To help you choose between Stripe vs. Paddle vs. FastSpring, this guide explores:

- How much of the payment lifecycle each platform handles (e.g. payment processing, gathering and remitting taxes, subscription management, etc.), plus any additional software you’ll need to add to your tech stack.

- Use cases, companies, and industries each solution is best for.

- A detailed comparison of key features, such as checkout and reporting.

- Basic information on pricing models for each.

TL;DR: Stripe primarily deals with payment processing, whereas FastSpring and Paddle handle payment processing, subscription management, collecting and remitting tax, fraud protection, and much more — without the need for additional software.

Table of Contents

- What areas of the payment lifecycle will you be able to manage, and what other software will you need for a complete payment solution?

- What types of businesses and which industries can use each platform?

- Functionality and feature comparisons:

- Pricing.

- Customer reviews.

Note: Information in this article was validated at time of publishing and is subject to change.

If you’re looking for a payment services provider and merchant of record to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, and digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

Stripe vs. Paddle vs. FastSpring: How Comprehensive Is Each Payment Solution?

What areas of the payment lifecycle will you be able to manage with each, and will you need other software or services for a complete payment solution?

Stripe

Stripe is best known for payment processing, meaning they help you collect payment details and get payments authorized. Stripe enables you to accept payments online (or in-person with the Stripe Terminal) for any type of product.

Stripe also offers a few basic features for subscription management, fraud detection, and invoicing, among other features. That said, you’ll need additional software to manage complex recurring billing needs, accept more payment methods around the world, or create a customized checkout process.

With Stripe, you’re responsible for remitting sales tax and VAT. Plus, it’s on you to stay up to date and compliant with local laws and regulations everywhere your customers live. (More on this later.) You may even need additional headcount to manage these aspects yourself.

FastSpring

Unlike Stripe, FastSpring offers a complete payment solution, ready “out of the box.” With FastSpring, you can outsource your entire checkout process from end to end — and we take on the liability for sales tax and VAT remittance, fraud prevention, and tax compliance.

With FastSpring, you’ll have access to:

- Multiple payment processors (to improve authorization rates and make global transactions easier).

- Flexible subscription management and recurring billing tools.

- Done-for-you tax compliance.

- B2B digital invoicing.

- Advanced fraud detection.

- Fully customizable checkout.

- Chargeback management.

- Detailed reports and analytics.

- And much more.

We act as your merchant of record (MoR), meaning we take on transaction liability for you. We take the lead on risk management, chargebacks, and global VAT and taxes — because we’re ultimately responsible for every transaction.

You’ll be able to manage all aspects of the payment lifecycle from your FastSpring dashboard — without adding extra software or headcount.

Paddle

Paddle offers solutions for payment processing, subscription management, and fraud detection, and is more feature-rich than Stripe’s solutions. Like FastSpring, Paddle is an MoR.

Related: SaaS Billing Software: 7 Tools in 3 Categories & How to Choose

Stripe vs. Paddle vs. FastSpring: Who Is Each Platform Best For?

Stripe: Nearly Any Business

Stripe can be used by nearly any type of business in nearly any industry, including both ecommerce and in-person sales.

While smaller companies and startups may get by with Stripe for a while, growing SaaS companies are likely to run into a few struggles while using Stripe, particularly around sales tax and VAT.

In the past, SaaS companies didn’t have to remit sales tax or VAT, but that changed when the European Union (EU) began requiring software sellers to collect and remit VAT based on the buyer’s location and the U.S. Supreme Court ruled that states can charge sales tax on purchases from out-of-state sellers.

Now SaaS companies have to keep track of — and adhere to — constantly changing tax laws in every locality where you have customers. That’s why SaaS and digital products companies are better off choosing an MoR (such as FastSpring) that will handle sales tax and VAT collection, remittance, and general compliance for you.

FastSpring: B2C and B2B SaaS and Digital Goods Companies

For 20 years, FastSpring has been serving both B2C and B2B companies selling software and digital products. We’ve been here throughout the growth of the subscription business and have an in-depth understanding of the unique complexities of subscription selling and billing.

- Mailbird achieved over 100% growth by switching from Stripe to FastSpring. The flexibility of the platform and the ability to stay compliant with tax laws, were the main reasons Mailbird chose FastSpring. Read the Mailbird case study here.

