Receiving Payouts

Through your Payouts Portal, FastSpring typically makes payouts on a monthly or biweekly basis, depending on the configuration in your Account.

In order to receive your payout, there must be a balance of your preset minimum in your account by the payout date. If you do not have sufficient funds on that date, they will carry over to the following payout date.

FastSpring will fund your FastSpring Payouts account according to your current Payment Frequency and you will manage disbursement from the FastSprings Payouts portal. Sellers who split revenue with other partners will experience no interruption in service and partners will receive funds through their dedicated FastSpring Payouts account.

Activate to Avoid Payout Delays

The FastSpring Payouts Portal requires a one-time account activation that is separate from your FastSpring App account. When you receive a notification to activate FastSpring Payouts, make sure to complete the activation so that we can fund your account as scheduled.

Set up your Payout Frequency

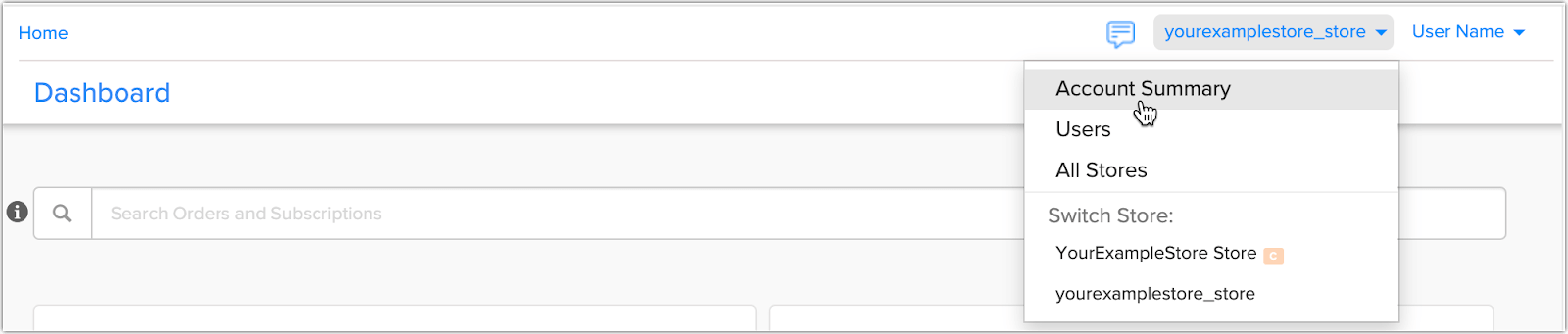

- In the FastSpring App, navigate to your Account Summary.

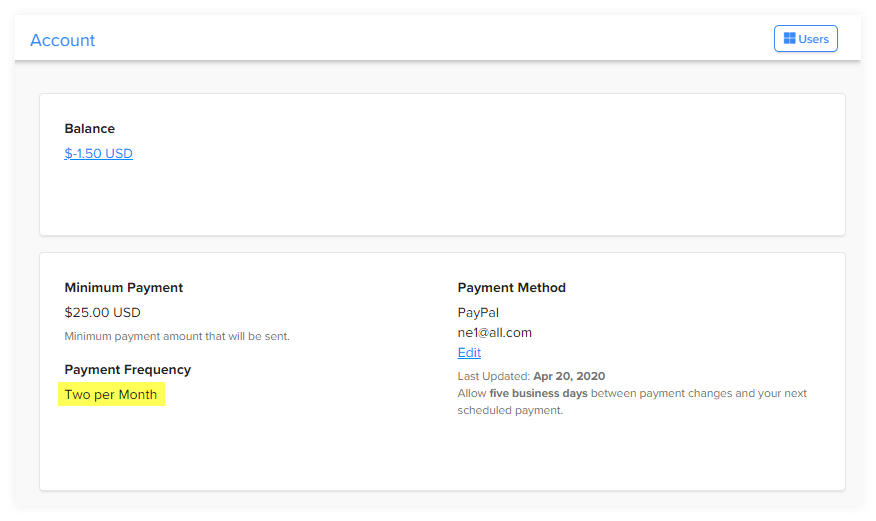

- On the left side of the Account page, the Payment Frequency field indicates how often FastSpring makes payouts for the Store.

Most FastSpring Sellers have a payment frequency of Two per Month. With this setting, you are paid every two weeks, with a delay of approximately two weeks from the end of a payment period until the payout is issued.

