When you’re expanding your software business into new regions, industry benchmarking data can help you make better strategic decisions by answering important questions about business in the region.

Here are the questions we sought to answer by analyzing anonymized subscription data for transactions across various Asian countries (excluding broader “APAC” regions like Australia, New Zealand, and Indonesia):

- How do customers in Asia’s growing markets prefer to manage their SaaS subscriptions?

- Are their preferences similar to those in the U.S. or EU, or are they different?

- Do regional nuances, such as the choice between annual and monthly plans, significantly impact renewal rates?

- How can businesses best position their subscription products for success in the Asian market?

Drawing on anonymized global subscription data, we compared monthly and annual subscription renewal rates between Asia, the United States, and the European Union for products across multiple SaaS verticals.

Here’s what we uncovered:

Key Insights Into How Asia-Region Customers Renew SaaS Subscriptions

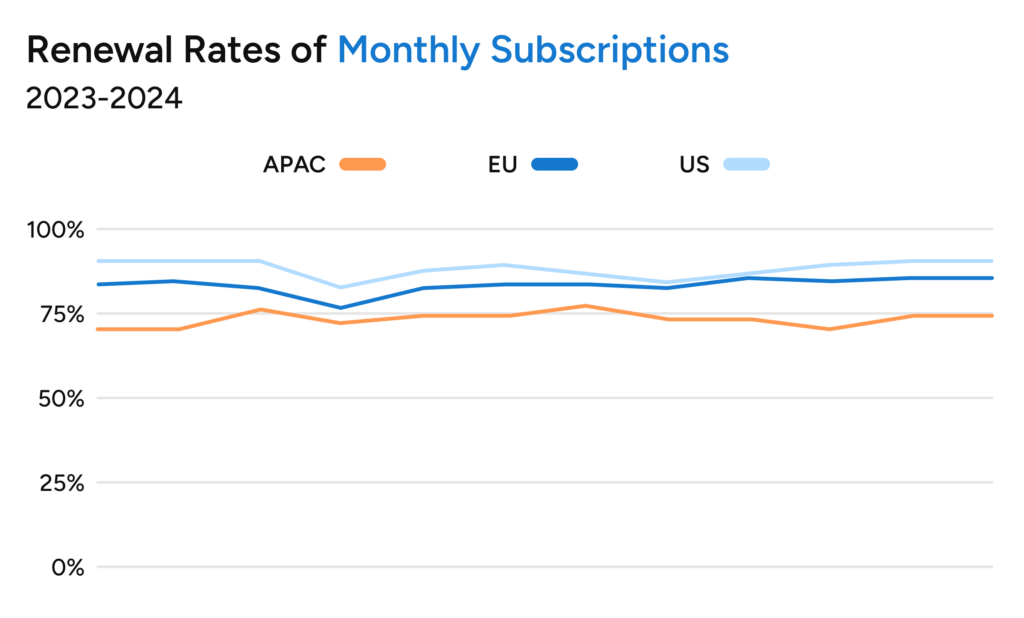

1. Monthly subscription renewals are lower in Asia than in the EU and the U.S., but they’re growing.

When it comes to monthly SaaS subscriptions — i.e., those that renew each month with the option to cancel at any time — both the EU and the U.S. report similar average renewal rates in the upper 80th percentile. The EU monthly renewal rates averaged 85% over the last 12 months, while the U.S. averaged 89%. This means that, for example, for every 100 U.S. customers in June, about 89 will renew their subscription for July.

However, in Asia, retention for monthly subscriptions is notably lower at 75%. If you’re selling software at the same price into both the U.S. and Asia, this subscription rate difference represents a 16% lower lifetime value (LTV) for Asia-area customers.

That said, there’s a silver lining: While monthly retention in the EU and North America remained stable from 2023 to 2024, Asia’s monthly retention rate improved by approximately 3%, showing positive momentum.

