Key Takeaways About 2Checkout vs. Stripe vs. FastSpring:

- Stripe, 2Checkout, and FastSpring all offer differing levels of services, especially when it comes to managing tax calculation, collection, and remittance.

- Stripe is a payment services provider (PSP), not a merchant of record (MoR). 2Checkout offers both PSP and MoR options. FastSpring is an MoR and always includes tax calculation, collection, and remittance with its services.

- Businesses that want more comprehensive tax management services for selling digital products should opt for a merchant of record like FastSpring.

If you’re currently using 2Checkout (now part of Verifone) or Stripe to sell digital goods but are considering switching — from one to the other, or to other options such as FastSpring — you may be wondering whether there are substantial differences between the platforms and their services.

In fact, there are some major differences when comparing 2Checkout vs. Stripe vs. FastSpring.

TL;DR: Stripe markets themselves as a payment services provider (PSP), 2Checkout is a payment service provider with an upgrade option to make them your merchant of record (MoR), and FastSpring is a comprehensive merchant of record from the outset.

What does all of that mean?

In this article, we’ll break down key differences between payment service providers and merchants of record, then we’ll explain what each of the above companies are and what main features they offer.

- Payment Service Providers vs. Merchants of Record: One Major Difference

- What Is Stripe and Who Is It For?

- What Is 2Checkout (by Verifone) and Who Is It For?

- What Is FastSpring and Who Is It For?

- Key Payment Processing Features of 2Checkout vs. Stripe vs FastSpring

- Key Platform Features of 2Checkout, Stripe, and FastSpring

- Handling Tax Calculation, Collection, and Remittance by 2Checkout, Stripe, and FastSpring

- Final Takeaways: 3 Different Levels of Service

- Partner With FastSpring, a Merchant of Record

If you’ve been looking at payment services providers but want a more comprehensive merchant of record to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, and other digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

Note: Information in this article was validated at time of publishing and is subject to change.

Payment Gateways, Payment Processing, PSPs, MoRs — What’s the Difference?

Step one of understanding the differences between 2Checkout vs. Stripe vs. FastSpring means clarifying a few helpful definitions:

- Payment services provider (PSP).

- Merchant of record (MoR).

Payment Services Provider

A payment services provider (PSP) is a platform that serves as a bridge between businesses wanting to sell a product, and the more specialized services and networks you need on the back end such as payment gateways, payment processors, and a merchant account.

A PSP makes it easier for those businesses to sell their products online because the businesses don’t have to directly interface with payment gateways and payment processors — the businesses can just use the PSP, and the PSP will handle payment connections in the background.

TL;DR: What’s happening behind the scenes is all pretty complicated.

- A payment gateway acts as a secure super highway to connect businesses to payment processors. It collects, encrypts, and transmits the sensitive information needed for a transaction.

- A payment processor is the piece on the back end that connects the payment gateway with the merchant’s account and card association networks. The issuing and acquiring banks can then authorize or deny the transaction request.

- A merchant account is a business-specific bank account that allows you to accept and process payments from credit and debit cards; it’s where the funds are held until the transaction is completed.

If all of that sounds really complicated to you, that’s because it is — which explains the appeal of a payment services provider that can handle all of that for you.

Merchant of Record

A merchant of record (MoR) includes the services of a payment services provider, but much more — it becomes the entity technically selling the product.

This means the MoR becomes the entity worrying about card brand rules, regulatory rules in many geographies, risk, and even taxes — which means you don’t have to. FastSpring’s experts will use the latest tools and techniques to manage risk, and we’ll even be responsible for calculating, collecting, and remitting taxes.

[merchant of record 95-second explainer video embedded here]

Merchant of record and payment services provider platforms may each offer varying levels of additional features, such as integrations and API connections, subscription management functionality, customer support, and more.

If you’ve been looking at payment services providers but want a more comprehensive merchant of record to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for digital-first businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

2Checkout vs. Stripe vs. FastSpring: What Are They and Who Are They For?

