. You can also let your customers choose their preferred currency (and language) or let FastSpring choose the appropriate one based on their location.

“Having many payment methods that are always relevant to each different region around the world has helped us achieve significant growth worldwide.”

– Ovi Negrean, Co-founder and Chief Executive Officer

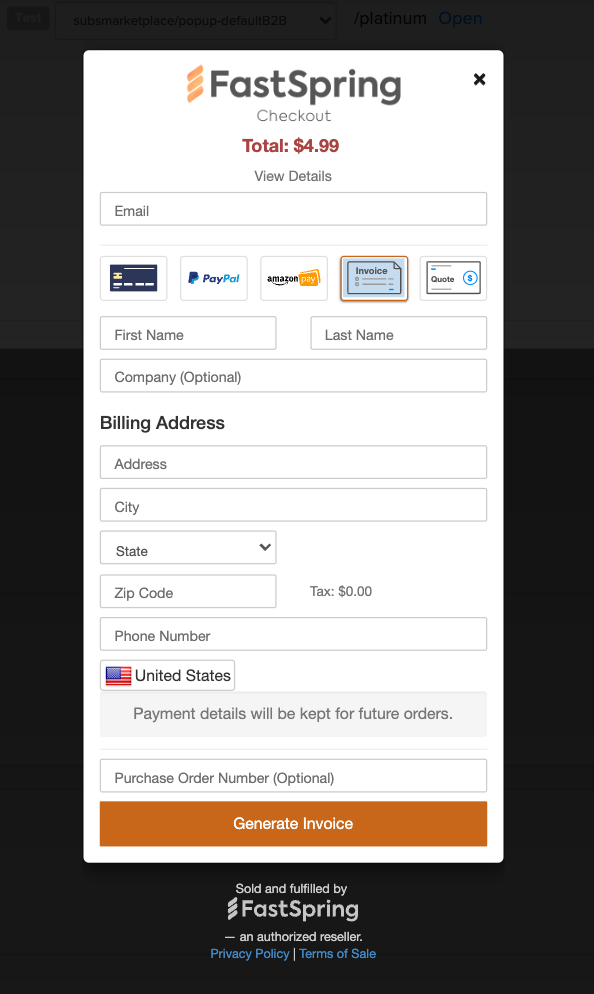

To pay an invoice, customers simply click on the ‘Pay Now’ button at the bottom of the invoice (as shown below).

This will take customers to either a popup checkout or a web storefront hosted by FastSpring, depending on what you choose. Either one is very customizable in terms of the look and feel of the checkout.

Note: You can use this same checkout on your website, and you’ll have the option to embed the checkout on your webpage, if you prefer. Plus, you can use FastSpring’s Store Builder Library to customize the buyer journey leading up to checkout (e.g., cross-sells, upsells).

Finally, you can configure FastSpring to send out payment reminders two, five, seven, fourteen, and twenty-one days after a payment method fails. In our experience, sending out multiple payment reminders is the best way to ensure ongoing payment.

Simplified Transaction and Fulfillment Reconciliation

Most accounting software will help you automate the process of making sure the payments you receive match the orders being filled. Even though it’s automated, it can be a huge task to verify that the automation worked correctly and to fix any imbalances.

Plus, international transactions make it more complicated because you may have payments coming in through different gateways (and therefore different software providers) and into multiple merchant accounts.

As MoR, FastSpring simplifies transaction reconciliation by handling it for you. We take all of the transactions with your clients and bundle them into one or two lump sum payments which we send to you once or twice per month.

Instead of spending hours balancing hundreds or thousands of transactions each month, you spend just a few minutes balancing one or two transactions from FastSpring.

You still have full control over your product (i.e., how it’s bundled, the pricing model, how much is sold, where you want to sell it, fulfillment, etc.).

Detailed Reporting for SaaS KPIs

FastSpring offers a built-in reporting feature to help you find the information you need to create common accounting reports (e.g., breakeven report or balance sheet). Most reports can be found in the Revenue Overview dashboard or the Subscription Overview dashboard, but you can also create and save custom reports.

If you don’t see the exact report you need, you can reach out to our team and we’ll help you find (or build) the necessary reports.

Any report can be viewed in your dashboard or downloaded as a CSV, PNG, or XLSX file. You can also integrate our Analytics and Reporting feature with third-party software to pull in or send out data.

Simple Flat-Rate Pricing

All aspects of FastSpring are available for one flat-rate price based on the volume of transactions you move through our platform. And, there are no upfront charges — you’ll only be charged when a transaction takes place.

“We were focused on not only finding an ecommerce platform that worked but also on building a relationship and partnership, which I believe is very important. You don’t want to buy something and then be alone. You need a good partnership. In the end, we picked FastSpring because they showed us they wanted to be a true partner.”