- Capture One increased their conversion rate by 40% by switching from an in-house solution to FastSpring to help them with global payments. FastSpring offers localized checkout experiences that automatically display accurate pricing, language, currency, and taxes around the world. Plus, it was clear FastSpring is a partner in growth, ready to help migrate from another payment processing platform, optimize checkout flows, or help expand into new global marketplaces. Read the Capture One case study here.

- SocialBee doubled their monthly recurring revenue and managed tax compliance by switching from Braintree to FastSpring. Once the SocialBee team realized they needed more than a payment processor, partnering with FastSpring was an easy choice. Read the SocialBee case study here.

Paddle: SaaS Companies

Paddle has been serving SaaS companies for about ten years. While Paddle’s platform was historically better suited for B2C companies, they’ve added more features for B2B companies such as automated invoicing.

Stripe vs. Paddle vs. FastSpring: Key Features

Payment Processing (Payment Methods, Currencies, and More)

Stripe

To start processing payments with Stripe, you have to configure each location with the currency and payment methods you want to offer in that location. Once set up, Stripe will automatically convert product prices and display the correct currency and payment options at checkout.

Stripe supports 135+ currencies.

You’ll be able to accept payments from major credit card networks (including MasterCard and Visa), bank transfers, vouchers, and popular wallets such as Apple Pay and Google Pay.

Stripe also supports in-person transactions via the Stripe Terminal and mobile SDKs.

FastSpring

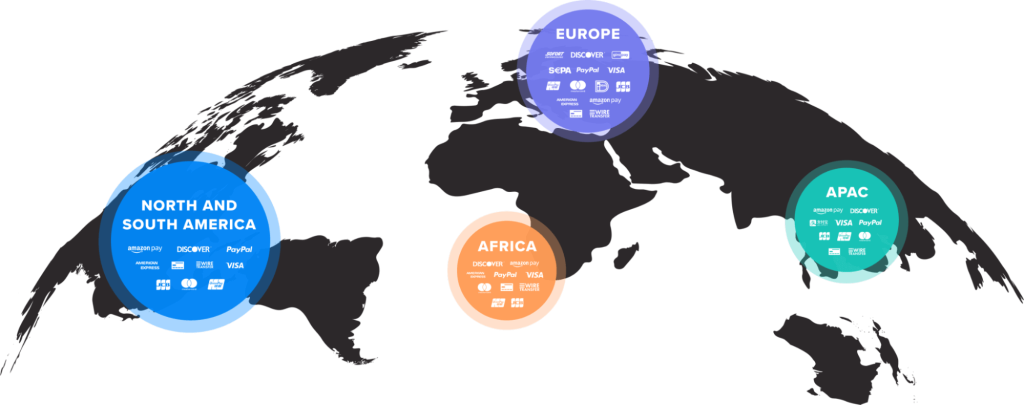

FastSpring makes it simple for SaaS and ecommerce companies to accept payments in most currencies and preferred payment methods around the world. Instead of configuring each one individually, FastSpring sellers can simply turn on localized payments and start accepting global payments right away.

While Stripe automatically converts prices to the local currency for you, FastSpring provides more flexibility:

- You can let FastSpring make the conversions for you, or you can set a fixed price for each of your products in each currency.

- You can let FastSpring choose the appropriate currency based on the user’s location, choose a specific currency for each location, or let the customer choose their preferred currency. FastSpring supports 23+ currencies.

With FastSpring, customers can make payments using:

- Credit cards including Visa, MasterCard, American Express, Discover, JCB, WeChat Pay, Kakao Pay, and UnionPay.

- ACH.

- SEPA Direct Debit.

- Wire transfers.

- Wallets including PayPal, Apple Pay, Amazon, Alipay, and more.

FastSpring also connects to multiple international payment gateways, improving the likelihood of authorization.

Payments have a higher success rate when the payment gateway is in the same location as the buyer. FastSpring automatically uses intelligent payment routing to route online payments through the gateway with the highest authorization rates for that payment method and location.

Plus, using multiple payment gateways solves most failed payment issues that are due to network errors. If a payment gateway is experiencing a technical failure, FastSpring automatically retries the payment using a different gateway — without your team having to lift a finger.

Bonus: FastSpring Partners with Sift

FastSpring takes the lead on fraud and risk activities (including chargebacks). We partner with Sift, a global leader in risk analysis and fraud prevention, to keep your transaction secure. Sift uses machine learning and AI to:

- Increase accuracy in fraud decisions.