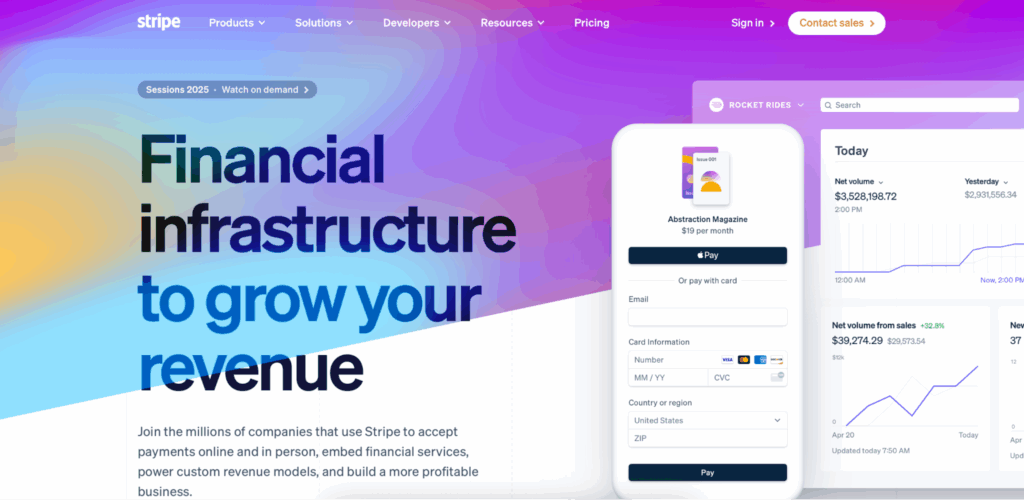

What Is Stripe and Who Is It For?

Stripe is a payment services provider that focuses on payments, payouts, and managing business online.

The many products on Stripe’s menu are sometimes bundled and sometimes separate for an additional cost, which can get a little confusing as you click through various product pages.

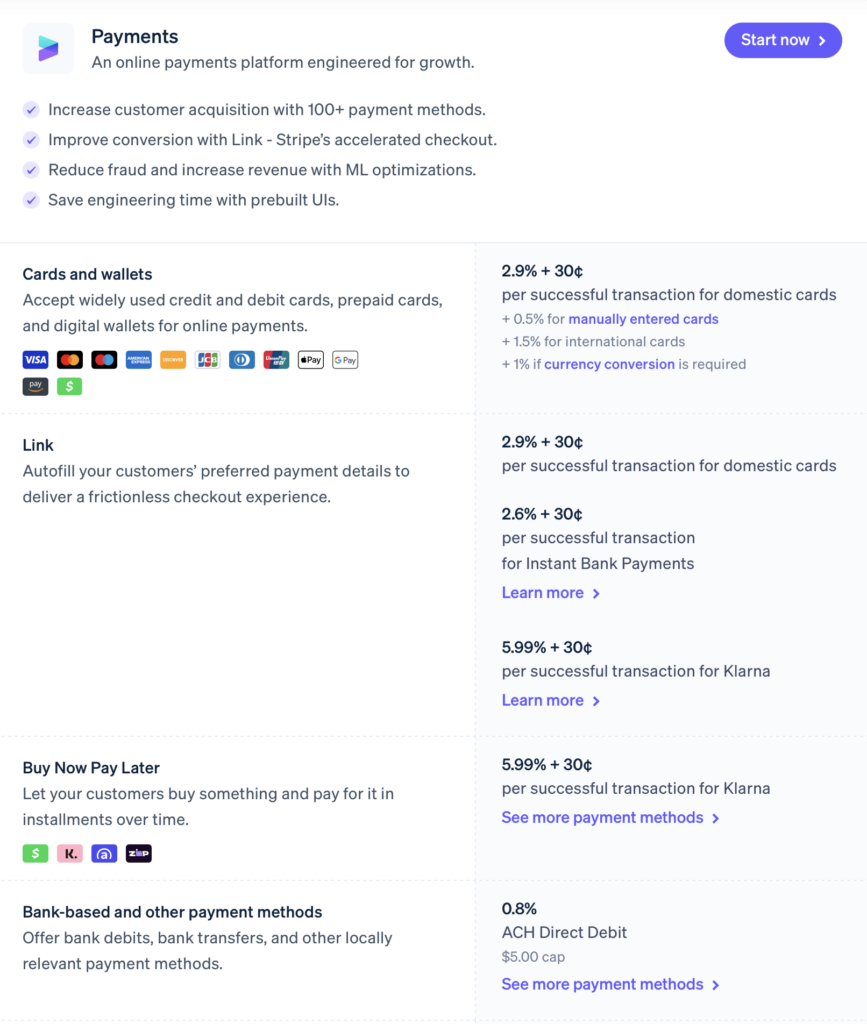

The core offering for payments is their Payments product, which includes the products Checkout, Payment Links, and Elements, but there are many features even within those products that are additional costs, such as additional payment methods, bank debits and transfers, point-of-sale (POS) Terminal, and post-payment invoices.

