Most Stripe alternatives fall into one of two categories: payment processors, or a billing solution that covers payment processing and other aspects of billing such as fraud detection, checkout, and more.

For digital-first businesses, the easiest way to manage all aspects of billing is to choose a solution that acts as your merchant of record (MoR). A billing solution that acts as your MoR gives you access to multiple payment processors (which lets you accept more payment methods and is useful when accepting payments globally, as we explain below) while taking on the liability of all transactions for you. An MoR also takes the lead on chargebacks, fraud prevention, tax audits, legal compliance, and more.

When selling physical goods and services (online or in person), various Stripe alternatives built for physical goods payments (such as Amazon Pay, Square, etc.) can provide payment processing, order fulfillment, financing options, and more. (It’s worth noting that most of these solutions can also be used by SaaS, software, video game, and other digital goods companies; however, none of them is a complete payment solution.)

In this guide, we compare eight of the best Stripe alternatives in each of these categories. Since our expertise is in providing MoR services to digital-first companies, we’ll start with an in-depth review of our solution, FastSpring.

Table of Contents

- MoRs for digital goods companies:

- FastSpring: International payment solution for SaaS, software, video game, mobile app, AI, eLearning, and other digital product businesses.

- Paddle: Payment infrastructure platform.

- Verifone: Formerly 2Checkout.

- Billing software for selling physical goods and services:

- Square: Popular payment platform for startups.

- PayPal for Business: Available on major ecommerce platforms.

- Authorize.net: For merchants and small businesses.

- Adyen: Robust financial technology platform.

- Amazon: Payment service and order fulfillment.

Note: Information in this article was validated at time of publishing and is subject to change.

If you’re looking for a Stripe alternative to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, mobile apps, and other digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

All-In-One Payment Solutions (MoRs) for Digital-First Businesses

Most companies using Stripe (or something similar to Stripe) know it’s more than just a payment processing platform — but that there are challenges to making the system work for a global SaaS company. It can require tons of add-ons, a complicated pricing structure, and additional fees — and still lack or limit some key features.

For example, Stripe advertises subscription management features as part of the Stripe Billing package; however, many companies end up integrating with another service like Chargebee or Recurly to get the subscription management features and ease of use they need.

Often, digital goods businesses end up with a payment tech stack of over a dozen tools for:

- Calculating and remitting international taxes.

- Accessing additional subscription management features.

- Covering fraud protection.

- Handling chargebacks.

- Implementing a checkout.

- Getting higher authorization rates in other countries.

- And more.

Making it all work together puts a massive strain on the development team.

Plus, you’ll need to maintain a large team of tax and legal experts to stay up to date on regional regulations and maintain global compliance (because solutions like Stripe don’t usually help with legalities). For example, while it’s true that historically, SaaS and ecommerce companies haven’t always needed to pay VAT or sales tax, that’s no longer the case. If you don’t collect and remit the right amount of tax in each jurisdiction where you sell, you could face hefty fines — or even be banned from selling in that region in the future.

Choosing a payment processing solution that also acts as your MoR solves all these problems.

A merchant of record (MoR) takes care of the entire digital goods billing process for you, including collecting and remitting local and international taxes (such as VAT and local sales tax), staying compliant with local laws and regulations, online payment processing, chargebacks, and much more.

FastSpring Is an International Payment Solution

FastSpring has been acting as an MoR for global software and video game companies for over 20 years, so we know what it takes to expand globally almost overnight. Here are some examples of how FastSpring helped other SaaS and software companies expand globally and increase revenue:

- Mailbird achieved over 100% growth by switching to FastSpring. They previously experimented with platforms like Stripe and PayPal. Read the Mailbird case study here.

- Capture One increased their conversion rate by 40% by switching from an in-house solution to FastSpring to help them with global payments. FastSpring offered them localized checkout experiences that automatically display accurate pricing, language, currency, and taxes around the world. Plus, it was clear that FastSpring is an invested partner with the scalability to grow with their business needs as Capture One expanded their global reach. Read the Capture One case study here.

- SocialBee doubled its monthly recurring revenue and managed tax compliance by switching from Braintree to FastSpring. Read the SocialBee case study here.

Next, we’ll take a deep dive into a few of FastSpring’s billing solutions.

