FastSpring Welcome Guide

Now that your FastSpring Store is live, we want to make sure you have all of the information you need to succeed. We designed this Welcome Guide to be an educational resource that you can refer to and share with your team.

You’re officially on your way to making more money, out-innovating your competitors, and delivering a world-class commerce experience. Welcome aboard, and we’re happy to have you in the FastSpring seller community!

All the best,

The FastSpring Team

How should my support team handle transaction inquiries?

If your support team receives inquiries from your customers regarding a transaction, advise them to contact us via FastSpring Consumer Support. This is the fastest way for us to manage transactional inquiries.

When consumers contact us through FastSpring Consumer Support, we can assist with:

- Questions about previous successful or declined orders

- Questions about sales tax or VAT

- Other transaction-related questions

How do I get support for an issue with my Account or Store?

When you cannot find an answer in our Seller Self-Service Resources, or if you need additional information or assistance, the FastSpring Support team is here to help you.

Visit the Customer Support Portal to contact us for additional help related to your account, Stores, reporting, or technical issues.

New Vendor Onboarding

If a corporate customer is interested in setting up a new vendor portal, or requires the completion of forms to conduct business, visit the FastSpring Vendor Onboarding Fact Sheet for commonly needed information.

Additionally, most commonly requested documents can be accessed via the Public tab in the FastSpring Trust Center.

For information not covered, submit a ticket to our support team. Our team will be happy help.

Important details about your Hyperwallet setup

Only one email is enabled to access your FastSpring Payouts account. The default Admin is the original email used to create your FastSpring account. Ensure you are the correct user within your organization before you complete this setup. Learn how to Activate Your Payout Account

How do I get paid?

FastSpring is committed to ensuring you receive your payouts in a timely and secure manner that works best for you.

FastSpring will fund your FastSpring Payouts account according to your current Payment Frequency and you will manage disbursement from the FastSpring Payouts Portal.

Sellers who split their revenue with other partners will experience no interruption in service, and partners will receive funds through their dedicated FastSpring Payouts account.

Learn how to Manage your FastSpring Payouts Portal

When do I get paid?

If you have worked with FastSpring to set up your payouts in a unique way, this payout schedule may not be relevant to you.

FastSpring typically makes payouts to our clients on a Monthly or Twice-Monthly basis. For clients whose payment frequency is Monthly, payouts are generally issued on or around the 14th or 15th of each month and reflect the sales from the previous calendar month.

To identify the payment frequency for your Store, navigate to your Account Summary in the FastSpring App. The Payment Frequency field indicates how often FastSpring makes payouts for the Store.

Most FastSpring clients have a payment frequency of Two per Month.

With this setting, you are paid every two weeks, with a delay of approximately two weeks from the end of a payment period until the payout is issued:

| Sales Transaction Date | Approximate Payout Date |

|---|---|

| 1st through the 14th of the month | 30th or 31st of the month |

| 15th through the end of the month | 14th or 15th of the next month |

Minimum Payments

If your account balance is less than the Minimum Payment Amount shown on the Account page, no payment is issued. In that case, your balance carries forward to the next payment period. For example, if your payment frequency is Two per Month, your balance will carry forward to your payment in two weeks. FastSpring Support can change the minimum payment amount at your request. For more information, see Receiving Payouts

Related Resources:

How do I calculate my Payout?

The amount that you receive in the Payouts Portal depends on the payout frequency that you set up for your store. This amount reflects the profit you have earned after all applicable fees are applied to your balance. It is displayed as negative because it will be transferred out of the App, into your Payouts Portal.

If your scheduled payout date falls on a US bank holiday or a weekend, you will receive the payout the following business day.

In the Account Transactions page, you will see:

- Orders & Returns – The total amount made from purchases after subtraction of refunds and chargebacks

- Adjustment – Manual changes made by FastSpring specialists when requested

- Payment – The sum of all Orders & Returns and Adjustments for the applicable pay period. This amount is displayed as negative because it will be transferred out of the App, into your Payouts Portal.