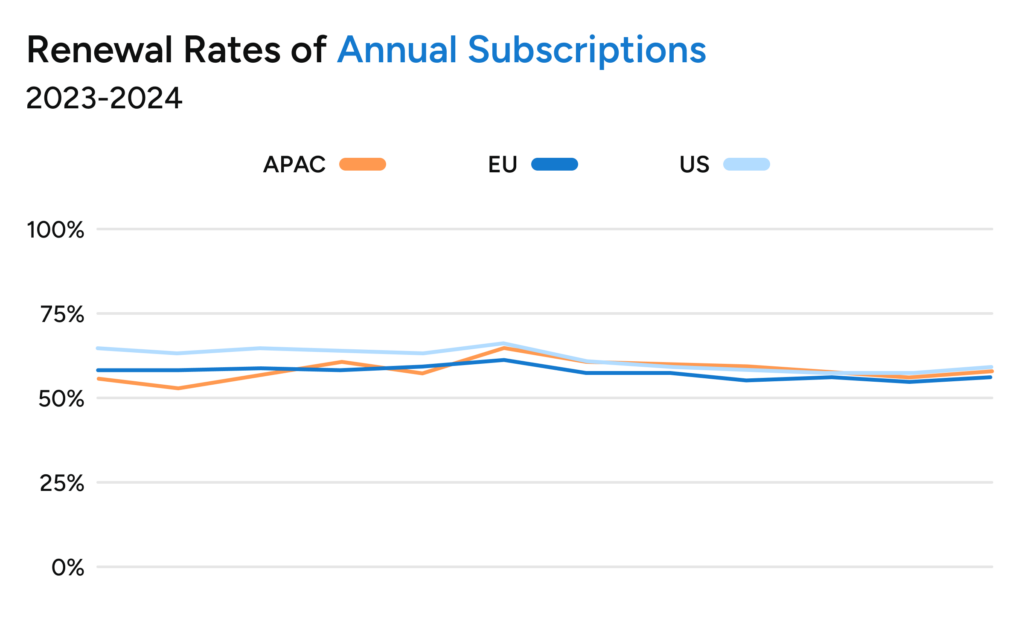

2. Annual subscriptions in Asia match or exceed renewal rates in other regions.

Annual SaaS subscriptions — i.e., those that renew once per year — paint a different picture. In the EU, customers renewed annual subscriptions at a rate of 55%, compared with 56% in Asia and 59% in the U.S.

Here we see Asia-area customers renewing annual subscription rates at much closer rates to global averages.

Conclusions

What we can conclude from this data is that customers in Asia are less likely to renew monthly subscriptions than customers in other global markets, but are just as likely to renew annual subscriptions.

This provides some crucial insights for SaaS companies selling into Asian markets — particularly when those companies use U.S. and EU customer data to set “one-size-fits-all” global pricing. Those pricing models may not hold up globally given the different regional customer trends.

Specifically, if you have set your monthly subscription pricing for all markets based on EU and U.S. customer trends, you may be disappointed by the financial performance of monthly subscriptions in Asia, given the likely 15% drop in LTV for that region.

A better bet is to promote annual subscriptions in Asia, where customer behavior better matches other global markets. With very similar renewal rates, your pricing model will more likely deliver the LTV, profitability, and subsequent growth that your business is expecting.

Strategy: Focus on Annual Subscriptions to Build a Strong APAC Subscriber Base

Prioritizing annual subscription models could prove to be the key to success for businesses looking to expand into Asia. Here are seven strategies to grow your annual subscription base in Asia.

7 Strategies for Growing Annual Subscriptions in Asia

1. Emphasize Annual Plans in Your Marketing

Given the stronger retention rates for annual subscriptions in Asia, make them a core focus in your marketing efforts. Offer exclusive incentives, such as discounts or bonuses, to encourage customers to commit to a yearly plan and maximize long-term retention.

2. Tailor Pricing to Favor Annual Subscriptions

Competitive pricing is crucial. Design pricing strategies that make annual plans more attractive than monthly ones, offering a noticeable discount for committing to a full year. This approach taps into Asia’s apparent preference for long-term subscriptions.

3. Leverage Popular Local Payment Methods

Simplifying the payment process is essential, especially for annual plans. Offering widely-used local payment options — such as AliPay or WeChat Pay — helps reduce friction at checkout and boosts customer satisfaction, leading to higher renewal rates.

4. Invest in Customer Support to Drive Retention

Retaining annual subscribers requires ongoing support. Ensure that your customer service is not only easily accessible but also localized to the region, with support offered in local languages. This can help address any issues or concerns over the subscription period and build trust, fostering long-term retention.

5. Reward Loyalty With Renewal Incentives

Consider implementing loyalty programs that reward customers for renewing their subscriptions. This is particularly effective for annual plans, where the stakes are higher and a single renewal carries more weight.

6. Monitor Regional Retention Trends

While the insights shared here are valuable, it’s important to regularly review your own subscription data across different regions. Each region is not a monolith, so trends can also vary from country to country, and even the type of business or software you offer may affect how receptive each area is to subscriptions. Staying on top of retention trends across Asia compared to North America and the EU will allow you to adjust your strategy and better meet the evolving needs of each market.

7. Localize the Customer Experience

Localization extends beyond just offering your checkout in many languages and currencies. Tailor your product features, pricing, and customer support to reflect regional preferences. By aligning your subscription offerings with the cultural and business nuances of each market in Asia, you can significantly boost long-term retention.

Let FastSpring Help You Take Your SaaS to Asia

FastSpring is the leading full-stack merchant of record service for growth-stage SaaS and software businesses. If you’re looking for a merchant of record to help your business expand globally, we’re here to help.

And with the opening of FastSpring’s office in Singapore in January 2024, this strategic expansion marks a significant milestone in our journey to strengthen our global footprint and better serve our clients in the Asia-Pacific (APAC) region.

✦ Meet FastSpring Senior Account Executive Jay Jia and benefit from his expertise about growing a digital goods business in Asia in this deep diving podcast interview. ✦

Our platform serves as an all-in-one payment platform that handles everything from payment and checkout localization, to sales and VAT tax management, to customer support for end consumers, and so much more.

Learn more about how FastSpring can help you grow your business globally: Set up a demo or try it out for yourself.