Stripe pricing starts low per transaction, but it will add up quickly if you’re looking for a more robust service.

Is Stripe a merchant of record?

No. Stripe as a PSP does not assume the same responsibilities an MoR does, such as managing risk, assisting with chargebacks, and handling taxes. When rules change in any jurisdiction where your customers live, you’re responsible for updating your checkout to comply.

Stripe does offer Radar, a product with two different levels of fraud and risk management tools, but if you want the advanced tools, it will cost extra per transaction.

Stripe also offers a Tax product that will calculate, collect, and report taxes in 90+ countries, and they can register in various countries for you — but the price goes up very quickly as you add additional countries, and there are limits on the number of tax filings and registrations per year as well as the number of transactions per month.

Because Stripe is not a merchant of record, it can be used for selling physical goods, but its platform and services may not be as tailored to businesses that were built to sell only digital goods, software, SaaS, and similar.

What Is 2Checkout and Who Is It For?

2Checkout (now part of Verifone) bills themselves as a monetization platform for both digital goods and retail businesses. The pricing page at 2checkout.com shows that with their 2Sell base product, you can “sell any type of product.”

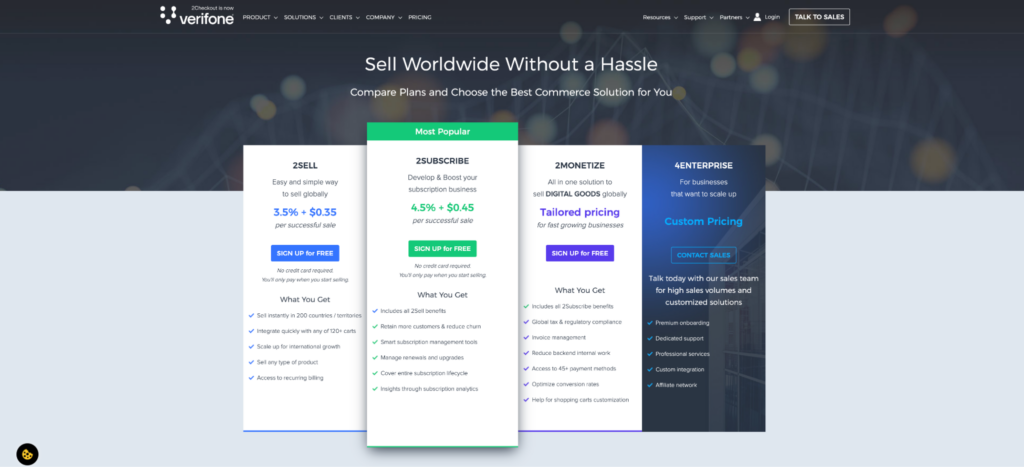

They offer three different levels of products: 2Sell for mobile and online payments worldwide, 2Subscribe to add on subscription management features, and 2Monetize to further add features such as global tax and regulatory compliance, invoice management, and more payment methods.

They also have additional add-ons for renewal recovery, premium support, affiliate partnering for 2Monetize, complex subscription billing for 2Sell, and an enterprise pricing package called 4Enterprise.

Is 2Checkout a merchant of record?

2Checkout offers both a payment services provider model and a merchant of record model. While their 2Monetize page and MoR guide page do not reference each other, 2Monetize is apparently 2Checkout’s MoR product.

What Is FastSpring and Who Is It For?

FastSpring is a merchant of record that for over two decades has been serving B2B and B2C sellers of SaaS, software, video games, mobile apps, AI, eLearning, and other digital goods.

