Bringing your products to a global market requires a lot more than just translating your website.

Many companies that expand globally reach a point where they can’t properly support their international customers with their current payment platform. They’ll start noticing issues like low conversion rates, low authorization rates, more chargebacks, and an overall plateau in global growth. That’s when many start looking at other solutions such as international payment gateways.

Even the best international payment gateways can help with some of these issues, but that’s only one piece of the puzzle. To accept payments internationally, you also need to offer local payment methods, collect and remit VAT and sales taxes, adhere to local transaction laws and regulations, and much more.

In this post, we clarify what an international payment gateway is, how it fits into the payment processing landscape, and how to choose the best one for your business. Then we compare nine of the top payment solutions, starting with a deep-dive into our solution, FastSpring.

Table of Contents

- What is an international payment gateway?

- Factors to consider when choosing the best international payment gateway.

- FastSpring: Merchant of record for global SaaS companies.

- 8 other international payment gateways for SaaS and non-SaaS businesses.

FastSpring handles everything from maintaining high authorization rates to filing and remitting monthly and quarterly sales tax and VAT for SaaS companies. Sign up for a free account or request a demo today to see how FastSpring can help you expand globally.

FAQs About International Payment Gateways

What Is an International Payment Gateway?

Traditionally, payment gateways and payment processors were offered as two separate services, and you would have different providers for each service:

- Payment gateways quickly and securely transfer the payment details from the checkout software to the payment processor.

- Payment processors verify that all necessary information is present and in the correct format and then carry it to the issuing bank or credit card network for final authorization. Some payment gateways integrate with multiple payment processors behind the scenes to optimize performance.

Fast forward to today, and these two services are often offered together, which is why many companies use these terms interchangeably.

For the remainder of this post, if we mention one, we assume the other is included.

Why Do You Want Your Payment Processor to Be International?

International payment processors let you immediately start accepting preferred payments from around the globe. Without an international payment processor, you could be locked out of cross-border transactions, your approval rates will suffer, and your associated transaction fees and processing fees will also suffer.

International payment processors take on the responsibility of staying in good standing with various payment schemes across different countries and localities, so you don’t have to.

Related: International Recurring Payments (How We Handle It for You)

Factors to Consider When Choosing the Best International Payment Gateway

When choosing an international payment gateway, the most important thing to consider is whether or not they also act as your merchant of record.

A merchant of record (MoR) takes on the liability of SaaS transactions for you, which means they handle payment processing, collecting and remitting taxes, staying compliant with local laws and regulations, chargeback management, and much more. If something goes wrong in any of these areas, your MoR is liable and takes the lead to resolve it for you.

If your payment gateway does not act as your MoR, then you’re on your own to:

- Calculate tax, collect tax from your customers, and remit those taxes to the local government — everywhere you do business.

- Understand and adhere to local transaction laws and regulations.

- Improve conversions with an optimized checkout flow.

- Handle chargebacks and fraud.

- And make myriad more checkout, payment, and risk decisions.

Many payment processors will provide an API or built-in integrations with other solutions that will help you with those things. However, you’ll have to manage that entire software stack and you’ll still be held liable for everything from paying taxes to fraud prevention to remaining compliant with regulations everywhere your customers live.

If taxes aren’t paid correctly, for example, you may face huge fines or be prevented from transacting in that region.

Once you’ve determined if the payment gateway also acts as an MoR, there are two other factors to consider:

- What countries they let you transact in (it will differ with each payment gateway provider).

- How they maintain high authorization rates (there are many reasons a payment can fail, even if you have a good relationship with the card network).

Next, we’ll take a deep dive into how FastSpring acts as your MoR, then we’ll compare nine other international payment gateway providers.

FastSpring: Merchant of Record for Global SaaS, Software, Gaming, and Mobile App Companies

Expanding your business globally is a very complex process that includes everything from localizing your website to learning about each region’s laws and regulations. To add to the complexity, many of these systems and regulations constantly change.

The tax landscape for digital goods companies has dramatically shifted. Where once businesses selling SaaS, software, and apps faced fewer obligations than traditional brick-and-mortar stores, they now often contend with more stringent tax requirements. To complicate matters further, tax rates and filing requirements at the local level can change regularly and without warning. Businesses must diligently monitor these shifting regulations to prevent significant penalties from late, missed, or incorrect payments.

And this is just one piece of what you need to manage international transactions.