- Improve approval rates and result in fewer false positives.

- Stop bad actors before a transaction is even processed.

FastSpring also blocks transactions from countries and jurisdictions where companies are currently not allowed to do business.

Paddle

Paddle also utilizes multiple payment gateways and lets companies accept global payments with minimal setup.

Paddle supports 30+ currencies, popular credit cards (including MasterCard, Union Pay, and more), wire transfers, and wallets (including Apple Pay, Google Pay, PayPal, and Alipay) — although some of these options are still in beta testing. Paddle does not accept checks or Pix.

Calculating and Remitting Sales Tax, VAT, and GST

Stripe

Stripe Tax can help you calculate sales tax, VAT, and GST. While Stripe can help handle U.S. tax registrations, they only provide instructions for enabling tax features and assigning tax codes in other localities. You are responsible for the decisions and implications of using those features (e.g., knowing how your product is classified under tax law and if/where you have nexus, need to register, collect, file, and submit consumption tax).

If you have questions about how to optimize tax rates, qualify for reduced tax rates, or any other tax-related question, you’ll likely be told to consult your tax advisor or read through the help articles.

If you accidentally set it up incorrectly and collect the wrong amount (or type) of tax, you’ll be held liable.

Plus, remitting sales taxes is often more involved than filling out a simple spreadsheet and writing a check. More and more countries are mandating additional requirements to stay compliant. For example:

- Countries such as Colombia, Japan, Mexico, Serbia, and others require local representation, meaning you have to hire someone with a physical presence in that country to be responsible for your tax liability. This can cost anywhere from US$5k to US$15k per year.

- Countries such as India, Indonesia, Japan, and others require your account to be “pre-funded” meaning you have to predict the amount of tax you will owe and keep that money in your account until it’s time to file (up to three months in advance).

- Countries such as Serbia, United Kingdom, Taiwan, and others require electronic invoicing (it applies to non-resident companies, as well). An average sized company will pay around US$10k annual for these services. Note: E-invoicing mandates are increasing at an alarming rate — with the EU rolling out universal electronic invoicing requirements by 2028.

- Countries such as Taiwan, Indonesia, Nigeria, Vietnam, and others require you to file corporate income tax in addition to VAT, regardless if you have a physical presence or permanent establishment. (This can increase a country’s compliance burden from 5%-20% based on local tax rates).

Finally, wiring international tax payments isn’t easy or free. The corresponding and receiving banks both charge fees, and there’s the additional risk involved with foreign transactions.

So, while Stripe has taken important steps toward helping you collect sales tax, they’re a long way from providing an end-to-end solution for sales tax and international tax.

FastSpring

FastSpring handles the entire process of gathering and remitting sales tax, VAT, and GST for you.

With 20 years of experience filing 1,200+ tax returns each year, our team ensures the correct amount of sales tax and VAT is being collected at checkout — we even handle tax-exempt transactions in the U.S. and B2B reverse charges when allowed internationally.

FastSpring files and collects taxes in over 55 countries, 13 provinces, and all 45 U.S. states that collect sales tax (five states don’t collect any sales tax).

Then, our team remits those taxes for you and ensures all the necessary procedures are in place to stay compliant. If a country or state approaches you about tax compliance, our team will advise you on how to respond — even as far as providing copy-and-paste responses.

We build and maintain relationships with tax law specialists across the world to make sure we are aware of laws and regulations as they change.

Bonus: Custom Tax Codes

Tools like TaxJar, Avalara, and other tax software provide you with tax codes for most products and services. If you want to offer a product or service that doesn’t fit neatly into those codes (e.g., an in-person conference with some virtual attendees and speakers), you’ll be on your own to calculate and collect the right tax rate.

This isn’t an issue for FastSpring sellers: we build unique product tax codes customized by use case — within minutes. Just tell us about your product or service, and we’ll create the tax code for you.

Paddle

Like FastSpring, Paddle takes the lead on gathering and remitting sales tax, VAT, and GST for you. Unlike FastSpring, Paddle doesn’t support tax exempt cases in the U.S.

Checkout

Stripe

Stripe Checkout is a prebuilt payment page designed for use on any device. You have a few options for customization (e.g., font, block shapes, colors, etc.) but it’s pretty limited. Stripe automatically translates Checkout to the appropriate language (35+ options) and currency (135+) based on the buyer’s location.