– Frederic Linfjärd, Digital Commercial Manager at Capture One

FastSpring is more than just software for some aspects of accounting — we’re your Merchant of Record. To see how we can help you quickly expand globally, sign up for a free account or request a demo today.

Build Your Own SaaS Accounting Solution

| $ | Accounting software for: Adding sales tax to invoices and generating sales tax forms. Payment processing for U.S. payments. Managing B2B transactions. Reporting. Balancing transactions. | VS. | FastSpring |

| $ | Tax software for adding sales tax to website purchases | ||

| $ | Software engineers for creating software that adds foreign consumption tax to invoices and checkout | ||

| $ | Tax law specialists for calculating and remitting foreign consumption tax (e.g., VAT and GST) | ||

| $ | International payment gateways for accepting more payment methods and increasing authorization rates | ||

| $ | Subscription management software for managing B2C and B2B products | ||

| $ | Financial reporting software for SaaS analytics and reporting |

In addition to FastSpring, you’ll need software to manage things like payroll and income tax. Next, we’ll cover six more options that provide solutions for those areas.

6 Other Accounting Software

1. Maxio (Formerly SaaSOptics)

SaaSOptics is one of the most well-known tools for tracking SaaS metrics (e.g., monthly recurring revenue), SaaS revenue recognition, and SaaS expense tracking. They recently merged with Chargify (a subscription management platform) to form Maxio.

While Maxio has a lot to offer SaaS companies, they don’t take on transaction or indirect tax liability for you. Plus, you’ll need additional software for things like accepting preferred payment methods around the world. (They do work with Avatax to help you collect sales tax and VAT, but the functionality is limited).

Maxio offers solutions for:

- Recurring billing.

- Revenue management.

- Expense amortization.

- Integrating with payment gateways.

- Analytics, reporting, and forecasting.

2. Oracle NetSuite

Oracle NetSuite is a business management suite that offers solutions for accounting, B2B and B2C ecommerce, ERP, CRM, and much more. They serve many different industries including software companies. They also support all sizes of businesses from SaaS startups to enterprises.

Note: NetSuite provides single-seat access to streamline communication between your company and your CPA.

NetSuite includes solutions for:

- Financial reporting.

- Revenue recognition.

- Automated general ledger spreadsheets.

- Tax reporting.

- Revenue management.

- Project planning and budgeting.

3. QuickBooks

QuickBooks by Intuit is a popular accounting solution for small to midsize businesses and startups. They offer an on-premise and a cloud-based version (called Quickbooks Online).

QuickBooks wasn’t specifically designed for SaaS companies. Instead, QuickBooks recommends SaaS companies integrate with SaaSOptics to get the metrics and functionalities they need.

QuickBooks offers:

- Payroll management tools.

- Accounts receivable and payable tools.

- Time tracking tools.

- Tools for maximizing tax deductions.

- Virtual bookkeepers that will help you with simple accounting tasks.

- Payment processing online or in person for some debit and credit cards, ACH, Apple Pay, PayPal and Venmo.

- Real-time business reports (e.g., profit and loss statements, cash flow statements)

4. FreshBooks

FreshBooks offers accounting tools to freelancers and companies with multiple employees or contractors. They serve multiple industries including technology, construction, accounting and more. They charge you based on how many billing clients you have that month starting with five billing clients up to unlimited clients.

Freshbooks offers:

- Payment processing for MasterCard, Visa, Apple Pay, Discover and ACH.

- Project estimations and management.

- Mileage and time tracking.

- Payroll.

- Bookkeeping.

- Invoicing.

- Reporting.

5. Stripe

Stripe is a payment processor that can be integrated with your accounting software solutions to help you accept and manage payments. Although their platform focuses on getting customer payments into your bank account, they do offer a few accounting-related services such as revenue recognition.

Stripe serves many different industries, including SaaS, at many different stages of growth, including early-stage startups. However, in this article on Stripe alternatives, we discuss why Stripe may not be the best choice for SaaS companies. In short, companies that choose Stripe as their payment platform often end up with a large software stack to manage.

Stripe provides solutions for:

- Your website checkout.

- Gathering sales tax at checkout.

- Fraud and risk management.

- Recurring invoicing and subscriptions.

- Data warehouse management.

- In-person payments.

6. Xero

Xero is an accounting system for small businesses, accountants, and bookkeepers. Xero is another software that doesn’t directly serve SaaS businesses, and instead offers an integration with SaaSOptics.

Xero’s features include:

- Accounts payable and cash flow automation.

- Spend management and reimbursements.

- Multiple bank account integrations.

- Online invoicing and payments.

- Payroll.

- Project management.

FastSpring handles international indirect tax, payment processing, digital invoicing, subscription management, dunning, and much more for you. Sign up for a free account or request a demo today.