With FastSpring, you can scale almost instantly to over 200+ regions, because we:

- Stay in good standing with dozens of payment providers around the world so you can accept popular local payment methods (including but not limited to Apple Pay, Google Pay, ACH bank transfers, SEPA, Amazon Pay, Pix, AliPay, UPI, and more).

- Collect and remit indirect tax (including GST, VAT, SST, etc.) for every transaction and file all necessary tax returns for you.

- Take on the responsibility of adhering to local transaction laws and regulations. Our team of legal experts stays up to date on all relevant legalities and makes sure all the necessary procedures are in place for collecting payments.

- Handle currency conversions and checkout localization.

FastSpring is fully compliant with the EU General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Additionally, we renew our level one certification (which is the highest level possible) with the Payment Card Industry Data Security Standard (PCI DSS) every year. FastSpring also conducts an annual SOC 2 Type II assessment.

Visit FastSpring’s Trust Center for more information.

In the following sections, we cover in detail how FastSpring helps you:

- Achieve high authorization rates in 200+ regions with advanced payment failure handling and local payment methods.

- Increase conversions with an optimized checkout experience.

- Reduce involuntary churn with proactive dunning.

- Handle complex billing logic and free trials without code.

- Scale quickly with transparent flat-rate pricing.

Achieve High Authorization Rates in 200+ Regions with Advanced Payment Failure Handling and Local Payment Processing

Many companies are able to maintain high authorization rates in their home country but quickly see a decline in authorization rates when they expand internationally.

This is because transacting globally is much more complicated — so more things can go wrong.

For example, the card network or issuing bank could mark the transaction as suspicious (and therefore deny authorization) because the seller isn’t in the same country as the buyer.

It can be very difficult — and a drain on resources — to identify what’s making the payments fail and find a way to solve those issues on your own.

As your payment processing solution and MoR, FastSpring takes care of maintaining high authorization rates for you. Here are two ways that we maintain high authorization rates.

1. Payment Processor Rerouting

While payments can fail for simple reasons like low funds or inaccurate payment details, payments can also fail because of network or system failures. If a payment fails on the first attempt, FastSpring tries again using a secondary processor. While this won’t solve issues like low funds, it often solves the issue of network or system failures.

2. Local Payment Processors

Card networks and issuing banks are more likely to authorize transactions when the payment processor is in the same country as the buyer. FastSpring connects with multiple international payment gateways and uses intelligent payment routing to send payments through the gateway that offers the highest authorization rates for that location (and payment method).

Increase Conversions With an Optimized Checkout Experience

Before the payment details are even sent to the payment gateway, there are many reasons a customer may abandon the checkout process. For example:

- They have to create an account in order to purchase and don’t want to.

- Additional fees and taxes are added but not clearly labeled, so the customer doesn’t know why the price is different.

- The checkout screen isn’t clearly labeled as secure, so the customer doesn’t feel safe entering personal information.

- Checkout translation and localization is incorrect, inconsistent, or missing, so the customer questions the store’s legitimacy.

FastSpring helps you reduce checkout abandonment and improve conversion rates with:

- Localized checkout. FastSpring can automatically convert currency for you, or you can choose your own fixed price for each product in each currency. You can let FastSpring select the language and local currency based on the customer’s location, set your own language and currency for each, or allow customers to select their preference from the 21+ languages and many local currencies FastSpring supports.

- Complete visual customization with Store Builder Library (SBL). Most payment gateways only provide checkout templates with a few basic options for customization (like adding your logo or choosing from a preset list of colors). FastSpring gives you the tools, functionality, and personalized support needed to customize, brand, and streamline your entire checkout flow. (We also provide a pre-built template that is optimized for high conversion rates.)

- An embedded, pop-up, or web storefront checkout. With FastSpring, you can embed checkout directly on your website, insert a popup checkout, or send customers to a secure web storefront managed by FastSpring. This gives you the flexibility to choose the solution that’s best for your team and customers.

Reduce Involuntary Churn With Proactive Dunning Management and Revenue Recovery

Successfully converting potential buyers to paying customers is just the first step. For SaaS businesses, additional payment issues often come up between that initial purchase and subsequent billings. The most common way to deal with payment failures is to simply notify the customer; however, you’ll need to do more — like send out multiple reminders — if you want to significantly reduce involuntary churn.