Note: The following solutions are also offered to digital-first businesses selling downloadable software, video games, app subscriptions, and other digital products.

Leverage Multiple Payment Processors to Increase Revenue

Many digital-first companies and founding teams initially think they just need one payment processor to accept payments. However, most of those companies eventually end up needing more in order to:

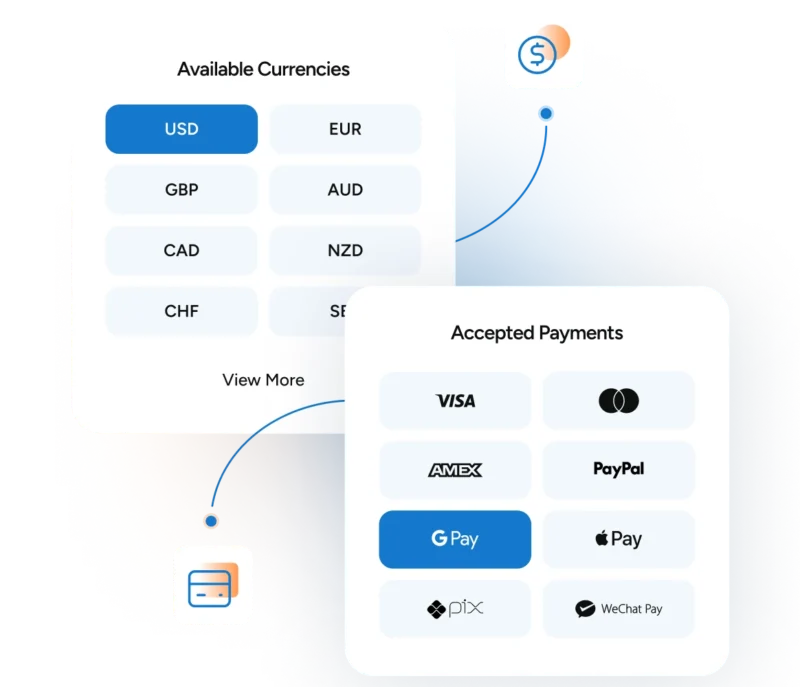

- Accept more payment methods: Customers are more likely to complete a purchase if they can use their preferred payment method. However, not every payment processor supports the same list of payment methods. Working with multiple payment processors lets you accept more local payment methods and, therefore, increase revenue.

- Increase authorization rates for international transactions: Card networks are more likely to authorize transactions when the payment processor is in the same country as the buyer. Some payment processors will establish a legal entity in multiple locations; however, most companies still need to work with multiple payment processors in order to process all payments locally.

- Accept payments from more countries: Some payment processors only support payments from select countries or regions. Working with multiple payment processors lets you reach customers in more locations.

- Minimize failed payments: Working with multiple payment processors can also solve connectivity issues or system failures. If one payment processor is experiencing a network failure, you can reroute the transaction to a payment processor that’s fully operational.

With FastSpring, you’ll be supported by multiple payment processors that specialize in global transactions and accept the most common payment options around the world — including but not limited to Apple Pay, Google Pay, ACH bank transfers, SEPA, Amazon Pay, Pix, AliPay, UPI, and more (with more added all the time).

Click here to see the full list of payment methods accepted by FastSpring.

FastSpring connects with multiple international payment gateways, and our platform uses intelligent payment routing to send each payment to the gateway with the highest authorization rates for that payment method and location. Then, if a transaction fails, we automatically retry the transaction using a secondary payment processor.

Related: Top 10 International Payment Gateways: An In-Depth Guide

Prevent Fraudulent Transactions Without Blocking Valid Transactions

The right fraud protection can help you increase authorization rates, decrease chargebacks, and protect your company from attacks. However, if legitimate transactions get marked as fraud, you’ll lose revenue.

FastSpring takes the lead on fraud and risk activities by partnering with Sift for advanced risk analysis and fraud protection. Sift uses machine learning and AI to analyze millions of global transactions each month to identify risky transactions with higher accuracy. This means your fraud protection is constantly evolving to provide better security and improve approval rates.

FastSpring can also block transactions from countries and jurisdictions where companies are currently not allowed to do business.

Note: You also have the option to block transactions from certain regions or limit products in each region.

If one of your customers does initiate a chargeback, or there’s an issue with fraud, FastSpring takes the lead to resolve it for you.

