It takes an enormous amount of time, money, and headcount for SaaS companies to handle VAT, GST, and sales tax (and any other form of indirect tax) in-house. You have to consider:

- Whether or not you’re required to collect and remit indirect tax (SaaS companies didn’t always have to remit indirect taxes, however, many countries now have new tax laws that target non-resident software companies).

- How much indirect tax you should be collecting and remitting (figuring this out is rarely cut and dry — it typically has to be done by a tax specialist).

- How you will collect the right amount and type of tax at checkout (there is software to help you collect sales tax (assuming you know how to properly configure to optimize and comply with the more than 10,000+ taxing authorities in the US), however, most software is inadequate for collecting VAT, GST, and other forms of consumption tax.

- Whether or not there are additional requirements for staying compliant (e.g., some countries require you to file income tax in addition to indirect tax).

- How you will remit those taxes (this is rarely as simple as filling out a form and cutting a check; many countries have additional requirements such as having a representative located in that country handle your tax liability) …

… for every state, province, and country you do business in.

That’s why most businesses turn to tax software and/or tax consultants to help them manage indirect tax.

In this guide, we talk about the areas of collecting and remitting indirect tax that tax software and tax consultants can and can’t help you with. Then, we’ll show how our solution, FastSpring, handles all aspects of collecting and remitting indirect tax for you.

Table of Contents

- What Tax Software Can Help You With

- Disadvantages of Tax Software

- What Tax Consultants Can Help You With

- Disadvantages of Tax Consultants

- FastSpring: Tax Software + Tax Consultants + More

- Conclusion

- Frequently Asked Questions

FastSpring is more than tax software or a tax consultant, we’re the Merchant of Record for companies selling digital goods and software-as-a-service. Request a demo or sign up for a free account to see how FastSpring can help you expand globally almost overnight without adding headcount.

Note: The information contained in this article is not to be taken as tax advice.

What Tax Software Can Help You With

Most tax software solutions provide tools for:

- Automatically calculating tax rates for each product at checkout.

- Filling out forms to remit indirect tax.

- Registering your business in each tax jurisdiction.

- Knowing when you’ve reached the liability threshold for specific locations and therefore have to start collecting and remitting taxes.

- And more …

Disadvantages of Tax Software

Disadvantage #1: You Have to Manually Assign Tax Codes and Configure Your Checkout

To understand the first shortcoming of tax software, we need to take a closer look at how to use tax software to calculate tax rates.

The amount of tax that needs to be gathered at checkout is determined by a number of factors:

- The type of product you’re selling

- The type of customer

- How much revenue you’ve earned from customers in a given location

- If products are bundled together

- Where your business has nexus

- And many more

If even one of these factors changes, it can affect how much tax you have to collect and remit. For example, software sold as a subscription and hosted on a cloud-based server may be taxed differently than software sold as a subscription but hosted on the seller’s private, physical servers.

Tax software takes the most common combinations of these factors and labels them with a tax code (most tax software will provide hundreds of different codes). To use the software, you find the matching tax code for each of your products and configure your checkout to use the appropriate tax code for each item in the cart. Then, the tax software automatically calculates the appropriate tax rate (based on the tax code you assigned and additional information gathered at checkout such as the buyer’s location) and adds it to the customer-facing pricing.

It can be extremely complicated to choose the right tax code.

For example, let’s say your company sells digital blueprints for building a DIY deck. With the blueprints, you also include a PDF with recommended designs for landscaping around the deck. Your tax software gives you two different tax codes that seem to fit:

- A0002: For designs and plans sent to the customer via electronic means only.

- A3001: For blueprints sent to the customer via electronic means only.

Should you use tax code A0002 because both the blueprints and the landscaping designs could fall under ‘designs and plans’? Or do you use a combination of both tax codes? Or do you use the A3001 code for the blueprints and offer the landscaping design plans as a free bonus? Or something else altogether?

Most companies find they need a tax specialist to handle assigning the right tax code to each product.

Then, you still have to do the manual work of setting up your checkout to use the appropriate tax code for each item in the cart (which typically takes hours of setup and ongoing maintenance).

Disadvantage #2: You’re Held Liable

A common misunderstanding is that tax software providers are responsible for ensuring the correct amount of indirect tax is collected at checkout. However, that is not the case. Most tax software includes a line similar to the following:

“While we try to make these tools as accurate as possible, please remember that you are responsible for determining the appropriate tax codes.” – Avalara

Which essentially means that if the wrong amount of tax is collected for any reason, you’re held responsible.