FastSpring

FastSpring lets you customize your checkout, from custom fields to custom colors using our branding tools and CSS overrides. You also have the flexibility to choose whether you want to give your developer complete control over checkout or let FastSpring manage it for you (or somewhere in between).

Here’s an overview of FastSpring’s checkout options:

- Three versions: You have the option to embed checkout directly on your webpage, use a popup checkout, or redirect your customers to a Web Storefront managed by FastSpring.

- Store Builder Library (SBL): FastSpring’s JavaScript library lets you customize, brand, and streamline your entire checkout flow to build trust and eliminate friction throughout the buyer’s journey.

- Localized Checkout: Let customers choose their preferred language or let FastSpring choose the appropriate language based on the buyer’s location. FastSpring supports 21+ languages and 23+ currencies to help expand your global reach.

- Built-in tracking and testing tools: With FastSpring’s built-in tracking tools, you can easily identify ways to improve conversion rates.

- Personalized customer support: Our team is always available to help you build the best checkout experience for your business. Some companies only provide personalized support to their largest clients. At FastSpring, we don’t play favorites — our team is always happy to help in any way they can.

Paddle

Paddle provides two versions of checkout:

- Pop-up overlay.

- Inline embedded on your webpage.

Customization is pretty limited with the overlay checkout option, but the inline version allows you more control of the look and feel. Paddle supports 17 languages and automatically translates your checkout.

Subscription Management

Stripe

Stripe Billing includes a few different subscription options:

- Flat-rate billing (for a monthly or annual price).

- Multiple price billing (where a single product is sold for different prices in different locations).

- Per seat billing (based on active users during the billing cycle).

- Usage-based billing (single unit or tiered).

- Flat-rate + overage (a combination of flat-rate and usage-based billing).

These options work for some companies that only have a few simple subscription-based products, but companies with more complex recurring billing needs (read: SaaS) often need an additional tool, meaning you’ll have to manage and pay for both separately.

Finally, Stripe offers a customer portal where customers can manage their accounts (both FastSpring and Paddle offer this as well).

Related: 8 Best Chargebee Alternatives and Competitors (And How They’re Different)