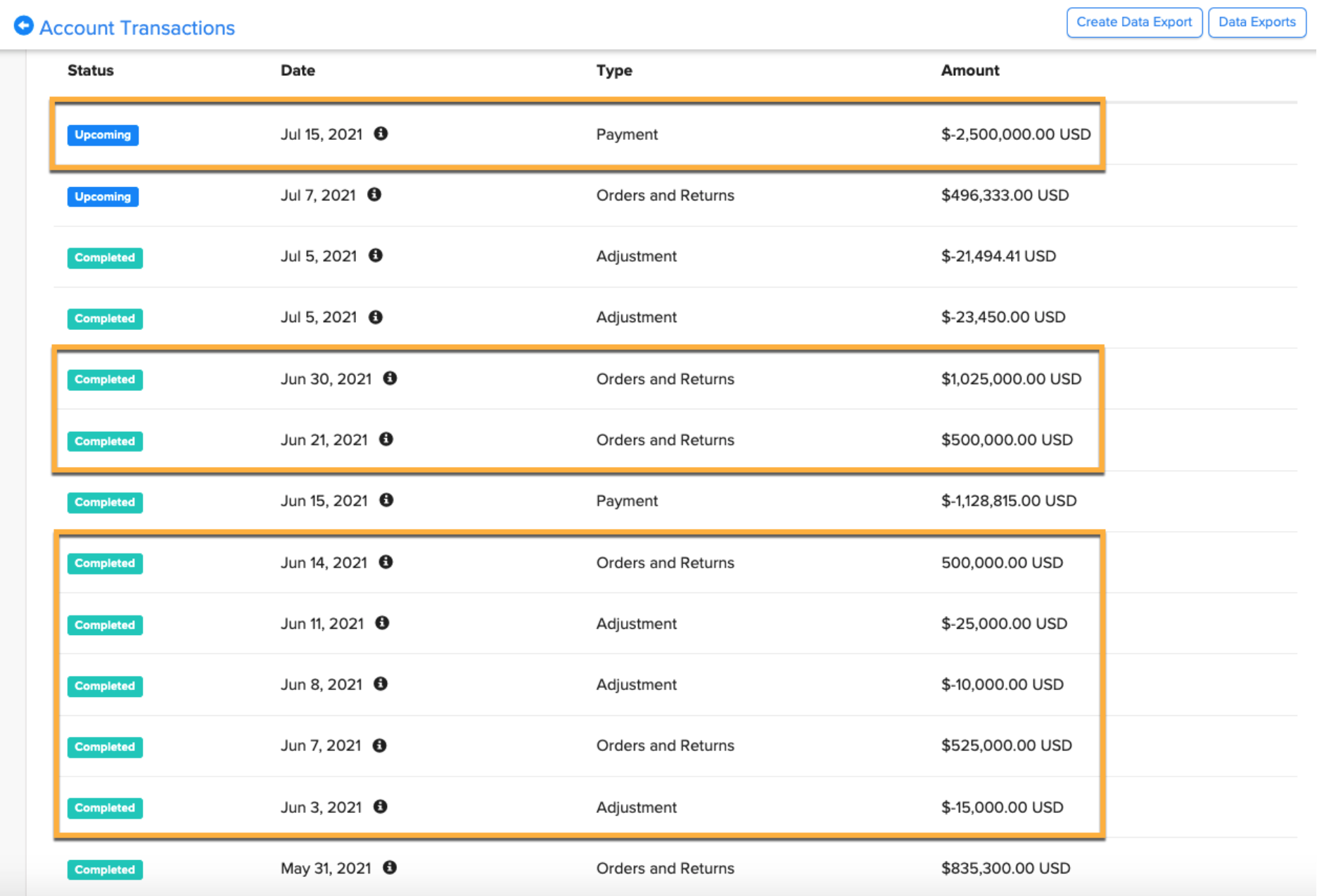

Monthly Payouts

If you have configured monthly payouts, you will receive the payout on the 15th of each month. Each payout reflects the profit earned from the previous month. For example, the July 15th payout reflects all of the June transactions.

- In the FastSpring App, navigate to Account. Click on your balance to view all of your Account Transactions.

- Add all Orders & Returns and Adjustments for the applicable month. Note that Adjustments appear as negative amounts.

- The sum of the Orders & Returns and Adjustments is the amount of the Payment, which will be transferred to your FastSpring Payouts portal on the 15th of the next month.

In the example below, the June payout will be disbursed on July 15, 2021 for a total payout of $2,500,000 USD based on the combined orders, returns and adjustments that occurred in June.

