Most subscription billing platforms let you:

- Automate invoicing and payments.

- Customize and manage one or more subscription and trial models.

- Provide a self-service portal to customers so they can manage their accounts (including payment information, seats, and more).

- Offer and manage one-time add-ons, coupons, and more.

- Gather metrics and view reports on monthly recurring revenue.

However, the vast majority of companies doing subscription billing will also need a solution for other aspects of subscription billing management including:

- Payment processing.

- Fraud prevention and chargebacks.

- Collecting and remitting consumption tax.

- Legal compliance.

- And more.

Many subscription billing platforms won’t cover these essential aspects of managing subscriptions.

Plus, you’ll need to consider whether or not the billing platform supports businesses like yours. For example, some billing solutions only support SaaS companies while others also support companies selling physical goods and/or services (e.g., gym memberships, monthly food clubs, or remote accounting services).

In this post, we compare five top subscription billing platforms by specifying which areas of the billing lifecycle they support, what other solutions you’ll need to add, and what types of companies they serve.

Our solution, FastSpring, lets global SaaS companies handle everything on both lists above. So, we’ll start with a deep dive into FastSpring. The remaining options on this list serve both ecommerce and companies selling physical goods and services.

Table of Contents

FastSpring handles the entire payment and subscription billing process for global SaaS companies, from checkout to remitting end-of-year taxes. To learn more about how FastSpring can help you scale quickly, sign up for a free account or request a demo.

FastSpring: Comprehensive Subscription Billing Platform for Global Software Companies

FastSpring is a comprehensive payment solution built for SaaS companies and companies selling digital and/or downloadable goods. With FastSpring, B2B and B2C software companies can manage:

- Multiple subscription models, trials, one-time add-ons, discounts, and more.

- Automated invoices and customer notifications.

- Payment processing (for tons of payment methods around the world).

- A fully managed self-serve portal for customers.

- Reporting and analytics.

- And much more.

Plus, FastSpring takes on the liability of transactions, which means we manage chargebacks, fraud prevention, gathering and remitting consumption tax, and legal compliance.

As you grow, there won’t be any surprise costs because all FastSpring features are offered for one flat-rate price based on the volume of transactions you move through FastSpring — and you’ll only be charged when transactions take place.

In the following sections, we take a closer look at how to:

- Build Custom Subscription Models and Trials without Code

- Let Customers Manage Account Details from a User-friendly Portal

- Optimize Your Checkout Process to Increase Conversions

- Protect Your Company from the Legal Liability of Transactions

- Let FastSpring Gather and Remit VAT and Sales Tax for You

- Automate Payment Failure Handling and Reduce Churn

- Automatically Gather Key Metrics and View Detailed Reports

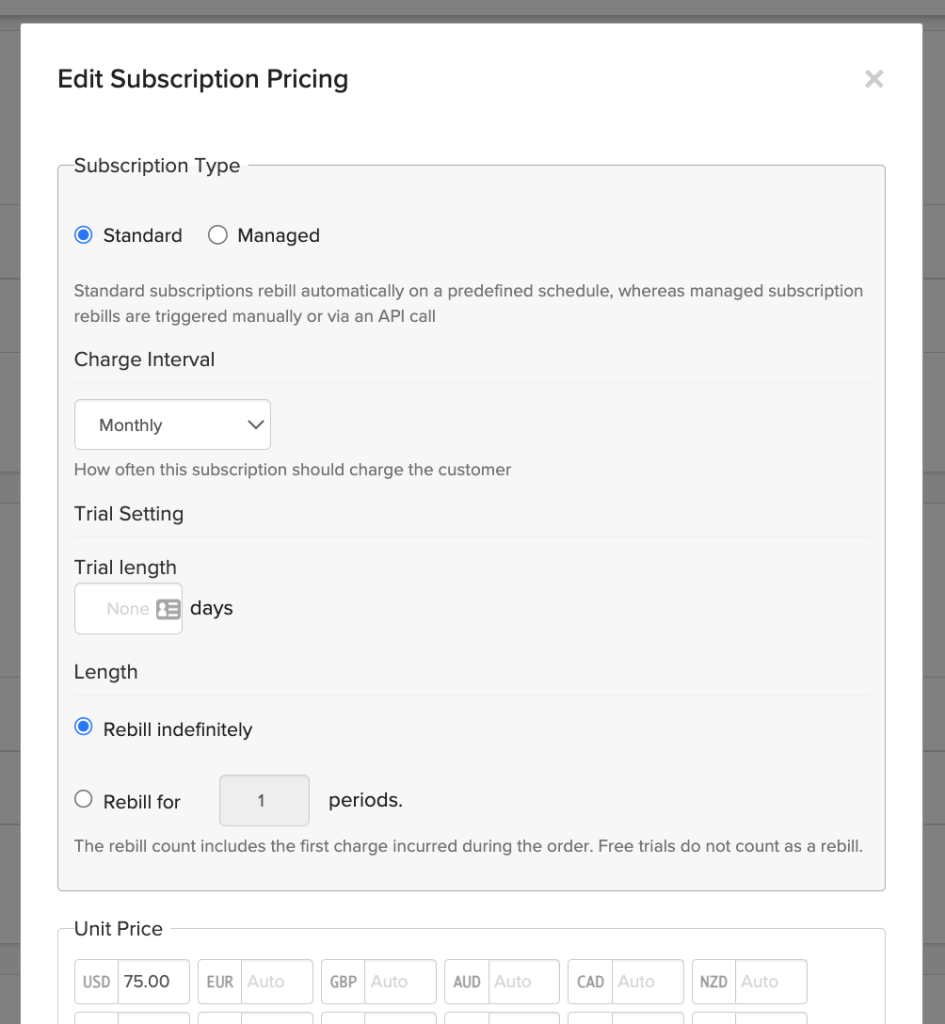

Build Custom Subscription Models and Trials without Code

Most companies need a variety of recurring billing models and trial types to accommodate different products and different target markets. Also, the models that work for you at one point may not be the most effective long-term models as your business evolves.

Many billing platforms will allow for custom subscription plans, but you’ll need your development team to manually configure those customizations (with little or no assistance from your billing solution provider).

FastSpring offers lots of pre-built options so anyone can set up custom subscription plans without technical skills.

Here are just a few examples of the types of subscription plans and trials you can set up:

- Free, paid, or usage-based trials.

- Automatic billing after the trial has ended (or let customers manually start a paid subscription).

- Preset billing frequencies and/or date (or let your customers choose).

- Usage-based billing.

- Discounts, coupons, prorated amounts, and one-time add-ons.

- Automatically store payment information (or let customers decide).

- Auto-renew to a different subscription plan.

- And more.

If you need even more customizations, you can use FastSpring’s API and Webhooks Library to design your own subscription model. FastSpring developers are always available to help you build the perfect solution and answer any questions you may have.

If you already have subscriptions on another platform, we can help you migrate over to FastSpring. For subscription data migration with payment information included, click here for more info. For subscription data migration without payment information, click here for more info.