FastSpring

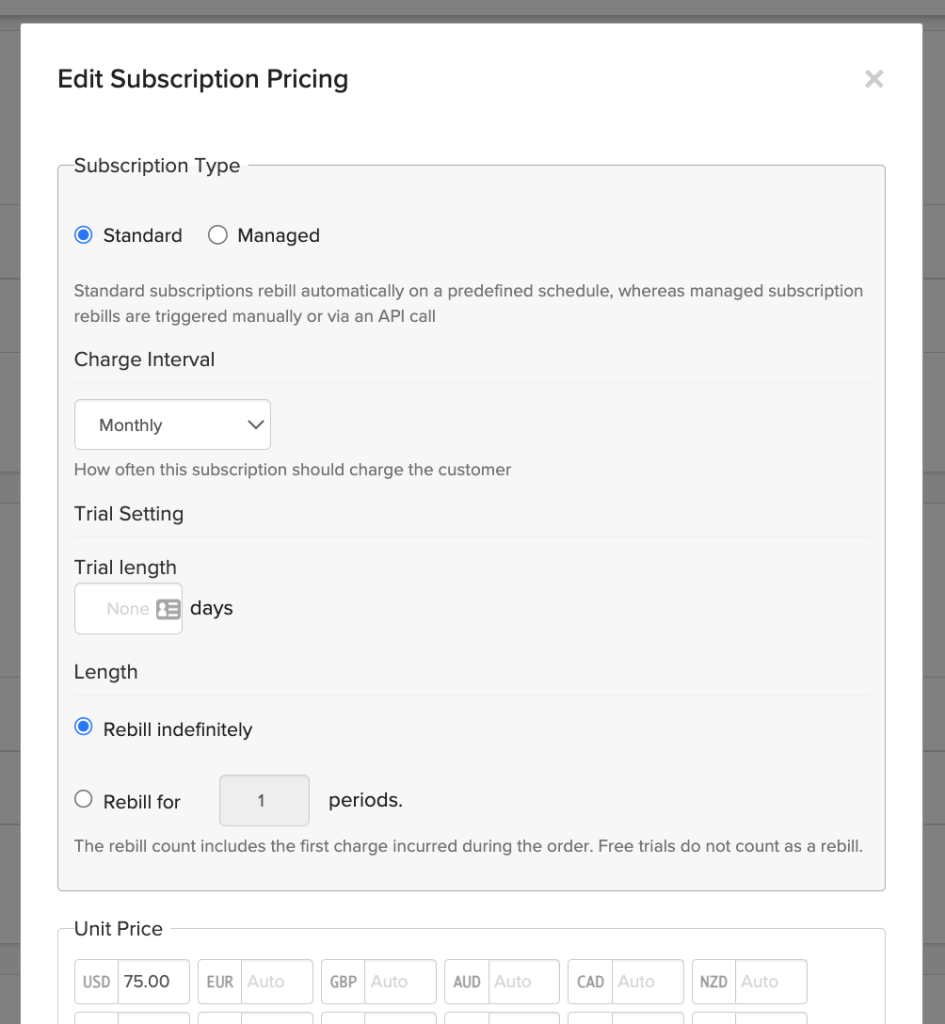

FastSpring provides a wide variety of subscription management options built specifically for SaaS and other digital product companies.

Plus, most of these options can be set up without writing any code. For example, you can set up:

- Automatic weekly, monthly, yearly, or custom recurring billing.

- Prorated billing to accommodate upgrades — and downgrades — mid cycle.

- Free or paid trials of any length.

- Trials with or without collecting payment details.

- Automatic or manual renewal.

- Upsells, cross-sells, one-time add-ons, and discounts.

- Automatic failure handling, notifications, and retries to reduce churn.

- B2B digital invoicing

- And much more.

You’ll also have access to our API and webhooks library for more customization options.

Don’t forget: If you don’t use an MoR like FastSpring, you’ll still need to worry about your recurring billing model following local transaction laws and regulations.

For example, the Reserve Bank of India (RBI) limits most automatic recurring payments to ₹15,000 (approximately US$180). If a payment is over that amount, the customer must approve each transaction manually. You also have to file an official mandate with the RBI that outlines the procedures you have in place to ensure compliance — or face heavy fines or be prevented from selling to customers in India.

While some subscription management tools will release community updates whenever they learn about new regulations, you’re the one held responsible for keeping track of and adhering to all laws and regulations.

FastSpring customers don’t have to worry about this because we take on transaction liability for you.

Our team of legal experts stays up to date on all relevant legalities, ensures the necessary procedures are in place, takes the lead on audits, and offers individual guidance on how to stay compliant — all at no additional cost.

Related: International Recurring Payments (How We Handle It for You)

Paddle

Using a series of webhooks and their API, Paddle claims to support “any billing model.”

Paddle supports free or paid trials; however, it looks like customers will be required to provide payment details in order to start the trial. Paddle also automatically applies prorated amounts when customers change their plan mid-cycle (e.g., add new users or upgrade).

Related: An In-Depth Guide to Subscription Billing Platforms (+ 5 Options)

Reporting and Analytics

Stripe

Stripe offers a suite of revenue recognition tools to help you streamline accounting, including:

- Standard accounting reports, such as balance sheets and income statements.

- Configurable revenue rules, such as excluding passthrough fees and auto-adjusting recognition schedules.

- Revenue overview reports.

- Query your Stripe data using SQL.

All reports can be viewed in your Stripe dashboard, and some reports can be downloaded as a CSV file. You can also integrate with popular accounting tools such as QuickBooks Desktop and Xero. However, the ability to import data from other revenue recognition providers into Stripe is still in beta.

FastSpring

FastSpring Reporting and Analytics is a robust suite that helps you understand:

- How each product contributes to your bottom line.

- When customers are most likely to drop off.

- What coupons or promotions are working.

- Which subscription models generate the most revenue.

- Where your customers are located.

- What currencies and payment methods customers prefer.

- Chargeback rates by customer segment.

- Chargeback rates by product line.

- The status of your active webhooks.

- And much more.