Avoid High Fines and Penalties by Letting FastSpring Handle Local Legal Compliance for You

Even if all legitimate transactions go through, you could face hefty fines or be prevented from transacting in that region if the transactions don’t comply with local laws and regulations. (For example, the Reserve Bank of India limits automatic recurring payments to ₹15,000 INR, or approximately US$170; transaction attempts above that amount simply won’t go through.)

Most companies need a full compliance department of legal professionals to keep up to date with all the laws and regulations of each jurisdiction they do business in.

You can also face fines or penalties if you don’t file consumption tax. SaaS companies didn’t always have to pay tax, but tax regulations for digital sales are changing and being increasingly enforced.

Companies that use Stripe (or another point solution) must handle tax on their own. While Stripe will help gather sales tax, you’ll need other software to collect VAT, GST, and other forms of consumption tax. Plus, you’ll need a staff of tax experts to remit the tax at the end of each tax period.

FastSpring handles the whole process of calculating, collecting, and remitting global sales and consumption taxes for you by:

- Collecting all consumption tax (including GST, VAT, SST, etc.) and remitting it at the appropriate times.

- Taking the lead on legal compliance (including audits).

FastSpring collects and files taxes in more than 55 countries, 13 provinces, and all 45 U.S. states with sales tax (the other five states don’t collect sales tax). We even handle tax-exempt transactions in the U.S. and B2B reverse charges (when and where allowed) internationally.

FastSpring is fully compliant with the EU General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Additionally, we renew our level one certification — which is the highest level possible — with the Payment Card Industry Data Security Standard (PCI DSS) every year. FastSpring also participates in the Data Privacy Framework (DPF) for international data transfers. Learn more at our Trust Center.

We build and maintain relationships worldwide with tax law specialists who keep us aware and up to date on laws and regulations as they change.

Manage Everything From Checkout to Subscriptions in One Platform

Instead of building and onboarding a payment stack of over a dozen different solutions to help you manage subscriptions, checkout experiences, reporting, analytics, and more, FastSpring lets companies streamline and manage all aspects of digital goods billing directly from their FastSpring dashboard.

Below is a brief overview of these features. For a complete list of features (including digital invoicing and interactive quotes) visit FastSpring’s product overview page.

Custom, Localized, and Optimized Checkout Experience

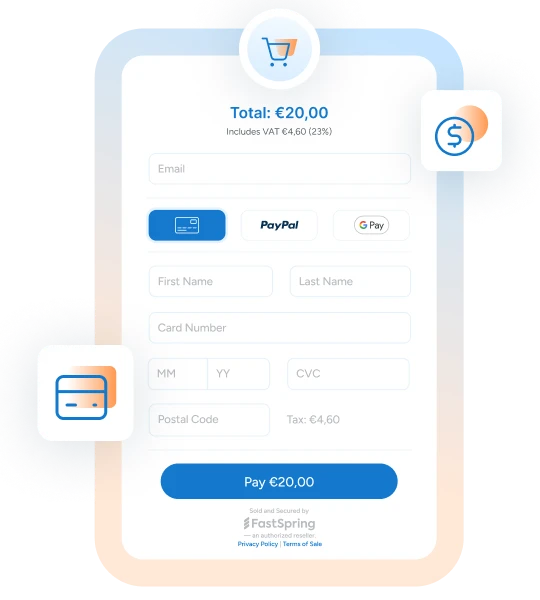

FastSpring gives you full control over your checkout process with our Store Builder Library (SBL). You can customize your checkout, and our team will offer personalized customer support along the way.

We also offer three pre-built experiences. With minimal code, you can embed the FastSpring checkout into a web page or insert a pop-up checkout. Or, if you want to outsource the entire checkout process, you can choose the web storefront option to send customers to a secure web storefront managed entirely by FastSpring. You can also customize the storefront to match the visual branding of your website.

Whichever checkout experience you choose, FastSpring can automatically localize your checkout based on the customer’s location, including translation into 21+ languages and price conversion to many local currencies. You can also set your own language, currency, and price for each region or opt to let your customers choose for themselves.