Our payments features help businesses go global instantly, but because we are inherently an MoR, we also help businesses increase profitability while mitigating risk — all while reducing your payments, sales tax, and subscription management tech stack down to one solution.

FastSpring offers global payments, multiple kinds of checkouts, subscription management tools for every stage of the subscription life cycle, fraud prevention, chargeback management, tax compliance, and more — all of which are included.

We’re connected to multiple payment gateways (increasing payment authorization likelihood), and we’re laser focused on making it super easy to ensure you’re following all the rules — because our experts are responsible for risk and chargebacks.

FastSpring’s pricing is a simple, single-package pricing model — not a base plan that requires lots of expensive add-ons. Our team will work with you to figure out a rate based on your transaction type and volume.

Note that there is no minimum transaction volume to use FastSpring, as we want to be the digital commerce partner that helps your business grow.

For more pricing information, reach out to our team.

Is FastSpring a merchant of record?

Yes! FastSpring is a merchant of record, which means that we’ll handle payment services, but we’ll also become the party actually selling the product, so we’ll manage risk, chargebacks, and global VAT and taxes — so you don’t have to.

If you’ve been looking at payment services providers but want a more comprehensive merchant of record to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for digital-first businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

Key Features

If you’re considering implementing a payment services provider or merchant of record for your business — or considering switching providers — there are many features you may need to know about before making a decision.

Here are some important options to consider, with details on how 2Checkout, Stripe, and FastSpring handle each of them.

2Checkout vs. Stripe vs. FastSpring: Payment Processing Features

Each provider’s basic payment capabilities include some combination of debit and credit card payments, alternative payment types, localized currencies, chargeback handling, fraud detection, and more to help ensure a successful sale.

Stripe

Stripe accepts around 17 different cards, including global brands like Visa and Mastercard, Discover, Europe’s Cartes Bancaires, and Asia’s China Union Pay. They also take various bank debits such as ACH and SEPA, redirects, and transfers that connect directly to bank accounts, and they work with many popular wallet payment systems (such as Apple Pay, Google Pay, and PayPal). To learn more, visit their documentation page on payment methods.

Stripe supports processing charges in over 135 currencies. Currency conversions get a little complicated, so check out their documentation on currency conversions for all the details.

Additional fees are applied for currency conversion and cross-border transactions.

Chargeback protection and fraud protection are also available, both for additional fees per transaction.

2Checkout

2Checkout accepts major worldwide credit and debit cards such as Visa and Mastercard, as well as various other regional cards across Europe, Asia, Brazil, and India. Various major digital wallets are also accepted, as are some online banking and direct debit payment options.

For offline payment methods, 2Checkout also facilitates wire/bank transfers, purchase orders, and a few region-specific options; visit the Verifone documentation page on payment methods for more details.

On their documentation page for pricing localization, it details that pricing localization settings can be enabled to display different prices based on geolocation by IP address, but that this feature is only available to 2Checkout Enterprise Edition accounts. 2Checkout offers around 100 billing currencies.

Risk and fraud protection are included in all three packages, 2Sell, 2Subscribe, and 2Monetize. 2Checkout states that while banks handle chargebacks directly, 2Checkout is still involved in the resolution of the dispute, acting as a mediator between the bank/PayPal, the buyer, and you.

FastSpring

FastSpring accepts many major worldwide credit cards and debit cards such as Visa, Mastercard, American Express, Discover, JCB, and UnionPay, as well as ACH direct debit and SEPA direct debit. Wire availability is available in select countries and currencies, as well as PayPal, Apple Pay, SOFORT, and various other popular payment options which are detailed on FastSpring’s documentation page for payment methods.

FastSpring enables its users to set up their stores to display currency localization in many different ways, based on what’s best for your business. FastSpring can make the conversion, or you can set a fixed price in each currency for each of your products; which currency is displayed based on location can be chosen by FastSpring, by you, or by the shopper.

To remain a leader in fraud and risk support, FastSpring is partnered with global risk analysis and fraud prevention leader Sift to ensure secure payment transactions and PCI compliance, with increased accuracy in fraud decisions and better approval rates (and fewer false positives).

And since FastSpring is a merchant of record, we’re responsible for keeping fraud rates and chargebacks under certain thresholds.

