Chargebee is a robust subscription management platformand if you’re looking for Chargebee alternatives, you’re likely already aware of many of its key features. However, there are certain aspects of collecting recurring payments that you would still be responsible for when using Chargebee, such as:

- Connecting to payment gateways manually. While Chargebee supports several different payment gateways, you have to set up and configure each one.

- Remitting taxes at the end of the year. They will collect taxes for you, but you are ultimately held responsible for filing taxes correctly with each state, province, country, etc.

- Reconciling payments, fulfillment, refunds, etc. While Chargebee lets you automate many mundane accounting tasks and integrate with account software, you still have to track and record every transaction, refund, etc.

- Responding to and processing chargebacks. Chargebee only offers full chargeback support for limited vendors, so other vendors will need to manage chargebacks for themselves.

In this guide, we present eight alternatives to Chargebee that help relieve some of these burdens for users, starting with an in-depth review of our solution, FastSpring.

Chargebee alternatives in this list:

- FastSpring.

- Stripe.

- Maxio.

- Zoho Subscriptions.

- Stax Bill (Formerly Fusebill).

- Zuora.

- Sticky.io.

- Braintree.

FastSpring handles the entire payment process from checkout to remitting end-of-year taxes for SaaS companies. To learn more about how FastSpring can help you scale quickly, sign up for a free account or request a demo today.

FastSpring: Takes on Responsibility for Payment Processing, Remitting Taxes, and More for SaaS Businesses

Most Chargebee alternatives are either subscription billing software or payment gateways. These types of providers may be able to help you connect to international payment gateways, alert you to chargebacks, and help you collect VAT and sales taxes. However, you’ll still be responsible for paying taxes, processing chargebacks, and for things like legal compliance, dunning, and more.

FastSpring, on the other hand, handles everything from optimizing your checkout flow to remitting end-of-year taxes by acting as your merchant of record (MoR). Next, we explain how an MoR is different from other payment service providers.

What It Means to Have FastSpring as Your Merchant of Record

A merchant of record is the business entity that sells goods or services to the buyer. You can act as your own MoR, or you can outsource the entire process to FastSpring. Companies that haven’t thought about who their MoR is are effectively acting as their own MoR.

When you outsource your transactions to FastSpring, your customers still visit your website to choose their software and subscription but FastSpring takes over when the customer goes to checkout. They’ll receive a receipt from FastSpring, and FastSpring will be listed on their bank or credit card statement. The profits are yours, but FastSpring is the liable party for the sale.

That’s why FastSpring can do more than other service payment providers and can:

- Collect and remit VAT and sales taxes.

- Comply with local laws and regulations.

- Manage chargebacks.

- Reconcile transactions, payments, refunds, etc.

- And more, all on your behalf.

If something goes wrong with taxes, local compliance, chargebacks, accounts not balancing, etc., FastSpring takes the lead to solve the issue on your behalf.

Instead of juggling multiple platforms and providers for a complete payment solution, you can work with just one provider — FastSpring.

Plus, you can start selling in 200+ regions almost instantly because we’ve already established the necessary processes in each region. You can learn more about how FastSpring helps you with international recurring payments here.

In the next sections, we’ll dive deeper into how FastSpring helps you:

- Create flexible free trials and recurring billing logic without code.

- Minimize payment failures with advanced payment routing and smart dunning.

- Increase conversions with branded, localized checkout.

We’ll also cover how FastSpring provides all features for one flat-rate price designed to fit your budget.

Create Flexible Free Trials and Recurring Billing Logic Without Code

Not every business can use the same free trial model. Some businesses will see more success if they let customers sign up without payment details while others will see more success if they require a payment method to sign up but don’t automatically charge the customer at the end of the trial. Additionally, what worked for your small business to start may not be the right solution for you long term as you grow. That’s why most SaaS companies need payment software that can support many different types of trial models, subscriptions, etc.

However, many payment processors only offer limited recurring billing and trial options. This makes it difficult to optimize your trials and subscription plans for high conversions. It also makes it difficult to adapt as a business in the long run.