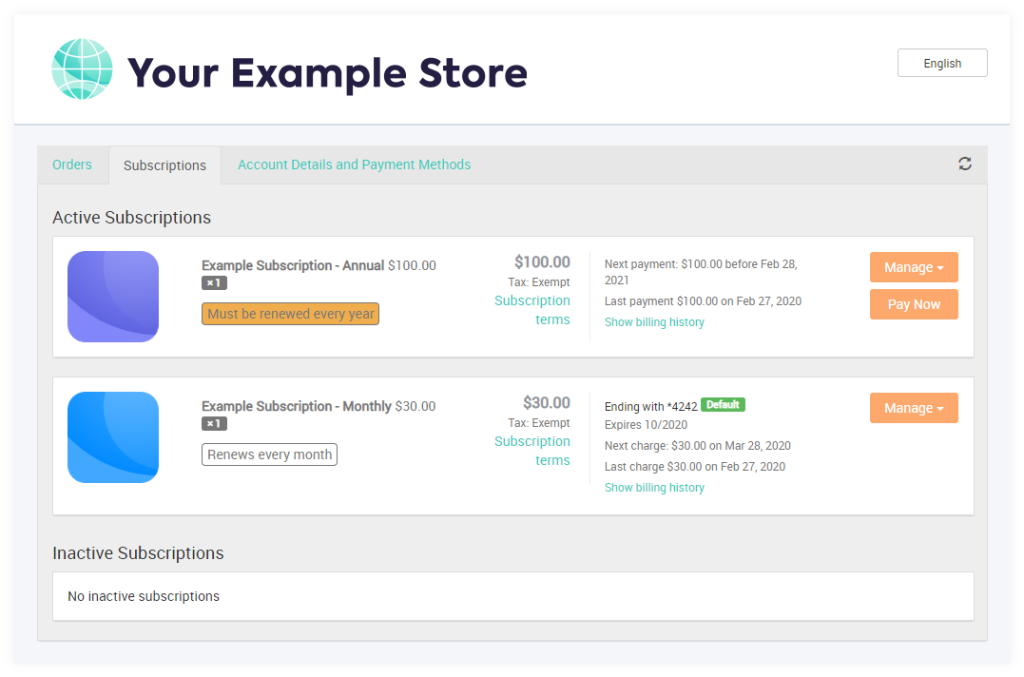

Let Customers Manage Account Details from a User-friendly Portal

FastSpring provides a self-serve portal where your customers can view:

- Active and inactive subscriptions (or trials).

- Order history (and IDs).

- License keys and download history.

- Payment details.

- Contact information.

- And more.

From this portal, customers can manage upgrades, downgrades, credit card or bank account details, and more without contacting your team.

FastSpring manages the entire portal so that your team doesn’t have to. However, you’ll have full control over the look and feel of the portal. This lets you create a cohesive experience for customers without putting more strain on your development team.

Optimize Your Checkout Process to Increase Conversions

With most subscription billing systems, you’ll need a separate solution for checkout and payment processing (which means additional fees and software to manage).

FastSpring lets you manage subscriptions, checkout, and payment processing with one solution.

With nearly 20 years of experience helping software companies, we have gained valuable insight into how you can optimize checkout for increased conversions. For example, customers are more likely to follow through with a purchase if:

- You accept their preferred payment method.

- The payment gets accepted on the first try.

- Checkout is in the local language and currency.

- The look and feel of the checkout process match the rest of the website.

Each of these areas is built into the FastSpring platform:

- Preferred payment methods: FastSpring lets you accept the most common payment methods around the world.

- High payment approval rates: Each card network and issuing bank has different acceptance levels for fraud and chargebacks. FastSpring makes sure your transactions are compliant with these regulations so you can maintain high authorization rates. Additionally, transactions are more likely to be approved if the payment gateway has a legal entity in the same location as the buyer. FastSpring works with multiple payment gateways around the world and automatically routes each payment through the gateway with the highest approval rates for that area.

- Automatic currency conversions: FastSpring automatically converts prices into the buyer’s local currency. You can either choose a set amount for each location or let FastSpring make the conversion in real-time.

- Checkout language translations: FastSpring also helps you translate checkout into the local language. You can choose to have FastSpring choose the appropriate language based on the buyer’s location, or you can let the buyer choose which language they prefer.

- Fully branded checkout: With FastSpring, you have three options for checkout — an embedded checkout, a pop-up checkout, or a separate storefront managed by our team. With each option, you have complete control over the look and feel of the checkout or webpage. Most checkout solutions only have a few options for customization (e.g., add a logo or choose from a preset list of colors), but FastSpring checkouts can be customized down to the pixel.

Protect Your Company from the Legal Liability of Transactions

As experienced SaaS companies know well, it’s necessary to outline the terms and conditions of the subscription and have customers agree to those terms before collecting payment. The challenge is knowing what to include in that contract. It gets even more complicated for companies transacting internationally because the details of what the contract needs to include will change with each country, state, territory, and province. If you don’t include the right elements, you could face heavy fines or be banned from transacting within that jurisdiction.