When payment frequency is Monthly, payouts are generally issued on or around the 14th or 15th of each month for sales from the previous calendar month.

Payout dates

- For sales transactions during the 1st through 14th of the month: approximate payout date will be the 30 or 31 of the month.

- For sales transactions from the 15 through the end of the month: approximate payout date will be 14th or 15th of the next month

- New accounts: For brand new accounts, it may take longer to receive your very first payout.

When your usual payout date falls on a weekend or a U.S. holiday, the payment will occur on the following business day.

Minimum Payment Setting

If your account balance is less than the Minimum Payment amount shown on the Account page, no payment is issued. In that case, your balance carries forward to the next payment period. For example, if your payment frequency is Two per Month, your balance will carry forward to your payment in two weeks. FastSpring Support can change the minimum payment amount at your request.

See also: Payment Details

Payout Currency

Your FastSpring Payouts account can be funded in:

- USD – U.S. Dollars

- EUR – Euros

- GBP – Pounds Sterling

- AUD – Australian Dollars

- CAD – Canadian Dollars

Change your Payout Currency

For funding in currencies other than USD, FastSpring charges a 2.5% currency conversion fee.

- In the FastSpring App, navigate to Store Menu > Account Summary.

- Under Payout Details, click the Edit link next to your current currency selection.

- On the Payment Methods page, click Edit in the FastSpring Payouts row.

- Under FastSpring Payouts Setup, select your preferred currency from the FastSpring Payouts Currency drop-down menu.

How to Calculate the Payout

The amount that you receive in the Payouts Portal depends on the payout frequency that you set up for your store. This amount reflects the profit you have earned after all applicable fees are applied to your balance. It is displayed as negative because it will be transferred out of the App, into your Payouts Portal.

If your scheduled payout date falls on a US bank holiday or a weekend, you will receive the payout the following business day.