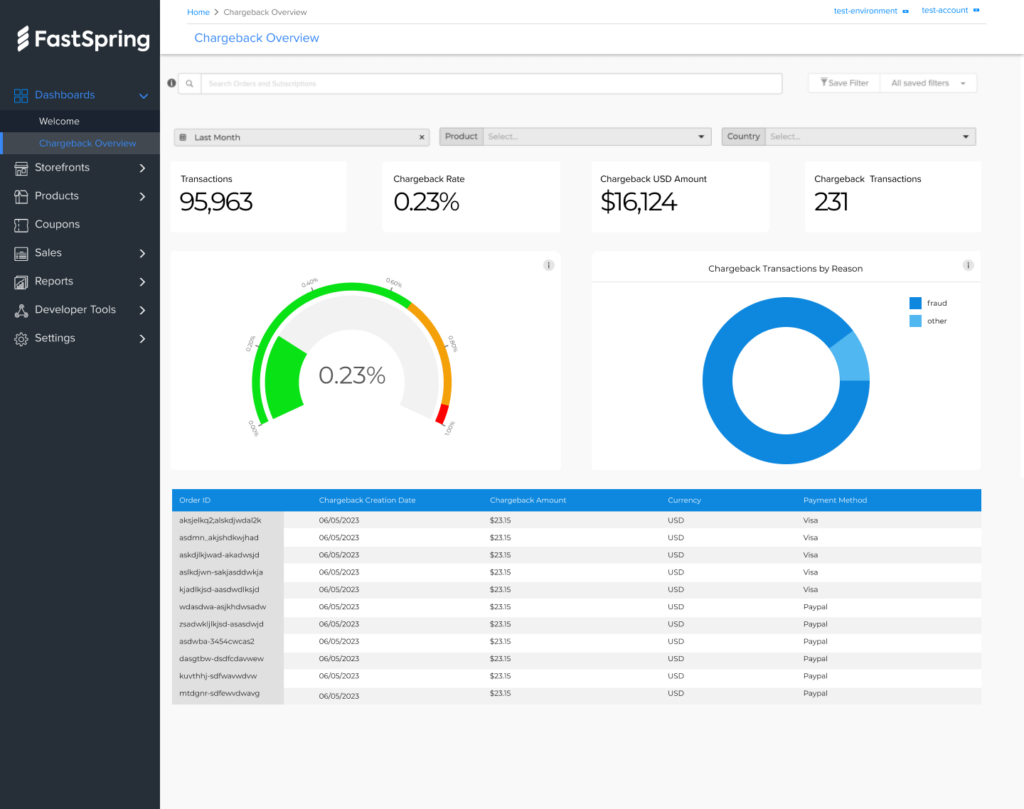

If you need support assistance with chargebacks, our Risk team can help, and the FastSpring platform also includes a Chargeback Overview Dashboard to help you keep track of chargeback rates, which products are most frequently involved, and a comprehensive log of the most recent chargebacks with filters to help you drill down for analysis.

2Checkout vs. Stripe vs. FastSpring: Platform Features

Besides the online payment processing features and services that are core to PSPs and MoRs for online businesses, the platforms and how they integrate with your business (and website) can make or break how well they help your business move product and support a successful sale.

Here are rundowns on checkout, payouts, integrations, APIs, reporting, and analytics for 2Checkout, Stripe, and FastSpring.

Stripe

Stripe offers a hosted, brandable checkout for both one-time payments and recurring billing, which can be embedded on your own site, or you can pay a monthly fee to use their hosted checkout with a custom URL of your own. They have a tool to walk prospects through the customizations they offer so you can see what the checkout page might look like.

Many factors go into how and when you can receive payouts from Stripe, especially dependent on your country, so be sure to check out their documentation page for more information. But if you’re in an eligible country, you may be able to receive daily payouts (although weekly, monthly, or manual schedule options may also be available).

Stripe’s multi-currency support for payouts appears to include the same currencies as their presentment currencies, meaning that if you can process payments in a currency with Stripe, you can receive a payout in that currency.

Stripe has a directory of partners that may offer easy integrations or connections to Stripe for ease of use, but they offer limited support in this area and refer users to the third parties for assistance when needed. They also have a REST API, with Payment objects used to facilitate payments, as well as SDKs.