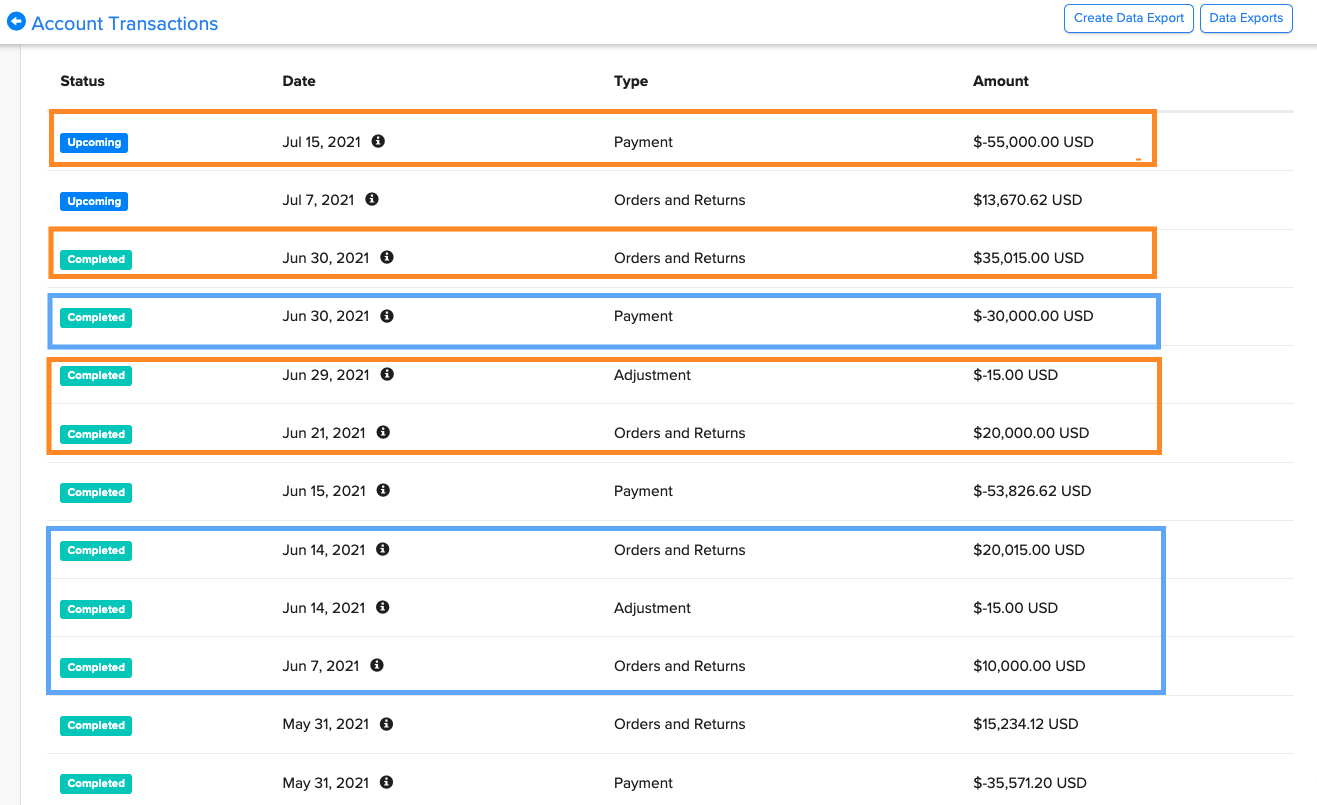

Two Payouts Per Month

Most sellers configure two payouts per month. With this setting, you are paid every two weeks, with a delay of approximately two weeks from the end of a payment period until the payout is issued.

- For sales transactions during the 1st through 14th of the month: approximate payout date will be the 30th or 31st of the month.

- For sales transactions from the 15 through the end of the month: approximate payout date will be 14th or 15th of the next month

- New accounts: For brand new accounts, it may take longer to receive your very first payout

To calculate your next payout:

- In the FastSpring App, navigate to Account. Click on your balance to view all of your Account Transactions.

- Add all Orders & Returns and Adjustments in the pay period 2 weeks prior to the payout date. For example, if you would like to know how much you will receive on June 30, calculate the sum of the transactions from June 1 through June 14.

- The sum of the Orders & Returns and Adjustments is the amount of the Payment, which will be transferred to your FastSpring Payouts portal 2 weeks after the period ends.

In the example below, the payment on June 30 for $30,000 USD is the sum of all transactions that occurred between June 1 and June 15. The payment on July 15 is the sum of all transactions that occurred between June 16 and June 30.

How do I run reports?

The Reports menu in the FastSpring App includes reports for Events and Data Exports. Select the Events tab to see recent events of all types, or select Data Exports to create data exports or access legacy/original reporting. The Subscription Overview and Revenue Overview dashboards also have detailed reporting available.

Related Resources:

How do I add my logo to customer-facing emails?

By default, FastSpring automatically sends transactional email messages to your customers, such as email receipts and notifications about subscription charges.

To include your logo on customer-facing emails, you need to host the logo image file externally so it can be accessed via a URL.

For emails, we recommend using a logo image no wider than 275 pixels; the default FastSpring logo image is 143 x 35 px.

How to add your logo:

- In the FastSpring App, navigate to Settings > Customer Emails.

- On the left-hand side of the page, select Shared Snippets.

- In the list of shared snippets, locate the one named {{>logo}}; you may need to scroll down to find it. Click Edit below the {{>logo}} snippet.

- In the Shared Snippet dialog, delete the default placeholder image URL from the Snippet Text/HTML Value field and enter the URL for your logo image.

- Click Save.

Related Resources

Can I see examples of other FastSpring Checkout experiences?

Whether you’re selling digital products, subscriptions, or software, our customizable checkout experiences are designed to create a seamless and fast shopping experience you and your customers will love.

Curious to see what partnering with FastSpring could look like? Take a look at these FastSpring customer checkout flows to see what’s possible.

Related Resources

- Create and Customize your Popup Storefront

- Customizing Your Web Storefront

- Embedded Storefront

- Store Builder Library Overview

Provide your feedback below on this article to help us improve!

Updated about 2 months ago