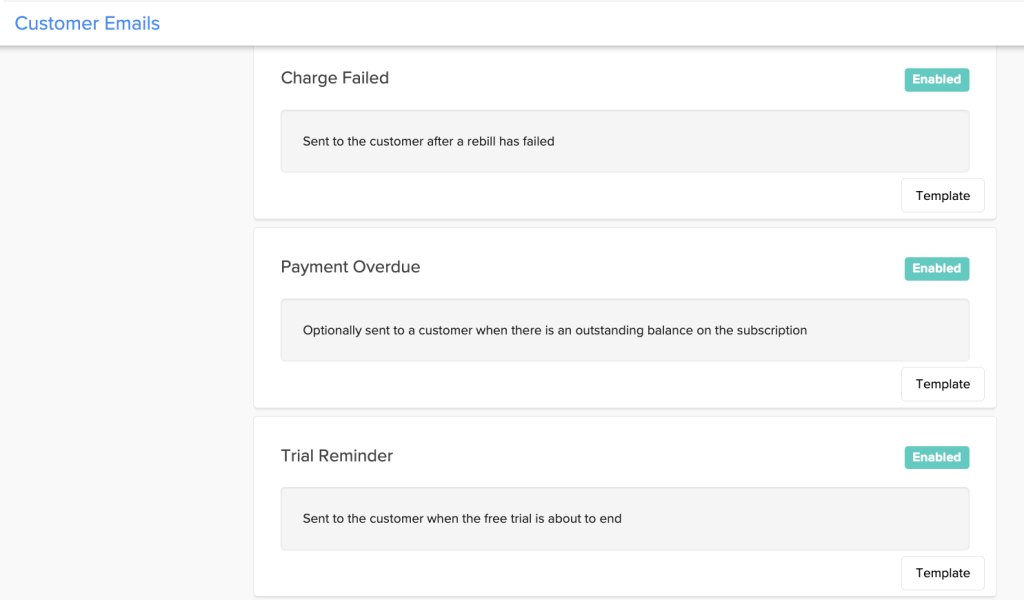

FastSpring provides flexible dunning management, which includes:

- Proactive reminders to update payment information. FastSpring will notify customers with flexible, custom email reminders when their debit or credit card is expiring. You can use our pre-made email template or customize your own message to be sent two, five, seven, 14, and 21 days after the initial failure.

- Multiple automatic payment retries. Before sending out each reminder, FastSpring automatically retries the existing payment method, minimizing disruption for customers and protecting your business from unnecessary failed transactions.

- Easy to access self-serve Customer Account Portal. FastSpring provides an easy-to-access website where your customers can view their complete order history and manage their subscriptions and payment methods. This self-serve website is entirely managed by FastSpring, but the appearance of the portal will match the branding of your checkout to provide customers with a cohesive and user-friendly customer experience.

You can choose how many reminders it takes before the customer’s service is paused. We’ve found that allowing the service to continue through the first several reminders reduces involuntary churn and provides a better user experience.

After the final reminder, you have the flexibility to choose whether to pause or cancel their service if they fail to update their payment information. Pausing their service makes it easier for them to restart service without going through the entire onboarding process again.

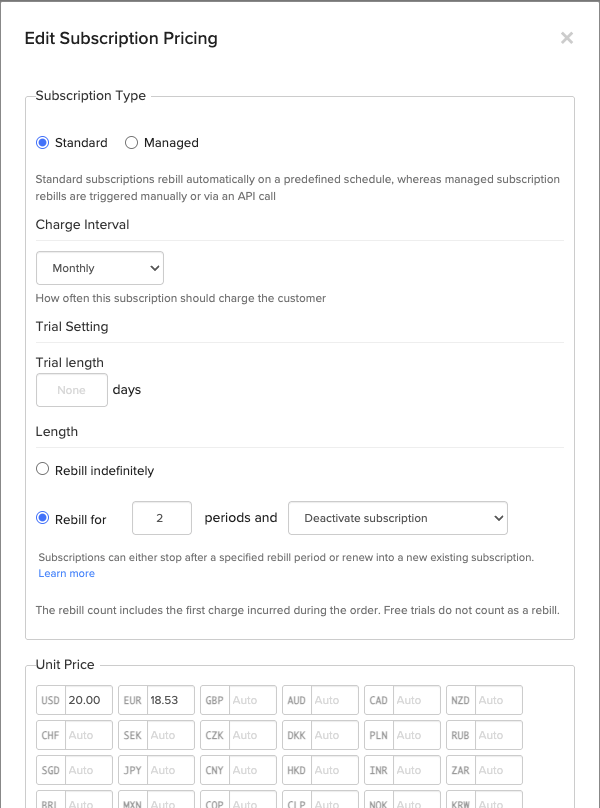

Handle Complex Billing Logic and Trials Without Code

Building out recurring billing logic internally is often a drain on developer time, and it’s difficult to maintain. While some international payment gateways will support subscription billing, most providers only offer basic options (e.g., a free trial that automatically turns into monthly billing).