Also, most jurisdictions have additional laws and regulations for automatic recurring payments beyond what’s required in the contract. For example, India limits automatic payments to ₹15,000 (approximately $180 at the time of writing). If a recurring payment is over that amount, the user will have to manually approve the transaction each time. To avoid fines, you also have to file an eMandate with the Reserve Bank of India that outlines how you will comply.

Keeping up to date on regulations like these for every jurisdiction is a huge challenge for any business.

For FastSpring customers, this is not a concern because we handle compliance with local transaction laws and regulations. Our team of legal experts stays up to date on all transaction legalities and makes sure all the necessary procedures and documentation are in place for collecting automatic payments.

FastSpring is fully compliant with the EU General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), among many other regulations.

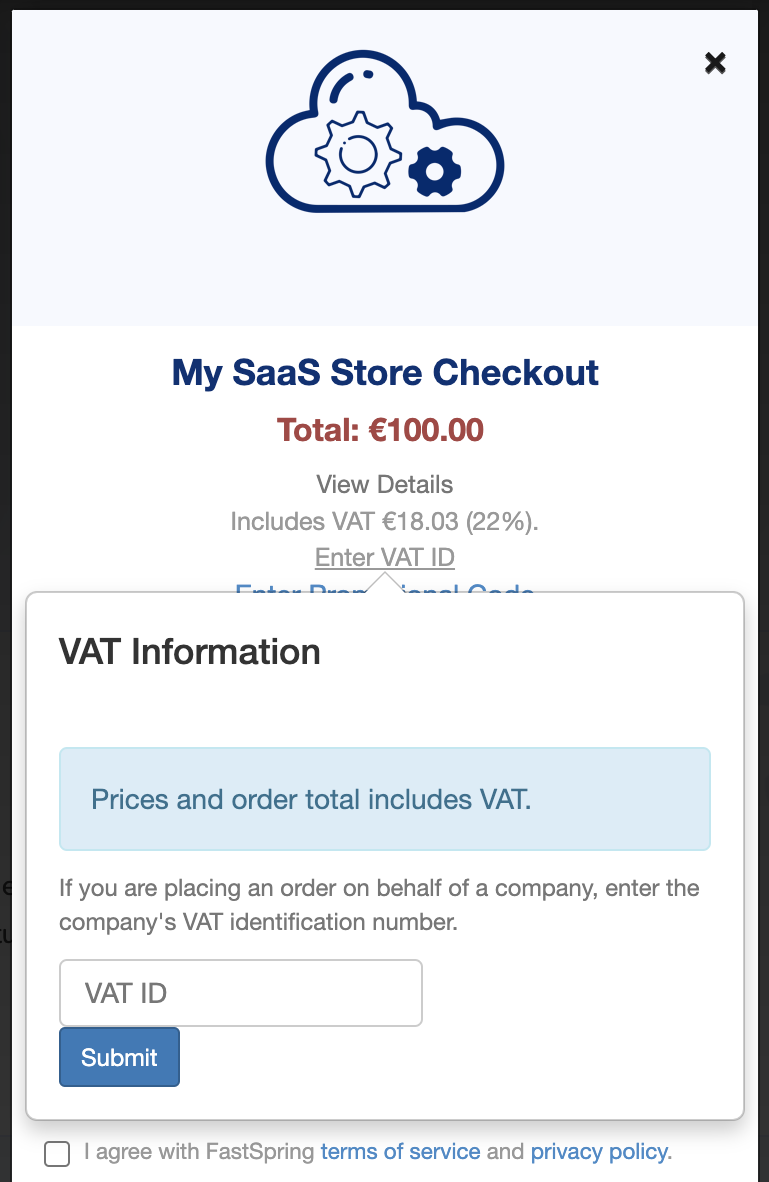

Let FastSpring Gather and Remit VAT and Sales Tax for You

SaaS companies didn’t always have to collect consumption tax, however, tax laws for software companies are changing and being more strongly enforced.