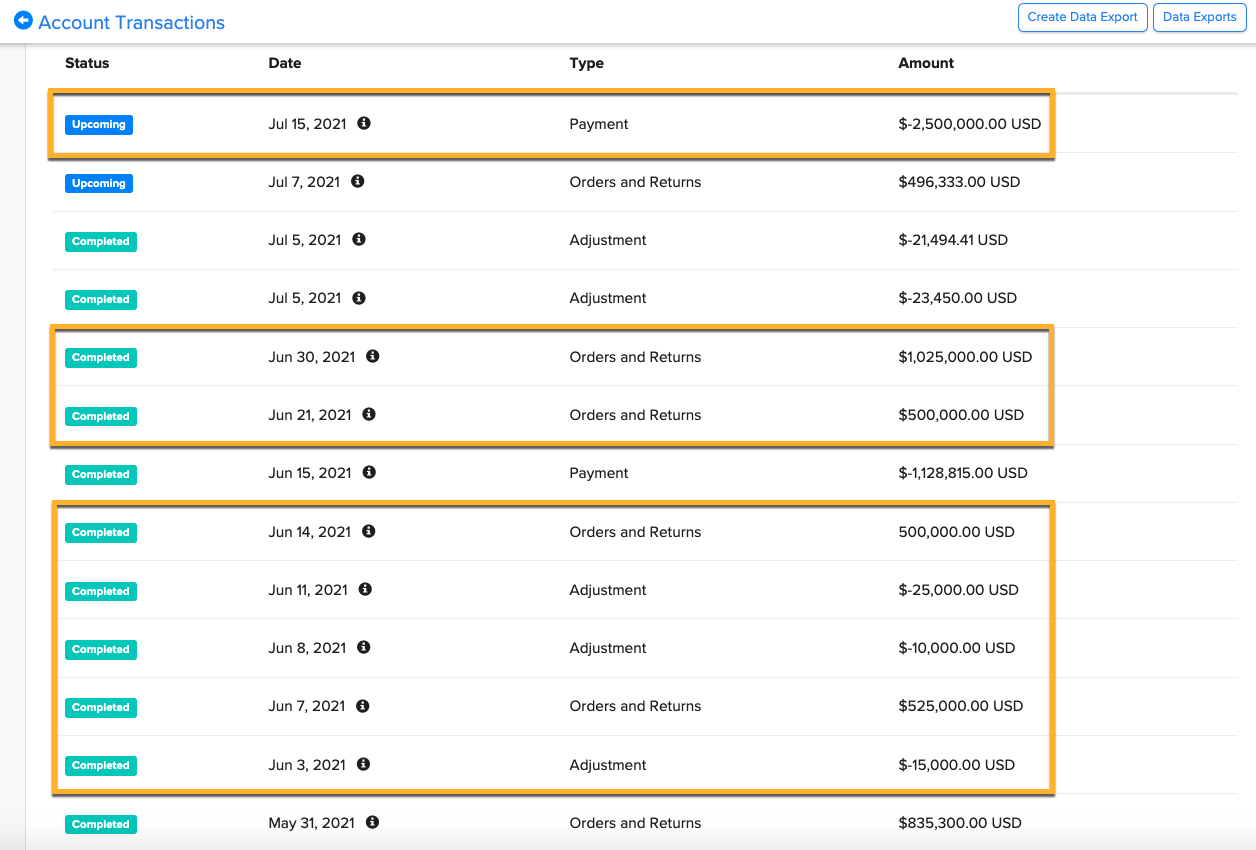

In the Account Transactions page, you will see:

- Orders & Returns –The total amount made from purchases after subtraction of refunds and chargebacks

- Adjustment – Manual changes made by FastSpring specialists when requested

- Payment –The sum of all Orders & Returns and Adjustments for the applicable pay period. This amount is displayed as negative because it will be transferred out of the App, into your Payouts Portal.

Monthly Payouts

If you have configured monthly payouts, you will receive the payout on the 15th of each month. Each payout reflects the profit earned from the previous month. For example, the July 15th payout reflects all of the June transactions.

- In the FastSpring App, navigate to Account. Click on your balance to view all of your Account Transactions.

- Add all Orders & Returns and Adjustments for the applicable month. Note that Adjustments appear as negative amounts.

- The sum of the Orders & Returns and Adjustments is the amount of the Payment, which will be transferred to your FastSpring Payouts portal on the 15th of the next month.

In the example below, the June payout will be disbursed on July 15, 2021 for a total payout of $2,500,000 USD based on the combined orders, returns and adjustments that occurred in June.