Some of Stripe’s financial reports are free, but for more advanced tools, you’ll need to upgrade your account and/or request beta access. For example, Advanced Revenue Reporting is still in beta, and their custom reporting offering using SQL, called Sigma, starts at $15 per month for up to 250 charges (plus 6¢ per additional charge).

Stripe offers some strong analytics tools, such as via their payment authentication report, but that requires their Sigma product.

2Checkout

2Checkout offers a few checkout types. Users can choose between one-step or multi-step popup experiences with their Inline cart, or users can choose the hosted checkout option that redirects shoppers to a 2Checkout page.

A third option for users of popular ecommerce platforms like Shopify, Magento, and Woocommerce is to integrate 2Checkout with that site’s native online shopping cart; a list of those sites can be found on their website.

2Checkout also offers a few integration connectors with popular CRMs like Salesforce and Adobe Analytics. Also available are an API and webhooks.

By default, 2Checkout’s payouts occur on a weekly, biweekly, or monthly basis depending on the type of 2Checkout package you use, and minimums of 50 or 100 USD/EUR/GBP also apply. Those are the only three currencies in which 2Checkout will facilitate payouts.

2Checkout’s Business Intelligence, an engine for custom reporting and scheduled reports, is included in all three of their pricing packages, but advanced features like user log audits, subscription analysis, and financial reporting are not available in their base package of 2Sell.

Analysis can be done using the reporting dashboard, and third-party analytics tools such as Google Analytics can be connected to your account for cart web analytics (on request for 2Sell and 2Subscribe users; included in 2Monetize).

FastSpring

FastSpring offers three types of checkouts:

- A Web Storefront hosted by FastSpring serves as the default option, allowing users to use product catalogs from their own websites or to utilize FastSpring’s platform to display products.

- A Popup Checkout utilizes your own website’s catalog and then provides a same-page experience by displaying the checkout window in front of your webpage.

- Embedded Checkout keeps the checkout experience on your site without the need for redirects or popups.

For payouts, most FastSpring sellers have a two per month frequency, but this can also be set to monthly. FastSpring can also change the minimum payment amount at your request. There are five currencies available for payouts — USD, EUR, GBP, AUD, and CAD — but there is a small currency conversion fee for payouts in currencies other than USD.

FastSpring’s dashboards enable users to dig into reporting around revenue, subscriptions, and even chargebacks. See transaction rates, net sales, refund rates, and more to assess maximum revenue impacts by each product. Understand critical subscription trends across regions, over time, and by individual products with built-in widgets for MRR, customer lifetime value, rate of churn, and more.

That data can be exported to CSV or JSON, or you can use FastSpring’s data API and webhooks to generate revenue and subscription reports to take your data wherever you need it.

FastSpring offers many tools that work in combination to empower your integrations: extensions, webhooks, APIs, and the FastSpring Store Builder Library (our JavaScript library). These are the tools and systems that help businesses get up and running quickly on FastSpring, so they can go global faster.

The developer-friendly, ready-to-deploy FastSpring Store Builder Library (SBL) enables you to pass sensitive information in an encrypted format — which is great for integrations — but it’s also great for setting up your store initially. This highly customizable JavaScript library helps quickly embed FastSpring ecommerce experiences into your website or application.

Webhooks work with your backend or third-party systems for advanced integration and tracking events, and the FastSpring API lets you easily query your sales and subscription data via GraphQL or REST format on a programmatic basis.

Extensions such as MailChimp for emails, AdRoll for retargeting, and Google’s Analytics, AdWords, and Tag Manager make it easy to integrate FastSpring’s platform with other helpful business tools.

2Checkout vs. Stripe vs. FastSpring: Calculating, Collecting, and Remitting Taxes

Tax calculation, collection, and remittance are very important actions a business needs to take to stay compliant wherever its product is being sold.

Each payment services provider may handle different combinations of those functions, while a merchant of record should handle all of them. Knowing which pieces your provider takes care of for you (and if you’ll need to handle any yourself) is key to keeping your business compliant — and avoiding hefty tax fines.

Stripe

By default, Stripe won’t calculate or collect taxes for you, and it won’t file or remit any of those taxes either.

If you upgrade to the Stripe Tax product at the Basic level, it will automatically calculate and collect taxes for you, but there are per-transaction fees that vary based on the kind of integration you use.