FastSpring, on the other hand, delivers a wide variety of options for how you can set up trials, subscriptions, and more. Below, we provide an overview of FastSpring’s subscription management tools.

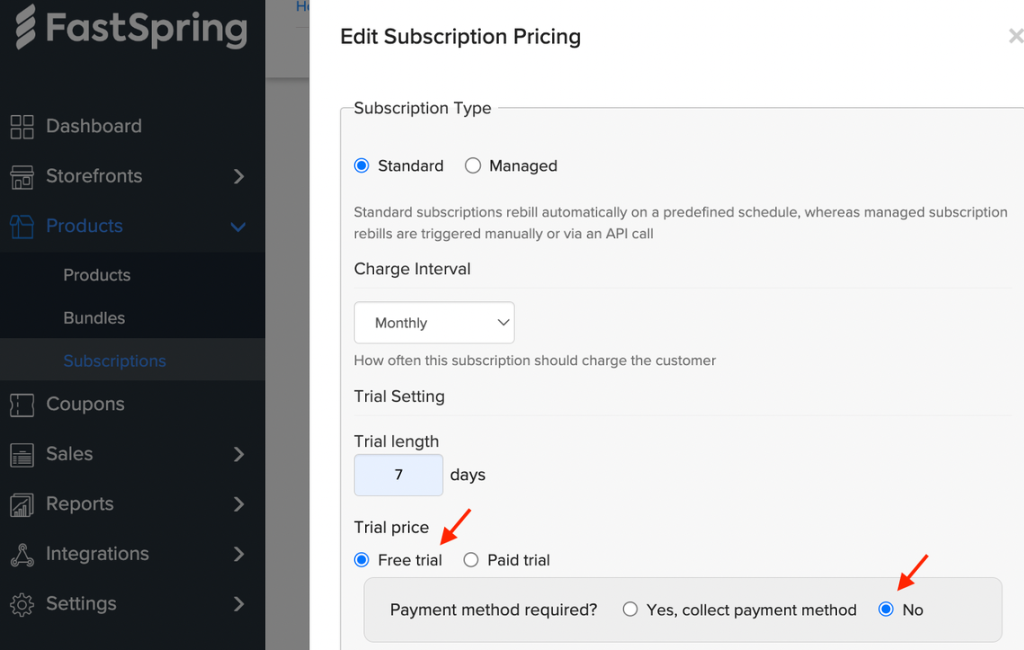

Trial subscription options:

- Set any length of trials.

- Set up free, paid, or usage-based trials.

- Choose whether or not to require a payment method when signing up for a trial.

- Choose to automatically bill the user after the trial has ended or let them manually start a paid subscription.

- Allow subscribers to reactivate expired trial accounts.

- Choose when FastSpring will send reminders of ending trials (e.g., three days before the trial ends).

- Offer a discounted trial period.

- Automatically detect when a single user tries to sign up for multiple trials and only allow one trial account.

- And more.

Recurring billing options:

- Choose subscription frequency and billing date (or let your customers choose).

- Set subscriptions to auto-renewal, manual renewal (i.e., customers have to re-enter payment information each time they’re billed), or managed renewal (i.e., your team initiates the charge via the API, which is great for usage-based billing).

- Offer discounts and coupons.

- Allow prorated billing if a customer wants to upgrade, downgrade, or pause the service part-way through the billing cycle.

- Add one time purchases to initial bill but not recurring billings.

- Manage upsell and cross-sell products at checkout.

- Give customers the option of whether or not to store payment information (or make the decision for all customers).

- Auto-renew to a different subscription.

- Offer subscription add-ons.

- And more.

Fulfillment options:

- Choose whether to share products and resources via a license key, product download, signed PDF, or email.

- Configure multiple fulfillment actions for one subscription (e.g., send a license key and product manual PDF via email).

FastSpring also provides your customers with a self-serve portal where they can upgrade, downgrade, or pause their subscriptions. This self-serve portal is entirely managed by FastSpring but reflects the visual branding of your checkout for a cohesive and user-friendly customer experience.