Even if the tax software fails to calculate the right amount of tax or they experience a glitch in their system and stop collecting tax altogether in a specific region, the tax software does not have to cover the funds for those taxes — instead, it will likely come out of your pocket.

(The same is true if you accidentally assign the wrong tax code or your checkout is configured incorrectly and not collecting the right amount of tax.)

Additionally, if you get audited, you’ll be on your own. Some tax software companies will provide on-demand reports and help docs to help you get through audits, but it’s ultimately up to you to come up with a response.

Finally, if you have questions about how to optimize tax rates, qualify for reduced tax rates, or any other tax-related question, you’ll likely be told to consult your tax advisor or read through the help articles.

Disadvantage #3: Most Tax Software Is Inadequate for Collecting VAT, GST, and Other Foreign Consumption Tax

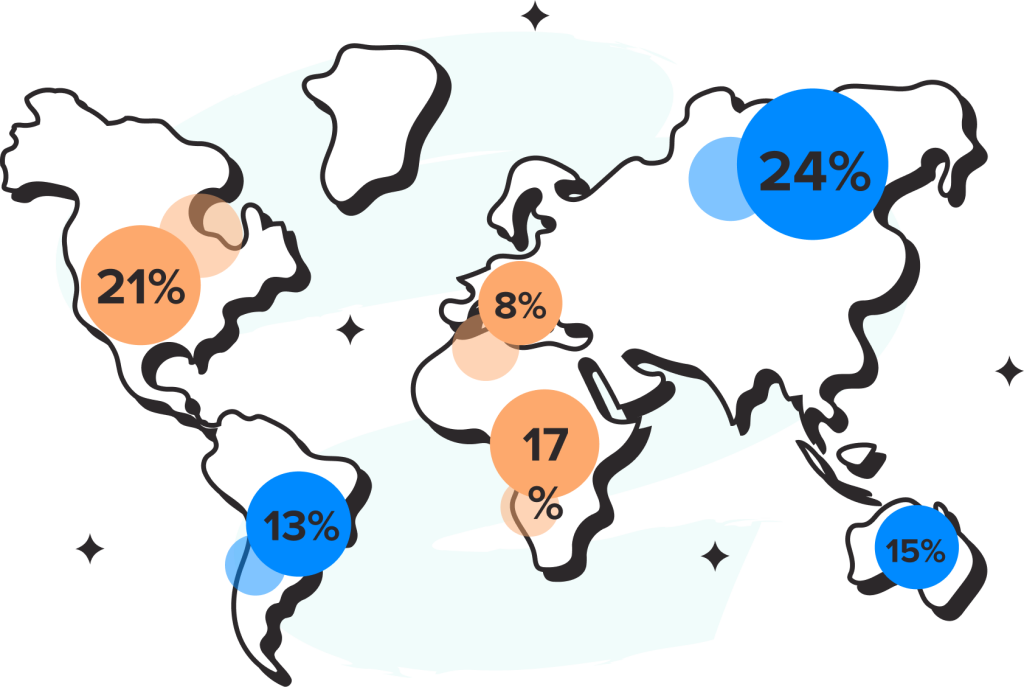

While there are good solutions for calculating sales tax rates in the United States, most are insufficient for collecting indirect tax for transactions outside of the U.S. Many SaaS companies run into situations where their tax software is calculating the wrong amount of VAT or GST, can’t calculate tax rates for countries they want to do business in, or doesn’t provide the necessary tax code for their product in all countries. Because of this, most SaaS companies end up calculating indirect tax outside of the U.S. on their own.

Disadvantage #4: You’re Limited to the Tax Codes They Provide

Tax software typically provides hundreds of tax codes that cover different variations of products and services, so most companies can find a tax code that matches their product. However, if you have a product or service that isn’t covered by a tax code, you’ll be on your own to collect the applicable tax.

What Tax Consultants Can Help You With

Tax consultants can help you:

- Stay up-to-date on the tax laws of each jurisdiction you do business in.

- Provide recommendations about when it’s time to start remitting tax in a specific jurisdiction and how to implement measures for compliance.

- Remit indirect tax at the appropriate time. (Keep in mind: Not all tax consultants will offer this service, so you may also need to hire an accountant.)

Note: Some tax consultants specialize in sales tax compliance in the U.S. or tax on tangible personal property and don’t necessarily specialize in tax laws for digital products or international transactions. So, you’ll want to choose your tax consultant carefully — many SaaS companies need multiple tax consultants to cover all their bases.

Disadvantages of Tax Consultants

Tax consultants can help you stay up-to-date on laws and regulations, but you have to decide what to do with that information. Very few tax consultants will give you straightforward advice on how to handle specific situations. Instead, they’ll most likely inform you of the laws and how other companies have handled various situations in the past. If they do offer advice, it’s often very conservative.