Most payment solutions will help you gather consumption tax, however, you’re responsible for making sure it’s the correct amount and remitting those taxes at the end of each tax period. If you don’t collect and remit the correct amount (and type) of consumption tax at the right times, you could face heavy fines and/or be barred from transacting in that location.

FastSpring automatically adds the right amount (and type) of consumption tax to the customer-facing price and remits those taxes for you.

We support tax-exempt transactions and other special cases. We also take the lead on any audits.

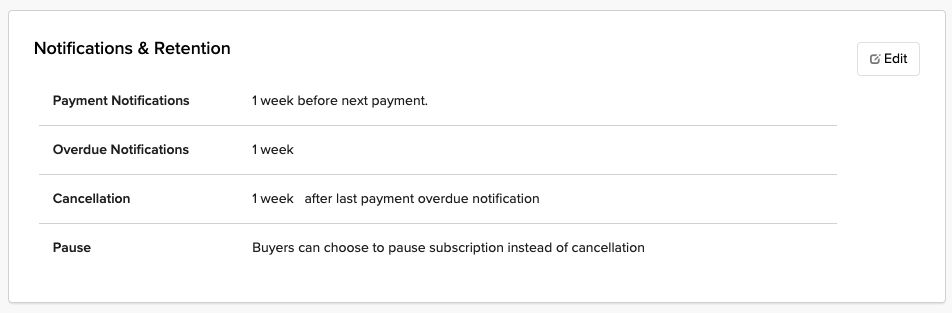

Automate Payment Failure Handling and Reduce Churn

Between the initial payment and each subsequent rebill, many things can go wrong that prevent the payment from going through and cause customers to churn. Having worked with hundreds of companies, we’ve developed automatic processes to solve common issues, prevent churn, and recover most failed payments.

Here are a few FastSpring features that can help you reduce churn and failed payments:

- Proactive reminders: In our experience, letting customers know about upcoming payments and notifying them of expired payment methods, is one of the best ways to reduce involuntary churn and failed payments. With FastSpring, you can set up automatic reminders about upcoming payments.

- Multiple reminders: After a payment has failed, customers often need multiple reminders before they fix the issue (e.g., add funds to their account, update the payment method, etc.). You can choose to send out follow-up reminders two, five, seven, 14, and/or 21 days after the initial failed payment (FastSpring will retry the payment before sending out each reminder).

- Continuing the service: Another effective way to reduce involuntary churn is to continue the service while you attempt to collect the payment. This provides a better customer experience because the customer has a chance to resolve the issue without the negative experience of a paused service. The better the customer experience, the more likely they are to stay.

- Easy reactivation: After all reminders have been sent out, you can choose to pause rather than cancel the customer’s subscription. This makes it easier for customers to restart their subscriptions without the hassle of onboarding again (onboarding is often a significant barrier to restarting a service).

As we covered earlier, FastSpring also automatically retries every payment using a different payment gateway (without anyone on your team having to lift a finger) which can solve failed payments caused by network issues.

