Product Tax Category

When you configure a product for the first time, FastSpring displays a questionnaire to help you select the most appropriate tax category.

Apply one tax category to each product. FastSpring cannot advise you or make the selection for you. As long as you select a tax code that is relevant to your product, you will be in compliance.

Virtual Product Portfolio (VPP) Sellers: You do not need to configure individual product categories. All VPP products use tax code D9999999 (Temporary unmapped digital goods sku – taxable default) unless your default store code differs.

If the options do not apply to your product, search for the most accurate tax code and submit it to FastSpring Support.

Add or Edit a Product Tax Category

- In the FastSpring App, navigate to the details page of the product you would like to update.

- Above the Overview section, click the link next to Product Category.

- If you have already applied a tax category to the product, the link displays the tax code. Otherwise, the link reads Unspecified.

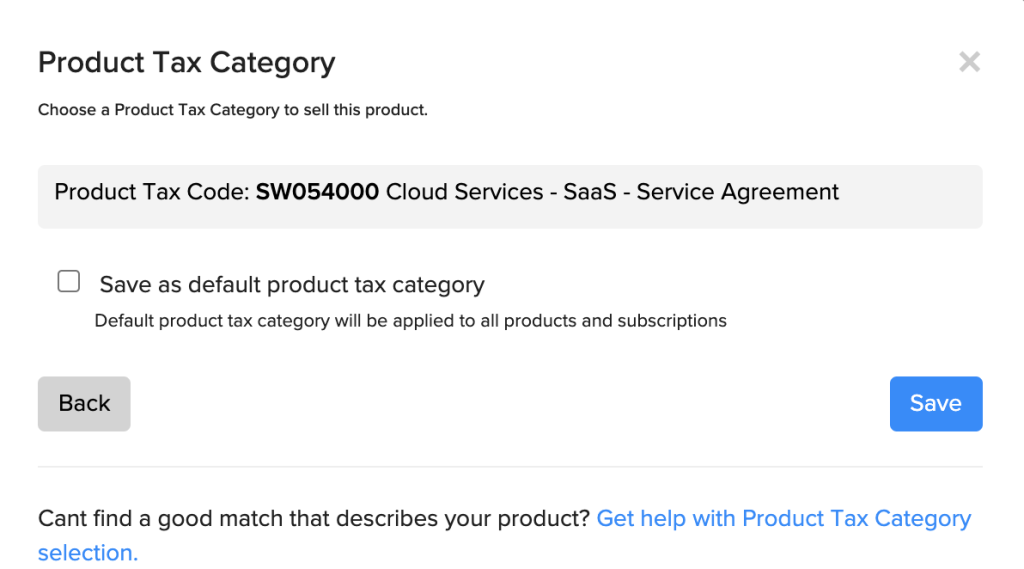

- In the Product Tax Category dialog, select the most appropriate option.

- Following questions vary depending on your selection in step 3. Select the most appropriate option for each question until you see a tax code.

- Optionally, select Save as default tax category. FastSpring will apply this code to all current and future products. You can edit this in each product’s details page.

- Save your changes.

Updated 4 months ago