Related: International Recurring Payments (How We Handle It for You)

Subscription Management

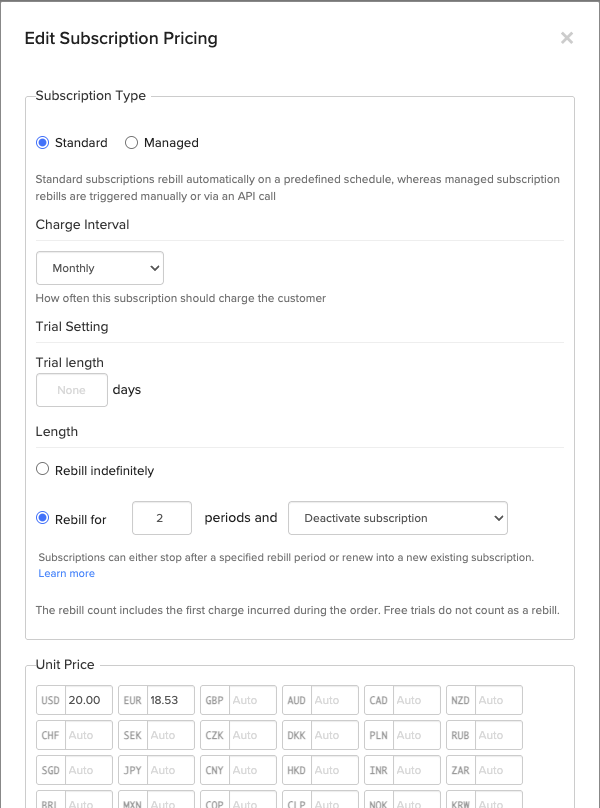

FastSpring lets you create a variety of custom trial and recurring billing models without writing a line of code. You can set up:

- Automatic weekly, monthly, yearly, or custom recurring billing.

- Prorated billing to accommodate upgrades — and downgrades — mid cycle.

- Free or paid trials of any length.

- Trials with or without collecting payment details.

- Automatic or manual renewal.

- Upsells, cross-sells, one-time add-ons, and discounts.

- Automatic failure handling, notifications, and retries to reduce churn.

- B2B digital invoicing.

- And much more.

You‘ll also have access to FastSpring’s developer-friendly API and webhooks library to build more complex custom subscription logic and integrations.

If you want to see how FastSpring compares to Chargebee, read this article.

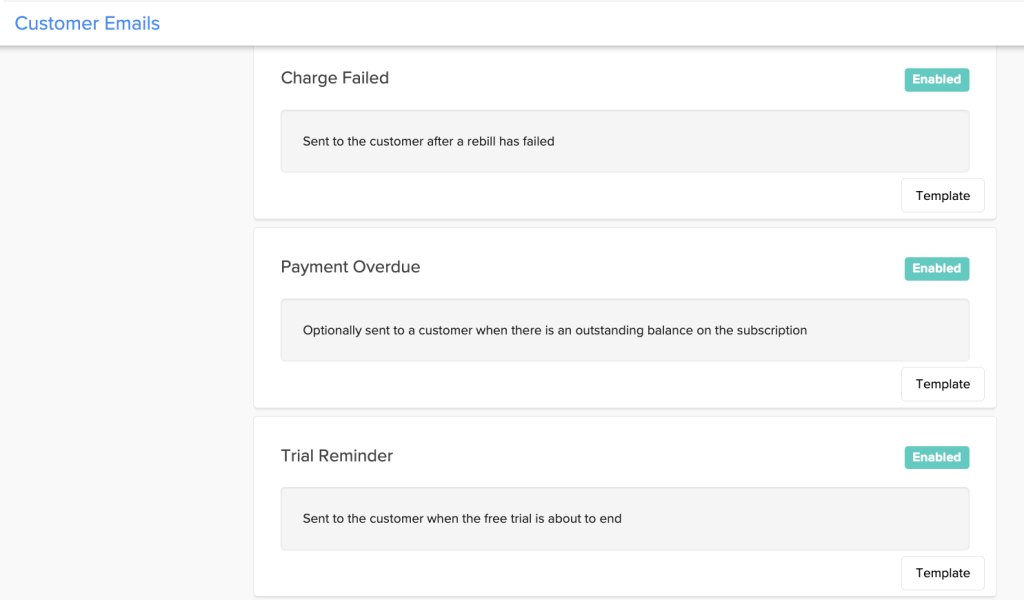

Dunning Management

FastSpring handles all failed payments and customer notifications for you — simply choose how you want it handled, and we take care of the rest. Our platform offers flexible dunning management options, which include:

- Proactive reminders when payment information needs updating. Automatically send flexible, custom email reminders to your customers before a debit or credit card expires. We offer a pre-made email template — or you can customize your own email and set it to send two, five, seven, 14, or 21 days after a payment failure.