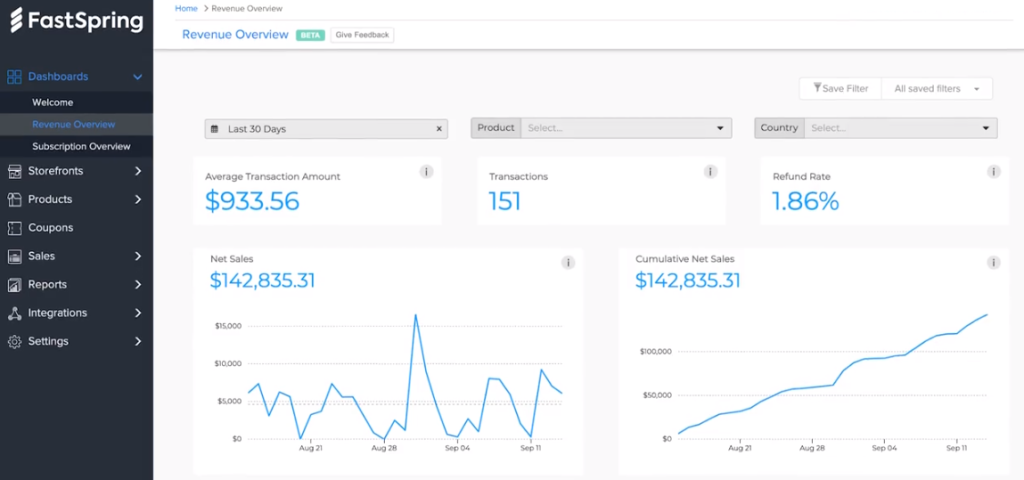

Automatically Gather Key Metrics and View Detailed Reports

FastSpring Analytics and Reporting lets you answer questions such as:

- How is each product contributing to my bottom line?

- Which products are the most successful and which are a drain on resources?

- What coupons, promotions, and discounts are attracting more customers?

- Which subscription models are the most effective?

- What markets are the most successful and which ones have more potential?