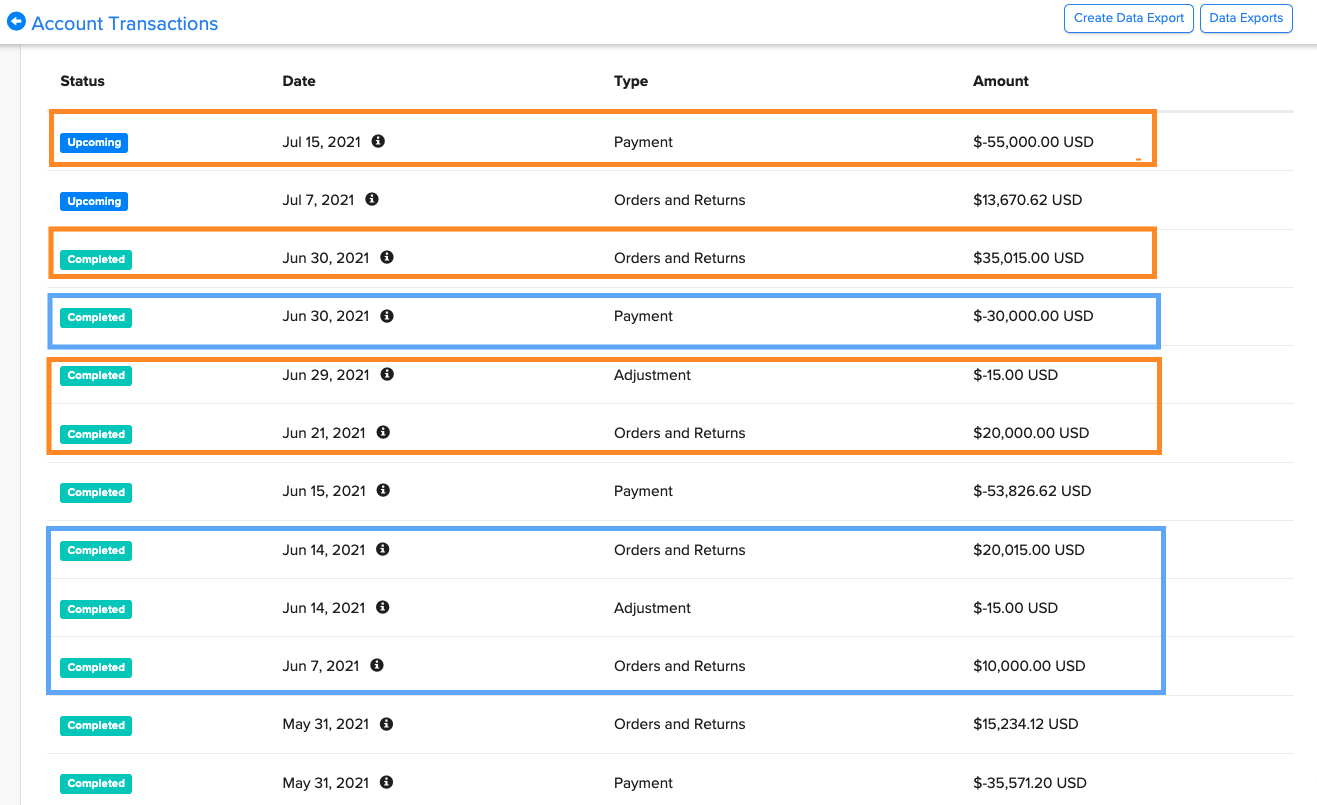

Two Payouts Per Month

Most sellers configure two payouts per month. With this setting, you are paid every two weeks, with a delay of approximately two weeks from the end of a payment period until the payout is issued.

- For sales transactions during the 1st through 14th of the month: approximate payout date will be the 30th or 31st of the month.

- For sales transactions from the 15 through the end of the month: approximate payout date will be 14th or 15th of the next month

- New accounts: For brand new accounts, it may take longer to receive your very first payout

To calculate your next payout:

- In the FastSpring App, navigate to Account. Click on your balance to view all of your Account Transactions.

- Add all Orders & Returns and Adjustments in the pay period 2 weeks prior to the payout date. For example, if you would like to know how much you will receive on June 30, calculate the sum of the transactions from June 1 through June 14.

- The sum of the Orders & Returns and Adjustments is the amount of the Payment, which will be transferred to your FastSpring Payouts portal 2 weeks after the period ends.

In the example below, the payment on June 30th for $30,000 USD is the sum of all three transactions that occurred between June 1 and June 15.

Payout Refunds

Split Accounts

In a situation where you have a split account, your partner takes a certain percentage of the sales or a certain percentage of the revenue that remains after the FastSpring fee.

Example 1: Fixed Percent of Sale Price

The customer paid $100 for your product and your partner gets a 70% split. $100 goes into your account, and then part of it comes out for the FastSpring fee. In this example, the FastSpring fee is $5.00 (your actual fees may vary). $5.00 would come out of the $100 order, leaving your account with $95.00. Then your partner’s 70% split would be deducted next and paid into their account; that is, ($100 x 0.70), or $70. This would leave ($95 – $70), or $25, credited to your account.

If there is a full refund, the $70 is removed from your partner’s account and put back into your account. FastSpring returns the $100 from your account to the customer and retains the order fee.

Example 2: Fixed Percent of the Revenue

The customer paid $100 for your product and your partner gets a 70% split. $100 goes into your account, and then part of it comes out for the FastSpring fee. In this example, the FastSpring fee is $5.00 (your actual fees may vary). $5.00 would come out of the $100 order, leaving $95.00. Then your partner’s 70% split would be deducted next and paid into their account; that is, ($95 x 0.70), or $66.50. This would leave ($95 – $66.50), or $28.50, credited to your account.

If there is a full refund, the $66.50 is removed from your partner’s account and put back into your account. FastSpring returns the $100 from your account to the customer and retains the order fee.

Bank Transfers

Bank transfers are typically not refundable, but there are alternate ways FastSpring can refund the order.

- If the customer has a PayPal account, we can create a manual refund through PayPal. This is the easiest option.

- If the customer does not have a PayPal account:

- We can send the customer a USD check. If the customer is outside of the United States, before sending the check, we need to verify that the customer can deposit it. There is a $10 fee for sending a check, which we deduct from the refund amount.

- We can send the customer a bank transfer manually. There is a $30 fee for a manual bank transfer, which we deduct from the refund amount.

Updated 4 months ago