- Automatically retry failed payments. FastSpring retries the original payment method multiple times, including before sending each reminder email.

- Flexible failed payment logic. Continue (or pause) service until the last notification has been sent out. Pause (or cancel) the service once all notifications have been sent out and the payment is still getting declined.

With FastSpring, your customers will also have an easy-to-access and intuitive self-serve Customer Account Portal where they can view their order history, update payment information, and manage their subscriptions. The portal is managed by FastSpring but matches the branding of your checkout for a cohesive customer experience.

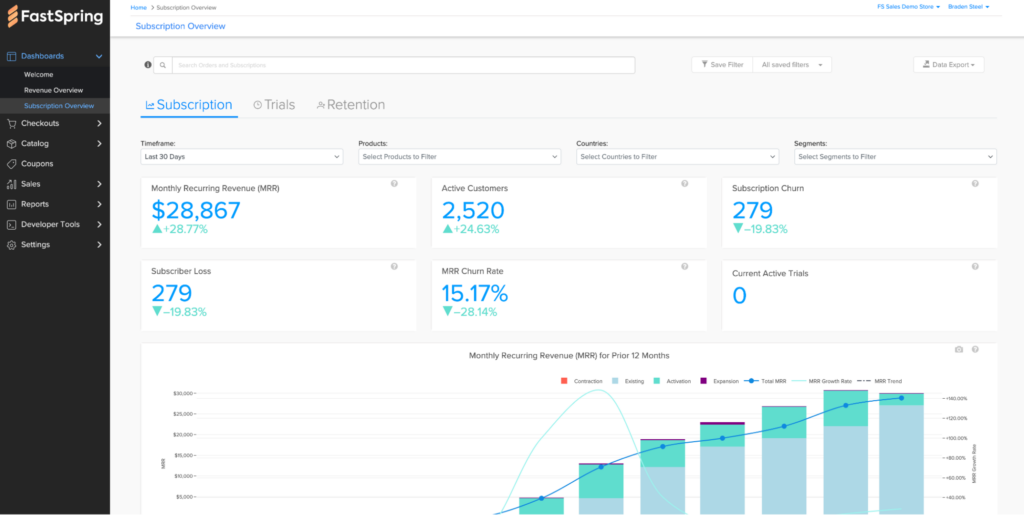

Reporting and Analytics

While Stripe does offer revenue recognition tools for accounting purposes, many SaaS companies using Stripe end up adding a reporting and customer analytics tool to give them more insight into stats such as MRR, churn rate, new customers by product type or geography, and more.

FastSpring’s Reporting and Analytics, on the other hand, is a robust suite built for digital products businesses. You can view key performance indicators (KPI) for your customer base and subscription models to better understand:

- How each product contributes to your bottom line.

- When customers are most likely to drop off.

- What coupons or promotions are working.

- Which subscription models generate the most revenue.

- Where your customers are located.

- What currencies and payment methods customers prefer.

- Chargeback rates by customer segment.

- Chargeback rates by product line.

- The status of your active webhooks.

- And much more.

Our platform features several dashboards, which include:

- Revenue Overview.

- Subscription Overview.

- Revenue Recognition.

- Chargeback Overview.

- Webhook Status.

If you don’t see exactly what you need, you can create and save your own custom reports. You can also reach out to our team for help finding or building the report you need. Export and share reports as a CSV, PNG, or XLSX file.

For a complete list of features — including Digital Invoicing and Interactive Quotes — visit our website.