For example, let’s say a country you’re transacting in passed a new law requiring consumption tax on some digital goods sales. Their guidelines aren’t very clear so you don’t know if your product qualifies or not. A tax consultant will likely advise you to go ahead and file taxes even if there’s a good chance that your product won’t qualify once the guidelines are clarified. If you do decide to file and later find out that you didn’t need to, the tax you already paid is gone and won’t be refunded.

Some companies would rather take the risk and not file in this situation, however, very few tax consultants will recommend that course of action. Either way, it’s entirely up to you to decide what to do with the information your tax consultant provides, and you’ll be the one held liable.

FastSpring: Let Us Handle Sales Tax, VAT, and GST Liability for You

The challenges mentioned above with tax software and consultants are one of the reasons we created our solution, FastSpring.

FastSpring combines the benefits of tax software and tax consultants and overcomes the disadvantages of both by acting as your Merchant of Record (MoR), which means we fully take care of sales, VAT, and GST taxes for you.

Specifically, as MoR we:

- Take on tax liability

- Help you assign tax codes

- Calculate tax rates

- Collect and remit sales tax, VAT, and GST

- Take the lead on audits

- And much more …

You control your product, the checkout experience, and branding. We simply provide you with a complete payment solution and take care of sales tax, VAT, and GST for you.

“The decision to move to FastSpring was a complex one, but one of the key factors was the fact that FastSpring was easing our administrative burden regarding global tax and VAT management, and the number of invoices that we needed to register.”

— Ovi Negrean, Co-Founder and CEO at SocialBee

Click here to read the SocialBee case study.

In the following sections, we dig into what it looks like to have FastSpring as your MoR.

Get the Right Tax Codes for Every Product

Our team of tax professionals assigns tax codes to all your products so your team doesn’t have to. Just tell us about your product and we take care of the rest.

As we mentioned earlier, most tax software has a limited number of tax codes. If one of your products or services doesn’t fit into one of those tax code descriptions, you’ll be on your own to calculate the appropriate tax rate.

FastSpring solves this problem by offering custom tax codes. We can create a unique tax code for any product or service in just a few minutes.

Calculate and Collect Tax at Checkout With Minimal Setup

Our team ensures the correct amount (and type) of indirect tax is being collected at checkout — we even handle tax-exempt transactions in the U.S. and 0% reverse charges when allowed internationally.

Although we calculate and collect indirect taxes for you, you’ll have full control over the look and feel of your checkout. Here’s a brief overview of the options you’ll have for your checkout:

- Three options for setup: You can have your checkout popup over your website or embedded into your website. You can also redirect customers to a web storefront hosted by FastSpring.

- Visual customization options: You can change the look and feel of your checkout with CSS overrides and custom brand tools.

- Customize the buyer’s journey. FastSpring’s JavaScript Store Builder Library lets you add FastSpring elements (e.g., buttons) to steps leading up to checkout. This lets you manage upsells, cross-sells, and more.

- Localization: FastSpring automatically converts prices to the local currency and translates text to the local language based on the buyer’s location (you can also let the buyer choose their preferred language/currency).

- Dozens of preferred payment methods around the world. FastSpring partners with payment gateways that specialize in global transactions so you can offer dozens of payment methods (and ensure high authorization rates).

“At DaisyDisk, we’re obsessed with the user experience. We chose FastSpring because it provides an easy, localized purchasing experience for every customer, everywhere. FastSpring handles all the details — we don’t even have to think about it.”

— Oleg Krupnov, Founder and CEO at DaisyDisk

Click here to read the DaisyDisk case study.

Ensure Full Tax Compliance in Every Jurisdiction You Do Business In

Our team remits indirect taxes for you and ensures all the necessary procedures are in place for full compliance.

With over 20 years of experience filing 1,200+ tax returns each year, we know what it takes to stay compliant across the globe.

If you want to expand into a new territory, just reach out to us and we’ll start the process for maintaining compliance in that region.

“Thanks to FastSpring, we entered the international market and are successfully receiving payments from customers from all over the world.”

— Paul Mit, Co-Founder and Chief Growth Officer, FlowMapp

Click here to read the FlowMapp case study.

Note: Some countries have been sanctioned by the United States Government, meaning all transactions within that country are prohibited. FastSpring adheres to these laws.

Backed by Tax Specialists Around the World

Not only do we have a dedicated in-house team with over ten years of experience, but we also build and maintain relationships with tax specialists across the world. This ensures we are aware of laws and regulations as they change.