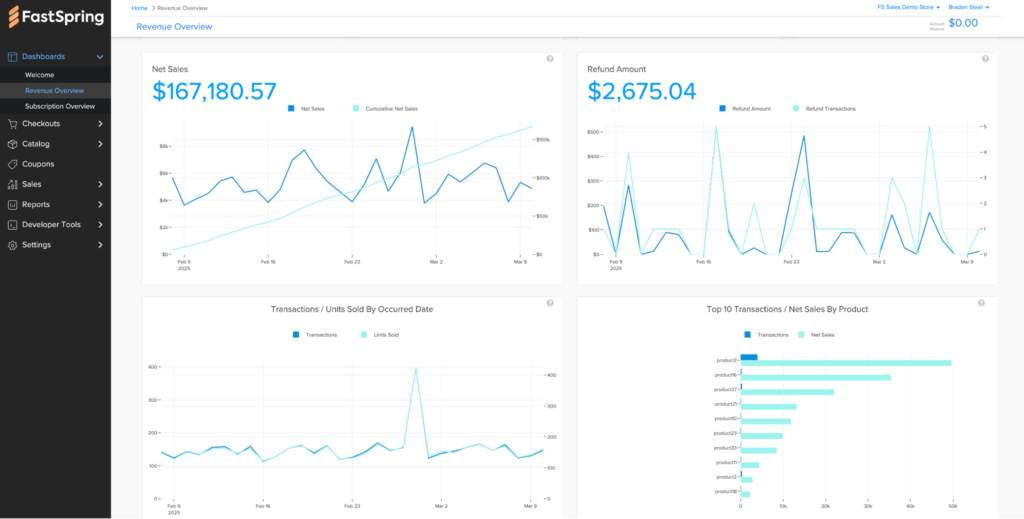

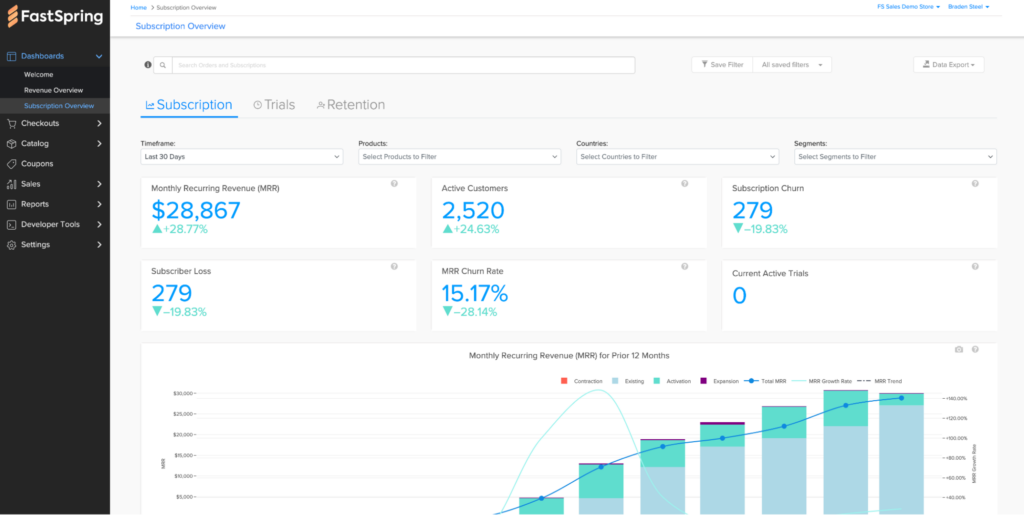

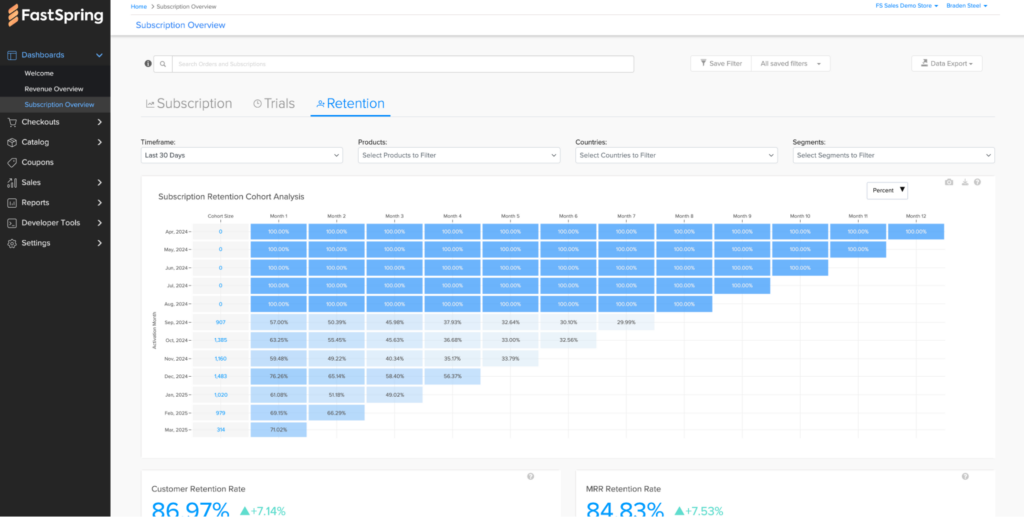

Most of this information can be found in one of FastSpring’s several dashboards, including:

- Revenue Overview.