If you upgrade to Stripe Tax Complete, they will manage obligation monitoring, registrations, calculations, collections, and filings, starting at $90 per month with a minimum one-year contract, and additional fees if the registrations and filings are outside of the U.S. — but that only includes two registrations per year, 200 transactions per month, 2,000 calculation API calls per month, and four filings per year. The slider-bar pricing tool on the Stripe Tax page suggests that per-month fee will get expensive quickly based on the number of registrations, transactions, API calls, and filings you need.

Key takeaway: If you’re looking for a turnkey tax solution, Stripe probably isn’t what you want.

2Checkout

Since 2Checkout offers either a PSP or a MoR model, there are different levels of tax handling with each type.

For businesses using their PSP packages (2Sell or 2Subscribe), there is a tax calculator that can be activated, but it is based on your tax data supplied to 2Checkout and comes with a disclaimer to that end. There appears to be a rather lengthy process to get the tax calculation feature set up and activated.

For businesses using their 2Monetize package, global VAT and sales tax collection and handling are included, and 2Checkout handles VAT and compliance.

FastSpring

FastSpring is intrinsically a merchant of record, so tax calculation, collection, and remittance in over 200 regions around the world is always included for businesses using our services.

You also won’t need to register for tax purposes in all of those regions, since FastSpring is the entity actually selling your product. Our tax experts stay up to date on global VAT, GST, and sales taxes so you don’t have to, and we file and pay $50M+ in taxes for our customers every year.

Final Takeaways: 2Checkout vs. Stripe vs. FastSpring

In summary, Stripe is an entry step into using a payment services provider, but it isn’t a merchant of record and won’t handle your taxes for you unless you upgrade with expensive add-ons. You can accept payments, but you’ll still have a lot of other business management to handle on your own or with additional partners besides Stripe.

If you have a small business or startup, Stripe may be a serviceable option at first, but you could quickly outgrow it if you take your business global.

For starters, you’ll have dozens of jurisdictions to manage risk and taxes in, you’ll need to decide how to manage chargebacks, and you’ll need to set up subscription management tools and settings like dunning for rebilling, etc. — or you can watch the Stripe or third-party transaction fees stack up as you add on more products to cover as much of that as they can.

2Checkout offers either just PSP services or an upgrade to MoR services, but some platform features like pricing localization and certain reports are only available on a limited or upcharge basis. Their PSP-only services will calculate taxes for you, but that’s based entirely on tax data you supply to them, so you’ll still need to worry about those if you don’t upgrade to 2Monetize.

To compare, FastSpring handles both payments and taxes by offering one comprehensive MoR service. Choose between multiple checkout types with localized pricing, integrate with other important business tools, and stop worrying about global taxes as your business grows.

This makes FastSpring very user friendly for B2B and B2C SMBs selling SaaS, software, video games, mobile apps, AI, eLearning, and other digital goods.

FAQs

2Checkout is a payment services provider (PSP). It serves as a bridge between your business and the more specialized services and networks you need on the back end — which includes payment gateways— in order to process a transaction.

The most important difference is that 2Checkout offers merchant of record (MoR) services with some plans, whereas Stripe is not a merchant of record and only offers some tax service upgrades. The two also offer differing pricing models and packages.

Both 2Checkout and Stripe use a combination of packages and optional add-ons, which work on a per-transaction basis. Stripe’s add-ons are more a la carte than 2Checkout’s, making the plans more flexible — but also potentially more expensive as costs add up.

Partner With FastSpring

If you’ve been looking at payment services providers but want a more comprehensive merchant of record to help you grow your business internationally, we can help.

FastSpring provides an all-in-one payment platform for digital-first businesses, including VAT and sales tax management, payment localization, and consumer support.

If you think FastSpring could be the right payments and MoR solution for your business, reach out to our team or set up a free account.

Related reading: SaaS Companies: Four Signs You’ve Outgrown Stripe: Growth expert Fred Linfjärd (a former FastSpring user himself) explains the disadvantages of DIY-ing a payments solution with Stripe, and how FastSpring frees up dev resources to focus on your core product instead of payments and monetization.

This post was originally published in October 2023 and has been updated.