In the case of audits, our team takes the lead. If a country or state approaches you about tax compliance, our team will often provide copy-and-paste responses.

Handle Indirect Tax and Your Entire Payment Platform for One Flat-Rate Fee

FastSpring provides solutions for the entire payment lifecycle, including:

- Global payment processing

- Subscription management

- Checkout

- Digital invoicing (for B2B transactions)

- Reporting and analytics

- And much more …

All FastSpring solutions are offered for one flat-rate fee based on the volume of transactions you move through our platform. There are no hidden fees and you won’t be charged until a transaction takes place.

Request a demo or sign up for a free account to learn more.

“We were focused on not only finding an ecommerce platform that worked but also on building a relationship and partnership, which I believe is very important. You don’t want to buy something and then be alone. You need a good partnership. In the end, we picked FastSpring because they showed us they wanted to be a true partner.”

— Frederic Linfjärd, Digital Commercial Manager at Capture One

Click here to read the Capture One case study.

Conclusion: Tax Software vs. Tax Consultants vs. FastSpring

FastSpring is the only solution in this guide that takes on indirect tax liability for you. Plus, we automate the entire process of calculating, collecting, and remitting indirect tax.

Tax software and tax consultants can be useful if you’re set on handling indirect taxes yourself, but be prepared to dedicate an enormous amount of time and resources to the task.

If you think FastSpring is the right tax solution for your SaaS business, request a demo or sign up for a free account.

Frequently Asked Questions

What Are SaaS Tax Requirements by State?

While there are some generalizations that can be made, each state will have its own tax rules for how they tax SaaS products — and those sales tax laws are constantly changing. Furthermore, each zip code within each state may be taxed differently (resulting in 12,000+ taxing jurisdictions throughout the U.S.).

Here’s a brief overview of sales tax obligations by state (at the time of writing).

SaaS is taxable in Alaska, Arizona, Hawaii, Kentucky, Louisiana, Massachusetts, New Mexico, New York, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Utah, Washington, and West Virginia.

SaaS is non-taxable in Arkansas, California, Colorado, Florida, Georgia, Idaho, Illinois, Indiana, Kansas, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Jersey, New Hampshire, North Carolina, North Dakota, Oklahoma, Oregon, Vermont, Virginia, Wisconsin, and Wyoming.

Some SaaS may be taxable (depending on if it’s for business use or personal use) in Connecticut, Iowa, Maryland, and Ohio.

SaaS is partially taxable in Texas.

Is SaaS Taxable Internationally?

Yes. Although not every country taxes sales of digital goods, more and more countries are passing laws targeting nonresident software companies in order to level the playing field for local companies (who are at a disadvantage if their overseas competitors are not required to collect tax).

What’s the Risk of Ignoring Sales Tax, VAT, and GST?

The risk of ignoring sales tax, VAT, and GST will be different for company and jurisdiction. However, here are a few things to consider:

- You could end up owing huge fines and penalties.

- You could be banned from transacting in that state, country, or province.

- You could end up paying years worth of indirect taxes. (If you collect indirect taxes in the right amount, you won’t have to pay anything. On the other hand, if you aren’t collecting indirect taxes, those taxes will come out of your pocket.)

- It could affect the valuation of your company. (We’ve seen million dollar price adjustments because a small software company was noncompliant with indirect tax laws.)

- Your company could be added to a public blacklist to encourage people not to do business with you.

Learn more: Can SaaS Companies Afford to Ignore Sales Taxes and VAT? – FastSpring

What Is “Nexus”?

Nexus thresholds are what determine whether or not you have to charge sales tax in a given state. Historically, a company had to have a physical presence in a state (i.e., an office building or remote employees) in order to fall under that state’s sales tax jurisdiction.

However, the United States Supreme Court’s ruling on South Dakota vs. Wayfair in 2018 changed that. Now, each state can consider revenue earned when determining nexus. For many states, the economic nexus threshold is $100,000. If you earn over $100,000 in revenue from transactions in that state, you’ll be required to collect and remit sales tax — even if you don’t have a physical presence in that state.

What’s in the Future for Indirect Tax Requirements for SaaS?

More and more countries that didn’t tax sales of digital goods are passing new laws that target nonresident SaaS companies. And, many countries are finding ways to enforce their tax laws more strictly.

Additionally, the EU is rolling out electronic invoicing requirements in 2028 (many countries already have this requirement in place for business with legal entities in that country). This will require all businesses — resident and non-resident — to submit electronic invoices in real-time for every transaction. Not only will this help them enforce compliance with VAT laws, but many countries will likely follow suit.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)