- Subscription Overview.

- Revenue Recognition (Beta).

- Chargeback Overview.

- Webhook Status.

For example, the revenue overview dashboard contains more general information, such as total transactions by country or net sales by product.

For another example, the subscription overview dashboard lets you drill down into more specific details, such as active customers or monthly recurring revenue (MRR) over time.

If you don’t see the exact report you need in the dashboards, you can create and save custom reports. Or, you can reach out to our team and we’ll help you find (or build) the report you need. Any report can be viewed in your dashboard or downloaded as a CSV, PNG, or XLSX file.

Paddle

Paddle acquired ProfitWell to provide reporting and analytics features. A few of the things you can do with ProfitWell Metrics include:

- Automatically track and report on key performance indicators, such as MRR.

- Monitor user engagement and churn.

- Use benchmarking and segmentation tools.

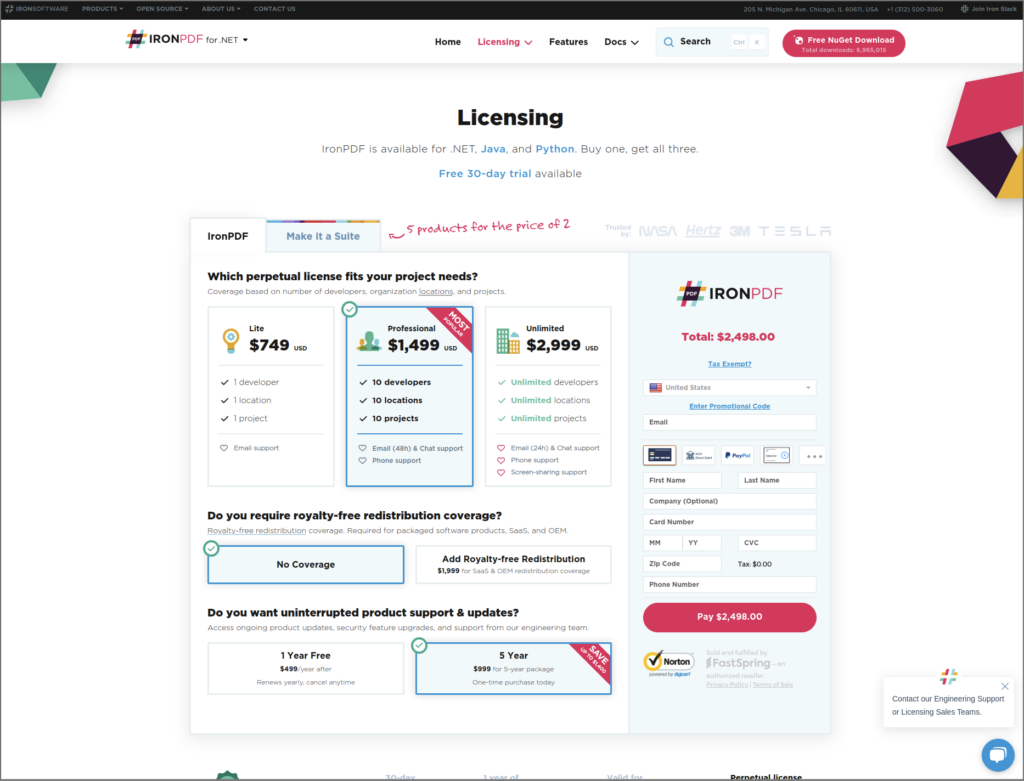

Stripe vs. Paddle vs. FastSpring: Pricing Models

Stripe

For Stripe, pricing works loosely on an a la carte model. Payment processing is priced based on transactions, with the exact transaction fee varying based on payment method (e.g., credit card, digital wallet, Buy Now Pay Later, ACH, etc.).

By using Stripe payment processing, you’ll gain access to a number of features, such as checkout and payment links. Other key features, such as recurring billing, invoicing, instant payouts, and tax features incur additional fees.