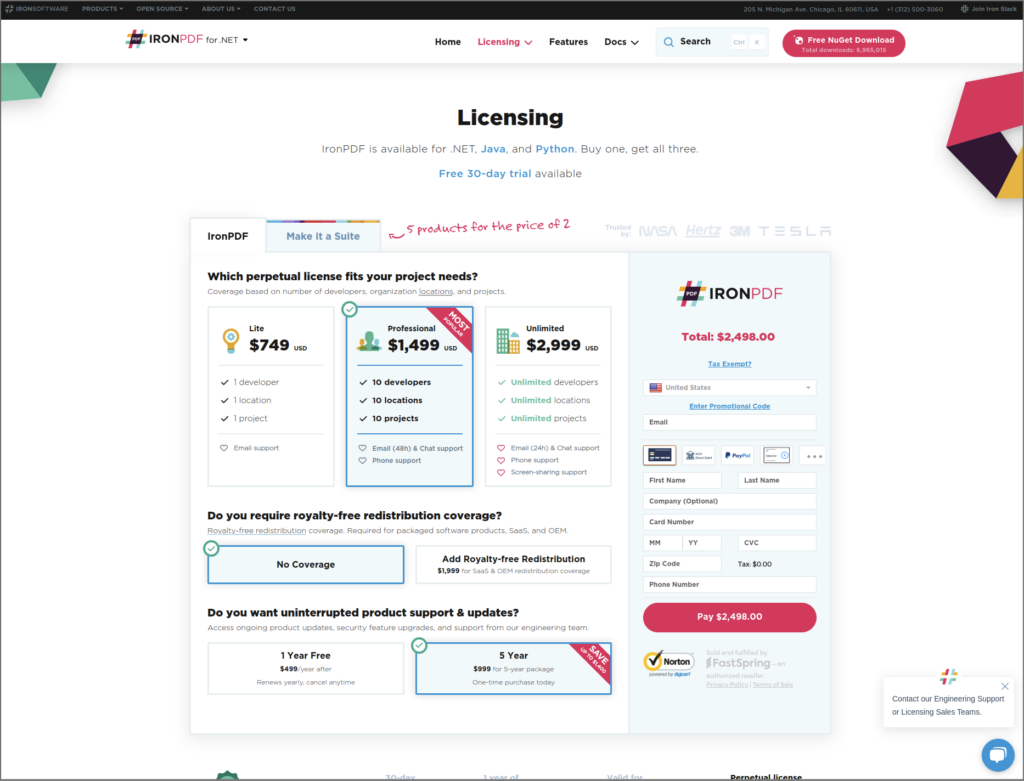

FastSpring, on the other hand, offers a wide variety of flexible subscription management options for free trials, billing periods, and payment — built specifically with SaaS and digital product companies in mind. Here’s an overview of the options you have with FastSpring’s recurring billing feature:

- Free or paid trial periods of any length.

- Trials with or without collecting payment information upfront.

- Upsells, cross-sells, one-time add-ons, and discounts.

- Prorated billing to accommodate mid-cycle upgrades — or downgrades.

- Automatic weekly, monthly, yearly, or custom recurring billing cycles.

- Automatic or manual renewal.

- Automatic failure handling, notifications, and retries to reduce involuntary churn.

- B2B digital invoicing.

- And many more.

Most of these options can be set up in just a few clicks, without writing any code.

If you need custom subscription logic, you’ll have access to our API and webhooks library. Plus, our experienced developers are readily available to help you create the best solution for your business model.

Don’t forget: Without a global MoR like FastSpring, you’re responsible for ensuring your recurring billing models follow any and all local transaction laws and regulations. FastSpring handles this — and takes on the associated liability — for you.

Note: If you already have subscriptions set up on another ecommerce platform, our team can help you migrate over to FastSpring. Learn more here.

Related: Create, Manage, and Localize Your Digital Invoices

Scale Quickly With a Single Comprehensive Package

With most payment processors, you’ll have to add additional software to your stack to manage recurring billing, taxes, dunning, etc. Additionally, many payment processors charge extra for each feature beyond processing payments. This makes it difficult to know what you’ll be paying, and the costs can rack up quickly as you grow.

FastSpring doesn’t charge extra for each feature. With FastSpring, you get access to the entire platform — and all services — for one simple, flat-rate price. Instead of charging per feature, our team works with you to find an affordable, monthly fee based on the volume of transactions you move through FastSpring. Plus, you won’t need to pay for or manage any additional software or headcount to handle things such as sales tax and VAT.