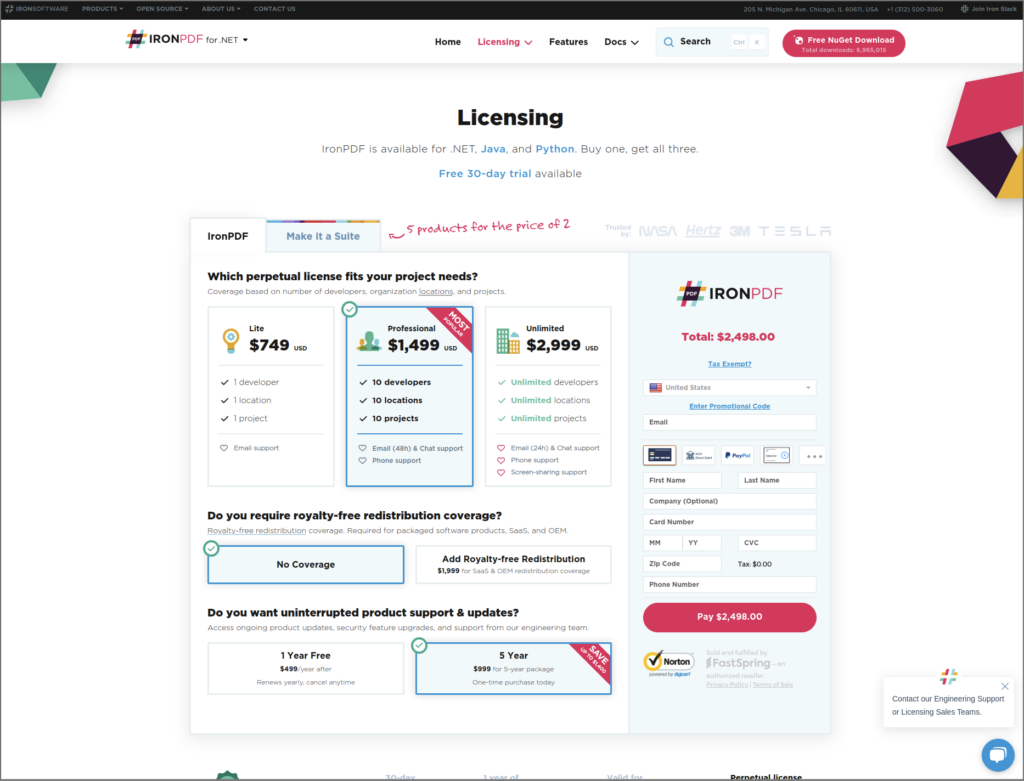

One Simple Pricing Model; All the Benefits

Most payment processors (like Stripe) typically charge a low processing fee; however, they’ll charge extra for features such as subscription management, additional payment method support, tax collection, and more.

They’ll also usually pass along transaction fees such as network/scheme downgrade fees.

Plus, you’ll have to pay for any additional software needed for a complete billing solution — and the staff to manage the entire process.

For most companies, what starts as seemingly low, flat-rate pricing ends up being an expensive route to take.

On the other hand, FastSpring manages your entire digital goods billing process for one flat rate. You’ll get access to our whole platform — including every feature and all services — in a single comprehensive package.

Our team works with you to find an affordable monthly fee based on your transaction volume (and you’ll only be charged for successful transactions). Plus, you won’t need any additional software or headcount since we’re liable for transactions and take the lead on sales tax and VAT.

If you’re looking for a Stripe alternative to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, mobile apps, and other digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

Paddle: Payment Infrastructure Platform

Paddle is another Stripe alternative that acts as an MoR for SaaS and software companies. Paddle has features such as:

- Multiple payment gateways.

- Secure checkout.

- Recurring billing management.

- A robust payments toolkit.

- Fraud protection.

- Transaction and subscription reporting.

- Invoicing.

- And more.

Learn more about Paddle alternatives.

Verifone: Formerly 2Checkout

Verifone is a Stripe alternative that can act as your MoR or just as a payment service provider. This gives them the flexibility to support small- to medium-sized companies in different industries offering both in-person and online goods or services (e.g., retail and hospitality).

Verifone functionalities include:

- Integrated point-of-sale (POS).

- Kiosks.

- Subscription management.

- Hosted checkout.

- Partner sales channel management.

- And more.

Some of these features are included with Verifone packages, while others are add-ons with their own additional fees.

With over 20 years of experience serving international software companies, FastSpring is one of the longest-standing MoRs for SaaS, software, video games, mobile apps, and other digital products companies. Use our expertise to help grow your business quickly. To learn more, sign up for a free account or request a demo today.