With Stripe, you may also need to pay for additional software and headcount to manage other aspects of the billing lifecycle such as advanced fraud detection, subscription management, remitting sales tax and VAT, and more.

To learn more about Stripe pricing, check out their pricing page.

FastSpring

With FastSpring, you’ll have access to the entire platform (and all services) for one flat-rate fee. Since we take on transaction liability for you and take the lead on sales tax and VAT, you won’t need any additional software or headcount.

Our team works with you to find an affordable price based on the volume of transactions you move through FastSpring. Plus, you’ll only be charged when successful transactions take place.

Reach out to our team to find the rate that works for you. You can also preview FastSpring features by setting up a free account.

Paddle

Paddle advertises a flat-rate fee of 5% + 50¢ per transaction for their core product, which includes most of the features you’ll need — payments processing, checkout, subscriptions, global tax and compliance, fraud protection, reporting, and more — but it doesn’t include everything.

Invoicing, for example, is an extra charge.

To learn more about Paddle pricing, visit their website.

Customer Reviews

Stripe

Stripe currently has 4.4 stars on G2 (a popular software review site) with 125+ reviews.

FastSpring

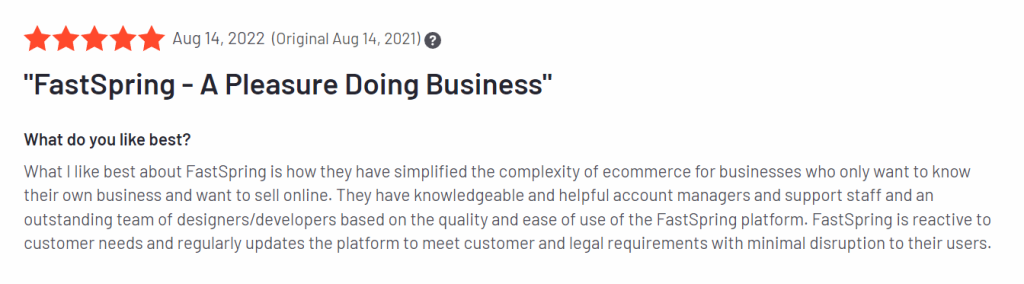

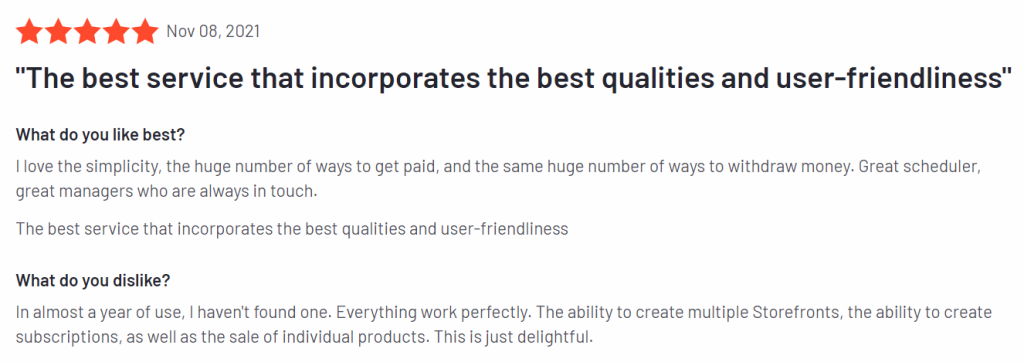

FastSpring currently has 4.5 stars on G2 with 185+ reviews.

Here’s what some of our customers had to say:

Paddle

Paddle currently has 4.5 stars on G2 with 171+ reviews.

Conclusion: FastSpring vs. Paddle vs. Stripe

If you’re selling physical products or services, FastSpring and Paddle are not an option, making Stripe the best choice out of the three options discussed here. If you are selling digital products, Stripe may not be the best choice because you’ll be on your own to build out a complete payment solution (which is costly and time-consuming).

FastSpring has been serving SaaS businesses for twenty years and is well prepared to support B2C and B2B business needs.

If you’re looking for a payments solution that also handles taxes — so you can focus on building great products — FastSpring can help. Our all-in-one payment platform for SaaS, software, video games, and digital products businesses includes VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

This post was originally published in January 2023 and has been updated.

![[Customer Story] Why TestDome Considers FastSpring a Real Partner](https://fastspring.com/wp-content/themes/fastspring-bamboo/images/promotional/2023/FastSpring-TestDome-blog-thumbnail.jpg)