Finally, some subscription management tools require a lot of technical skills to set up and use. FastSpring lets you set up many of the options mentioned above without code. If you have unique subscription management needs, you can also use our API and webhooks library for more control.

Note: If you already have multiple subscriptions set up in another platform, we can help you easily migrate over to FastSpring. For subscription data migration with payment information included, click here for more info. For subscription data migration without payment information, click here for more info.

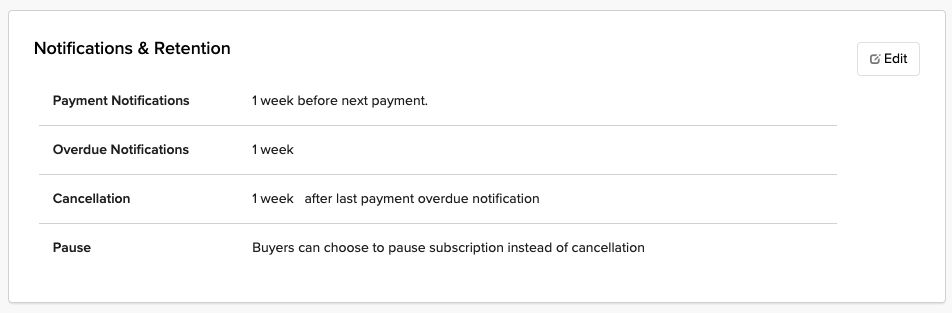

Minimize Payment Failures With Advanced Payment Routing and Smart Dunning

From the initial purchase to each subsequent rebill, failed payment is one of the main reasons for lost revenue. Many payment service providers will automatically retry failed payments once or notify customers of failed payments. This is a good place to start, but there are more ways to reduce churn due to failed payments.

FastSpring helps you proactively minimize payment failures and reduce churn with:

- Proactive notifications (e.g., “Your subscription is due soon.”).

- Multiple follow-up notifications (e.g., two, five, seven, 14, and 21 days after their payment method fails).

- Multiple payment retries before each follow-up notification is sent out.

- Automatic payment gateway rerouting (this solves many payment failures due to network or system errors).

- Intuitive self-serve portal (customers can easily update payment information from the same portal where they manage their subscription plan).

Plus, you can choose whether to pause or continue the service when a payment fails. If you keep the service going after a failed payment and give your customers a chance to update their payment information, you’ll have less churn and increase retention.

You can also choose to pause rather than cancel their service after all reminders have been sent out. This makes it easier for your customer to restart their subscription without the hassle of onboarding again.

You can read more about how one of our customers reduced churn by 50% in this case study.

Increase Conversions With a Branded, Localized Checkout

Friction at the purchase step can cause customers to fall off before completing a purchase. For example:

- If the price at checkout is different than it was on the website (e.g., different currency or different amount because additional fees have been added without a clear label), customers may decide not to buy.

- If the checkout is visually very different from the website or if the checkout is on an entirely different website, the customer is less likely to believe the checkout is authentic and secure.

These are just two examples, but there are many reasons why a customer may decide against completing a purchase at the last minute. FastSpring helps you anticipate objections and reduce friction at checkout in the following ways:

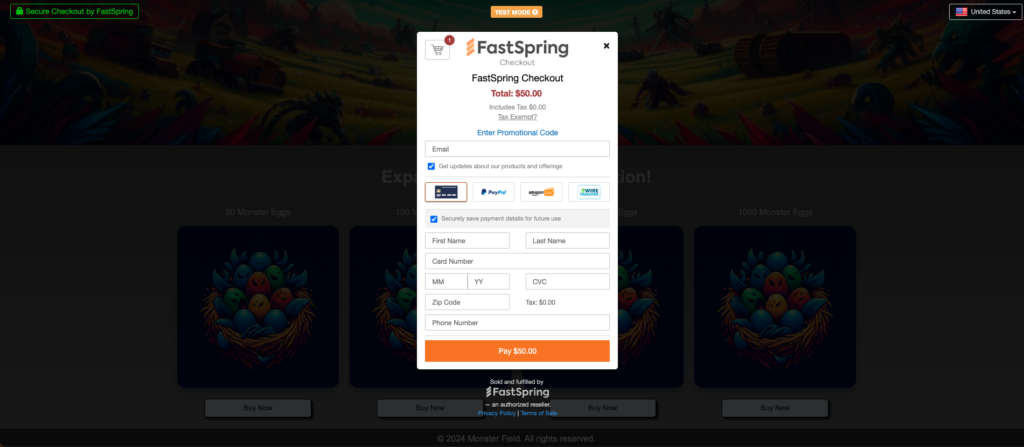

Customizable Checkout UI

Many subscription management platforms or payment processors only provide checkout templates where you can add your logo and choose basic color schemes. These solutions usually fail to match your visual branding and may not be optimized for increasing conversions. To create the best experience for your customers and get the highest conversion rates, you need more custom abilities.

FastSpring lets you customize the look and feel of your checkout with pre-built branding tools and CSS overrides. We also provide our Store Builder Library that gives you extensive flexibility over how your checkout looks and operates. This allows you to create the checkout experience that most aligns with your brand and highlights your product.

Preferred Payment Methods

One of the biggest reasons customers fail to complete a purchase is because they can’t use their preferred payment method.

However, offering different payment methods isn’t as simple as adding their logo to your checkout screen.

You have to agree to certain terms and conditions before a payment network or issuing bank will approve transactions with your business. Each payment provider will have different regulations regarding fraud, chargebacks, privacy protection, etc. It can be a huge task to stay in good standing with many different payment providers on your own.

If you want to transact internationally, there will be even more to manage. While Visa and Mastercard may be popular payment methods in the U.S., buyers in other countries prefer different payment methods. To convert international customers, you need to provide many different types of preferred payment methods — which means more payment providers to maintain.

For instance, Pix is a preferred payment method in Brazil, while AliPay is a preferred payment method in China.

FastSpring takes care of all of this — from staying in good standing with payment networks to managing fraud and chargebacks — for you. FastSpring already has good relationships with many different payment networks and issuing banks around the world, which means you can accept your customers’ preferred payment methods right away.

Local Currency Conversions and Language Translations

Customers are more likely to trust a checkout experience that uses the same language and currency as what’s shown on your website. That’s why FastSpring lets you translate checkout into the local language and convert prices to the local currency.

You can let each buyer select their preferred language from a dropdown menu. Or, you can lock the language and FastSpring will automatically select the appropriate language based on the buyer’s location.

You also have the option to set a custom price in each currency or let FastSpring automatically convert prices to the local currency.

If you choose to let FastSpring convert product prices for you, we match the format of the original price. For example, if the original price is $12.99 and the conversion to Euros is €14.29, FastSpring would change it to €14.99.

You can learn how Nelio increased growth by 50% with localized checkout in this case study.

Embedded Checkout, Pop-Up Checkout, or Web Storefront

With FastSpring, you can embed checkout directly on your webpage, which ensures less disruption and decreases the likelihood of your buyers abandoning.

You can also choose to implement a pop-up checkout, which requires less setup (simply insert a few lines of pre-written HTML and Javascript in your webpage).

Learn how DaisyDisk was able to spend less time managing their checkout while significantly increasing conversions by using FastSpring’s pop-up checkout, in this case study.

Finally, if you want to outsource the entire checkout process to FastSpring, you can choose to use the web storefront option. Customers will be redirected to a webpage entirely managed by FastSpring where they can view their cart and complete the purchase. This web storefront will be customized to match your visual brand identity.

Personalized Developer Support

Many payment service providers will only help you with the initial setup and when something goes wrong with the software. This leaves you on your own to manage ongoing payment operations.

FastSpring is dedicated to providing you with the best experience throughout the entire engagement. Our friendly support team will help you find and build out the best solutions for your business — regardless of how big or small your operation is.

All-in-One Pricing Without the Need for Additional Software

Chargebee separates its Billing features into three pricing plans, so you may eventually need the most expensive plan to get the features you need. For example, chargeback automation is not offered in Chargebee’s Starter plan.

Plus, you’ll still have to pay for additional software solutions like payment gateways or tax software for a complete payment management system (and the staff to manage all of it).