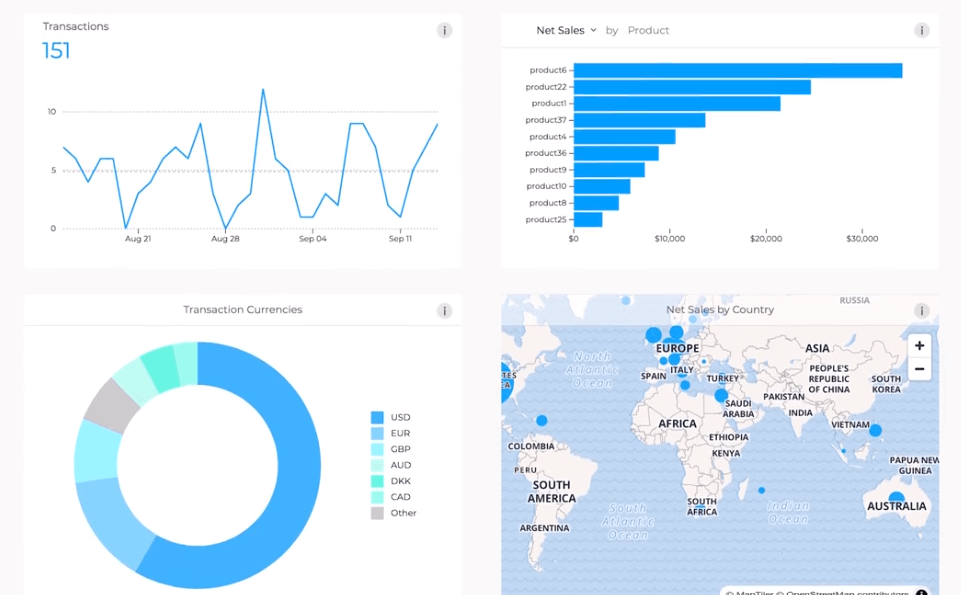

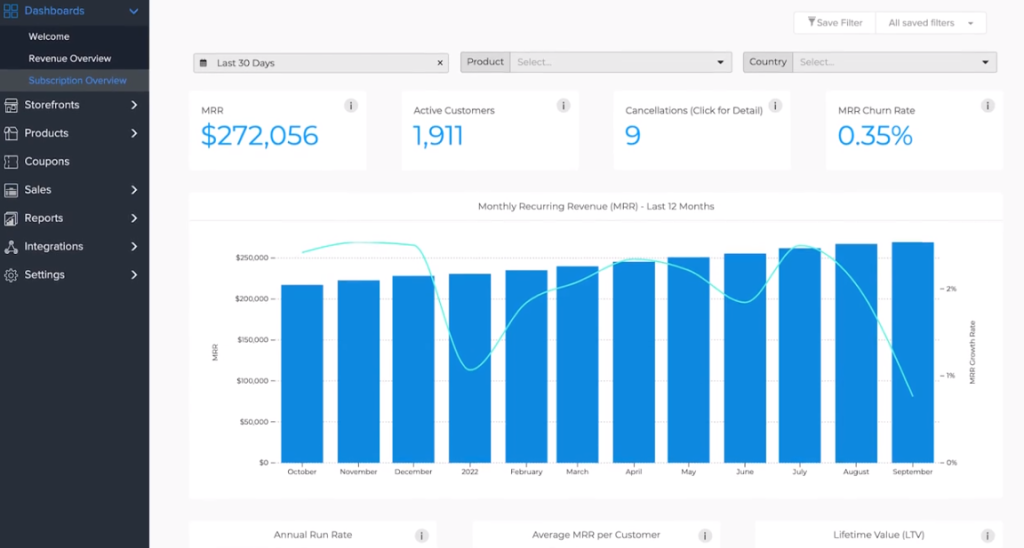

FastSpring provides two main dashboards: the revenue overview dashboard and the subscription overview dashboard.

The revenue overview dashboard gives you an overview of your entire business’ performance, including:

- Where your customers are located.

- What currencies and payment methods customers prefer.

- Net sales by product.

- Total transactions by country.

- And more.

The subscription overview dashboard lets you track monthly recurring revenue (MRR) and dig deeper into what’s affecting your MRR over time. This dashboard gives you metrics on:

- Upsells, cross-sells, and add-ons.

- The long-term value of each customer.

- Total customer churn.

- When in the billing cycle churn happens most often.

- The lifetime value of a customer.

- And more.

You can customize and save any report and share reports with key stakeholders via the FastSpring dashboard or as a CSV, PNG, or XLSX spreadsheet export.

SaaS companies can manage the entire subscription lifecycle with FastSpring for one flat-rate price. If you think FastSpring could be the right payment solution for your subscription business, sign up for a free account or request a demo.

Four More Subscription Management Platforms

Recurly

Recurly is a recurring billing and subscription management platform built for companies selling:

- B2B and B2C software.

- Mobile app.

- Media and entertainment.

- Consumer goods and retail.

- Professional services.

- eLearning.

Recurly supports easy integrations with multiple payment gateways; however, you’re responsible for setting up and managing each one. Most companies using Recruly also end up adding software solutions for:

- Taxes (e.g., Avalara).

- Accounting (e.g., QuickBooks).

- Fraud protection (e.g., Sift — FastSpring customers are automatically protected by Sift).

You’ll also be responsible for transaction and tax liability so you’ll likely need a dedicated department for compliance. (With FastSpring, all of this is included in one price and is fully managed by our team.)

Chargebee

Chargebee is a subscription billing and revenue management platform built for:

- B2B SaaS.

- eCommerce.

- eLearning.

- Publishing.

- Video and OTT.

Like Recurly, Chargebee is primarily a subscription billing software so you’ll likely need additional solutions for taxes, fraud prevention, payment processing, and more. Chargebee does provide lots of built-in integrations (e.g., Stripe, PayPal, SalesForce, and QuickBooks), however, these are not included in any Chargebee plan.

Related: 8 Best Chargebee Alternatives and Competitors (And How They’re Different)

Chargify

Chargify offers subscription billing solutions to B2B SaaS companies.

You’ll likely need additional solutions for taxes, fraud prevention, payment processing, and more. However, Chargify does offer simple accounting software for revenue recognition (for multiple business models).

Chargify is also merging with SaaSOptics to form a new company, Maxio. With this merger, subscription-based businesses will have more functionalities to manage their finances, including automated expense and revenue recognition and automated reporting.

Zuora

Zuora is an end-to-end monetization platform with subscription management software built in. They primarily serve companies in the following industries:

- Manufacturing and IoT.

- Software.

- High tech.

- Media and Entertainment.

Zuora supports typically subscription-based pricing models (e.g., a usage-based freemium product that upgrades to a paid plan), but they also offer features to streamline accounting workflows, dunning, and payment processing (although some companies end up connecting to additional payment gateways).

FastSpring is a complete payment solution for SaaS companies. To see how we can help you expand globally, sign up for a free account or request a demo.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)