FastSpring is more than just an international payment gateway or payment services provider — we’re a merchant of record that can help grow your business internationally. FastSpring provides an all-in-one payment platform for SaaS, software, video games, and digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

8 Other International Payment Gateways and Other Payments Options

Verifone

Verifone (formerly 2Checkout) is a secure payment platform for digital goods and retail. Their solutions include:

- Subscription management.

- Reporting and analytics.

- Global tax and financial services.

- Risk management and compliance.

- Partner sales channel management.

Some of these features are offered for an additional price as an add-on. Verifone is the only other option in this list that offers MoR services. They let you choose between an MoR model and payment service provider model.

Stripe

Stripe is a popular cross-border payment processing platform that offers many different solutions, including:

- A prebuilt or customizable payment form and checkout flow.

- Simple subscription management.

- Fraud prevention and risk management.

- Online invoicing.

- In-person payments.

Stripe can also assist you in issuing virtual and physical cards and help you manage business spend. It’s also fairly easy to set up and integrate with other systems. However, Stripe does not act as an MoR, and many of their features are à la carte and must be bundled, which can create a higher cost than it initially appears.

PayPal

PayPal is both a payment processor and a popular digital wallet (not an MoR). PayPal supports online businesses and brick-and-mortar businesses, with services including:

- QR code and POS systems.

- Invoicing.

- Installment payment management.

- Support for preferred payment methods (other than PayPal’s digital wallet).

- Crypto payments.

- Risk management and chargeback protection.

PayPal now also has Braintree under its umbrella as PayPal Enterprise Payments.

Authorize.net

Authorize.net offers payment solutions for ecommerce merchants and in-person sales. Authorize.net’s products include:

- Recurring payments.

- Virtual and mobile point of sale.

- Online payment processing.

- Advanced fraud detection.

- Simple checkout button.

They offer a package for payment gateways, or you can choose a bundle that includes a merchant account (different from a business bank account). Authorize.net serves companies in the U.S., Canada, and Europe.

Adyen

Adyen is an end-to-end payment processing, data, and financial management solution. Here’s an overview of Adyen’s features:

- Online and in-person debit card and credit card payments.

- Fraud detection.

- Intelligent payment routing.

- Automated dunning.

- Subscription management.

Adyen serves companies offering digital goods, transportation services, retail, food and beverage, hospitality, and SaaS and subscription businesses.

WorldPay (Formerly by FIS)

WorldPay, a global payment processing solution, announced in February 2024 that it had separated from Fidelity National Information Services, Inc. to become its own independent company. WorldPay’s features include:

- Hosted payment page.

- Multi-currency support.

- Support for many alternative payment methods, including mobile payments, digital wallets, pre-pay, and more.

- 24/7 support in most global regions.

While WorldPay can give you instant global reach, payment processing is just one of their many offerings, so you may not receive as personalized attention as if you used a more specialized payments company or MoR.

Amazon Pay

Amazon Pay lets your customers use the account they’ve already set up on Amazon to pay you. When customers go to checkout on your ecommerce site, they’ll see Amazon Pay as an option and will be able to use the payment options and contact information already stored in their account. Amazon Pay includes:

- Payment processing.

- Optimized checkout flow (modeled after Amazon’s own checkout experience).

- Recurring billing and subscription management.

- Fraud protection.

- Express payouts.

You do not need to become a seller on Amazon Marketplace to use Amazon Pay. Amazon Pay may be a good option for small businesses and online stores that are just getting started.

Note: You can accept Amazon Pay with FastSpring.

Checkout.com

Checkout.com offers:

- Payment processing.

- Fraud detection.

- Chargeback protection and dispute management.

- Customizable checkout blocks and mobile SDK.

They also offer flexible incoming payment options that let you choose how to allocate money from split payments to commission fees. Checkout.com partners with over 50+ other vendors so you can build your global payment system.

Looking at International Payment Gateways for Your SaaS, Software, Video Games, or Digital Products Business?

Let FastSpring be your merchant of record!

If you’re looking for an international payments solution that lets you manage every aspect of global SaaS payments from one platform — and handles taxes and compliance for you — FastSpring can help.

Our all-in-one payment platform for SaaS, software, video games, and digital products businesses includes VAT and sales tax management, payment and checkout localization, and customer support — so you can focus on building a great product. Interested? Set up a demo or try it out for yourself.

This post was originally published in December 2022 and has been updated.