FastSpring, on the other hand, offers one flat-rate price that includes all services and features. Our team works with you to find an affordable price based on the volume of transactions you move through FastSpring.

If you think FastSpring could be the right payment solution for your subscription business, sign up for a free account or request a demo today.

7 Other Chargebee Alternatives

1. Stripe

Stripe’s main service is payment processing, however, they do offer a few other services such as:

- Checkout.

- Fraud and risk management.

- Online invoicing.

- In-person payments.

- Subscription management.

- Virtual and physical card issuing.

- Business spend management.

Stripe billing has fewer options than Chargebee for recurring billing, but you can easily integrate the two software solutions. Stripe works with companies of all sizes, from startups to large enterprises.

2. Maxio

Maxio (formerly Chargify and SaasOptics) is a financial operations platform for B2B SaaS. They offer solutions to automate financial systems on the back end and features to help improve the order-to-revenue process. Their main services include:

- Subscription management.

- Usage-based and global billing.

- Revenue recognition and revenue management tools.

- Billing system analytics and metrics.

- Built-in integrations with various other software (e.g., accounting software like QuickBooks and Xero).

- International payment gateways.

Maxio advertises their ability to accommodate any go-to-market strategy (i.e., product-led or sales-led approaches).

3. Zoho Billing (Formerly Zoho Subscriptions)

Zoho offers a large suite of software to run your business, from a CRM and ERPs to a video meeting platform. Zoho Billing is their payment processing and recurring billing solution. Some of their key features include:

- Invoicing and invoice templates.

- Multi-currency support.

- 50+ pre-built analytic reports.

- Automatic online payment retries.

- Out-of-the-box integrations with other billing platforms (e.g., Stripe, PayPal, etc.).

Zoho Subscriptions offers more pre-made solutions than other options on this list, which some companies may find limiting. However, Zoho Subscriptions may be a good choice if you’re already using other Zoho tools.

4. Stax Bill (Formerly Fusebill)

Stax Bill provides subscription management software and a payment gateway in one platform. Other than offering a payment gateway with each plan, Fusebill offers many of the same features as Chargebee, including:

- Dunning management.

- Flexible recurring billing options.

- Recurring revenue recognition features.

- Billing analytics.

Fusebill also offers flexible catalog pricing and inventory tracking tools.

5. Zuora

Zuora is a monetization platform for B2C and B2B companies. Zuora’s key functionalities include:

- Customer subscription management.

- Revenue reconciliation tools.

- Revenue analytics.

- Built-in integrations with lots of business software.

- Low-code SDKs and APIs to build your own integrations.

- Quoting software.

Zuora provides a lot of flexibility for building out your own solution on top of their platform; however, non-developers may find it difficult to manage.

6. Sticky.io

Sticky.io is a subscription management platform that integrates with popular ecommerce platforms like Salesforce Commerce Cloud, BigCommerce, and Shopify. They advertise the ability to:

- Support nearly any subscription or pricing model.

- Create coupons, discounts, and special promotions.

- Offer add-ons, upsells, etc.

- Fight fraud and chargebacks.

- Manage automated dunning.

Like Chargebee, Sticky.io doesn’t provide a payment gateway; however, they do offer pre-built integrations with several payment gateways.

7. Braintree

Braintree by PayPal is a payment gateway provider that also provides merchant accounts. Braintree offerings include:

- Subscription billing management.

- Optimized checkout flow.

- Flexible risk mitigation options.

- Reporting and analytics.

- Third-party integrations for recurring billing, accounting, and more.

Braintree supports payment from PayPal, Venmo (in the U.S.), Apple Pay, and Google Pay.

Need a Chargebee Alternative for Your SaaS, Software, Download, or Video Game?

Let FastSpring help!

Instead of managing a large software stack, let FastSpring handle the entire payment lifecycle for you. FastSpring is more than a subscription management platform — we’re the merchant of record for global SaaS companies and many other digital businesses.

Sign up for a free account or request a demo today.

This post was originally published in December 2022 and has been updated.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)