Stripe Alternative Billing Software for Selling Physical Goods and Services

While digital product companies can use almost any billing solution to sell their product (although some will be more effective than others), not every solution will be effective for companies selling physical goods or services. Companies selling physical goods and services need solutions that can manage both online and in-person transactions.

When selling physical goods or services, most companies end up using two or more software solutions to build a complete billing solution. However, there are ways to minimize how many you need and how much it will cost you. The best place to start is to carefully consider your current needs (e.g., are you selling in person and online?) and plan for your future needs (e.g., are you a new business owner who might want to start selling online in the future?).

Then, you can evaluate each billing solution by asking a few key questions:

- How many aspects of billing does the software cover? Is each offering truly sufficient for your current needs (e.g., maybe they offer a subscription billing solution but don’t support the business model you need)? Do the features leave room for your company to grow?

- Does their pricing model allow you to get all features for one price, or will you have to pay extra for the features you need? Will the price be sustainably cost effective long term, as your company grows?

- Does the software offer seamless integration with other software you use?

- Is the software user friendly?

Next, we cover five Stripe competitors for companies selling physical goods and services to help you get started with your search.

Square: Popular Payment Platform for Startups

Square is a popular point-of-sale solution for companies of all sizes. With Square, you can accept payments from your online store, in-person, or via social media. Beyond payment processing, Square also offers solutions for:

- Virtual terminals (so you can accept credit card payments using your computer).

- Business management.

- Customer engagement.

- Banking (including merchant accounts, savings accounts, and loans).

- Team management (including payroll, time off, etc.).

- And more.

PayPal for Business: Available on Major Ecommerce Platforms

PayPal is a well-known digital wallet for personal online payments; however, they also offer payment processing for both online and brick-and-mortar businesses. PayPal supports debit card and credit card processing in store or from your online business.

(Digital-first businesses using FastSpring can also process payments using PayPal.)

PayPal for Business also includes:

- QR code and POS systems.

- Donation tools.

- Built-in integrations with major ecommerce shopping carts (e.g., Shopify, WooCommerce, and more).

- Risk management and chargeback protection.

- Mass payouts.

- And more.

Note: PayPal also has a payments option called PayPal Enterprise Payments (formerly Braintree) that offers your own merchant account.

Authorize.net: For Merchants and Small Businesses

Authorize.net (a Visa solution) is a payment service provider that supports mobile payments, phone payments, and ACH. They also provide a card reader for in-person payments and support online purchases.

Other features offered by Authorize.net include:

- Simple checkout button.

- Recurring payments.

- Digital invoicing.

- Advanced fraud detection.

- Optional merchant account bundle.

- And more.

Adyen: Robust Financial Technology Platform

Adyen is an end-to-end solution for payment processing, data, and financial management. In addition to payment processing, Adyen offers features such as:

- Virtual and physical card creation.

- Tools to optimize traffic in real time.

- Fraud detection.

- Automated dunning.

- Business bank accounts for your users.

- And more.

Amazon Pay: Payment Service and Order Fulfillment

Amazon Pay lets your customers use the payment information already stored in their Amazon account on your website. You can use Amazon Pay as a stand-alone payment solution without becoming an Amazon Marketplaces seller — or you can easily use Amazon Pay on your own website and become an Amazon merchant (which gives you the option for fulfillment by Amazon).

Amazon Pay includes:

- Optimized checkout flow (modeled after Amazon’s own).

- Co-marketing campaigns.

- Self-service reporting dashboard.

- Fraud protection.

- Easy integration tools.

- And more.

Note: With FastSpring, your customers can pay using Amazon Pay and many other payment methods.

Need a Stripe Alternative for Your SaaS, Software, Video Game, Mobile App, or Other Digital Product?

Let FastSpring help!

FastSpring lets you manage every aspect of global payments from one platform — without managing tons of different software solutions. We shoulder the liability for online transactions and take the lead on VAT and sales tax management, regulatory compliance across the globe, and much more for you.

If you’re looking for a Stripe alternative to help you grow your business internationally, we can help. FastSpring provides an all-in-one payment platform for SaaS, software, video games, mobile apps, and other digital products businesses, including VAT and sales tax management, payment localization, and consumer support. Interested? Set up a demo or try it out for yourself.

This post was originally published in January 2023 and has been updated.